The Soft Landing U.S. Labor Market May Not Last

The U.S. labor market has followed the Fed’s blueprint for a soft landing, with labor supply increasing and demand for new workers easing without layoffs. But further weakening is likely needed to sustainably ease inflationary pressures, and Citi Research’s analysts aren’t convinced we've seen those signals yet.

They warn that the past year’s rebalancing seems to have stalled without wage inflation returning to a level consistent with underlying 2% price inflation. And they say they are not convinced by many of the indicators often cited as early signs of labor market weakness.

Exploring the labor supply

The Citi Research report starts by looking at the labor supply. In October, the participation rate was 62.7%, slightly above the higher end of the authors’ springtime expectations. That increase has been largely due to foreign born workers, with a rise in that population substantially offsetting the natural aging of the native born prime-age population. Essentially, they write, the increase in the foreign born population since late 2020 has made up for a contraction during the pandemic. But there’s likely limited scope for foreign workers to give overall participation another boost from here, they say.

Participation rates of prime-age and younger workers have already returned to pre-pandemic levels or even a bit above, so further upside is by no means assured.

The most obvious upside, the authors note, would be for prime-age participation to continue along an upward trend that formed before the pandemic, with prime-age women’s increasing participation a key factor. The total participation rate would increase if prime-age participation continued to rise in line with that trend, returning to pre-pandemic levels by mid-2025. Recent increases in participation by workers aged 16 to 24, on the other hand, are unlikely to persist and would depend on dynamics such as a continued downward trend in college enrollment.

Signs of weakness?

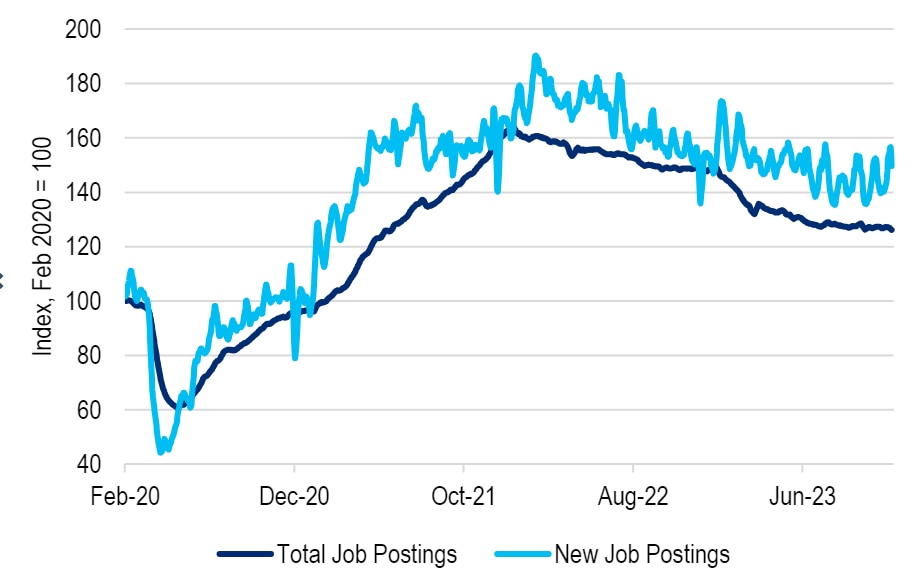

The report says that dire conclusions about the labor market’s health haven’t played out over the past year, but adds that some emerging dynamics may be early warning signals. Job growth has been consistently strong, with payrolls rising by more than 200,000 a month, on average, in 2023. That implies both a demand for workers to fill open jobs and a supply of those workers. Job openings remain elevated in the range of 9 million to 9.5 million.

Job openings could remain elevated around 9-9.5 million

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

New postings for jobs are also above February 2020 levels

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

A few data points are often cited as reason for concern: average hours worked, temporary help workers, and the Conference Board’s labor market differential. The authors acknowledge those data points are worth watching but add that they wouldn’t read much into them, noting that supposed weaknesses seen may just be conditions normalizing.

The early warning signal most worth watching, they say, is the rise in the unemployment rate: it now stands at 3.9%, up from 3.4% at the start of the year.

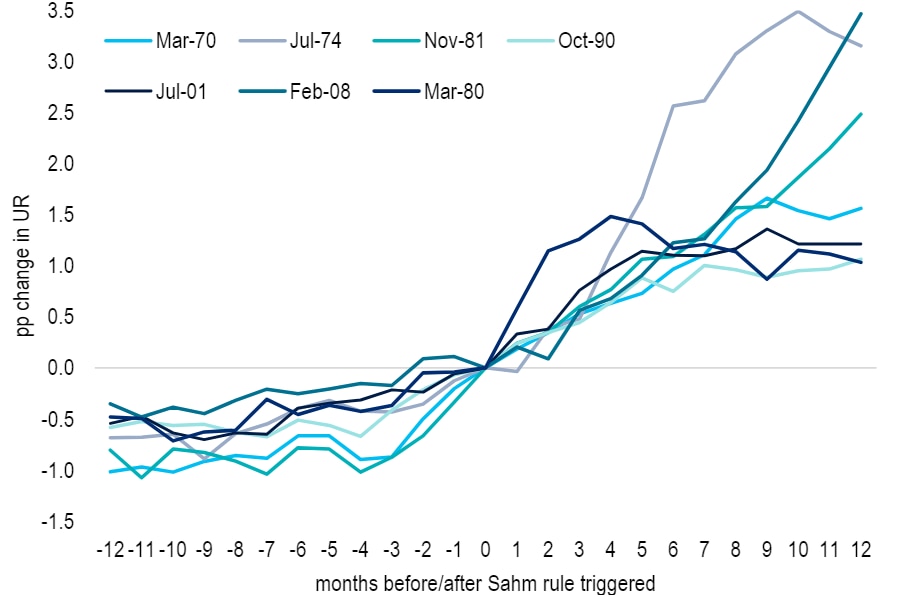

The report notes that has led many to revisit the “Sahm rule,” which states that a recession follows the three-month moving average of the unemployment rate rising more than 0.5 percentage point above its minimum in the last 12 months. Right now, the average is close to meeting those parameters. The authors note that the unemployment rate has largely been rising because labor supply has been increasing, but caution that’s also been true in previous instances of the Sahm rule holding.

Previous recessions have been marked by the 3mma of the unemployment rate rising by 0.5pp from the lows

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

In late 2022, weaker household employment was touted as foreshadowing an imminent weakening in payroll employment — and household employment was weaker in October 2023. But if this year follows last year’s pattern, the report says, household employment should accelerate to better match the establishment survey in coming months.

In previous downturns, the unemployment rate has generally bottomed 10 to 15 months before the defined start of a recession, and it has been seven months since that rate hit an official recent low of 3.39% in April. In the past few months, a larger increase in longer-duration unemployment in particular could signal a hiring slowdown.

The unemployment rate typically bottoms 10-15 months before the defined start of a recession

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Rising jobless claims also would seem to signal that the unemployed are having more trouble finding work. The authors acknowledge that some of this increase appears to be related to bad seasonal adjustment— in recent years claims have consistently risen starting in September — but add that the past few weeks’ increase has been somewhat larger than in the past. Signs of slowing hiring are consistent with a drop in the hiring rate, and the layoff rate remaining low is an encouraging sign that even if demand for new workers has fallen, demand for existing workers hasn’t.

Ultimately, the authors write, job losses rather than just softer hiring will likely be the true sign of a slowing labor market. In previous episodes, initial job losses started rising about 13 weeks before the Sahm rule was triggered. Such a rise hasn’t been seen of late, which the authors note keeps them watching initial jobless claims as the best early signal.

Signals from wages?

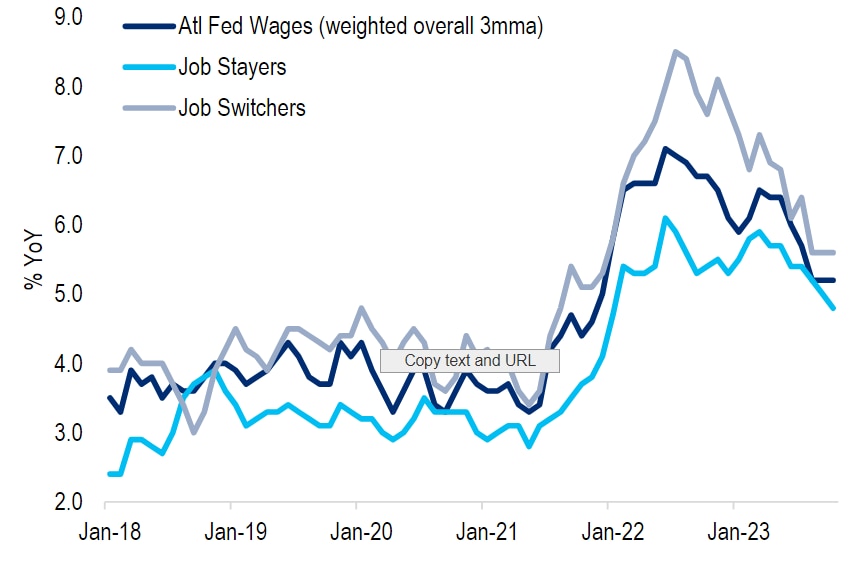

How tight or loose the labor market is may also be determined by watching wage growth — and the authors write that even more importantly, wage growth will be the determining factor for how tight or loose the labor market needs to be to return inflation to 2%.

A true weakening in the labor market, with the unemployment rising to around 5.5% next year in Citi’s base case, should mean overall wage growth also slows, likely back toward the neighborhood of 3% to 4%. But a number of current wage measures suggest stabilizing wage inflation around 4% to 5%, too strong to be consistent with 2% inflation.

Wage growth for job switchers and job stayers may be converging around 5%

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Strong wage growth, the authors write, points to a labor market that’s still tighter than before the pandemic, with the ratio of job openings to unemployed workers still elevated at 1.5 to 1. This tightness is more pronounced in some sectors than others, with production workers in demand, and wage growth over the past year has been much stronger for production and nonsupervisory workers, as opposed to total employment that includes management positions.

Wage gains received by people switching jobs have slowed, which the authors note is consistent with softer hiring or the drop in the quit rate. But a reduction in labor market churn would be natural after years of turnover that has been greater than usual, and does not necessarily indicate a weakening labor market. For now, wage growth of both job switchers and job stayers looks to be at risk of stabilizing in the 4% to 5% range.

The authors conclude that Fed officials will be encouraged that demand for new workers is easing without a decline in demand for existing employees — that’s the labor market blueprint for the ideal “soft landing” scenario. But the wage growth stabilization seen implies that the modest loosening of the labor market observed up until now isn’t enough to bring price inflation back to 2%. For that to happen, a sharper drop in demand may be necessary, one that extends to existing workers.

The full report, first published on 15 November 2023, is available here: US Economics - The “soft landing” labor market of 2023 may not last in 2024

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.