Future of Cross-Border Payments

The world of cross-border payments is at an inflection point. As the ecosystem is shaken up by new competition and technologies, there will inevitably be winners and losers. All players must remain nimble and adapt if they are to retain their market share and thrive. This report examines the challenges and opportunities faced by market participants at this pivotal time.

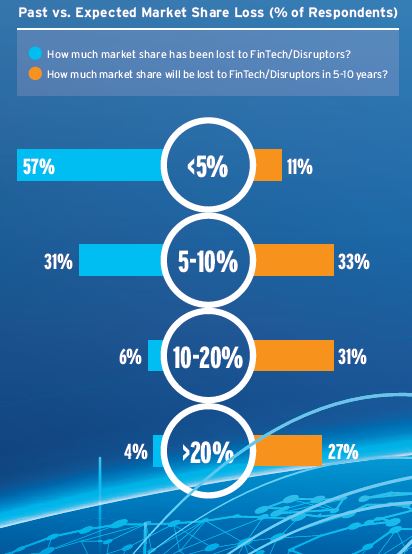

The fierce level of competition in cross-border payments is unsurprising given the rewards on offer. There is a race emerging — between new entrants and existing players, often with new business models — to seize a slice of the cross-border payments wallet.

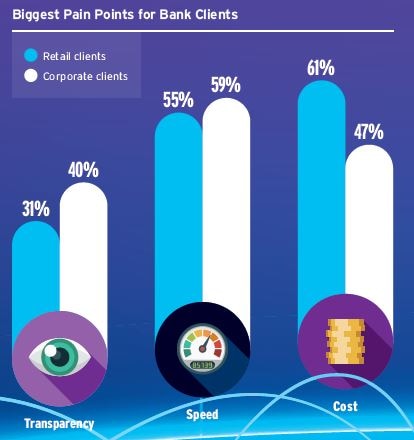

The evolving landscape is also driven by changing behaviors, and heightened expectations, with consumers seeking a streamlined, transparent, 24x7 real-time experience, both domestically and across borders. These expectations have crossed over to the corporate and institutional client market as well. New business models, such as direct-to-consumer offerings, marketplaces, and shared economy models, are also spurring change in the payments world.

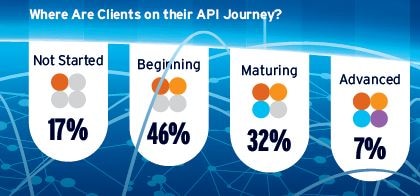

Competition is increasingly multi-faceted within the industry. Payments are moving away from traditional instruction methods, which are tied to batch and files, and moving toward application programming interface (API) connectivity. This is leading to a heightened opportunity for both FinTechs and other participants that will be enabled through traditional financial infrastructures. Regulation is also increasingly fostering innovation via initiatives such as open banking and there has been a consequent increase in players that can deliver technology nimbly and leverage digital client experiences as a differentiating factor.

This report builds on qualitative contributions from key market infrastructure experts — from within and outside of Citi — FinTechs, and a diversified set of banks spanning across four continents. It also outlines the key findings from a proprietary survey of more than 100 of Citi’s financial institution clients. Their priorities were resoundingly clear: Speed, cost efficiency, and transparency are critical to delivering best-in-class client experiences.

We examine what it takes to deliver such an experience, explore technological innovation across the traditional fiat currency stack — including alternative payment methods and other industry-driven developments — and draw connections to the fast-changing digital asset space. Digital assets have yet to scale; however, interesting use cases, such as smart contracts and real-time liquidity, are already emerging. Artificial intelligence has captured significant mindshare in 2023 and could act as a catalyst for change in the payments market.

While leveraging the pace of innovative change, it is also imperative to stay focused on safety and soundness for clients while continuing to comply with the needs of the evolving regulatory landscape.

As we show in this report, best-in-class client experiences — leveraging new technologies — can address clients’ key pain points and have the potential to transform cross-border payments for the benefit of all. Citi is proud to play a key role in this journey, and we hope these insights help you both understand and benefit from the dynamic future of cross-border payments.

Our vision to be the preeminent banking partner for institutions with cross-border needs grows ever more relevant every day. With international networks fully engaged and payment activity continuing to grow across borders, clients need solutions that meet their global needs. Our industry is on a journey to reach the next phase of evolution within cross-border payments. We’re partnering closely with financial institutions, FinTechs, corporates, and industry experts — all of whom have contributed their perspectives in this paper — to continue building best-in-class experiences for clients and using technologies such as artificial intelligence and digital assets to make it happen. I’m excited to see the immense opportunity that the next five years will bring as we work together to transform cross-border payments. Jane Fraser, CEO, Citi

Growing Revenue Pie Is Attracting Competition

The Pain Points

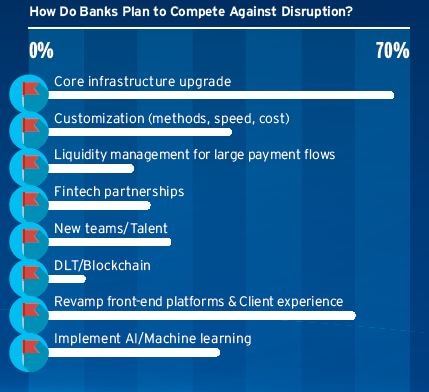

Keys to Winning Share for Banks

Where Are Clients on their API Journey?

Delivering Best-in-Class Client Experiences