Have We Reached a Turning Point for EM?

A new Emerging Markets Economic Outlook & Strategy report from a team led by Head of Emerging Markets Economics Johanna Chua says the start of protracted easing by the Fed should support net inflows into emerging markets (EM), though important caveats apply — most notably that this will require a soft or at least “softish” landing for the U.S. economy as well as the U.S. elections proving more friendly for emerging markets.

In the report, we note that the drivers of capital flows are complex and go beyond rate differentials to broader measures of expected returns. A look at broad valuation metrics signaling a strong U.S. dollar (USD) shows this signal started well before the Fed even started hiking, which we think was influenced by a recalibration of growth prospects in the rest of the world given a sharp slowdown in leverage-fueled growth in China and the end of the commodities super-cycle.

Broad dollar valuation metrics conceal a more nuanced story within emerging markets: Excluding China, net capital flows bounced back in 2023 and this year’s first quarter, but in a highly differentiated way.

India saw a strong rebound and central Europe and Latin America proved resilient, but net capital flows were relatively weak in lower-yielding ASEAN, particularly Thailand and Malaysia. EM resilience has been attributed to a significant reduction in reliance on external financing and an improved track record of credible macro policies, including pre-emptive monetary tightening. Meanwhile, China’s weak net capital flows have come from a secularly weakening growth story alongside a geopolitical/regulatory risk premium.

That said, common factors such as Fed policy can reduce this differentiation. Higher-frequency portfolio flow data show this EM differentiation fading in recent months as U.S. inflation risks receded, giving the Fed room to lower rates. We now expect most EM central banks to opt for smaller cuts than the U.S., either because they didn’t need to hike rates as much to re-anchor inflation to targets or because they’re in the more advanced stages of their own easing cycles. The only EM central banks we see cutting more aggressively are ones where monetary policy was very tight to begin with, a list that includes Colombia, Turkey, Egypt and Mexico. We see Brazil as the lone central bank that will need to reverse policy easing to re-anchor expectations.

As Fed easing advances, we think the situation could be particularly supportive for EM portfolio debt flows coming from economies with higher rates to begin with. The most extreme cases are Turkey and Egypt, but we also include South Africa, Hungary, India, the Philippines, Indonesia and Brazil. A potential stumbling block? It’s the U.S. elections: A Trump victory and potentially aggressive tariff actions would be viewed as USD-positive, at least over the short term, and a Republican sweep and repricing of the fiscal trajectory could further complicate our baseline path for the Fed to ease rates 225 basis points by mid-2025.

Assessing headwinds and tailwinds

A key assumption supporting our thesis that we’re at an EM turning point is that we won’t get a “hard landing.” Despite recession worries, so far actual data don’t suggest an imminent recession. But global growth headwinds are still evident, with the global manufacturing indices on a weakening bias and growth risks clearly rising in China, where we see the credibility to anchor inflation as among the lowest globally. Weak Chinese demand worsened by deflation expectations will likely further amplify margin pressures impacting global manufacturers, something we’re already seeing materially playing out in Europe, where the European Central Bank remains in a gradualist mode and so at risk of overtightening.

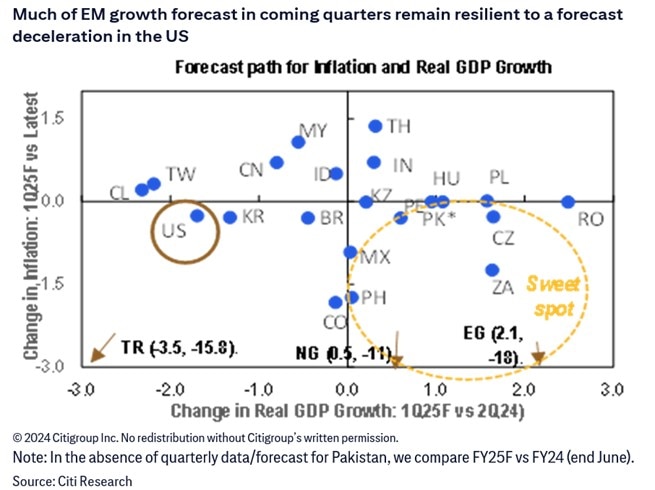

But our forecast growth and inflation trajectories for the coming quarters are also highly differentiated. Beyond the slowdown in the U.S. and China, only some of the more trade-linked economies are expected to slow. Most emerging markets are still forecast to remain steady or continue expanding during the period of Fed accommodation, with the most favorable stories in South Africa and Egypt.

We think it’s important to put the tech demand slowdown risk in perspective: We don’t see the kind of sharp business equipment downturn we saw in 2001’s U.S. recession, or a cyclical collapse amplified by financial deleveraging, as was seen during the 2007–2008 Global Financial Crisis. U.S. corporate balance sheets still look healthy, chip inventory ratios still look historically low, and we think a genuine tech product replacement and innovation cycle will persist alongside AI-related capex. Nor do we see a drag on commodity prices as a big enough hurdle to derail appetite for emerging-markets assets at this juncture in the Fed easing cycle.

We note that several EM economies — notable cases are Taiwan, Malaysia, India, Poland and Romania — have lower ex ante real rates vs. their established neutral settings to begin with, meaning that growth expectations are unlikely to be penalized much by more limited or nonexistent rate-easing action. Beyond this, we think the transmission of easing to the real economy can be faster in some EM economies than in the U.S. even though the quantum of easing — the amount of rate cuts expected from a central bank in a given period — will likely be more limited.

Factors that likely helped drive U.S. economic resilience amid historically aggressive Fed tightening were relatively strong private-sector balance sheets accompanied by long-dated fixed-rate mortgages that locked in at low rates before the Fed hiked. In contrast, a number of EM economies saw a significant buildup of leverage, and notable EM markets have been through a significant down cycle for housing prices and are also more exposed to adjustable-rate mortgages. This could cause an easing cycle to transmit more quickly into the real economy. That likely wouldn’t do much for China, but could provide relief for Hong Kong.

Our new report, Emerging Markets: Economic Outlook & Strategy: A Turning Point for EM?, also includes country-by-country discussions. It’s available in full to existing Citi Research clients here.