As the solar power supply chain diversifies, more capacity is being built outside of China. Citi Research analysts are raising their global solar installation forecasts on the back of this broad diversification.

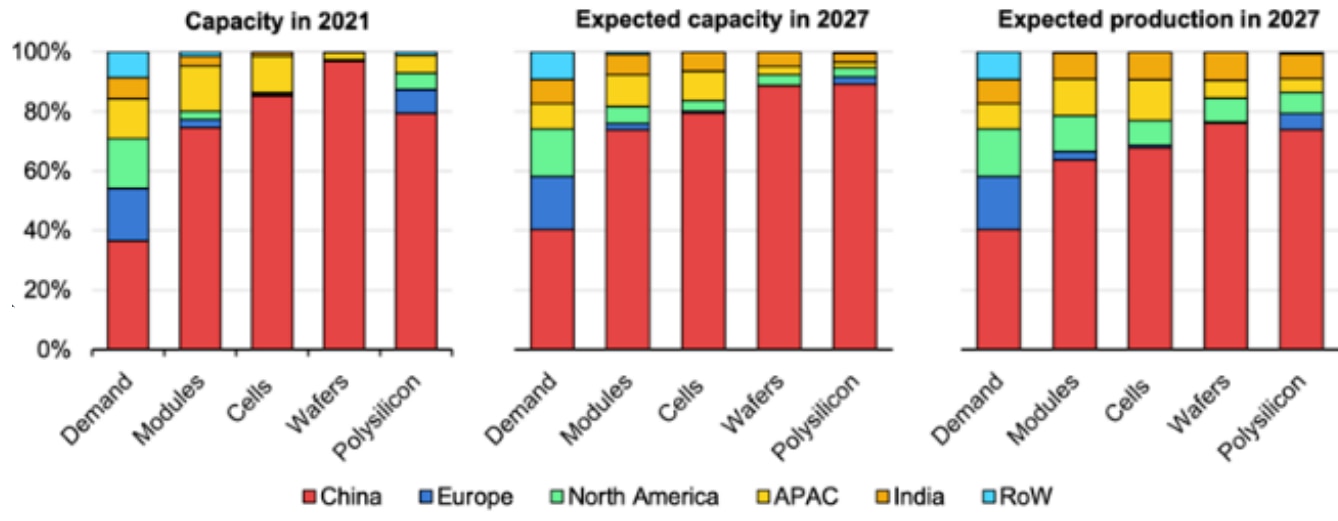

The International Energy Agency (IEA) forecasts that China’s production capacity mix of major solar components would drop from 80-95% in 2021 to 75-90% in 2027 due to more protectionism policies from major markets including the US, Europe, and India.

For instance, the US solar industry aims to establish 50GW of local manufacturing capacity by 2030 with the subsidy support from the Inflation Reduction Act (IRA), according to the Solar Energy Industries Association (SEIA).

The Net Zero Industry Act of the European Union targets to build 30GW of manufacturing capacity by 2025E. And India’s production linked incentive (PLI) scheme has allocated 48GW of module manufacturing capacity by 2026E.

Global solar production capacity and production mix by region.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

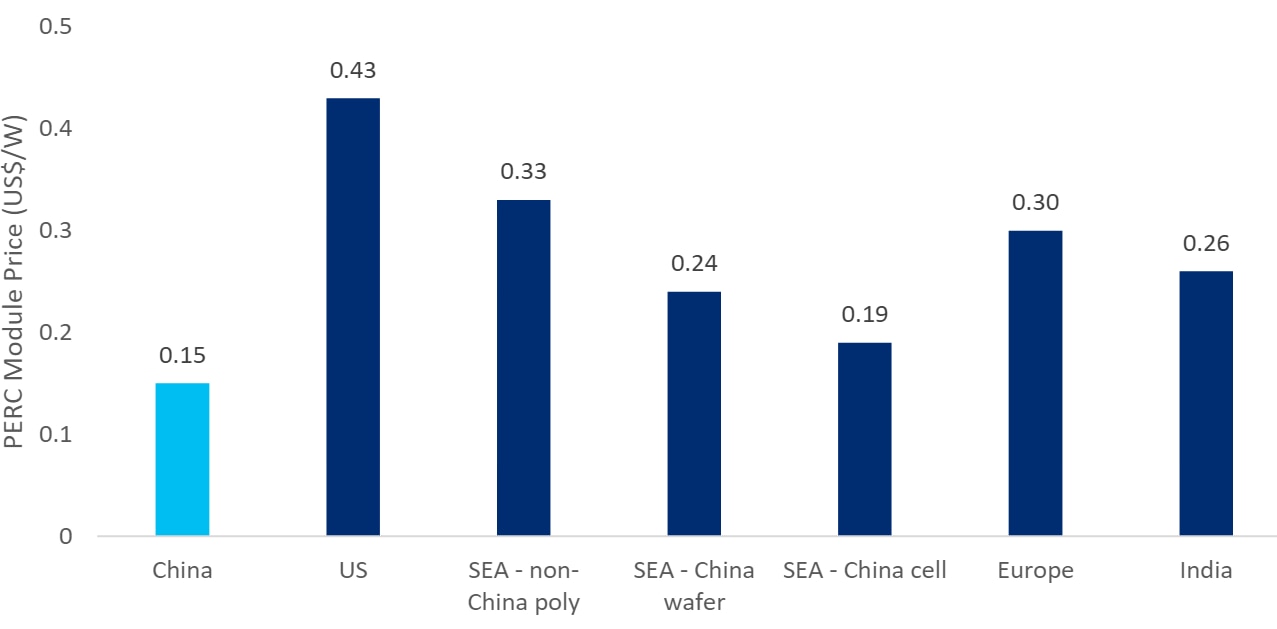

Price comparison of locally produced modules by region, Sep 2023

Source: Wood Mackenzie, Citi Research

While most upstream production in the solar supply chain is likely to remain in China, downstream products like solar cells and modules are increasingly being built outside of China.

Key developments in major solar markets include:

- China: Geo-diversification is a key strategy for China’s solar supply chain. Leading players have established complete supply chains in Southeast Asia for premium markets with high trade entry barriers (e.g., the United States). More plants are under construction in the US and the Middle East with favorable policies. Citi Research analysts expect China installations to make up more than 40% of global demand in 2024-25E, although they say growth is likely to decelerate from a high base.

- Europe: Current European solar supply chain is limited at 1-24GW for major products. The Citi Research analysts believe that the viability of European solar manufacturing is at risk even before it starts due to compelling legislation in other jurisdictions (e.g., US IRA) and less expensive viable alternatives (e.g., cheaper Chinese imports). Onshoring European modules would curtail solar project IRR by c.1.0% for developers. European solar developers benefit from higher power prices and lower input cost. Citi Research analysts expect that the EU will be able to reach the REPowerEU renewable penetration target without rolling out the 600GW of additional capacity targeted by 2030.

- United States: Modules make up the majority of solar capacity expansion in the US with low capital costs but high incentives under the IRA. Limited upstream capacity is under construction. Polysilicon is the key supply bottleneck for the US market under the Uyghur Forced Labor Prevention Act (UFLPA). Import uncertainty can benefit domestic suppliers. US module prices may not fall to the same extent as global prices, in the Citi Research analysts’ view. The analysts say the US could witness solar installations of 32GW in 2023E, with utility scale installations expected to grow at ~15% CAGR in 2024-28E. Solar accounts for ~54% of total new power generation capacity to be installed in 2023.

- India: India has the PLI scheme to support domestic solar manufacturing capacity. A total of 48GW of module capacity is expected to be up and running by the end of 2026. India has installed solar capacity of ~67 GW as of FY23 (end-March 2023). The government has announced plans to invite bids for 50GW of renewables annually for the next five years (FY24E-28E) to achieve its target of 500GW of renewables by 2030E.

- Brazil: More than 95% of solar module demand is met by imports. Brazil had installed solar capacity of 34GW by Sep-23, representing 16% of the country’s power matrix (compared with 12% in Dec-22). Citi Research analysts expect a decrease in solar capacity installations from 2022’s peak, mainly due to the deceleration of decentralized generation following the end of certain tariff exemptions.

- Australia: 99% of solar modules in Australia are imported, mostly from China. The government is looking to build a local supply chain development but costs can be challenging. The Australian Electricity Market Operator (AEMO) is estimating 5,212MW of solar installation projects are proposed across various stages of maturity.

For more information on this subject, please see the full report, first published on 23 November 2023, here: Global Solar Energy - Opportunities from More Global Solar Installations & Added Local Manufacturing under Emerging Protectionism

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.