Follow the Yellowcake Road

Uranium prices are up more than 50% for the year. That’s enough to make “yellowcake”, as it’s often known, one of the best performing commodities in the world.

|

Figure 1. UxC Uranium U308 spot price at record highs |

|

|

|

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, UxC |

What lies behind this? In short, burgeoning interest in nuclear energy coupled with continuing concerns about uranium supply from Russia and Niger. With some problems in Canada thrown in, too. Anticipation of a potential ban on Russian nuclear fuel and a hesitance -- particularly from Western utilities -- to buy from Russia leave little room for maneuvering.

While utilities in Russia, China, Turkey, and a few other countries secure material with long-term contracts, utilities in the UK, the EU, the US, and South Korea are effectively bidding up the spot price as they try to build a surplus in preparation for potential disruption ahead.

|

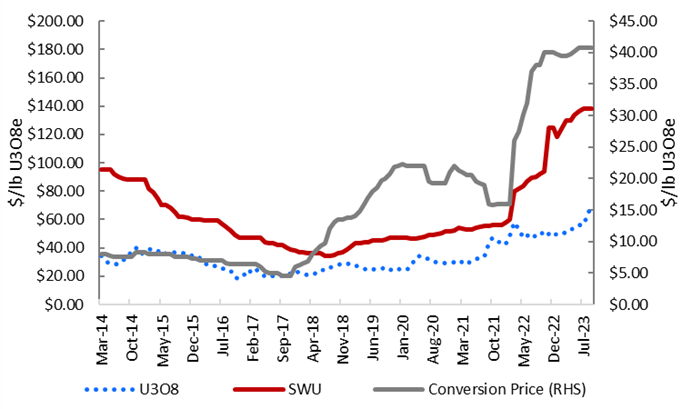

Figure 2. Nuclear fuel prices |

|

|

|

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, UxC |

Uranium prices have been climbing for consecutive months since June on the back of growing supply constraints and unprecedented interest in nuclear energy globally.

While most of the problems associated with nuclear energy remain -- namely high overnight capital costs, security, and extended construction time -- technology has contributed big strides in making some of this better. Rising borrowing costs and greater capital costs for other sources of energy are also making nuclear energy more acceptable on the global stage.

Niger has historically been considered one of the world’s most reliable partners in supplying uranium to the global market. But that has changed recently. Mines have been shuttered. Also, further mine development is not possible since borders have been closed following the recent coup there, and material required for mining has been in short supply.

As countries are actively working on green policies and developing an energy transition agenda, nuclear energy continues to be prioritized as a low-emitting energy. The Citi Research analysts say they currently count 440 active and non-decommissioned reactors worldwide, with a total capacity of 399GWe.

In 2023, demand for uranium by utilities reached 162.3mln lbs of U3O8, which is 1.6mln lbs higher than in 2022. Uranium demand is set to grow by 33%, according to Citi Research estimates, and globally by 2030 at 216.5mln lbs U3O8. This compares to a World Nuclear Association (WNA) forecast in its biennial Nuclear Fuel Report, estimating it to grow by 28%.

For more information on this subject, please see the full report, published on 3 October 2023, here: Global Commodities - Uranium Outlook: Radioactive prices amid supply shortage and growing demand for nuclear

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.