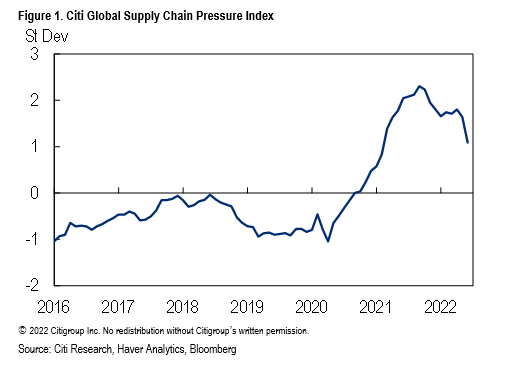

Citi’s global supply chain pressure index’s June reading shows a notable easing of supply-chain conditions—the first appreciable decline in the index since January.

The good news, according to Citi analysts, is that the index’s retreat in June suggests that the pressures in goods sectors, which have been a key driver of global inflation, may finally be abating.

The bad news is that this easing seems to be occurring mainly on the back of slowing global demand for goods, especially consumer discretionary goods.

This slowdown in goods demand, a central feature of the global outlook, reflects a combination of factors.

First, over the past two years consumers have binged on goods. With goods consumption and production viewed as more consistent with health concerns than services consumption (many of which require face-to-face contact), households rotated heavily into spending on goods. In the process, they front-loaded much of their goods expenditure, in some cases perhaps even reaching “satiation” points.

Second, as a related matter, with consumers now more comfortable with the health situation, they are rebalancing back toward spending on travel, hospitality, leisure, etc.—and services spending has become an important engine of growth.

Citi analysts see these two related dynamics as benign and, in fact, indicative of healing in the economy in the aftermath of the pandemic. But there is also a more worrisome trend afoot. Soaring prices for food, fuels, and utilities are cutting into the real incomes of consumers and putting a pinch on their spending. With only limited scope to substitute away from these essential commodities, the result has been strong downward pressures on consumer discretionary goods. Demand there has softened sharply, for example, in consumer demand for smartphones and PCs. And inventories of these goods are rising. Accordingly, the easing of supply chains that has occurred suggests reduced global inflation pressures but, in tandem, mounting recession risks.

Even while highlighting the importance of the June softening in supply-chain pressures, and its important implications, Citi analysts also emphasize that this is hardly an “all clear” signal for supply chains going forward.

With China’s “zero Covid” policy still in place, the global manufacturing sector remains vulnerable to further pandemic-related disruptions. And it’s not clear that the full supply-chain implications of the recent lockdowns have already worked through. Second, the economic disruptions from the Russia-Ukraine war remain in play, and these effects may yet take a further turn for the worse, for example, if inventories of key goods supplied by the region become depleted. Third, seasonal shipping pressures associated with the fourth-quarter holidays loom on the horizon. Firms move in the (northern hemisphere’s) late summer and early fall to fill their warehouses and shelves to meet the surge in demand. And, consequently, analysts say we may yet see renewed supply-chain pressures from this factor as well.

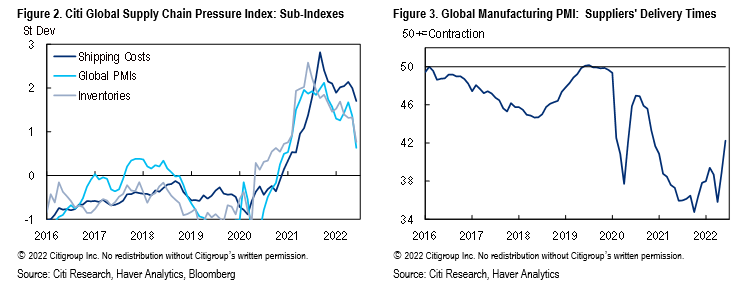

Figure 2 below displays the evolution of the sub-indexes for each of the three categories. Notably, June looks to have seen an especially sizable retreat in the data for PMIs and inventories. Both of these sub-indexes posted their least severe readings since early last year. Transportation costs also declined, but much less appreciably than for the other two categories.

For the PMIs, supplier delivery times improved from an extremely protracted reading of 36 in April to a still-challenging, but less severe, reading of 42 in June (see figure 3).

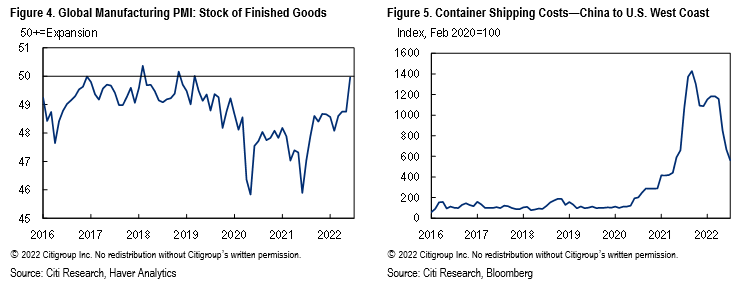

For the inventory index, the key driver of improvement was a normalization back up to 50 in the PMI for finished goods (Figure 4). This neutral reading suggests that on average across all sectors inventories are now neither rising nor falling. That said, the sense is that the underlying story for inventories is differentiated across sectors. Some sectors, especially those that are consumer discretionary, are seeing mounting inventories. In contrast, for other sectors that are less discretionary, more commodity intensive, or feeling sourcing pain from Russia-Ukraine, the situation remains tighter. Also, inventory conditions in the global auto sector remain tight.

The moderation in the transportation cost sub-index was comparatively muted. But even here, a notable easing in the cost of container shipping from China to the West Coast of the United States has occurred (Figure 5). The cost of shipping from China, which has been at the epicenter of the disruptions over the past year (given China’s role as a supplier of goods to U.S. consumers), is still well above its pre-pandemic level but down by more than half from its mid-2021 peak.

The situation in U.S. ports has also improved more generally. Even so, with China now moving out of its recent lockdowns—and the busy shipping season fast approaching—careful monitoring is required to confirm that the progress is sustained.

On one hand, the observed easing in supply-chain conditions suggests a moderation in goods-driven inflation in the months ahead. This is important for central banks and their ongoing campaign to tame high inflation. On the other hand, the source of this easing—Citi analysts reckon—looks to be an underlying easing in the global consumer’s spending on goods, which in part (at least) bears the worrisome imprint of demand destruction.

In this sense, the improvement in supply-chain conditions may ultimately be another signal of mounting recession risks, says the Citi report. For more information on this subject, please see Global Economics: Supply Chain Pressures Are Moderating—the Good News and Bad News*

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.