Citi’s annual review of wildcards affecting commodities takes a new turn this year.

Last year Citi analysts reflected on a return to normal, what it might mean, and why it might not happen – an appropriate theme at the time given many hoped, it turns out mistakenly in some cases, that we were at the height of the pandemic.

This year, they focus less on Covid, even given its critical impacts on supply chains, inflation, and most importantly commodity demand and global growth. Instead they reflect on other issues.

Here are 2022 wildcards that Citi analysts reckon have moderate or high probability.

-

OPEC+ finds itself in a market share battle again with non-OPEC+ producers, but finds it difficult to cut output again (probability - moderate)

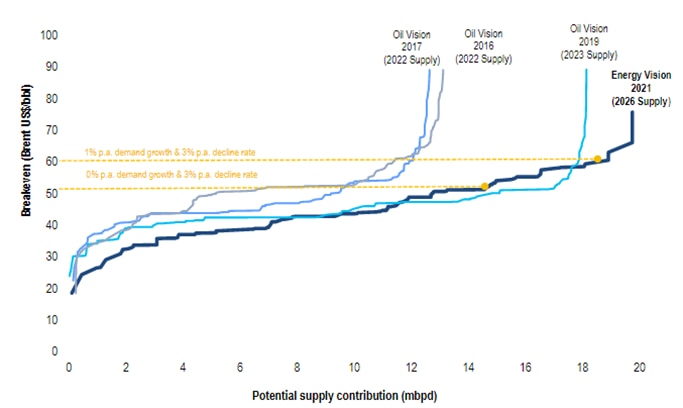

Consequences: Having cut production dramatically to avert a full-blown oil market crash since 2020, OPEC+ looks to have overtightened markets, dropping inventories to low historical levels, providing high prices to non-OPEC+ producers to expand production, leading to potentially heavily oversupplied markets in 2022 and beyond. If OPEC+ switches sharply to a market share battle, prices could fall dramatically. On the other hand, OPEC+ could continue to tighten markets further, creating additional temporary oil price spikes if winter weather and petrostate failure join in a perfect storm, which could result in a surge in prices. However, this would likely be kicking the can down the road for a price crash further down the line, given structural supply economics seeing ample supply to come at the $40-60 level.

|

Energy Vision 2021 - Global oil marginal incentive cost-curve |

|

|

|

Source: Citi Equity Research |

How to get there:

OPEC+ has been a major factor in rebalancing markets since spring 2020. It has now fallen into a configuration featuring Saudi Arabia and Russia as two of the major producers, while the UAE has also increasingly thrown its weight around. They have moved from monthly meetings to act as the market’s central bank (increasing or decreasing liquidity as deemed necessary) into a rhythm of meeting month after month as part of the Joint Ministerial Monitoring Committee (JMMC) meetings, largely adding a notional 400-k b/d for the “group” each month but paying lip-service to assessing market conditions and adjusting production policy from time to time.

-

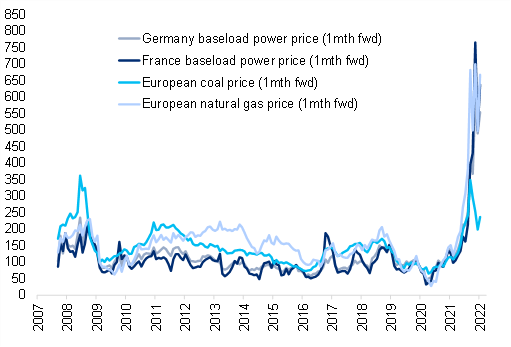

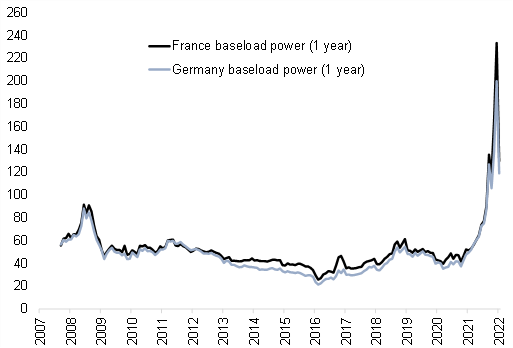

Europe’s power crisis worsens, increasing inflation, lowering growth, damaging energy-intensive industries (probability - moderate)

Consequences: The impact on European growth and inflation of power prices outperforming the forward curve could be severe, depending on how the burden of higher prices is allocated by the European authorities. The impacts of developments to date are already affecting industry, and are likely to continue to do so, whether the wildcard scenario plays out or not.

|

Power, coal, and gas prices have risen sharply across Europe, reaching all-time highs on a 1 month forward basis (Indexed, 2019=100) |

Figure 3. It's not just near dated power prices that have risen, power prices 1 year ahead are still trading at well over €120/Mwhr compared to ~€40/Mwhr normally |

|

|

|

|

Source: Citi Research, Bloomberg |

Source: Citi Research, Bloomberg |

How to get there: Colder than normal weather over the next 1-2 months, gas or coal supply disruptions, or unexpected European power plant closures (for maintenance or from geopolitical issues), would see Europe’s ongoing power crisis worsen.

-

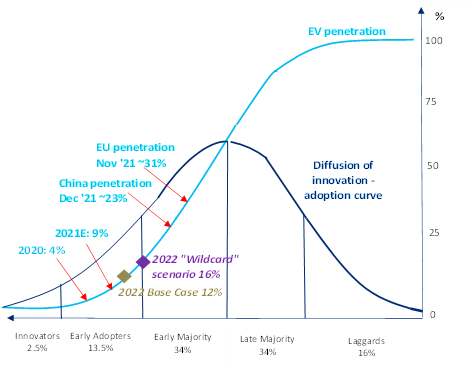

Electric Vehicle penetration rates rise much quicker than expected (probability - high)

Consequences: Metals costs/prices increase dramatically.

|

EV penetration on the S-curve of adoption and diffusion of innovation theory |

|

|

|

Source: Citi Research |

How to get there: EV sales grow at 100% y/y during 2022, the same growth rate as in 2021, compared to our base case forecast of 50% growth. The battery supply chain consumes metals 6-12 months ahead of EV sales meaning that consumption will not only be higher owing to the increase in 2022 sales but also on expectations for 2023, which will likely extrapolate forward the higher sales trend.

For more information on Citi’s commodities wildcards, please see Global Commodities - Wildcards 2022: A Year When the Unexpected Should Reign

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.