Revisiting the Call for Mild Euro Area Recession

The team had expected only a mild recession for the euro area, but they now warn that call looks too optimistic. The tensions between the European Union and Russia is intensifying, gas prices have risen another 30%, and leading economic indicators now point to a much worse outcome for Europe.

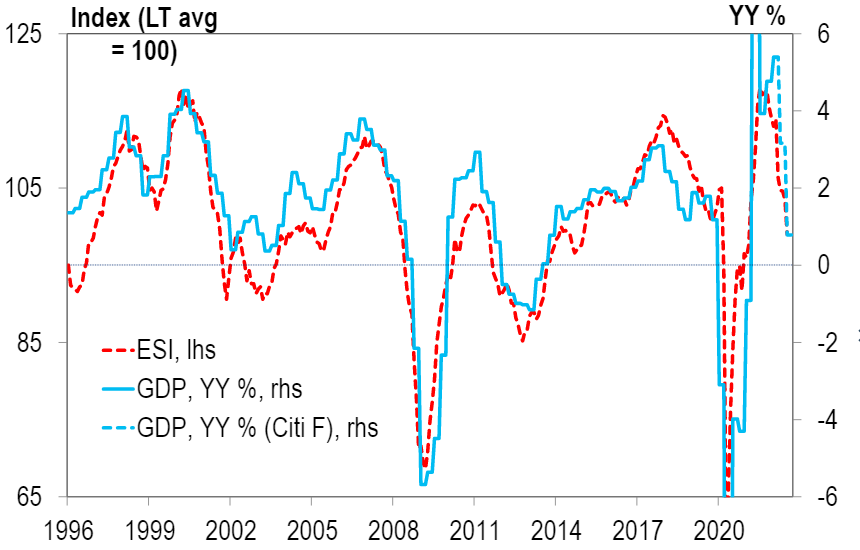

Starting in mid-July, the authors note, virtually all leading indicators of euro-area economic activity began flashing dark red. The Euro Area PMI composite output and the EU Commission’s Economic Sentiment Indicator both broke through critical levels, and while they’ve stayed clear of recession territory, other indicators suggest that’s unlikely to last.

Euro Area -- ESI and Real GDP Growth (YY %)

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

And of course Europe’s economy continues to face global headwinds, from ongoing supply-chain disruptions to tightening financial conditions. Citi has cut its 2023 GDP growth forecast to -1% for the Euro Area and -2% for Germany. Consumer confidence fell to new all-time lows in July, and Citi Research is particularly alarmed by evidence in Germany’s GfK survey that households may be ramping up saving—something that’s often a precursor for a downturn.

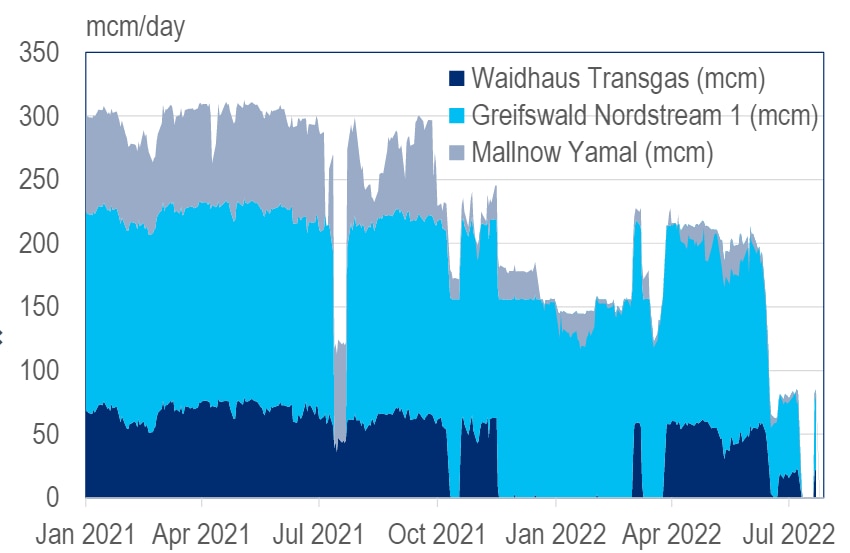

Gas prices have continued to rise, becoming the key driver of the recent declines in consumer and business confidence. Europe’s dependence on Russian gas is a critical factor in determining the shape of the downturn seen ahead, and so deserves further exploration. Mandatory reductions in Germany’s gas consumption, paired with EU action, would be costly in terms of output but allow Europe to wrestle back control of the situation and reduce uncertainty. But can that outcome be achieved?

Why Russian gas is key to the crisis

Germany/EU -- Pipeline Gas from Russia (MCM/day)

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Bloomberg

Overall gas flow from Russia to Germany via pipelines has dropped from 300 MCM per day through October to around 70 MCM at best now, and further cuts may lie ahead.

Remarkably, despite this sharp reduction, most EU member states have been able to raise their levels of gas storage—Germany, for example, raised its storage levels from 28% in late February to 55% in mid-June, when Russian gas was still fully flowing, and since then has raised levels to 67% despite fluctuating supplies. This was achieved in part by reducing consumption and by increasing the supply coming from other countries, mainly Norway. Citi Research’s model shows that if Russian gas supply stays at 20% until the end of the next heating period and alternative gas supply stays at the new, higher levels, German gas consumption would have to remain 12% lower than normal to avoid shortages. If Russian supply falls to zero, on the other hand, the reduction in consumption would have to be 18%.

Further reduction in gas consumption to reduce dependence on Russia is now a focus of the EU as well as many national governments. The economists note three efforts that could help achieve these reductions: replacing gas in electricity generation; voluntary savings by households and services sectors; and industrial rationing, which would hurt manufacturing and cut GDP output. But recently several German multinationals signaled that large reductions of gas consumption were manageable. Such anecdotes suggest that preparations for gas rationing have advanced and rationing’s impact wouldn’t be as large as this spring’s initial studies suggested. Citi Research’s calculations of the bottom-up impact of rationing on the economy point to a GDP impact of around 1% to 2%. Actions at the EU level, meanwhile, haven’t reduced prices yet, amid doubts about their implementation.

Exploring four scenarios

The report notes that the months before the height of the heating season are key in determining what happens next. If Europe manages to raise gas storage levels to 90% or more before the end of October, it will have room to maneuver until new alternative supply comes online. Success or failure in this effort is key to Citi’s euro-area growth projections for the rest of the year—as is the related question of how to achieve that storage level.

Citi Research’s European economic team sees four possible scenarios.

In the first, Europe rolls over and retreats from its sanctions on Russia, returning gas flows to pre-November levels. This could create a gas glut, relieving pressure on both household real incomes and corporate profits. But such a course of action would pose a possible conflict with the U.S., and for that reason the team sees it as unlikely.

The second scenario sees Russia continuing to deliver 40% of capacity for another three months while the EU makes progress on reducing consumption and replacing Russian gas. That could make a recession as mild as Citi’s current forecast. But there’s a problem: Russia is unlikely to help reduce uncertainty in this way.

The third scenario sees Europe’s efforts stall and Russia cut the gas supply, preventing the 90% storage-level goal from being achieved and making it too late for soft rationing. This would leave Europe dependent on Russia gas, an exposure that Russia could then leverage.

Finally, the economists explore a fourth scenario, in which European governments take action to reduce consumption immediately, including through mandatory rationing. This would make it easier to reach the 90% gas storage threshold, preventing Europe from being dependent on Russian gas during the winter. The economic hit might still be 1% to 2% of GDP, but taking action before a Russian cutoff could lead to gas prices falling and uncertainty fading.

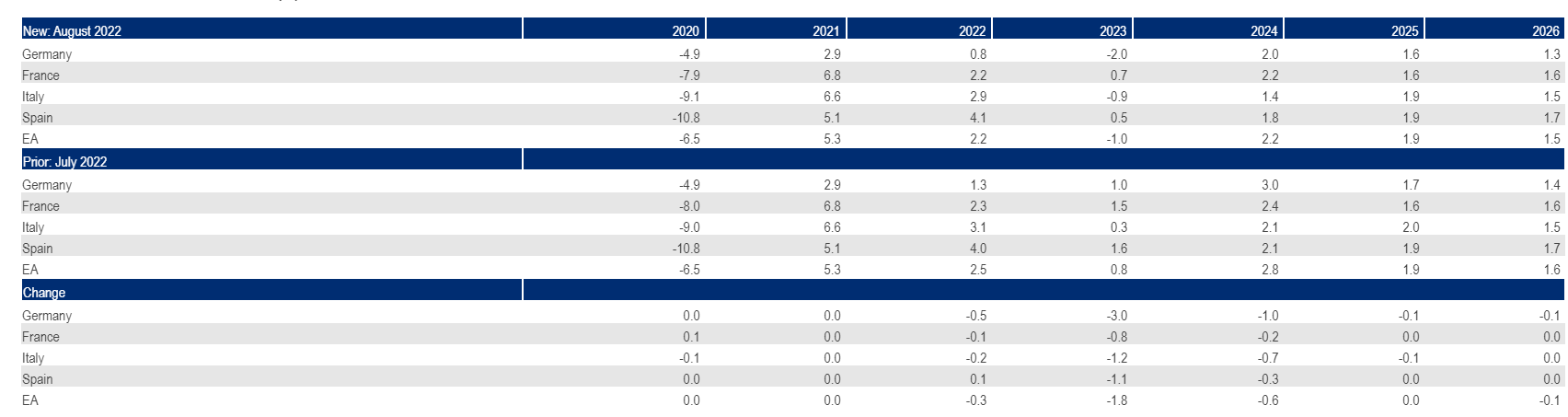

Euro Area -- Real GDP Forecasts (%)

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Eurostat

The second scenario—gradual progress for the EU as Russia continues to deliver gas—is the only one consistent with Citi Research’s current set of forecasts. But the authors observe that it’s difficult to see this coming to pass. Nor do they see a conflict with the U.S. improving Europe’s economic outlook, which rules out their first scenario. That leaves the third and fourth scenarios—the one that used to be the worst case and something likely even worse than that. The new forecasts represent a mix of these two.

To conclude, the team considers a broader context. Europe’s weaning itself off Russian energy would be a permanent shock to the trajectory of its economic potential. New sources of energy require lots of time and investment, and can only restore potential to what it was before. Gas consumption will have to stay at lower levels well beyond this winter, which makes the team more skeptical that growth can rebound swiftly. The pre-pandemic path of GDP growth now looks out of reach unless coordinated monetary and fiscal policies unleash a very large investment increase. Given the ECB’s focus on spot inflation, Germany’s focus on fiscal discipline, and the constraints posed by rising borrowing costs in the periphery, the authors warn that they aren’t holding their breath.

For more in-depth analysis, please see European Economics Weekly - Europe Veers Off-Course

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research. The comments expressed herein are summaries and/or views on selected thematic content from a Citi Research report. For the full CGI disclosure, click here.