Global growth strategies: Unlocking growth with digital solutions

*This content was produced by Global Trade Review on behalf of Citi Commercial Bank.

As companies grow internationally, their financing needs shift, calling for more sophisticated solutions that can match their increasing digital requirements. They need a bank with a digital platform to help them transact with speed, security and transparency.

When companies expand globally, their business and financing needs change. This often means moving from traditional debt-based trade finance to more advanced working capital solutions. A prime example is payables finance and receivables finance. Both solutions aim to help improve the cash conversion cycle and focus on enabling businesses to effectively manage their cash flow and potentially reduce the debt/leverage on its balance sheet through improved cash management.

Over the past decade, large corporates have extensively used payable finance via supply chain finance (SCF) programs to improve their working capital management, a trend now increasingly seen among mid-sized firms with global growth ambitions.

“As companies grow and mature and start thinking about external ratings and accessing the capital markets, maintaining a lean balance sheet becomes crucial,” says Shrey Daga, Citi’s global head of trade and working capital solutions for commercial banking clients.

“There’s been a noticeable uptick in the demand for off-balance sheet funding. Our payables and receivables business has grown significantly in the last few years, mainly fueled by clients in North America and Western Europe. However, we’re witnessing a similar trend among mid-sized firms growing their businesses internationally, even in emerging markets,” Daga says.

A fully digital offering

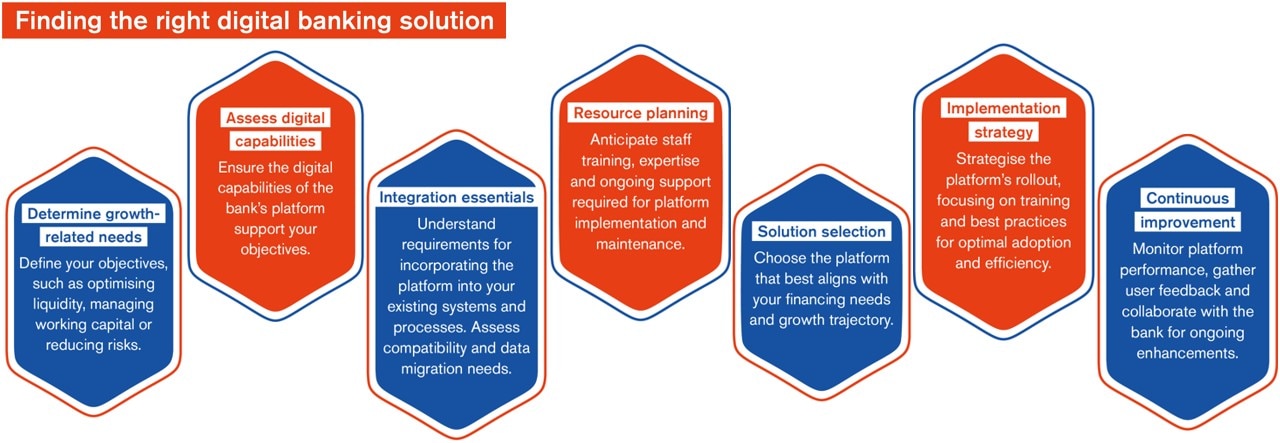

As companies expand into new markets and start leveraging potential off-balance sheet solutions, they need to be able to digitally consolidate information about their supply chains, centralize treasury operations, and oversee the entirety of their banking solutions.

Recognizing the dynamic nature of clients’ financial needs, the CitiDirect® platform facilitates integration between these solutions to enable clients to efficiently manage day-to-day banking interactions with Citi, all in one place.

“This integration between solutions helps keep the process simple. In the case of electronic loans (eLoans) and SCF functionalities, for example, a buyer can vet a purchase order and the funds can be provided to pay the supplier on the same platform,” says Daga.

By leveraging Citi’s global banking presence in 95 countries, the platform links with a significant number of buyer and supplier networks transacting in 144 currencies and providing data-driven insights to help inform decision-making.

“With CitiDirect’s comprehensive digital capabilities, we gain access to valuable data on payables and receivables, which means we can provide clients with insight into which of these solutions will be most effective and how to deploy them, allowing us to help our clients meet their specific funding needs,” says Francisca Michielsen, Citi’s head of trade and working capital sales for the UK, Europe and MEA for commercial banking clients.

In 2023, Citi started rolling out its CitiDirect Commercial BankingSM platform to meet the demands of its commercial banking clients. This single-entry digital platform brings together Citi’s global products and services, giving clients a comprehensive, real-time view of their Citi banking relationship across cash, trade and working capital solutions, including eLoans, FX, servicing and onboarding.

Source: Global Trade Review

Shaping the future

Citi has made substantial investments in its technology in recent years as it further enhances and simplifies its offerings to provide a more connected experience for clients.

Across the full trade lifecycle, investments in technologies such as optical character recognition have enabled faster processing of trade documents. Solutions like Citi Digital Bill aim to reduce reliance on traditional paper-based methods. Citi is also exploring emerging technologies, including artificial intelligence and natural language processing, to power new solutions.

“As digitalization transforms the global trade industry and companies seize new opportunities in business and finance, Citi is taking proactive steps to lead the transformation required from banks,” says Daga.

Case study: Wallbox

Wallbox, headquartered in Spain, is one of the leading providers of electric vehicle chargers and energy management solutions for electric vehicles (EVs). The company creates smart charging systems that facilitate communication between vehicles, the grid, buildings and chargers. Wallbox’s Pulsar EV charger range can be found in many households around the world due to its compact design, power capabilities and the convenience of control through the Wallbox App.

Wallbox is on a mission to expand globally, driven by increasing demand for its smart EV charging and energy management solutions. The company sought innovative digital methods to fund its suppliers across various regions in alignment with its business model. This led Wallbox to reach out to Citi for support.

Given Wallbox was already on the CitiDirect platform, the company could easily leverage the platform’s eLoan module to apply and access working capital. This feature facilitates digital loan disbursements across multiple jurisdictions and borrowing entities and offers the convenience of centralized management by Wallbox’s treasury team.

The eLoan solution proved to be precisely the self-service tool that Wallbox sought, providing full visibility into the status of each loan. It enhanced the user experience for Wallbox by enabling access to crucial loan information, tracking interest rate fluctuations, and assessing credit line availability through an interactive and intuitive dashboard. Moreover, all loan drawdowns are initiated electronically via the eLoan platform.

The use of a single platform solution has enabled Wallbox to achieve digitization, mitigate risks, streamline processes and effectively meet its core working capital requirements.