Energy Transition

As world leaders trekked to COP26 in Glasgow in November 2021 there was a feeling of enthusiasm in the air. Commitments made under the Paris Agreement in 2015 were an important first step in addressing climate issues, but now it was time to turn promises into global action and recommit to tackling the climate crisis. At the same time, concerns over the COVID-19 pandemic were fading, economies were recovering, and there was a general feeling things were getting back to “business as usual.”

By all accounts, COP26 was a success as ambitious targets were agreed to on reducing greenhouse gas emissions and funding climate action for developing countries. Consensus was forming around the idea that net-zero carbon could be achieved by 2050. And financing mechanisms were being put in place by developed countries to honor their $100 billion commitment to developing nations to help fund the Energy Transition.

And just as it felt like things were going back to “business as usual,” the Omicron variant of COVID-19 took hold and the Russia-Ukraine conflict erupted. Suddenly we were spilling into a world of rising inflation, supply constraints in fuel and food, and a deteriorating political backdrop. Combined, these headwinds threatened to derail the push for decarbonization as governments focused on energy security and short-term economic issues.

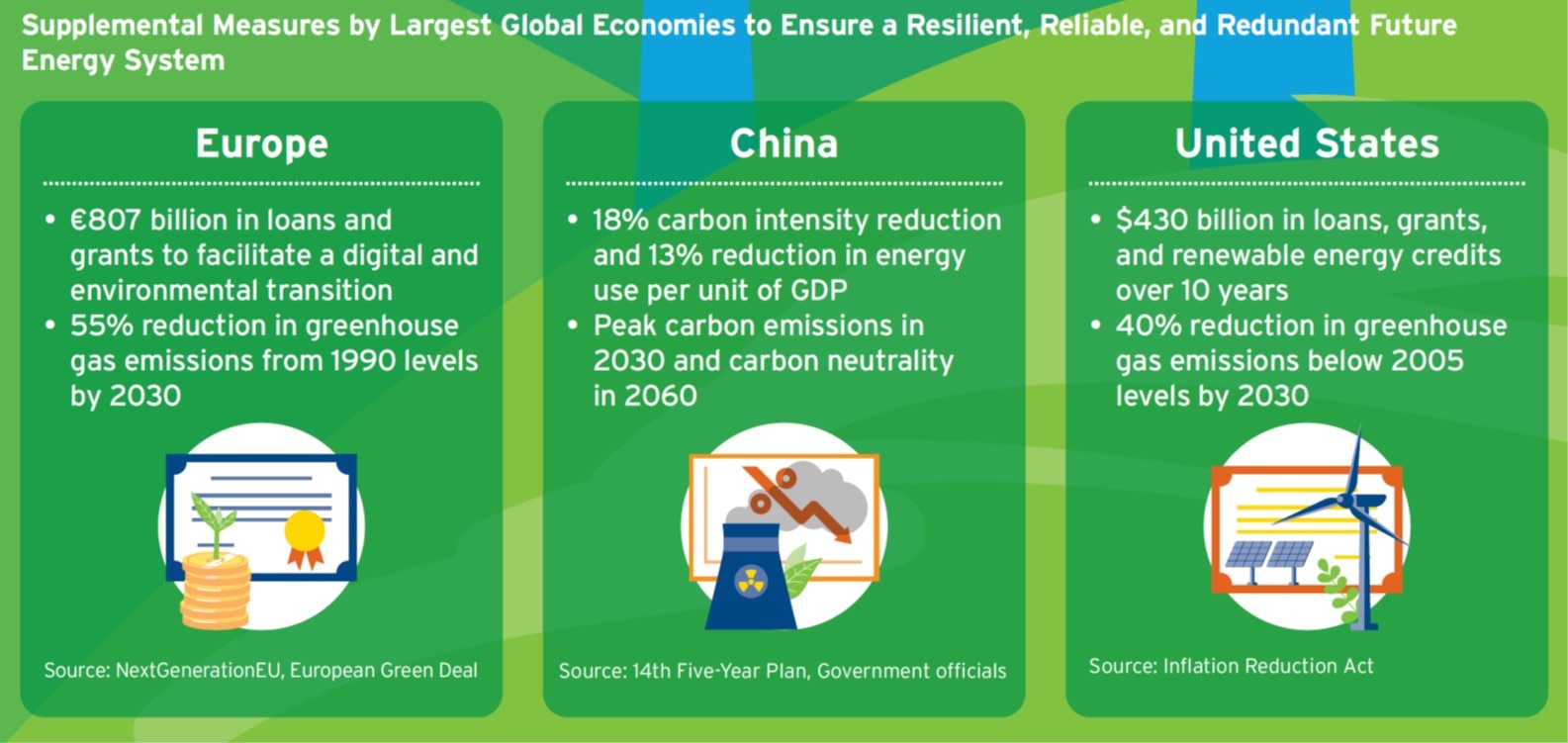

On the regulation side, three major economies — the U.S., the EU, and China — have taken action to significantly accelerate the Energy Transition: (1) The U.S. passed the Inflation Reduction Act in August 2022 with $369 billion in investment earmarked for energy security and climate change sectors; (2) the EU’s REPowerEU plan, unveiled in May 2022, forced an upgrade to its already ambitious Energy Transition goals from the prior “Fit-for-55” package; and (3) China reiterated its commitment to see peak CO2 levels by 2030 and net zero by 2060.

Technology and innovation in energy storage systems; carbon capture, utilization, and storage; and alternative energy such as biofuels/sustainable aviation fuel, nuclear, and hydrogen, will drive energy security and independence. On the financial side, carbon pricing schemes and carbon credits for hard-to-abate sectors can help internalize the cost of pollution, thus giving an economic incentive to switch to more sustainable approaches. More importantly, multilateral development banks, and supranational institutions can step up to create blended finance at scale, can facilitate the Energy Transition in areas of the world that need it most.

Given the scale of the issue, we have published Energy Transition in two volumes. Volume I — Mixed Momentum on the Path to Net Zero — looks at (1) where we are on the commitments agreed to last year at COP26 given recent geopolitical and climate events, and (2) what needs to be done to keep momentum on track in the Energy Transition. Volume II — Building Bridges to Renew Momentum — focuses on the funding requirements and tools required to ensure a successful Energy Transition.Authors:

Momentum Stalled in 2022

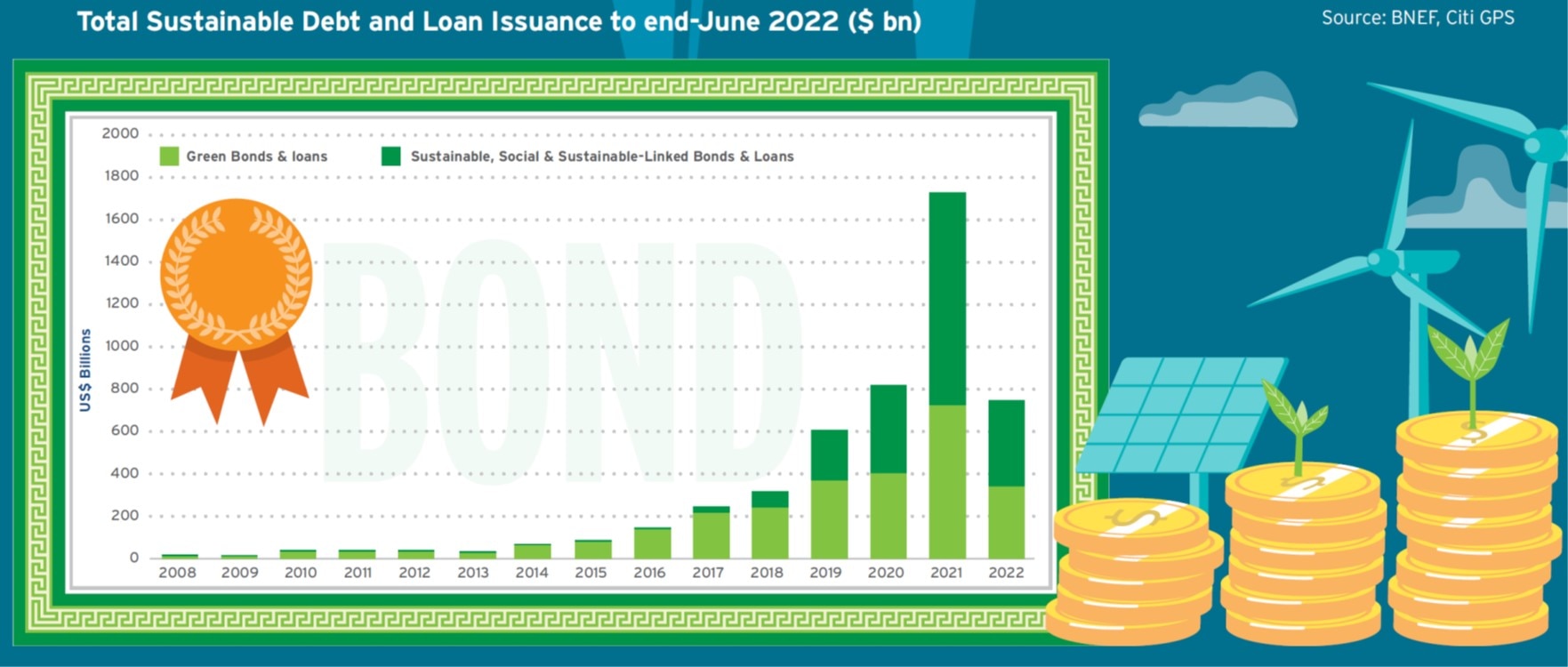

Sustainable Financing Is Also Slowing

Solutions to Accelerate the Energy Transition

Fiscal Stimulus Required for Renewable Energy Supply and Infrastructure