Hydrogen

Since the 1930s, hydrogen has run into application difficulties in implementing what has appeared, on the surface, to be its great allure: in theory, it is more abundant and more versatile than all other fuel sources outside of petroleum. Hydrogen can be — and has been — a transportation fuel; it makes up 2.5% of all energy consumed due to its critical use in refining as an upgrading ingredient to turn heavy products, like residual fuel oil, into light products, like gasoline and diesel; it can be a source of power generation and can be stored longer and more efficiently as a last resort replacement for interruptible renewables like wind, solar, and hydro than utility-scale batteries; and since it burns at high temperatures, it can be a clean replacement for coking coal.

Obstacles surrounding its explosivity began to confront hydrogen with the Hindenburg disaster in 1937, which rapidly brought its promise as a light, clean fuel for zeppelin airships to an end. Despite this, it has been tamed as the principal fuel for rockets. Hydrogen now confronts scalability issues in creating electrolyzers, leakage issues when it comes to pipelines and storage, and cost hurdles along with “not-in-my-backyard” (NIMBY) obstacles. And the high cost of scalable projects has certainly slowed down the development of hydrogen projects globally.

But signs of breakthroughs have emerged over the past few years. This partly stems from an overall acceleration in green technology investments, which Bloomberg NEF (BNEF) indicates reached $1.1 trillion with 30% financing growth in 2022. Although very little of that acceleration was in hydrogen, the beginning of 2023 brought the first large-scale global hydrogen financing with an $8.5 billion hydrogen project in Saudi Arabia.

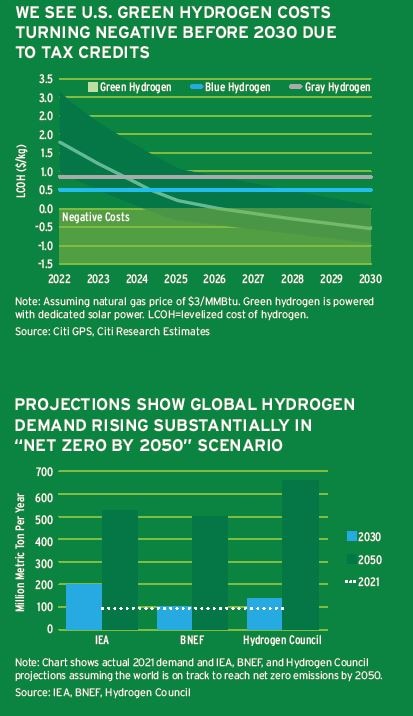

Between 2021 and 2022, the U.S. enacted a series of new laws, including the Inflation Reduction Act, which together with prior legislation and existing authorities are expected to provide as much as $1.7 trillion in investment incentives. A significant proportion of these incentives are for hydrogen projects, including via the support of hydrogen hubs around the country. The tax credits provided by the Inflation Reduction Act are so generous that net production costs of green hydrogen after adjusting for tax benefits could be negative later this decade. In response, Europe enacted its own Green Deal Industrial Plan, and government incentives are being offered in a growing list of countries already endowed with renewable resource potential and/or with the incentives to reach net zero, including Australia, Chile, China (the leading producer of hydrogen in the world), India, Japan, Oman, Saudi Arabia, and the UAE. It looks like it is time for hydrogen’s doubting Thomases to retreat.

Hydrogen 101

The Subsidy Arms Race Is On

Hydrogen Costs Are Falling While Demand Is Rising

Despite Momentum, Challenges Remain Ahead