Europe’s Cost of Living Crisis – Modelling Household Spending

If the euro area is heading for recession, household sentiment will be an unusually early leading indicator of it.

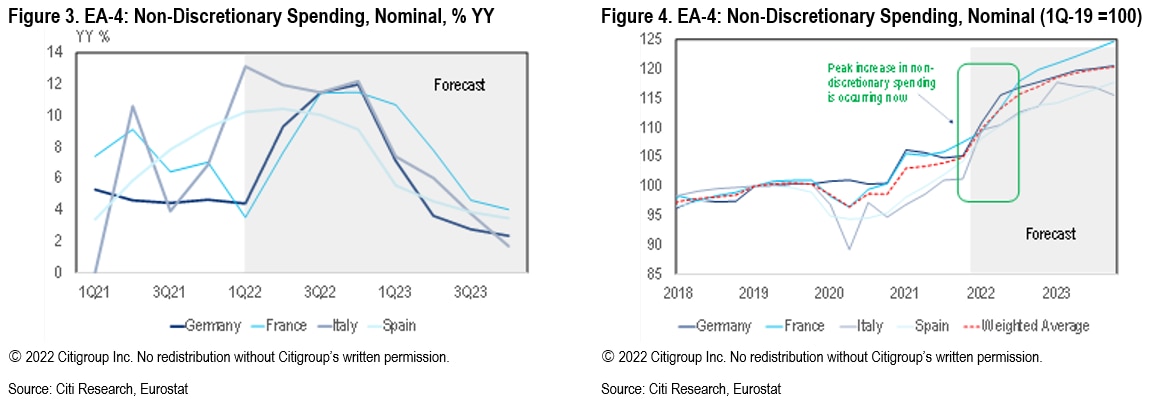

Whereas business confidence remained resiliently in expansion territory on both the PMIs and the EU Commission’s economic sentiment indicator (see figure 1), Eurozone consumer confidence in June fell deeper into recessionary territory (see figure 2).

Retail sales data up to May point to another likely contraction in 2Q, although this may reflect the rotation back from goods to services.

Investment and inventory re-stocking kept euro area GDP away from a technical recession this winter. Citi analysts say this divergence with the UK-US has little to do with the Omicron outbreak, but rather reflects an already-severe cost of living crisis.

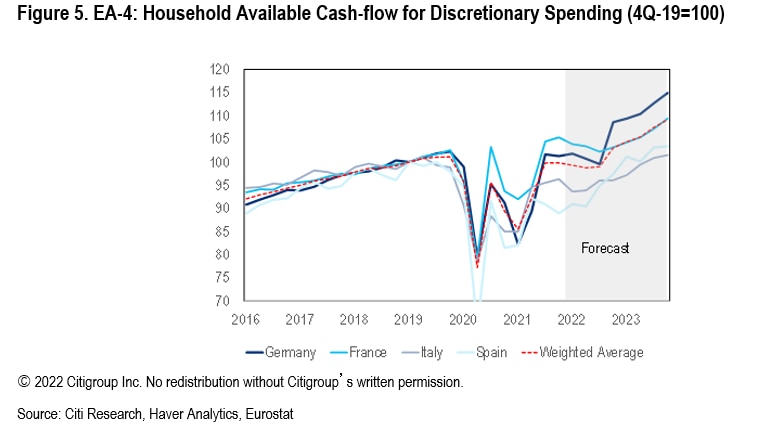

Based on Eurostat as well as national statistical data, Citi analysts built simple models of households’ available cash-flow for discretionary spending (HAC) for the main four Eurozone countries (EA-4).

The purpose was to

- better understand the timing of the squeeze in real purchasing power

- highlight potential cross-country differences in the magnitude and/or timing of such a squeeze and

- refine Citi’s outlook for Eurozone private consumption.

Disposable income – a boost from rising interest rates?

At the latest data points available (Q1 2022 for Germany and France, Q4 2021 for Italy and Spain), nominal disposable income was up by 3.4% YY (Spain) to 4.4% YY (Germany).

Despite relatively modest growth in hourly wages, the jump in employment and hours worked compared to a year earlier boosted household incomes. Growth rates of entrepreneurial income (e. g. strong in Germany, weak in France) or property income (weak in Germany, average in France) were more idiosyncratic.

Surging non-discretionary costs

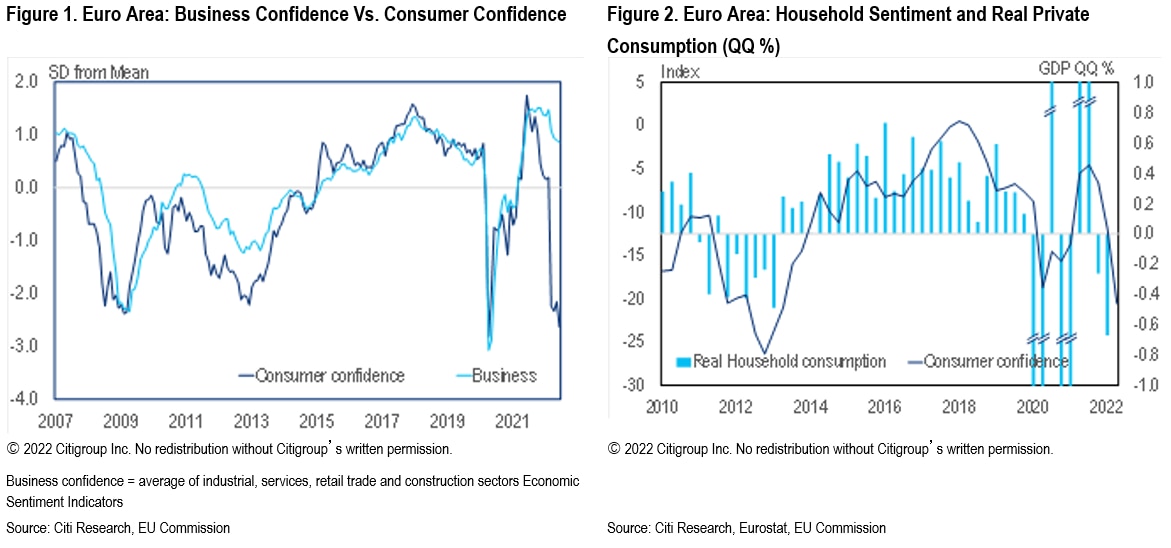

Against relatively buoyant nominal income prospects, households are now facing an unprecedented inflation shock. The squeeze on spending power is driven mostly by increased disbursements for non-discretionary items, such as heating and electricity bills and food.

These expenditure categories are where inflation rates are currently the highest and households least able to substitute. Energy and food price inflation jointly account for more than 70% of the overall headline euro area HICP inflation rate.

This share is likely to increase further in the coming months. As a result, households’ cash disbursements for non-discretionary consumption – a large share of which is food and energy – have been surging at an unprecedented pace.

At the euro area aggregate level, non-discretionary expenditures started to accelerate at the start of this year, with Germany mainly driving the increase. In Italy and Spain, the shock had hit already in mid-2021. France is suffering a significantly smaller shock, mostly because of its lower exposure to higher natural gas prices (thanks to nuclear). Possibly related to this lower exposure, food price inflation has so far been much more contained in France than elsewhere (in May at 4.6% YY vs. 8.1% YY in the Eurozone).

Saving rate

The household saving rate increased significantly across all countries throughout the pandemic. At 13.7% in the Eurozone as a whole in 4Q-21, the saving rate was still above pre-pandemic norm (12.7% on average in 2018-19). Data from France and Germany suggest it will have dropped further in 1Q-22.

Citi’s baseline assumption is that the saving rate will continue to normalise quite quickly towards the pre-pandemic level during the course of 2022. This should provide a positive contribution to households’ available cash-flow.

However, this assumption is subject to significant risks on both directions. On the one hand, low consumer sentiment and increased concerns around the personal financial situation may induce higher precautionary savings and prevent a full normalisation.

In addition, the rise in net interest incomes, which will mostly benefit wealthier households, may also boost savings. On the other, there is also an upside risk that households may deploy part of the accumulated savings from the pandemic to finance current consumption, resulting in a lower saving rate of the current stream of income. In this case, the boost to HAC may be larger than we currently expect.

Other more structural reasons, such as ageing, may also cause a shift higher in the saving rate compared to the recent years.

Household Available Cash-flow

The worst hit to real purchasing power is happening at the moment (Q2-3Q 2022) – as it is now when inflation on non-compressible items is highest and income growth has not yet picked up much. However, these drivers could take the opposite direction in 2023. Germany and France saw a larger pick-up in HAC than Italy and Spain in 2021.

UK: Same, but worse

The UK is similar to the EA in its dynamics, but worse in scale. Already the UK has seen a sharp drop in consumer confidence.

While household sentiment has been relatively weak in the UK since 2016, recent reductions have been driven by a deterioration in households’ assessment of their own financial situation.

Historically, these have tended to be a stronger indicator of the private consumption outlook. In recent months, nominal retail sales have generally held up, while high inflation has begun to eat into volumes. However, in more recent weeks, there have been signs nominal spending is beginning to roll over. As cost shocks associated with both food and energy inflation intensify, discretionary spending could be expected to fall back quite sharply.

For more information on this subject, please see European Economics Weekly: Timing the Household Income Squeeze: the Worst is Now

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.