Japan’s Corporate Governance Enters New Phase

It has been a decade since corporate governance was introduced into Japan’s national growth strategy as part of the Japan Revitalization Strategy.

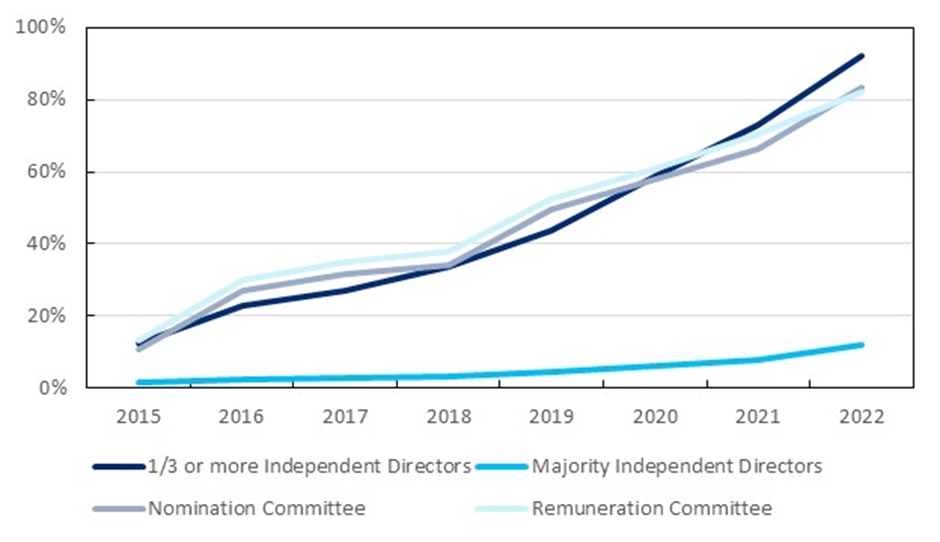

Since then, revisions and updates have been made and there has been some progress. For example, compared with 2015 there has been a big uptick in the proportion of companies with independent or outside directors. Indeed, almost 82% of prime market companies had an independent director share of at least one-third as of 2022 (see chart below).

But the fact remains that Japanese firms are still lagging compared with international firms.

Ratio of listed companies in Japan with independent directors, nomination committees, and remuneration committees

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: JPX, Citi Research

The proportion of female directors is rising but was still only 11% in 2021 compared with 30%-40% for the US and Europe.

Cross shareholdings are a particular feature in Japan, and they count as negative in ESG index governance items. Modest progress has seen the average number of names held fall from 65 in 2010 to 43 in 2019, but sales have been limited to small holdings.

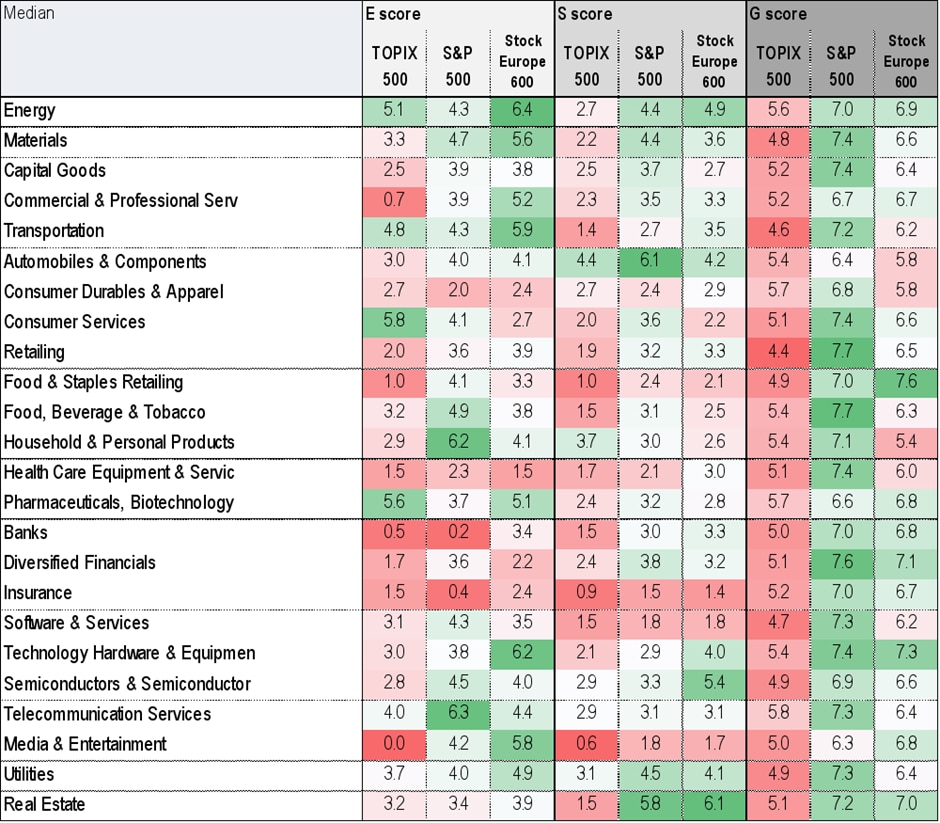

Meanwhile, the Bloomberg governance scores show improvement for Japanese companies but persistently low levels compared with US and European counterparts.

Japanese ESG scores are generally comparatively low but particularly so for governance (see chart below).

Comparison of Bloomberg E, S, and G scores in Japan, the US, and Europe

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Bloomberg, Citi Research

Citi Research analysts highlight the TSE’s Council of Experts Concerning the Follow-up of Market Restructuring as a vehicle with the potential to make more progress.

On January 30, the TSE published a summary of its discussions over recent months including how steps should be taken to make the “comply or explain” provision of the Corporate Governance Code (CGC) widely known and highlight instances of inadequate explanations, among other measures.

At a February meeting, the Council of Experts released its specific requirements for initiatives to improve capital efficiency and stock prices, the details of which are outlined in the full report. Ideas discussed included promoting competition among companies by including a PBR benchmark of 1.0x in the standards for listing on the prime market and restricting the number of stocks in the TOPIX.

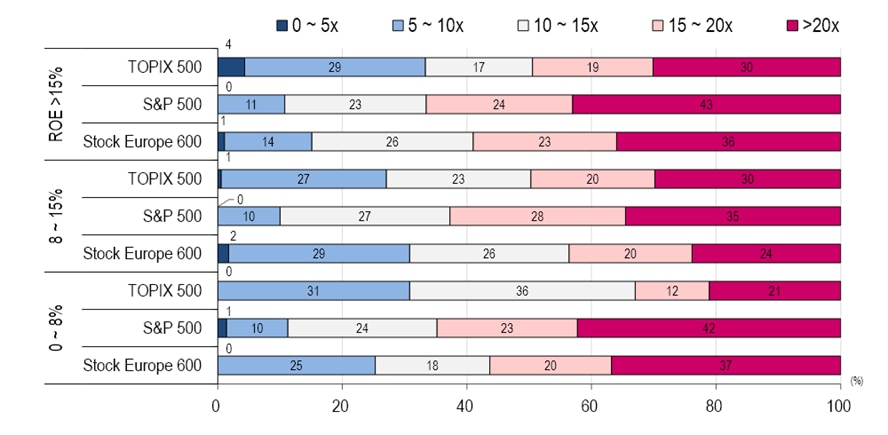

International comparison of 12m forward PER (by RoE level)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Note: Compiled using stocks for which data items are available. RoE on a 12m trailing basis.

Source: Bloomberg, Citi Research

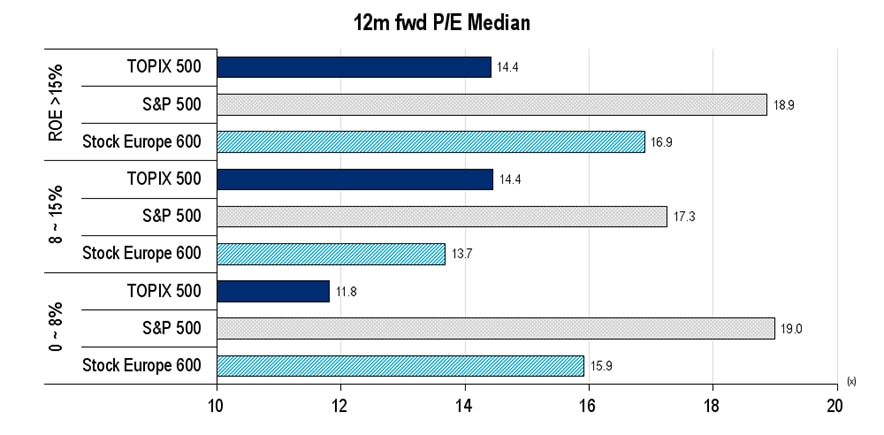

Japanese companies suffer discounts despite high RoE

The earnings multiples of Japanese companies are lower than those in the West across the board, and this tendency also affects companies with RoE in excess of 15% (see chart below).

One reason companies with high RoE are discounted relative to overseas peers is that the sheer number of companies with RoE below the cost of capital makes the Japanese equity market less attractive overall, thereby hindering the inflow of funds.

International comparison of 12m forward PER: median (by RoE level)

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Note: Compiled using stocks for which data items are available. RoE on a 12m trailing basis.

Source: Bloomberg, Citi Research

If the latest initiatives by the JPX promote capital policy reviews and business model reforms at companies with low RoE, it could lead to the medium- to long-term re-rating of Japanese equities and the rectification of the current discount, the analysts note.

For more information on this subject, please see: Japan Equity Strategy - Japan’s corporate governance reforms about to enter new phase (21 February 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.