Global growth strategies: Harnessing shifts in trade corridors

MORE STORIES

*This content was produced by Global Trade Review on behalf of Citi Commercial Bank.

Increasing focus on supply chain resilience and investment is creating new trade corridors. Solutions such as purchase order financing can help companies reduce risk and improve efficiency with their new trading partners.

Global supply chains have faced significant challenges due to geopolitical tensions and environmental concerns. Although pressures are gradually easing, companies continue to prioritise efficiency and cutting costs in their supply chains, especially with interest rates and inflation uncertainty.

According to a recent Citi Supply Chain Pressure Index,1 a geographical reconfiguration of supply chains is expected. The index suggests that reshoring and nearshoring are happening on a large scale.

A 2023 survey with East & Partners2 reveals that 56% of large corporates are considering a ‘China plus one’ strategy to diversify production and supply chain activities, with India, Thailand and Vietnam as prime targets. Outside of Asia, Mexico is emerging as a key country, offering cost advantages and proximity to the US. In 2023, the US purchased more goods from Mexico than any other country, a trend expected to grow given the United States-Mexico-Canada Agreement.3

As companies explore new markets, they need a bank with a network and services that can help them navigate local complexities.

“Mexico, for instance, is a regulated market where Citi’s presence and expertise allow us to manage local nuances and help companies do business there,” says Shrey Daga, Citi’s global head of trade and working capital sales for commercial banking clients. “The growing trade flow into Mexico demands robust trade solutions, particularly documentary credit, while local trade financing in pesos is crucial for clients’ working capital needs.”

Taking the first step

When expanding into new markets, companies must evaluate supplier reliability and resilience to provide consistent delivery and the ability to withstand market fluctuations. Likewise, helping suppliers meet ethical standards is crucial to avoid reputational risks.

Deciding between direct sourcing and using intermediaries is another consideration; while middlemen offer expertise and established networks, they also come with additional fees. Similarly, choosing between centralizing or decentralizing operations affects control, costs and logistics, and depends on the company’s resources and desired level of oversight.

“Once those decisions have been taken, setting KPIs for initiatives like working capital is crucial and should be embedded throughout the company, not just at the C-suite level,” says Francisca Michielsen, Citi’s head of trade and working capital sales for the UK, Europe and Middle East and Africa for commercial banking clients.

Meeting financing needs

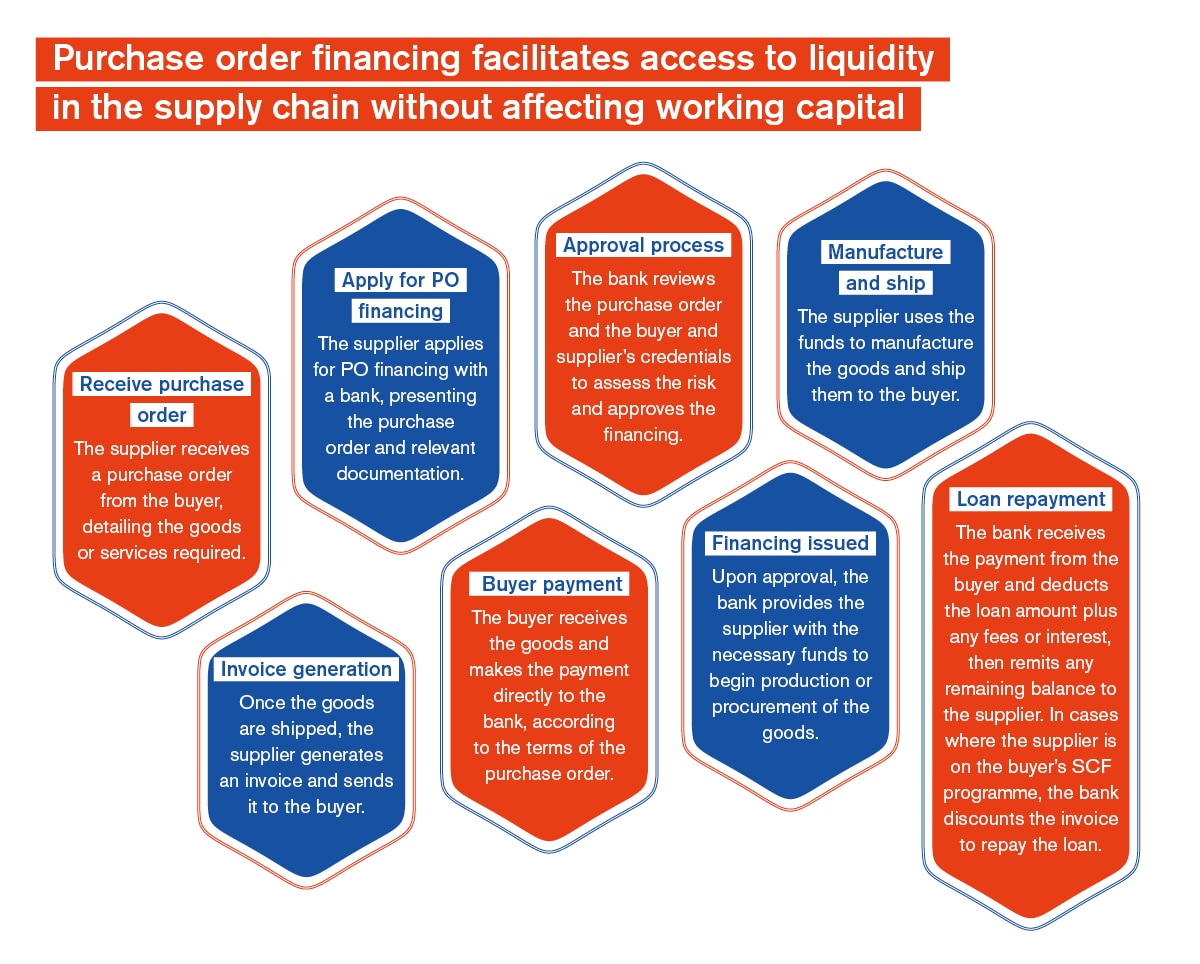

Financing solutions such as supply chain finance (SCF) and purchase order (PO) financing, offer suppliers the funds needed to manufacture and deliver goods before an invoice is generated and create liquidity in the supply chain.

With PO financing, the bank finances production based on a purchase order from the buyer. Once the goods are shipped and paid for, the loan is repaid.

This ensures secure funding, allowing suppliers to fulfil large orders without upfront capital, enabling them to meet buyer demands and grow in new markets.

PO financing has advantages over other options. SCF is used post-invoice, where the buyer approves the invoice, and the bank finances it, ensuring repayment once the buyer pays. Unlike PO finance, SCF requires an existing invoice and typically occurs after goods are shipped.

In some cases, when a supplier is already enrolled in the buyer’s SCF program, the PO financing is repaid through the discounting of invoices under SCF, offering end-to-end funding for suppliers. With Citi’s extensive supplier base of over 200,000, scale can be achieved quickly.

Documentary trade financing uses instruments like letters of credit, where the bank guarantees payment to the supplier upon shipment of goods and presentation of compliant documents. This is useful when PO financing is not feasible, especially for new or non-client suppliers, as it relies on bank-to-bank guarantees, helping reduce risk.

“The combination of PO financing with SCF and documentary trade solutions offers a robust framework for addressing end-to-end financing requirements,” says Daga. “Each is tailored to client needs, transaction stages and risk profiles, providing a flexible approach to expanding supplier bases in new markets.”

Source: Global Trade Review

Case study: Hiho Wheel

South Korean wheel manufacturer Hiho Wheel, a subsidiary of Hiho Metal, wanted to expand into North America by establishing a presence in Mexico, an important hub for auto manufacturers.

To support this expansion, Hiho Wheel required initial financing for a new plant and access to local banking facilities.

Despite planning to set up a treasury function in Mexico, Hiho Metal’s CFO needed to maintain oversight and control of financial activities from headquarters. Another consideration was Hiho Wheel’s ambitious project timeline.

Hiho Wheel selected Citi as its bank due to its international presence and comprehensive range of financial solutions.

Citi provided a financing facility fully backed by Korea Trade Insurance Corporation (K-Sure), South Korea’s official export credit agency (ECA), to help fund the construction of the plant that produces aluminum wheels in Apaseo El Grande, Mexico.

Additionally, Citi opened payments and collections accounts for Hiho Wheel Mexico, established treasury structures for cash and liquidity management, and worked with Hiho’s treasury team to deploy FX solutions, all accessible within the CitiDirect platform.

“We have built strong relationships and connectivity with Citi at our headquarters in Korea and through our treasury team locally in Mexico,” says Kwangseob Lee, president of Hiho Wheel Mexico.

“Citi goes the extra mile and has a personal touch. Recently, the head of Citi Commercial Bank for Korea visited our plant in Mexico, while the Citi head of multinational companies in Mexico came to our headquarters in South Korea. That level of commitment to understanding our objectives and growth ambitions is greatly appreciated by Hiho Wheel and the entire Group.”

References

- ‘Supply Chain Financing, Building Resilience as the New Definition of “Global” Emerges’, January 2024, Citi GPS: Global Perspectives & Solutions. Forecasts may not be attained.

- East & Partners Large Corporate Survey 2023, Citi Services.

- The Agreement was entered into on 1 July 2020.

Related Stories