A recent report from Citi Research’s Nathan Sheets and team looks at factors contributing to more sluggish global growth this year. The authors see global growth slowing this year to 2%, down from last year’s 2.7% pace.

While Citi Research economists doubt this will result in “global recession,” they warn that growth will be distinctly slower. That said they see this slower pace supporting a further decline in inflation and opening the door for rate cuts.

The authors see several factors contributing to this slowdown, ranging from the effects of monetary policy and moderating consumption to a loosening of the labor market and the effects of less-supportive fiscal policies from countries.

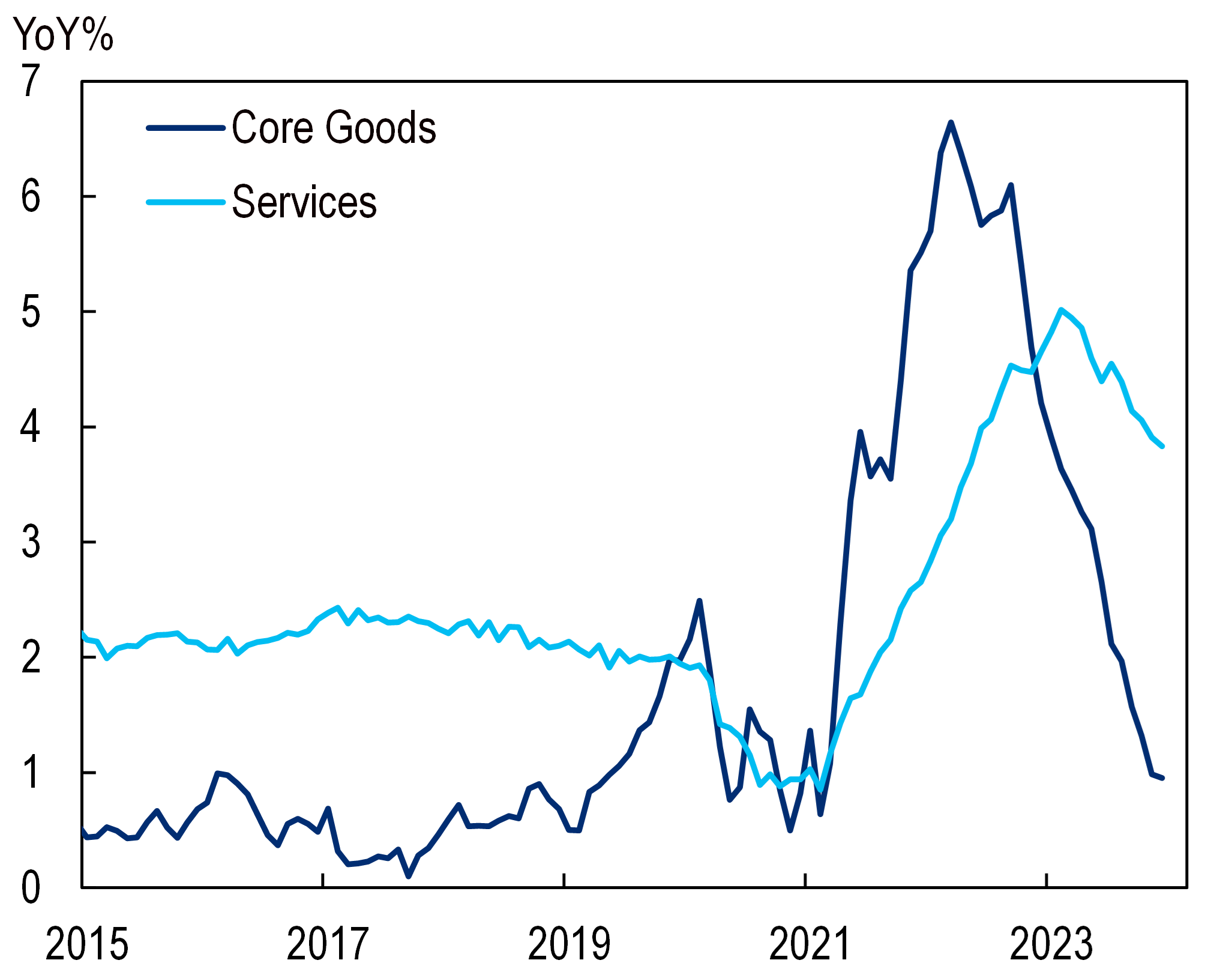

The report describes global inflation as continuing along the broad contours that have prevailed over the past year or so: Global headline and core inflation have both moderated significantly since 2022.

Chart showing that the decline in headline inflation has been much sharper and more pronounced than core inflation’s more gradual retreat.

Figure 1. Global Core Goods & Services Inflation

©2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, National Statistical Sources, Haver Analytics

Labor markets have been particularly resilient and a key source of economic strength, but the report anticipates labor markets loosening as 2024 progresses. That, in turn, should support central banks’ efforts to blunt services inflation and reduce core inflation.

Progress is expected to be relatively rapid in the Euro Area and the UK, with Australian inflation declining more gradually and labor-market tightness limiting progress for the US. All told, the authors project global headline inflation will retreat from 4.7% in 2023 to 3.3% this year, just slightly above its 3% historical average.

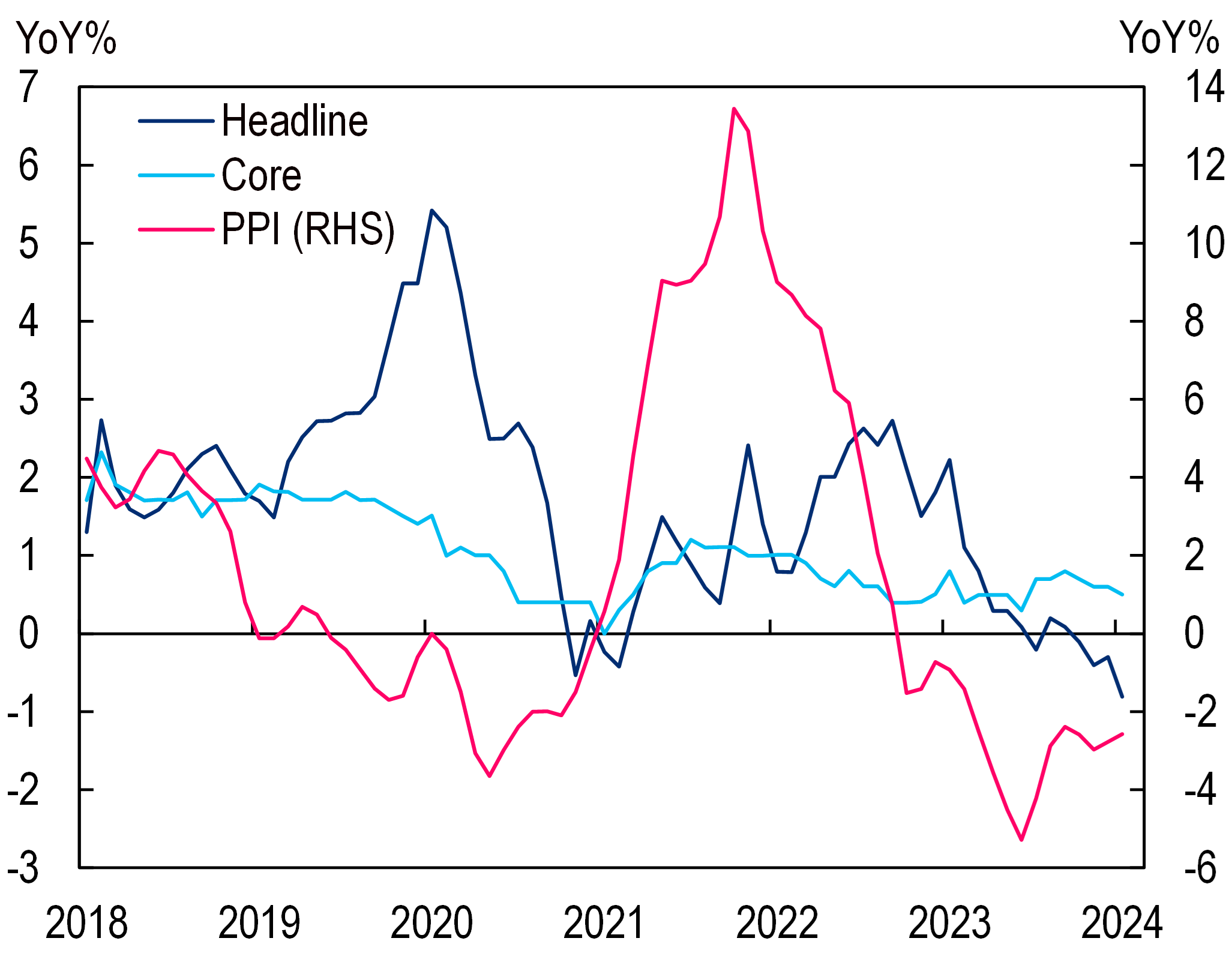

China’s weak inflation performance is worrisome, however, given its important role in the global economy. China’s PPI inflation has been in deeply negative territory since late 2022, the product of a “perfect storm” of moderating commodity prices, weakness in global demand for Chinese exports, and softness in the domestic economy.

Chart of China inflation shows that PPI in deeply negative territory.

Figure 2. China Inflation

©2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, CNBS, Haver Analytics

The report predicts China’s headline CPI inflation will rise back to near 3% this year, but caution that risks to this forecast are heavily skewed to the downside. Disinflationary impulses in China may prove stronger than currently assessed, and it’s not clear to the authors that Chinese authorities are prepared to address the challenge should disinflation prove more entrenched than expected.

Central Bank Policies

The report notes that the risks to global inflation now look increasingly two-sided: Inflation might once again prove more stubborn and entrenched than central banks believe, but downside risks are also coming into view. Besides China’s challenges, there’s a risk that central banks will keep monetary policy too restrictive as they seek “confidence” that inflation is sustainably lower, leading to downside growth surprises and a decline in inflation that is sharper than desired.

The authors expect central banks will cut policy rates, but do so cautiously and with the risk of stickier inflation in mind. The authors see developed markets’ major central banks as likely to begin cutting during the second quarter, with further cuts as the year progresses, and they continue to project a US recession, likely around midyear, which would spur additional second half cuts from the Fed.

The report’s authors see rate cuts coming from the ECB, the Bank of England, and most other developed markets central banks. Many emerging markets’ central banks, on the other hand, raised rates aggressively through the pandemic, allowing them to cut rates earlier than their developed markets counterparts. Emerging markets countries are now increasingly debating how sharp their easing cycles should be. Emerging Asia did not see the same rapid inflation as elsewhere in the world, and so those central banks’ hiking cycles were more muted, which should lead to more gradual rate cuts.

Key Risks

Beyond global inflation, the report highlights further risks and challenges for 2024. Geopolitical headwinds continue from the Russia-Ukraine conflict, and Middle East tensions have created another source of concern, with challenges emerging for global shipping. But the report notes that upward moves in shipping costs are only a fraction of those seen during the pandemic. While these developments require careful monitoring and assessment, the Citi Research report says that that at least so far they’re not game changers for the global outlook.

Another source of uncertainty comes from dozens of national elections on tap for 2024. The one that looms particularly large for markets is November’s US elections, which are poised to be close and hard fought. The ebb and flow of that campaign is likely to stoke volatility in global markets, particularly in the second half of 2024, the report says.

For more information on this subject, and if you are a Velocity subscriber, please see the report, originally published on 14 February 2024, here: Global Economic Outlook & Strategy - The Tide Turns Toward Softer Global Growth

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.

Related Stories

Citi Institute Future of Finance Forum 2025

The Citi Institute Future of Finance Forum brings together leading voices across finance, policy, and technology to explore how innovation is reshaping the financial system. With a focus on frontier technologies such as AI, blockchain, and quantum computing, the Forum connects industry experts, regulators, and thought leaders driving the next wave of transformation.

This year’s event featured guest speakers including Hon. Caroline Pham, Acting Chairman of the U.S. Commodity Futures Trading Commission, and offered forward-looking perspectives on the future of digital assets, financial infrastructure, and global innovation. Watch the highlights video above.

Watch the replays here