Saudi Arabia: Fintechs & Telcos Proliferate in Kingdom’s Digital Push

Saudi Arabia’s mobile banking and fintech scene is blooming.

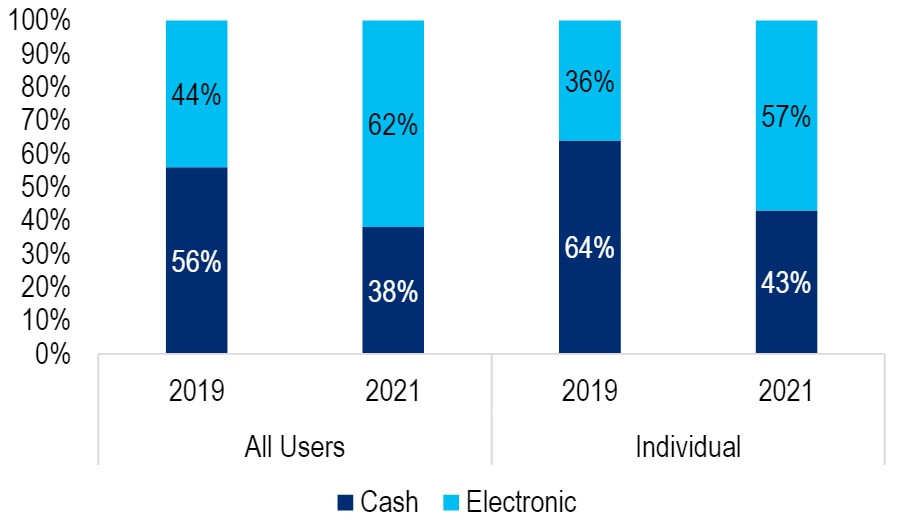

The speed of progress has been such that mobile payments, a key focus for Saudi authorities, have risen to account for 45% of point-of-sale transactions by volume and 35% by value. That’s up from a contribution of next to nothing as recently as 2019.

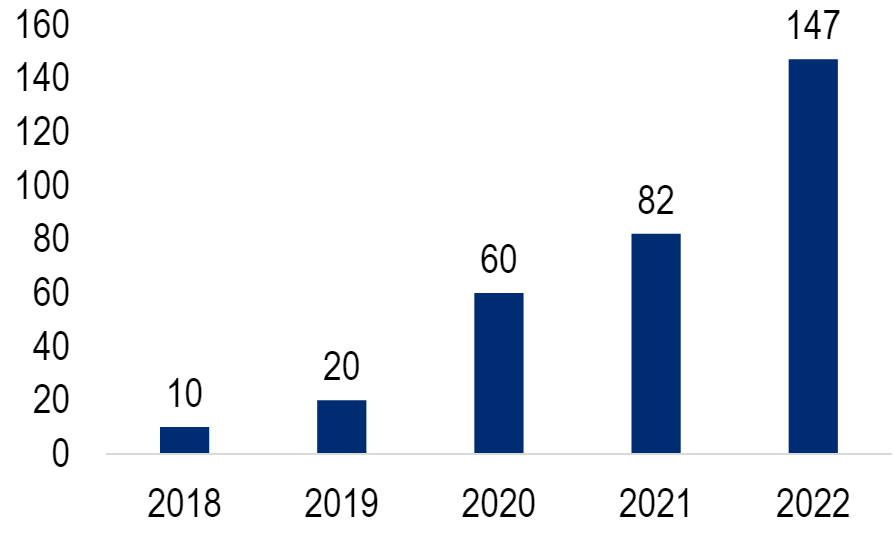

More than 150 fintechs now operate in the KSA market. And in addition to start-ups, telecom operators have also launched their own financial services, speeding the uptake of digital wallets and mobile payments.

It’s no coincidence. Authorities have been pressing forward with sweeping modernisation under the government’s Vision 2030 plan which also includes reducing the dependence on cash.

Indeed the government has targeted to convert 70% of payments to non-cash by 2025, pushing through both digitalization of banking platforms and by allowing more fintechs to operate in the market.

Number of Fintech operating in KSA

Source: SAMA

KSA Growth in electronic payments grew over 2019-21 (latest data)(%)s

Source: SAMA

The report notes that fintechs in KSA are quite fragmented in terms of their offerings. In addition to POS payments, they have also extended into the consumer financing space, saving products and online payments.

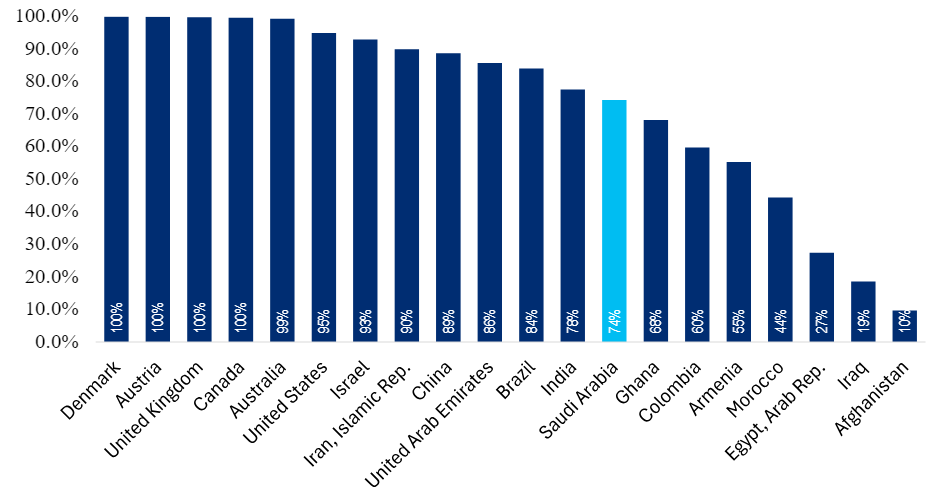

Financial inclusion has been a key challenge in many markets where banking reach and penetrations are low. Fintechs have played a key role in these markets to increase financial inclusion among the underbanked populations. One key reason for the success of fintechs in such markets: the higher administration cost model for banks compared to fintechs.

In Saudi, almost 3/4th of the adult population had an account with a financial institution or a mobile-money service provider.

% of population (age 15+) that own an account at a financial institution or with a mobile-money-service provider, 2021

Source: World Bank

Source: World Bank

Telcos are generally thought to hold an edge over other fintech players in their ability to deliver financial services. There are many reasons for this, including:

- Consumer reach/data: Telcos typically have broader reach and tend to have consumer related data sets which help them to offer more structured and targeted financial products.

- Distribution channel: Success of fintech businesses, particularly payments based ones often depends on that company’s merchant/agents networks. Telcos tend to have a better reach.

- Strong balance sheet: Mobile operators tend to have well-funded balance sheets.

That said, the fintech offering is generally more of a complementary service for telcos and not their core business, especially where the broader banking ecosystem is more developed as in Saudi. And Fintechs tend to be agile and technologically aggressive in adopting upcoming tech.

The full report goes onto to present case studies to illustrate the development of this burgeoning market.

For more information on this subject, if you are a Velocity subscriber, please see Saudi Arabia Banks, Telecom & Fintech Services - Digital Challenge 2023 (18 Sep 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.

Related Stories

Citi Institute Future of Finance Forum 2025

The Citi Institute Future of Finance Forum brings together leading voices across finance, policy, and technology to explore how innovation is reshaping the financial system. With a focus on frontier technologies such as AI, blockchain, and quantum computing, the Forum connects industry experts, regulators, and thought leaders driving the next wave of transformation.

This year’s event featured guest speakers including Hon. Caroline Pham, Acting Chairman of the U.S. Commodity Futures Trading Commission, and offered forward-looking perspectives on the future of digital assets, financial infrastructure, and global innovation. Watch the highlights video above.

Watch the replays here