What a difference a year makes. When it’s a year as tumultuous as this past one, that’s even truer.

Almost anywhere you look across commodities are indications of just how drastic the impact of Russia’s invasion of Ukraine has been.

In Jan. ‘22 Russia was the 1st, 2nd or 3rd largest exporter of >30 commodities, including being 1st in combined crude/petroleum products, natural gas and wheat.

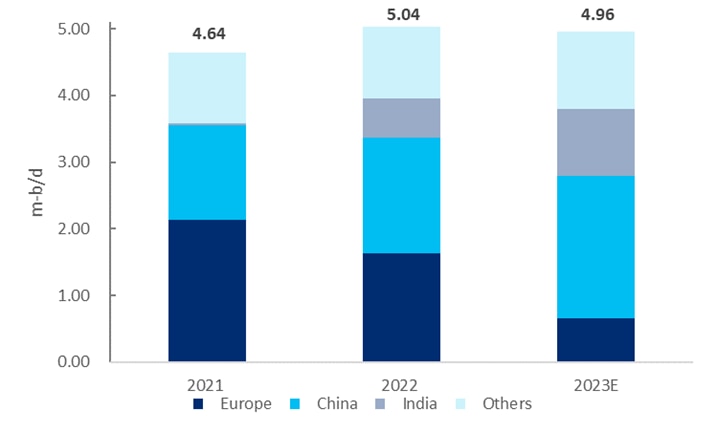

Russia crude oil exports, 2021-2023E (m-b/d)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research. Oilx

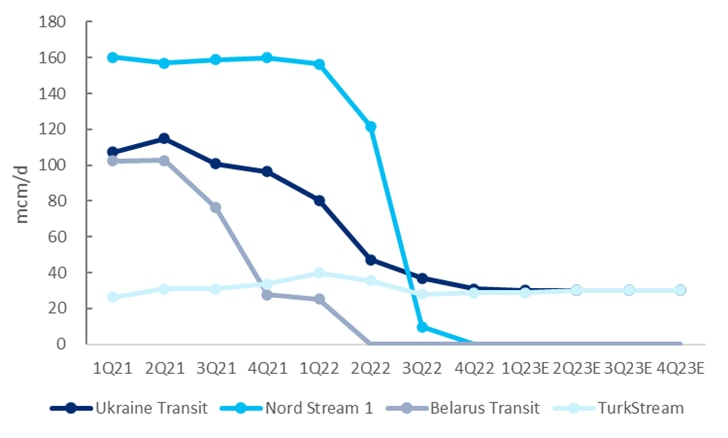

Fast forward to Jan. ’23, and the US is the world’s largest exporter of combined crude/petroleum products and natural gas. And Citi Research analysts say they believe Russia has essentially no hope of regaining its position in natural gas or oil for the rest of this decade.

In Jan 2022, 80% of Russian oil/products and natural gas was supplied to the Atlantic Basin, 20% to East of Suez; now those percentages have been reversed, with scant hope the old normal will return at all, or if it does, not for several years.

For most commodities, Russia’s sales now look eastward, at a discount to western sales, cutting Russia’s overall income from commodities sales.

Russian pipeline gas exports to Europe, 2021-2023E (mcm/d)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission

Source: Citi Research, Bloomberg

Battlefield outcomes aside, Russia will potentially never regain its position as the world’s number one exporter of some of the world’s most critical materials.

Indeed, regardless of if Moscow might try to revert to its historical position as a long term and reliable source of resources such as food, fuel, precious or industrial metals, the fallout from the war means several of Russia’s major commodities buyers are adopting the Chinese position that in the interests of resource strategy and security require imports from any single supplier must be limited to no more than 15%.

Critical uncertainties over potential outcomes of the Russia/Ukraine crisis initially led to a surge in commodities prices, especially in sectors in which Russia is among the 3 largest global suppliers. These include commodities in which Russia/Ukraine constitute the largest exporter: wheat, barley, natural gas, processed nickel, fertilizers, seed oils; or the 2nd largest: crude oil/products, palladium/platinum; lumber, refined copper, ammonia, steel, uranium/thorium, titanium; or 3rd largest: aluminum, coal.

Russia and China’s combined GDP share of 17.07% compares to the 55.88% share of NATO and allies in the Pacific

excluding emerging market countries economically tied to the latter. That’s likely to make a big difference as the dust settles and China decides where its major advantages lies.

For more information on this subject, please see Global Commodities - The Brave New World of Commodities: Assessing Global Tectonic Shifts on the 1st Anniversary of the Russia/Ukraine Crisis (6 Mar ’23) and please also see Global Commodities - Wildcards 2023: Global and domestic shifts could make 2023 a banner year for the unexpected (6 Feb ’23) for further reading.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.