Chinese Tourists’ Return Should Benefit Luxury Brands

In a new Citi Research report, a team led by Lydia Ling looks at how the return of Chinese tourists – the world’s biggest tourism spenders – is reigniting the global travel market. We draw on our global coverage and an extensive survey by our Innovation Lab to conclude that strong leisure travel demand, beauty premiumization and luxury shopping will continue to reshape the global travel retail market.

The following is a freely accessible summary of a published Citi Research report.

While Chinese consumers are facing macro uncertainties, experience consumption such as leisure travel remains a top spending category for them. Our Innovation Lab surveyed 2,502 Chinese about their outbound travel plans, spending patterns, preferred destinations, luxury shopping and brand appeal. The results suggest decent travel demand in the next three to six months. And with travel giving Chinese travelers more satisfaction, they’re willing to spend on it and explore more diverse activities. China’s consumption has been evolving, with a shift toward experience and emotional value. Experience consumption abroad – a category that includes activities, lodging and dining -- has been gaining traction at the expense of shopping, though shopping remains a top consideration.

Chinese outbound travelers remain a long-term driver of global luxury spending despite a gradual shift in wallet share toward experiential spend, as well as a repatriation of luxury spending to China. We estimate Chinese nationals will return to making a ~35% contribution to global luxury spending in 2024, in line with pre-pandemic levels. Such a return would be a driving force for a sustained recovery of the global travel retail market. We see their onshore/offshore split in luxury spending as ~70/30%, a product of improved variety and pricing of onshore offerings as well as concerns about taxes levied when returning to China.

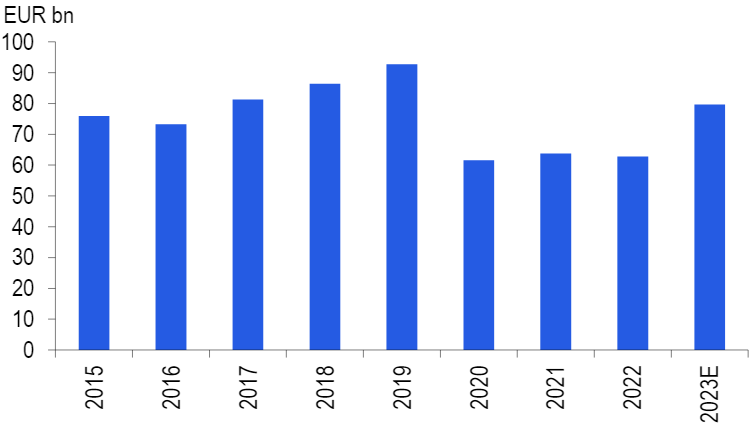

Chinese luxury spending still below pre-Covid level

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Bain & Company

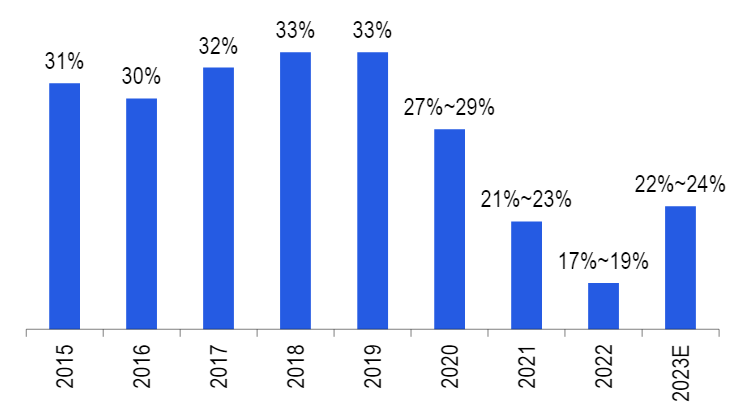

Chinese was the top luxury spender with 33% share in 2019 but this was down to 22-24% in 2023E

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Bain & Company

We selected 66 luxury items popular among Chinese shoppers and compared their prices across France, Japan, Korea, Hong Kong and Hainan to assess how much cheaper they are compared with official prices in mainland China. Given the yen’s depreciation, Japan is now the most attractive destination for the Chinese for luxury goods and Hong Kong the least. But as brands gradually adjust pricing in Japan, the pricing gap could fade. France is more attractive to China tourists for handbags as well as apparel and footwear. In Hainan, prices are more competitive after factoring in promotional activities. While Hainan still needs to enrich its luxury-brand portfolio, its allure for luxury shoppers is rising as more luxury brands enter the province.

Our new Super-Sector Analysis, China’s Travel Enthusiast Returns, Luxury Brands Set to Benefit, also features stock implications of Chinese tourists’ return.

Existing Citi Research clients can follow this link to access the full report.

Related Stories