Supply Chain Finance

Trade flows are a fundamental driver of global economic growth and commerce, mitigating pressures and inflationary challenges, with social and environmental benefits intrinsically linked to that growth. Trade accounts for 52% of global GDP, according to the World Bank.

A year ago, Citi published a comprehensive report examining The Complicated Road Back to “Normal” for global supply chains. I think we can agree that the past year — or even the past several years — have indeed been complicated. Nevertheless here we are, somewhere closer to normal, as Citi’s most recent Global Supply Chain Pressure Index shows overall levels have fallen back to pre-pandemic norms but supply chain stresses remain with inflationary pressure and rising interest rates across many countries.

However, this latest report, published by Citi experts leading our thinking on supply chains and backed by survey responses from thousands of large multinational corporations and their suppliers globally, indicates that disruption remains top of mind.

The pandemic and then the war in Ukraine demonstrated the fragility of supply chains. Many companies and customers experienced the pain of those disruptions and are now looking for resiliency wherever they can get it. While reshoring and nearshoring may seem like the next steps, buyers and suppliers alike indicate that the higher priority is resiliency or redundancy deeper into the supply chain.

Enterprises are now focusing on inventory management strategy, diverse and longer-term partnerships with producers, and a deeper investment in digital tools. The surveys also show they are focused on bringing the same resilience to their financial supply chains that they have brought to their physical supply chains to counter disruption.

The concern for the health of supply chain finance is amplified by inflation, which is hovering around 40-year highs in many countries, and also rising interest rates. These new challenges hit the smallest suppliers hardest, but the good news is as demand for resiliency grows, so too does the opportunity for smaller players not traditionally as engaged in global trade.

The report details how supply chain finance (SCF) programs like the one Citi offers can help to mitigate that financing challenge, particularly for small and medium-sized enterprises (SMEs). It also highlights the role multilaterals are playing in providing critical risk mitigation and access to liquidity that enable banks to support SME suppliers further down the supply chain, including last-mile suppliers in developing countries.

The challenges for trade continue to evolve and there is much to do to improve resilience across supply chains globally, physically, and financially. The many disparate laws, local regulations, and standards can make international trade fragmented at times, and lead to inefficiencies across supply chains. It is essential that we continue to collaborate on global solutions, including standardization, technology, and regulation. Citi is proud to play a pivotal role in that ecosystem and to present the insights we gain from doing it.Authors:

Pressure on Supply Chains Have Eased, But Awareness of Vulnerabilities Has Grown

After peaking in September 2021, Citi's Global Supply Chain Pressure Index eased somewhat further in December 2022. Overall pressures are now near levels seen during the global manufacturing expansion of late 2017 and early 2018. While conditions are normalizing rapidly, our sense is that firms will still take the lessons from this cycle seriously and look to adjust their production strategies to prevent prolonged disruptions in the future.

The Role of Supply Chain Finance

Physical supply chain disruption has given way to a new challenge: high inflation and rising interest rates. Corporates responded to physical supply chain disruptions quickly but must now turn their attention to the health of the financial supply chain that powers physical supply chains.

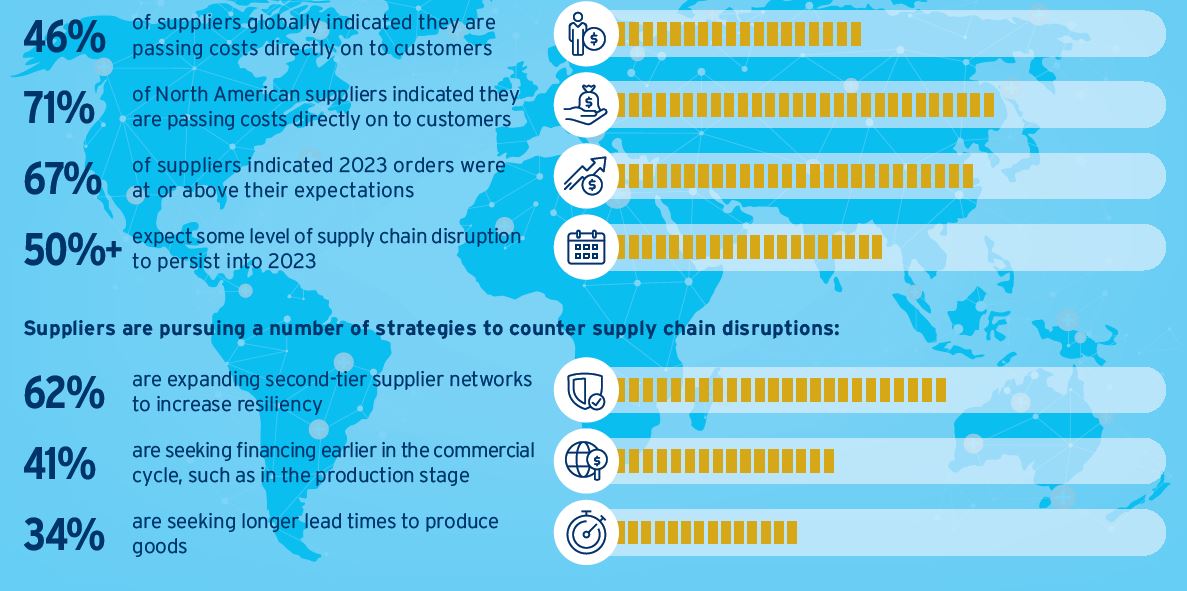

The State of Supply Chains: What Suppliers are Saying

Citi Research conducted a global survey of corporate suppliers participating in Citi-managed supply chain finance programs. Respondents most commonly identified rising costs as their greatest challenge.

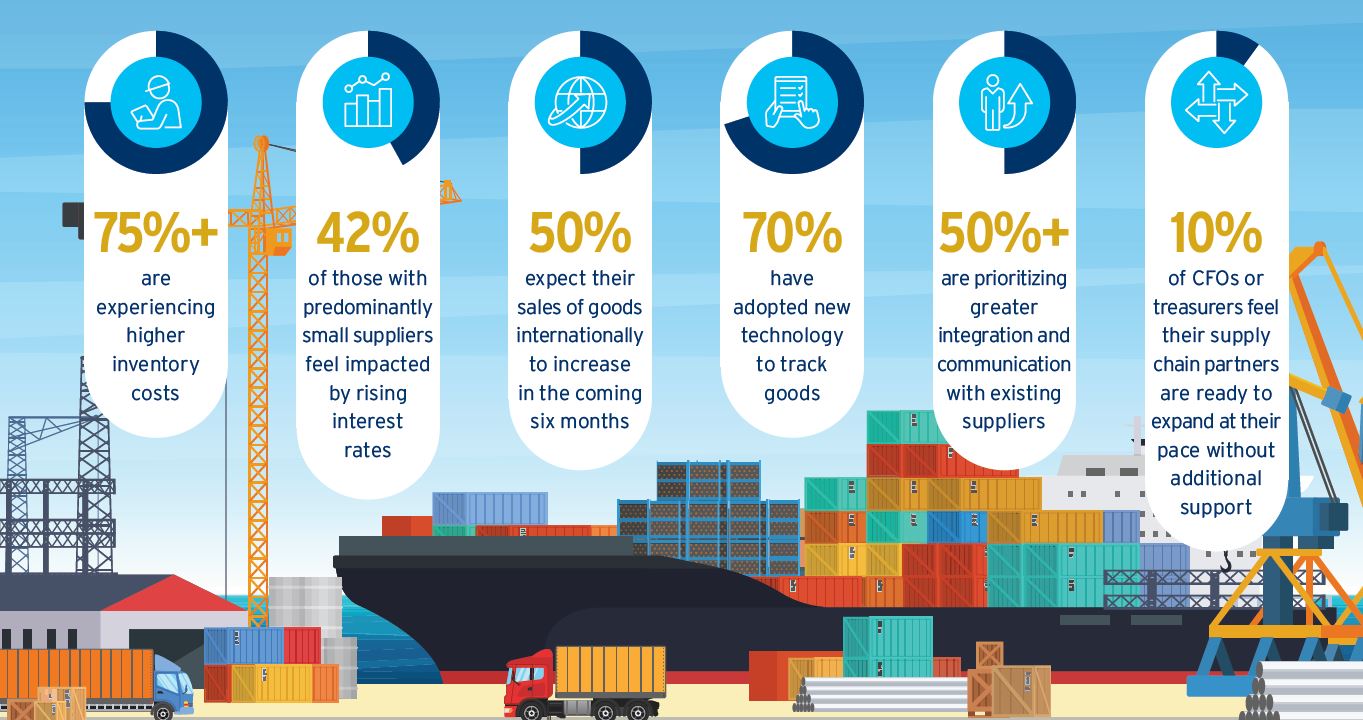

The State of Supply Chain: What Large Corporations Are Saying

Citi partnered with East & Partners to conduct primary, voice-of-the-corporate research on the supply chain challenges, resiliency, and futures of top 100 annual revenue-ranked corporates in each country market.