Latam: Lessons in Inflation

What can we all learn from Latam’s recent history in dealing with inflation?

Here’s a few lessons:

#1 – Inflation can stabilize above the target

This might be the most important lesson Latam’s recent inflation journey has to offer.

That’s not to say inflation is unanchored, but rather it moves in a different range than authorities are aiming for.

Even if that’s the case, the authorities may submit to that above target range because they’ll often conclude that the cost of bringing inflation back target is just too high.

The Citi Research note points out that this is important because it shows that higher inflation can become persistent.

Past inflation matters for future inflation, the note says. That’s why some countries operate with inflation rates outside their formal targets for long periods.

This topic is of course particularly relevant against the backdrop of global inflation.

The note says that persistent high inflation usually emerges from a combination of limited central banks’ credibility and a shock that pushes inflation higher. This then ends up being self- perpetuating due precisely to the lack of central bank credibility.

On the other hand, when a central bank is credible, a specific shock often has only a temporary effect on inflation, as inflation expectations remain anchored for longer periods.

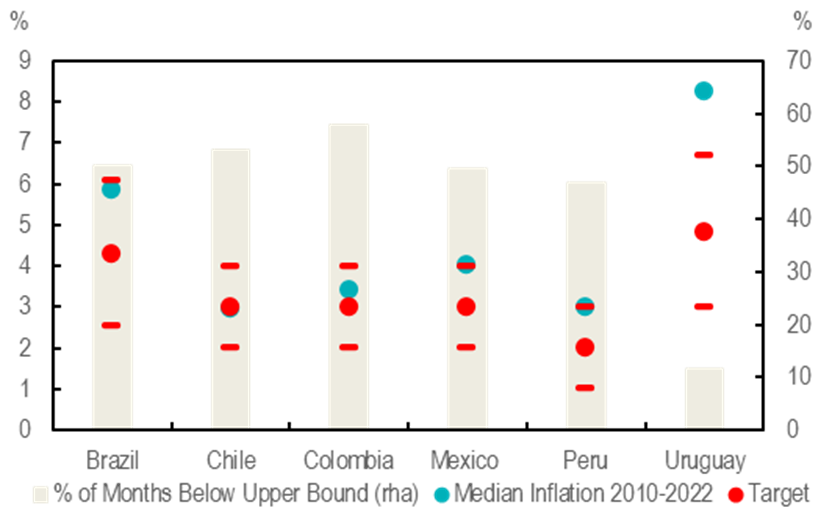

In LatAm, most central banks have inflation controlled within the target range.

However, Citi Research analysts pick out two cases that are interesting to look at:

- Uruguay – Inflation has been consistently above the target range. Only in a fraction of the period from Jan-10 and Dec-22 has inflation stayed within the target. Average inflation for 2010-2019 has not been in the target range during that period (between 3% and 7%) but at 8.3%. And Uruguay’s inflation target is rather high in the first place.

- México – Although the midpoint inflation target is 3%, the de facto objective is more like 4%. In 2010-2015, inflation fluctuated around 4%. But rather than hiking to bring average inflation to 3%, authorities instead acted as though 4% was the midpoint target. Only when inflation was consistently above 4% did a substantial hiking cycle begin around 2017.

Mexico and Uruguay are usually above the target range

Source: Citi Research

In short, these cases serve as a warning to countries with limited credibility inflation targeting regimes.

#2 – Central banks are slow to cut after inflation spikes

The Citi Research note says that Brazil and Colombia, between 2015 and 2017, offer comparable episodes to the present, in which inflation went significantly outside the central bank target range. Importantly in these episodes, one year ahead inflation expectations also moved above the upper bound of the range.

#3 – When monetary policy turns procyclical

It is interesting to note, the analysts say, that monetary policy remained expansionary when economies recovered from the pandemic and the output gaps turned positive again. Put another way, central banks have fallen behind the curve. In Chile, the monetary policy tightened last year even as the economy cooled off. The conclusion, they say, is that monetary policy in LatAm is turning more procyclical.

#4 – On the ‘structural’ drivers of inflation

Inflation can accelerate due to ‘structural’ reasons. As we’ve mentioned, curbing inflation can become too costly with structural’ factors potentially fueling inflation and making policymakers tradeoffs more challenging.

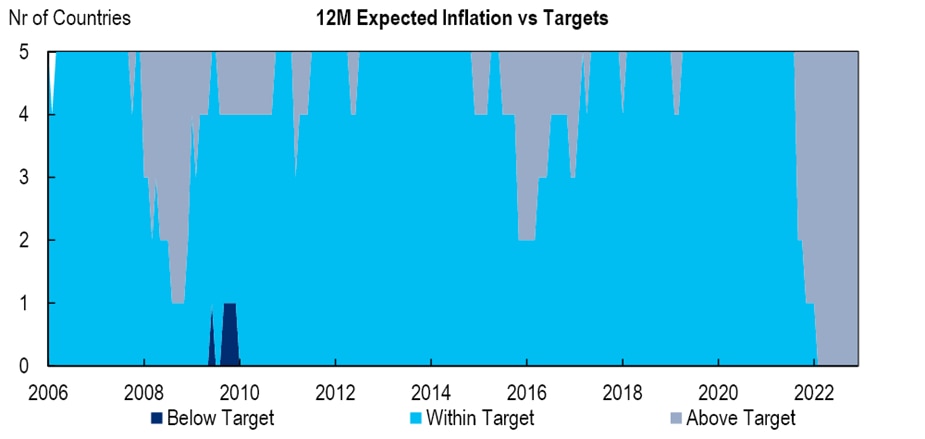

Inflation expectations have been mostly anchored in LatAm’s big inflation targeters

Source: Citi Research, Haver Analytics

In fact analysts found that relative prices have changed markedly in the last couple of years especially in Chile and Colombia and to a lesser extent in Brazil and Peru, something that could create inflationary pressures if these relative prices gaps start normalizing.

The main conclusion is that central banks tend to be prudent when easing after an episode of high inflation and unanchored expectations For more information on this subject as inflation remains front of mind for many, please see Latin America Economic Outlook & Strategy – Experienced in inflation: lessons from LatAm first published on January 24th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.