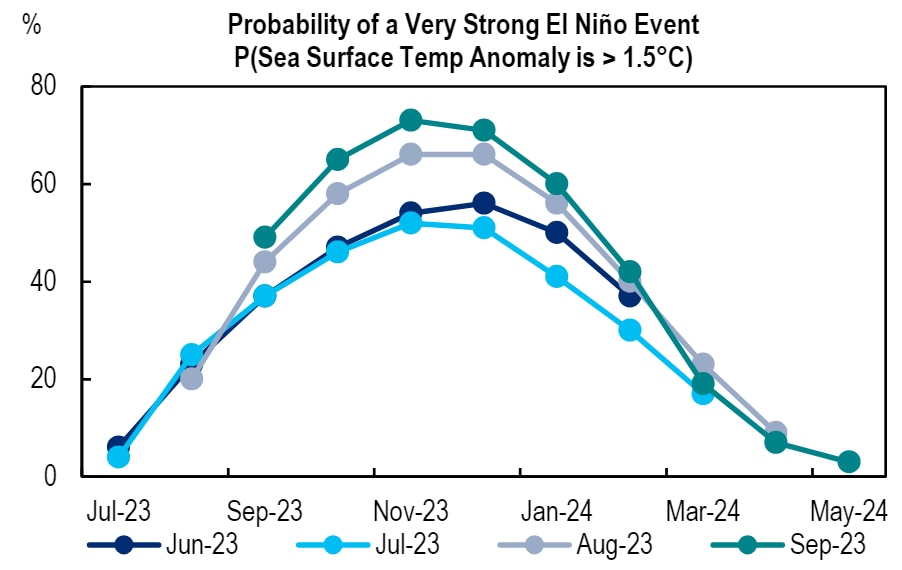

The probability of a strong El Niño weather phenomenon is on the increase. El Niño - characterized by changes in air pressure and sea surface temperatures in the equatorial Pacific Ocean - started earlier this year and the probability of a strong phenomenon by the end of 2023 is now at 70%.

Some impacts are already being felt across Latin America. These include:

- Chile and Peru have seen increased rainfall. That has impacted agricultural activity and prices.

- Peru’s fishing industry growth has slowed.

- Colombia’s government is preparing for possible energy shocks.

- Low water levels have limited activity through the Panama Canal.

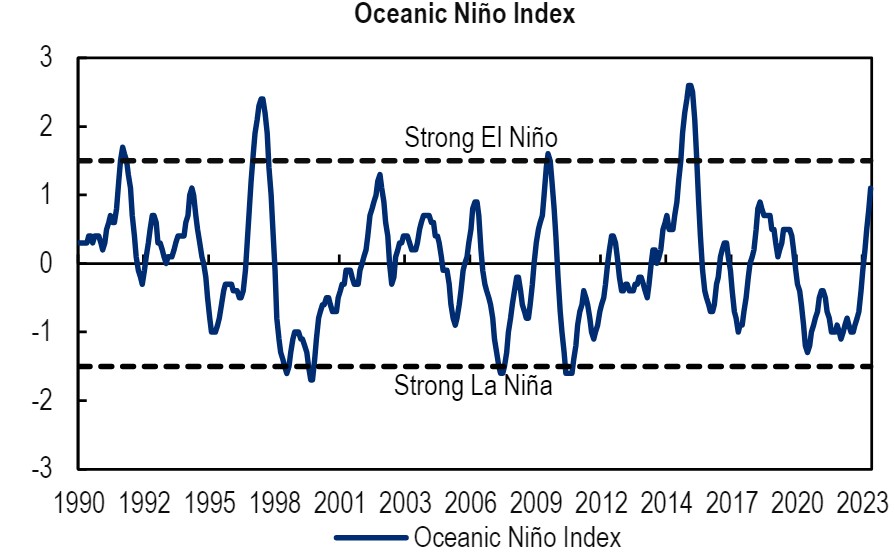

Rising average sea surface temperatures point to El Niño.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, NOAA

Probabilities of a strong event have been on the rise.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, NOAA

Historically, the phenomenon occurs irregularly every two to seven years, with asymmetrical impacts across the region. Two strong El Niño events have occurred in the past three decades, in 1997-98 and more recently in 2015. Other El Niño events have been milder (early and late 2000s, and at the end of the 2010s).

The impact of El Niño is highly dependent on geography, with climate effects manifesting in different ways across the globe and within LatAm. The phenomenon is associated with higher-than-usual rainfall in Chile, Peru, most of Argentina, Southern Brazil, and Northern Mexico.

On the other hand, some zones experience lower rainfall volumes and droughts, including Colombia, Central America and the Caribbean, Western parts of Argentina, Brazil’s agricultural belt, as well as the Centre/South of Mexico.

“Dry” effects have impact on crops through lower irrigation, and on energy through reduced hydro generation and higher reliance on fossil fuels. “Wet” effects, particularly if strong, can lead to flooding in detriment of agriculture, and landslides can affect transportation. The broad effects for the region are summarised here:

El Niño has an uneven impact in Latin America.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

These supply shocks suggest inflationary risks, although impact on activity could be more ambiguous. Milder events could also potentially be beneficial to growth, particularly in places where a moderate level of increased rainfall is welcomed. All told, the rising risk of a strong El Niño event this year at the very least sounds an alarm bell, in particular if the current disinflationary trend and early policy rate cutting cycles face a reversal.

Inflationary impact

Colombia and Brazil experienced higher inflation through the 2015 El Niño event. It took place against the backdrop of established inflation targeting regimes across the region, making it the best example, the analysts say, for possible impacts and policy responses this time around.

In 2015, Brazil and Colombia experienced heightened inflation pressures coinciding with the event. Sea surface temperature markers surpassed the 1 degree mark in 2Q15. Inflation was already high in Brazil by then, while inflation in Colombia started rising soon after. The shock playing through higher inflation is clearer for both countries when looking at the food subcomponent of CPI.

However, Chile, Mexico, and Peru did not experience such a shock. Chile witnessed a drop in food inflation. While this case is by no means conclusive of how shocks play out, it does show that effects do not necessarily play out as expected and that each event has idiosyncrasies.

It is also worth noting that, soon after the climatic event waned, food inflation retraced in Brazil and Colombia with around a six-month lag in both cases. This suggests that, at least in 2015, the shock on inflation was temporary. In the current context, an inflation shock would slow, though not revert, regional cutting cycles if expectations are affected.

If an El Niño shock leads agents to increase longer-term expectations once again, a policy response is possible. That said, the low-growth outlook and core inflation adjustment should still prompt central banks to ease their policy stances, the report says.

The analysts say that if there is a policy response this time around, this would likely include central banks slowing the pace of cutting cycles and, at most, a mid-cycle pause. They say they continue to believe terminal rates will depend more on international monetary conditions and how DM central banks ultimately behave through 2024 and 2025.

For more information on this subject, and if you are a Velocity subscriber, please see the full report, published on 28 September 2023, here: Latin America Economic Outlook & Strategy - El Niño on the Horizon

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.