Recent data have signaled slowing growth in the U.S., euro area and China. To what extent does this deceleration represent a temporary downdraft vs. a more pronounced weakening? In a new report, we conclude that global growth will likely soften a notch this year but broadly shake off the challenges.

The following is a freely accessible summary of a published Citi Research report.

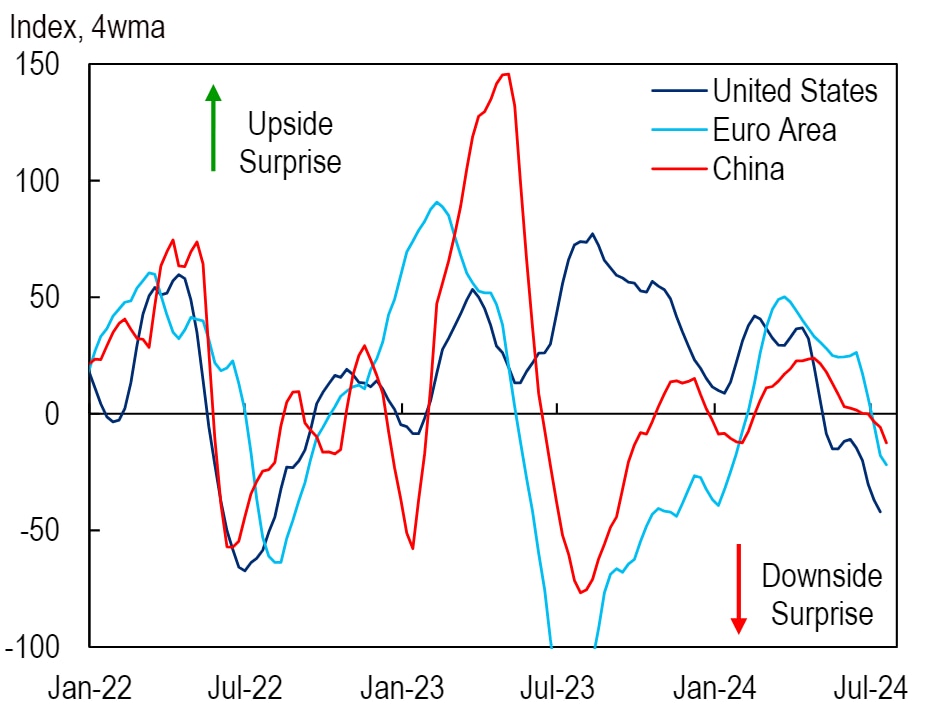

In the latest iteration of our global forecast, Chief Economist Nathan Sheets and team weigh three considerations. First, recent data have shown slowing economic activity in the U.S., the euro area, and China, with a key question whether this represents just a temporary downdraft or a more pronounced weakening. Second, we’ve seen a further escalation in global geopolitical and election risks, which can have powerful implications for economic activity and markets. Third, central banks must continue to focus on returning inflation to target, but we think the upside risks for inflation look less prominent than six or 12 months ago.

Sorting through these considerations, we expect the global economy will slow a notch but broadly shake off the current challenges in yet another manifestation of resilience despite unremitting headwinds. An important stabilizing force may come from global central banks, which are nearing a point where they’ll have scope to cut rates in earnest, marking a turning of the tide toward a broader and more significant easing cycle.

| Citi Economic Surprise Indexes | Central Bank Policy Rates |

|

|

|

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, Bloomberg |

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, National Statistical Sources, Haver Analytics |

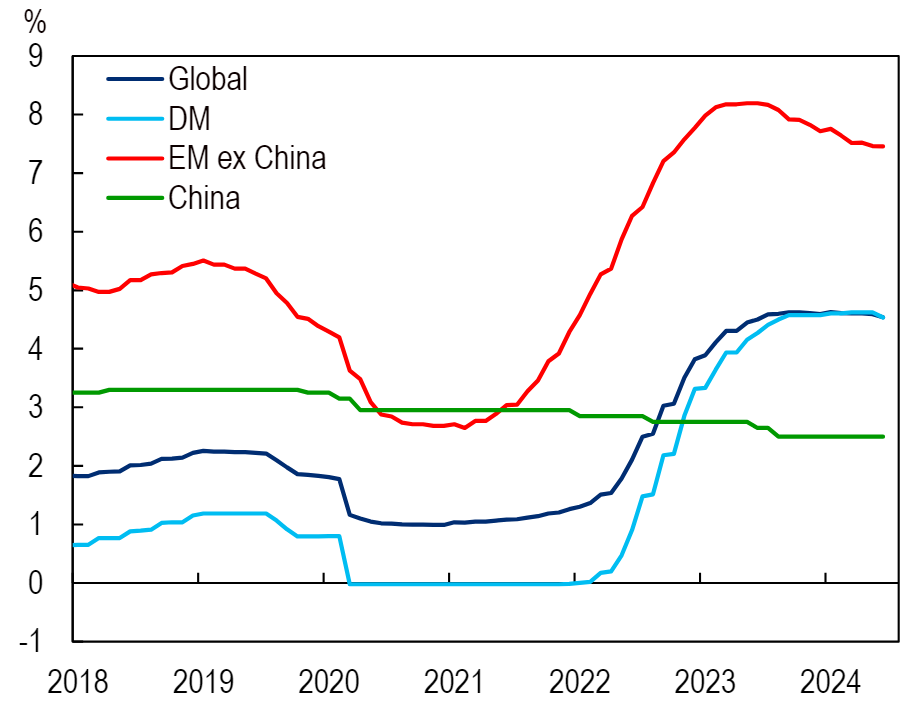

Bottom line, we judge that global growth will only slow to 2.4% this year from 2.7% last year. We think emerging-markets growth will be little changed at around 4%, while developed-markets growth is expected to decline to 1.1% from 1.7%. Global growth in 2025 should edge back up to around 2.5%.

Slowing in the U.S., euro area and China

Recent U.S. data have signaled a cooling in the pace of economic activity, most notably with labor-market conditions loosening. In addition, a range of indicators point to a slowing in consumer spending on both goods and services, while tight bank credit looks to be putting a squeeze on lower-income households and bank-dependent small firms. A critical question for our outlook is whether this slowdown is leading to a soft landing or points to a sharper, recessionary downturn.

The case for a more pronounced downturn is rooted firmly in history. A key feature of past U.S. business cycles is that once the Fed has hiked and the economy has started to slow, the pace of deterioration tends to accelerate sharply, an idea captured in the “Sahm Rule.” A review of U.S. business cycles over the past half-century suggests restraining wage growth and bringing down inflation have inevitably required a period of rising unemployment and, ultimately, recession.

But there are also compelling points in favor of a soft landing:

- the economy was previously running at too hot a pace;

- the labor market remains generally supportive;

- much of the adjustment in the labor market has reflected a massive immigration-driven inflow of workers, rather than a more familiar pullback in demand for them;

- consumer spending hardly looks primed for collapse, with the household sector’s aggregate balance sheet remaining robust; and

- the corporate sector looks well positioned for further growth, with equity-market confidence high.

For now, our baseline U.S. forecast leans toward expectations of recession, but we’re watching the data closely and note that Chair Powell has emphasized that the Fed is prepared to act more aggressively if further softening is seen.

In the euro area, growth has picked up a notch from 2023’s near-stagnation. The economy is gradually shaking off the effects of recent years’ devastating supply shocks, and the ECB is moving to reduce monetary-policy restraint. But the recovery remains lackluster. Digging into the details, we note very different performances within the euro area: Germany’s growth will likely continue to lag, with the economy eking out annual growth of just 0.1% this year, but Spain should be buoyed by still-strong services spending, with the economy expanding at a robust 2.7% pace. And the recent upsurge in political uncertainty surrounding the French snap elections is very much on our radar screens. While the outcome in France was more market-friendly than had been feared, it came as a reminder that the euro area’s recovery may still be vulnerable.

In China, second-quarter real GDP growth came in at 4.7% from a year earlier, well below our 5.1% forecast. The economy is clearly showing cyclical softness, marked by lower-trending retail sales growth, subterranean readings for consumer confidence, and generally soft PMIs. Despite these headwinds, we believe the second half will see fiscal stimulus, support for the housing sector, and corresponding momentum in private spending. As such, we think China’s 5% growth target is still achievable.

While we’re relatively sanguine about China’s near-term prospects, we remain concerned about its medium-term challenges. One key question is, “What will be the engine of growth for the coming decade?” President Xi has highlighted advanced manufacturing as a key driver. But this will require access to global markets, and recent Biden administration tariffs highlight that the U.S. market is closed to this strategy, with meaningful constraints in the EU as well.

Geopolitical and election risks

While we were well aware of 2024’s extraordinary sequence of national elections and the challenges and uncertainties that could result, we still weren’t prepared for the past two months’ string of surprises. Incumbents and established parties have taken it on the chin in election after election as voters express discontent with the status quo.

In India and South Africa, Modi and Ramaphosa were returned to office but are now managing coalitions. In the European Parliament elections, right-wing parties scored significant gains. That prompted France’s Macron to call snap parliamentary elections, which resulted in a “hung” parliament and left-wing parties ultimately coming out on top after political maneuvering. And in the UK’s early July election, the Conservative Party suffered a defeat of historic proportions. To date, Mexico has been the principal exception to these electoral trends, as Claudia Sheinbaum and President AMLO’s Morena party won a sweeping mandate in early June.

Global uncertainty has been further exacerbated by the recent assassination attempt on Trump at a time when his candidacy looked to be gaining traction. In response to Trump’s apparent momentum, investors are increasingly implementing curve steepeners, strong dollar, and long sectors such as energy and financials that are likely to benefit from Trump deregulation. Even so, we expect further twists and turns before Nov. 5. (Note: Our report was published before Biden’s decision to drop out of the presidential race and endorse Vice-President Harris.)

Other types of geopolitical risks also remain in play: The conflicts in Ukraine and the Middle East are grinding on, and we’ve seen new manifestations of tensions between the U.S. and China. These developments have helped fuel a surge in global container shipping costs; a meaningful further rise could put pressure on global goods inflation and create unwelcome challenges for central banks.

Implications for central banks

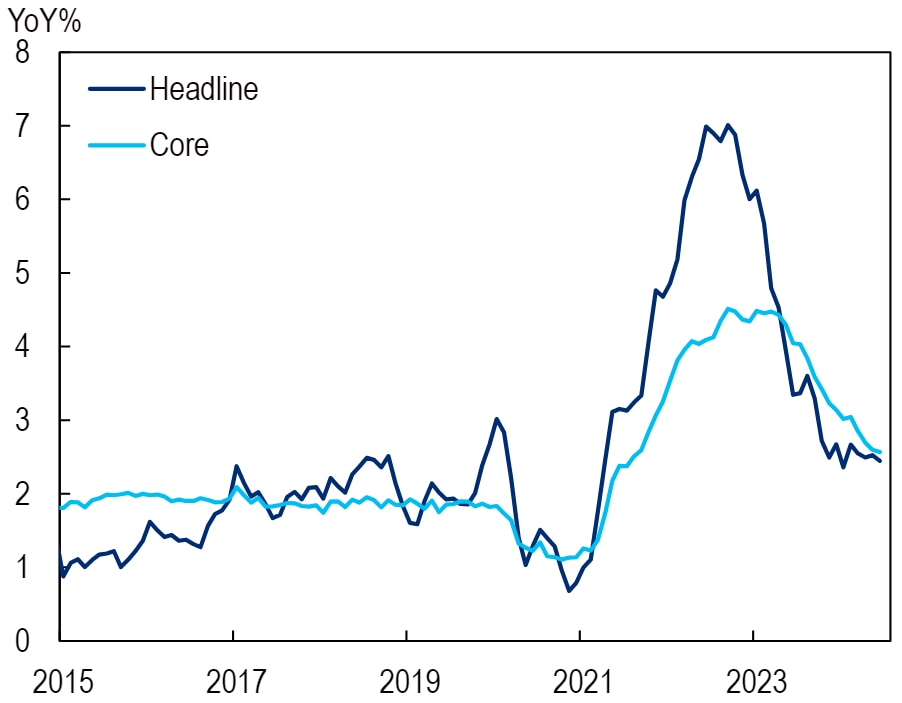

While inflation in many countries remains above target, central banks have made significant progress in harnessing inflationary pressures: Global headline inflation peaked near 7% in mid-2022 but is now hovering at 2.5%; core inflation had been as high as 4.5% but has fallen to around 2.5%.

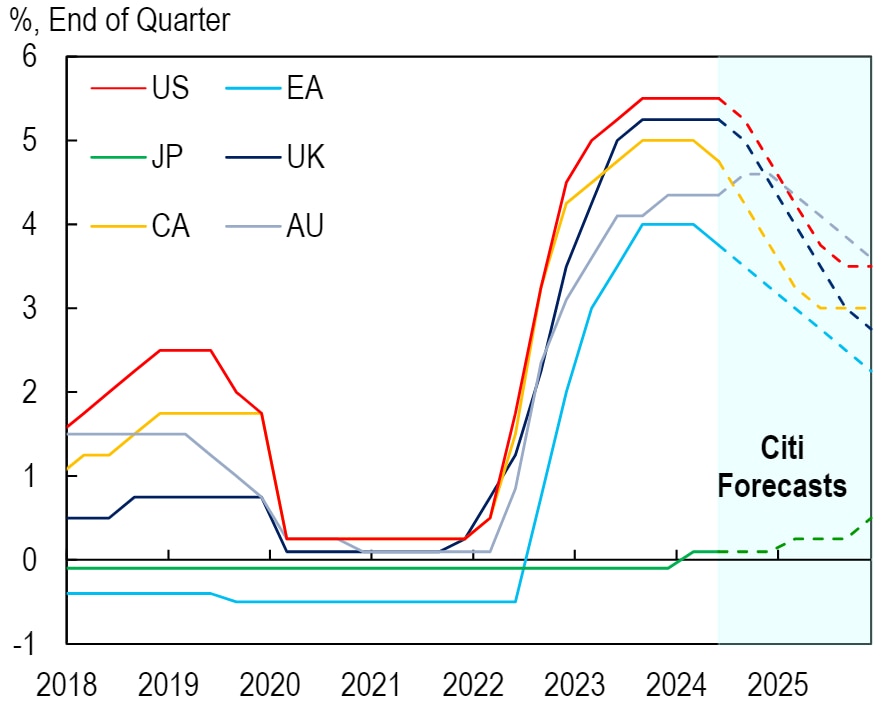

While we recognize the importance of the “last mile” and bringing inflation fully back to target, the global inflation picture now strikes us as more favorable. This, in turn, is creating scope for central banks to gradually reduce the restrictiveness of their policies. We see rate cuts gaining steam through the second half in the U.S., euro area, UK and Canada. (In Australia, on the other hand, we expect an August rate hike with cuts not coming until early next year.)

| Global Inflation | DM Policy Rates |

|

|

|

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. *Headline and core cover 15 economies with readily available data. Source: Citi Research, National Statistical Sources, Haver Analytics |

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, National Statistical Sources, Haver Analytics |

Central banks have clearly preferred to move together, and we expect their easing cycles to be similarly correlated. The Bank of Japan’s policies remain highly stimulative and a marked outlier. For now, the Japanese authorities are seeking to buy time and hoping rate cuts from the Fed and other central banks will be sufficient to take pressure off the exchange rate.

Many emerging-markets central banks are already well into their cutting cycles. Even so, the trajectory of cuts has generally been gradual, and in some cases the scope to cut rates has been less than anticipated. We speculate that developed markets’ initial rate cuts may pave the way for a second phase of easing in emerging markets.

The bottom line is that with inflation moderating, we expect central banks will have scope to shift to a less restrictive policy trajectory in the second half. That will likely be an important stabilizing factor for the global economy in the event of a sustained weakening in demand, or geopolitical headwinds that prove more pronounced or prolonged.

Existing Citi Research clients can follow this link to access the full report, which includes country-by-country discussions.