The banking sector has a critical role to play in the global drive to Net Zero by 2050.

Across the Pan Asia region, the banking industry is gearing up its efforts, with the remainder of this decade crucial. Citi Research’s report aims to help investors in the region assess progress around portfolio measurement, target setting, and implementation.

The state of play can be broadly summed up as follows:

- Pan Asia Banks are currently primarily focused on portfolio measurement and target setting when it comes to the Net Zero transition. They are undertaking a significant amount of work mapping, calibrating and setting emissions targets across lending and investment portfolios.

- However, the conversation is quickly turning to implementation and defining credible transition plans for the financial sector. Pan Asia and EMEA feature extensive measurement and target setting but varying degrees of strategic implementation, with EMEA demonstrating more progress in this area. An increased focus on credibility will likely change the game for both regions.

- As investors turn to implementation, they will need to have a view as to whether the Bank sector should be the ‘accountant’ or the ‘policeman’ during the implementation process. Will the banks ultimately just be measuring and reporting their clients’ transition performance (the accountant), or will shareholders want the banks to be the ‘policeman’ to enforce an outcome of their clients.

- There continues to be complexity for investors in assessing the progress of portfolio measurement and target setting by Pan Asia banks. Citi Research has conducted an assessment of the current progress of 19 banks in this region -- assessing participation in key initiatives, quantity of disclosures, and quality of disclosures. The full report has details on this.

- Portfolio measurement and target setting is an ongoing journey for each of these banks, and further progress is expected by all banks under assessment. Assessing current progress serves as a useful indicator of how quickly we may start to see a needed shift towards implementation and provides useful insights as to the comparability of current disclosures and targets, trends occurring, and key details to look for when monitoring progress.

What exactly is the Bank sector’s role here?

The need to transition the Bank sector is a recognition that resolving the climate crisis is, in one respect, a capital allocation problem. By understanding and managing their exposures to reduce financed emissions, banks will direct capital to support decarbonisation and trigger changes in capital flows that send transition signals across all sectors. Achieving the large-scale turnover of installed capital stock (e.g., retiring assets that emit greenhouse gases, and investing in their replacement with new zero-emissions technology) required for a Net Zero economic transition.

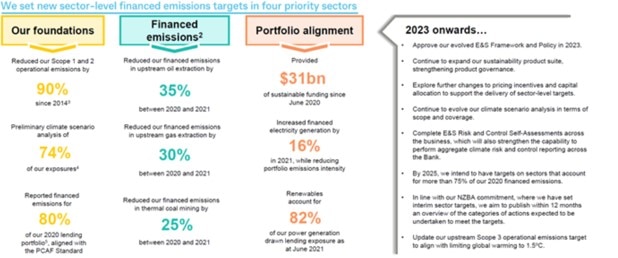

CBA's progress to date and future priorities |

|

| Source: Commonwealth Bank of Australia (CBA) |

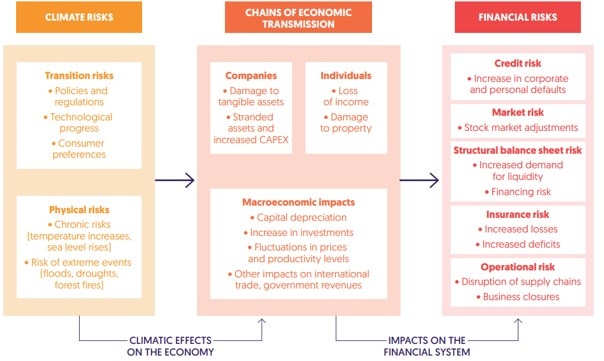

Banks are also in the process of identifying and measuring their exposure to climate change risks and understanding the opportunities available in a transitioning economy. Climate change risk, indirectly or directly, is present across all sectors and presents a financial risk that banks need to consider. Physical risks are already impacting customers and communities located in areas sensitive to climate risks, and this is expected to intensify. Climate risks affect the economy and impact the financial system.

Climate change presents a multitude of risks banks need to consider |

|

| Source: Groupe BPCE |

The transition requires a significant amount of new lending to fund the required level of investment. Globally, the annual capital expenditure required to meet Net Zero by 2050 is significant. GFANZ estimates that US$125 trillion of investment is required by 2050 to transform our economy and avoid the worst physical impact of climate change. Around 25% of this investment is required in the next 10 years, with 40% being required from the Pan Asia region. This highlights the important role banks in the region will need to play in supporting the transition. The Bank sector has an enormous role and opportunity to be part of the solution.

The Emissions ‘Accountant’ or ‘Policeman’?

Shareholders will need to quickly develop a view about the desired role of the Bank sector in meeting these global initiatives. Whilst the development of the bank transition plan is essential, it will be the implementation of the transition plan that is expected to have significant investment and reputation implications.

As the difficulties in reducing coal exposures has shown, the banks may have a somewhat limited influence on the targets in practice. The energy transition is a multi-factor process that is very influenced by investment, technology, regulation, and government support. In Australia for many years, the federal government has been reluctant to set meaningful targets and has lagged many developed economies. This has had a significant influence on the shape of the Bank sector lending portfolio. The reduction of carbon emissions in other sectors (Agriculture comes to mind) may be particularly influenced by factors outside the pure lending decision.

Banks will have the direct ability to decide on new lending facility or investment exposures in key sectors. However, it is the management of existing exposures that might prove problematic. Shareholders will need to assess the bank’s management approach to each borrower’s climate management plan. Will the banks ultimately just be reporting how the economy is transitioning to Net Zero (the accountant), or will shareholders want the banks to be the ‘policeman’ to force change?

What’s Next?

The market conversation is now quickly turning to defining credible transition plans. This is a dual process for banks. They must define and develop their own transition plan, but also define what they consider to be a credible transition plan for their clients (generally on a sector-by-sector basis).

The defining of credible transition plans is both inherently subjective and objective. Various international standards are emerging for different sectors and are objective to an extent due to their scientific basis in the emissions reductions required by each sector by 2030 and 2050 in order to align with a global Net Zero 2050 pathway.

However, there is an element of subjectivity in such modelling due to the use of assumptions, in particular around technology and scale, policy support, etc. For more information on this subject, please see Pan Asia ESG & SRI - How are Banks Acclimatising to Net Zero?

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.