The first half of the year has seen dramatic change where commodities are concerned. At the beginning of the year there appeared to be a balance between tailwinds from China’s post-COVID recovery and headwinds from the US, EU, and the rest of the OECD. That has given way to an unexpected reversal in the roles of China and the US, with Chinese growth and demand languishing and the US seeing a little-predicted surge in oil demand.

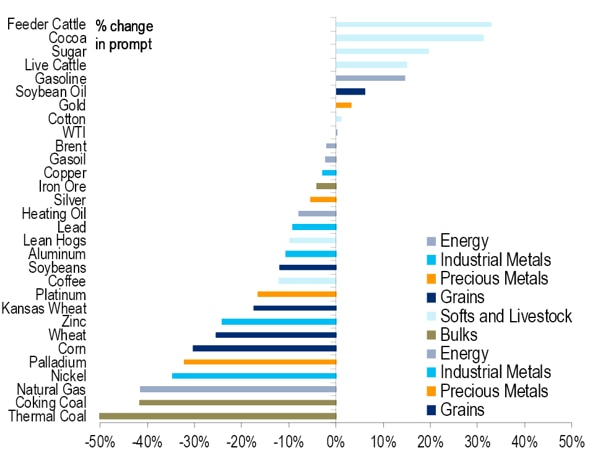

Commodities market price returns, YTD 2023

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Bloomberg

Several wildcard issues have emerged. One in particular has a potentially huge, unexpected impact on commodities: a potential ceasefire between Russia and Ukraine. Other wildcard risks can also be massively impactful by the end of this year.

Here are a few of them:

- While macro headwinds will likely emerge in late 2023 or 2024, the short run could bring bullish changes. Citi’s economists are projecting global GDP growth of 2.3% this year and 2.0% next year (with a potential US recession), along with continued increases in US and EU central bank rates. Commodities demand is particularly sensitive to GDP. Impacts from China and Ukraine have led to sustained commodity weakness after an initial bullish reaction to China’s return and Russia/Ukraine dislocation.

- The Energy Transition is bringing divergence to commodities, with fossil fuel demand flattening to zero and then negative net growth, while battery, EV, and energy transmission/distribution demand growth will likely be metals intensive for most of the decade to come. Citi Research analysts expect peak oil product demand to be reached by this decade’s end, although petrochemical and jet fuel demand will likely grow as motor vehicle demand retrenches. Meanwhile, overall energy supply should increase as a percentage of GDP growth.

- One of the major risks is of a ceasefire emerging in the Russia/Ukraine war as early as this summer given the costs and risks of both parties. Citi Research’s analysts give this a 30% probability as happening before year’s end, but there are also chances that the battle could continue in a virtual stalemate (50% probability) and a smaller (20% probability) of one or the other side winning a decisive advantage as the battle simmers at a lower level. A ceasefire would definitely be bearish for commodities, they say.

- China remains a critical part of both global commodity supply and demand. There are two risks emerging and potentially unfolding at the same time: 1) China seeing much lower than 5% growth (partly caused by domestic changes in policy, demographics, and economic challenges), with negative impacts on commodity demand; and 2) an intensification of the supply chain battles between China and the US, and between China and Europe as well, reducing global trade growth and seeing inflationary forces emerging from homing supply.

- Oil producers Iran, Iraq, Libya, Nigeria, and Venezuela produced 900-k b/d more in June 2023 than in June 2022, partly because of low output last year. But among them, Citi Research analysts can see 2-m b/d or more supply growth over the next 12 months and also the possibility of 2-m b/d less supply.

- Additionally, there are Vox Populi issues arising in various parts of the world, challenging commodity supply growth, whether in metals supply in Chile, Peru, and elsewhere in Latam, or Africa, or related to oil in the Middle East.

The full Citi Research report, published on 17 July 2023, is available to Velocity subscribers here: Summertime Doldrums or Fireworks?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.