India has committed to being a net zero emitter by 2070. Since it made that pledge at COP 26 in Glasgow in 2021, India’s government has unveiled new policies and regulatory action aimed at developing technologies to help the world’s most populous nation meet that target.

India's road to 'net zero'

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

Several companies in India have announced their own net zero goals, and their plans to reduce their carbon footprint through technology.

These clean energy drivers are primarily focused on: renewables, battery storage, electric vehicles, carbon capture, green hydrogen, and biofuels.

Let’s look briefly here at progress in renewables- so far the clear bright spot among those themes.

Renewables – Solar System

India’s renewable energy sector in India has witnessed huge change in the past 7-8 years.The government has an ambitious target of 500 GW of non-fossil fuel-based capacity by 2030.

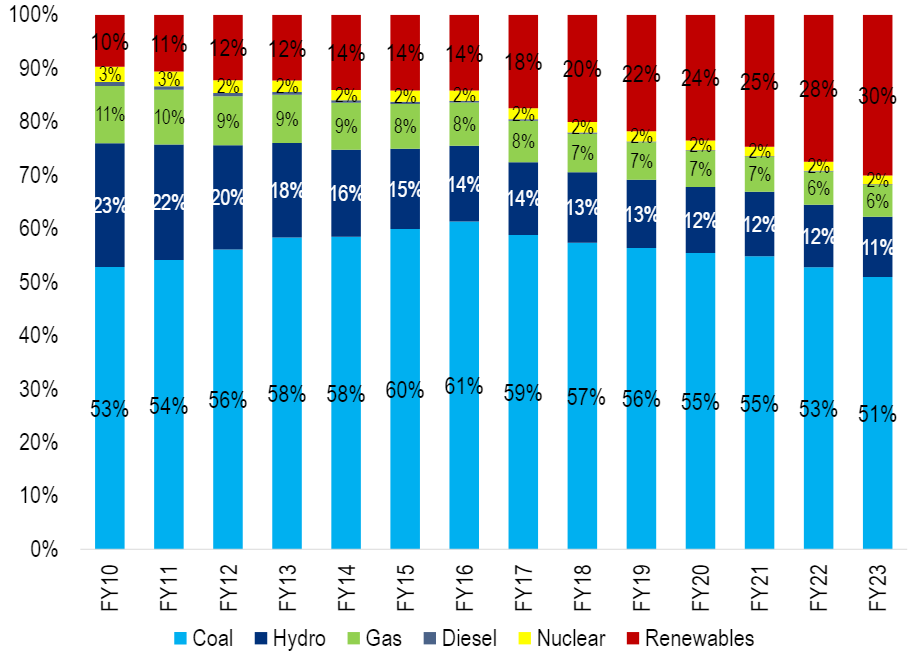

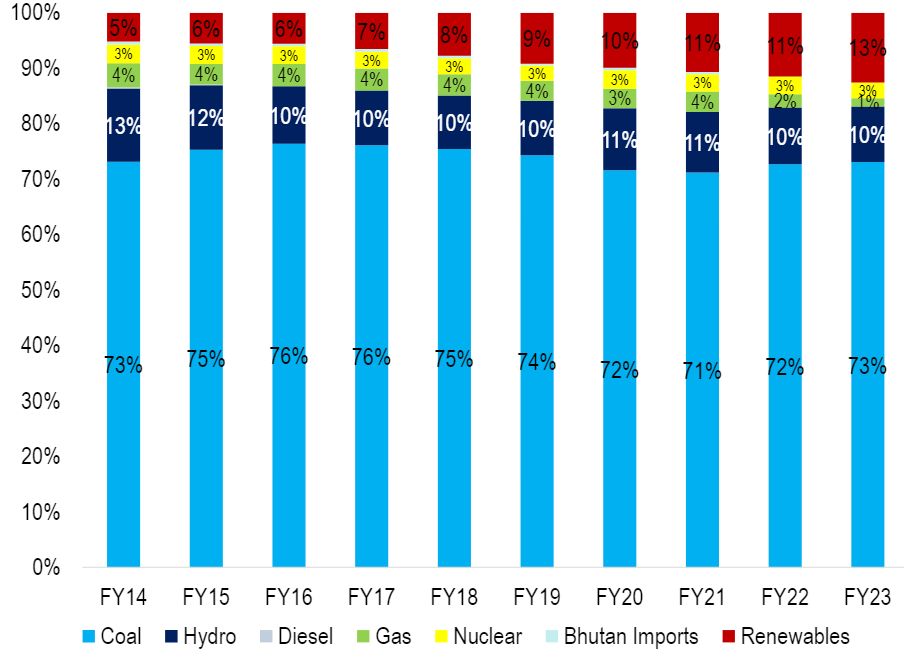

Policy has focused on increasing the contribution of renewables to the overall energy mix.

The share of renewables in installed power generation capacity has increased to ~30% in FY23 vs. ~10% in FY10.

India – Installed Power Capacity Mix

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Over the past 5 years, India has seen a steady increase in installed renewable capacity. As of Jul’23, India’s total installed renewable capacity is ~131 GW, which includes solar capacity of ~71 GW and wind capacity of ~44 GW.

EVs – Strong government focus. Two wheel progress.

The gov’t has pushed the adoption of EVs via several policies over the years.

Citi research analysts say that EVs are cost competitive in the ride-sharing and 2-wheeler categories, where high usage, coupled with gov’t incentives, leads to significant cost savings. But when it comes to ICE vehicles (esp. CNG) have a significantly lower TCO compared to EVs.

Electric buses, even with subsidies, have a higher life-cycle cost compared to their ICE counterparts, but could still see better adoption in public transport with adequate push from the central and state gov’ts.

As a result, two-wheelers are expected to see rapid adoption of EVs.

Key impediments to higher EV adoption include high upfront cost , range anxiety, regulatory issues and import dependence (India could end up overly reliant on the Chinese battery supply chain).

Green Hydrogen – A reality check

In January this year India approved the National Green Hydrogen Mission (NGHM). The target? To produce at least 5 MMTPA of green H2 by 2030.

The government will provide incentives of upto Rs50/kg for green H2 production and upto Rs4,440/kW for electrolyser capacities. This, however, lags countries like the US and China.

Under the IRA, or example, the US provides a subsidy of upto $3/kg (~Rs250/kg) of green H2 production, which could lead to significant reduction in production costs by 2030.

And Indian companies face the prospect of low-cost electrolyser imports from China.

Citi research expects India’s installed electrolyser capacity to reach ~12 GW by 2030, which would be equivalent to a green H2 production capacity of only 1 MMTPA (~20% of India’s target). That’s compared to global electrolyser capacity that is expected to reach 205 GW by 2030, primarily on the back of additions made by China, the US, and EU.

Biofuels and CCUS

India has a target to reach 20% ethanol blending in petrol by FY26 (from ~12% currently).

OEMs are already manufacturing E20 petrol vehicles and various players have showcased their progress at flex-fuel technology, the capability to run on 100% ethanol.

But CBG (compressed biogas) adoption has been low due to the lack of available technology and high cost. Several players have now announced plans to set up their own CBG capacities, but few commercial scale projects are up and running as yet.

Significance of carbon trading

India has approved a Carbon Credit Trading Scheme covering guidelines to form an Indian carbon market. As such groups from across various industries would have to comply with emission norms pre-set by the Ministry of Power and Bureau of Energy Efficiency.

Indian companies across industries have been aligning their targets with India’s COP26 commitments by setting aggressive goals for reducing emissions.

Citi research analysts say the development of carbon markets in India could encourage entities to monetise their investments in clean energy technologies like CCUS, green H2, renewable energy, etc. These could otherwise seem unviable owing to exorbitant costs of such projects.

The full report goes on to look at India’s steps to enhance domestic manufacturing of renewable energy machinery, components, and equipment with the most notable announcement being the production linked incentive (PLI) scheme for setting up manufacturing capacity.

For more information on this subject, please see Multi-Asset - India SRI: Assessing Clean Energy Ecosystem; Selective Progress, But Needs Policy Momentum (11 Oct 2023)

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.