Asia Battery Materials: Supply Chains and Demand

Global battery supplies are running low due to robust demand from electric vehicles and energy storage systems. In order to gauge the sustainability of the tightness along the supply chain, Citi Research’s regional battery analysts launched their first battery supply model in a recent report.

In it, they map out effective capacity growth, along the global battery supply chain, into quarterly forecasts through 2023. They compare capacity forecasts with various demand scenarios.

Some of their key conclusions are as follows:

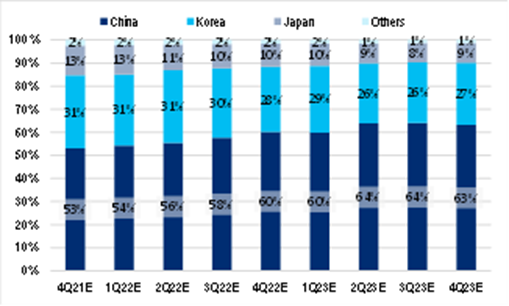

- Global battery supply could remain tight in the first half this year before marginally easing into the second half as Chinese and Korean producers ramp up. Chinese producers along the supply chain are building capacity faster than their peers.

- Among battery components, high-end separator and electrolyte supply will likely remain tight.

- Further price hikes along the supply chain are likely into the end of the year as lithium carbonate prices rise even more.

Chinese Battery Makers Building Capacity Ahead of Peers – Share of Global Battery Capacity

Source: Citi Research

Utilization of electrolyte should remain high at ~90% in 2022 before running into a deficit in 2023, based on Citi’s model. Utilization of separator will likely remain stable at ~80%, but Citi’s analysts see uneven distribution of customer orders while existing leaders continue to dominate. Utilization of anode should remain at ~75% before rising to 85% by the second half of 2023, according to Citi Research, while cathode should remain well supplied through the end of that year, with utilization at 75% on average, including Lithium Iron Phosphate (LFP) cathode utilization at only 64% and utilization of Nickel Manganese Cobalt (NMC) cathodes at 88%.

The “over construction” of cathode capacity means that cathode makers will continue to compete for lithium carbonate supply, which Citi forecasts should grow at only 33% p.a. by the end of 2023.

Lithium Supply Not Enough to Meet Cathode Expansion Over 2022-23E

Source: Citi Research

In the long run, Citi’s analysts think that the competitive landscape in each of the sub-sectors will be the key factor for price and margin stability. The battery and battery separator landscape stands out, as the top producers in China already enjoy ~50+% market share. This means that the leading companies will likely continue to enjoy cost advantages and pricing power over the long term. The top players in electrolyte and anode had 34% and 27% of the market, respectively, as of the fourth quarter of last year. Cathode is a fragmented market given that it has a more favourable competitive landscape. This means that overall room for cathode makers to expand margins should be relatively limited.

The Citi Research report goes on to assess the effective capacity of battery producers in the next two years and compare overall capacity with various demand scenarios in order to gauge the sustainability of current battery tightness.

Under Citi’s base-case demand forecast, battery capacity is expected to grow marginally faster than demand in 2022, resulting in slightly lower utilization of 80-85% versus 88-89% currently. Utilization is expected to rise again into 2023 to 90% as demand outpaces supply.

In the bull-case scenario, whereby demand could be 20% higher than the base-case forecast, Citi’s Research analysts think that overall effective supply might fall short, with NCM battery supply being much tighter than LFP battery supply.

In addition to the underlying demand analysis, Citi’s analysts point out that supply-chain restocking demand should not be overlooked. Inventories at both the new energy vehicle (NEV) makers and the battery producers have been rising sharply over the past few quarters. This is partially due to robust demand, which required the producers along the supply chain to prepare inventory to maintain operations. Citi’s analysts reckon that a certain amount of active restocking by the producers in expectation of demand trending even higher has also taken place. They factor in 20%~30% inventory build at NEV producers and the battery makers in the model, saying that they expect restocking demand to continue as long as underlying demand remains strong. For more information on this subject, please see Asia Battery Materials - The Future Is Electric, But Is the Supply Chain Ready?, published on 6 January 2022.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.