Global Economic Outlook & Strategy

2024's global growth looks like it will slow only modestly from last year, but downside risks have intensified of late. Such risks, coupled with more favorable inflation data, have opened the door for a full-blown central-bank easing cycle that's likely to gain steam in the months ahead. We explore what may lie ahead in a new report.

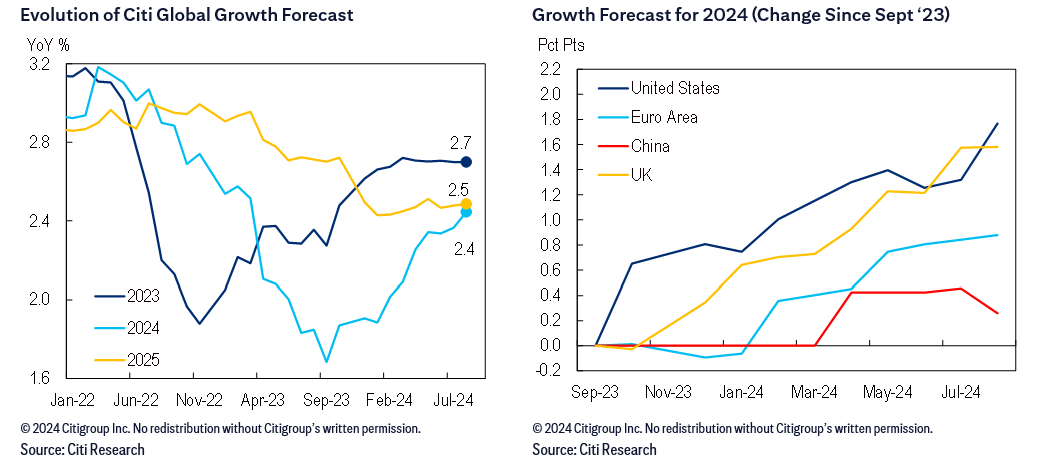

In a new Citi Research report, a team led by Nathan Sheets looks at what may lie ahead for the global economy, from forecasts of growth and inflation to central bank policies. We see the global economy as likely to register annual growth of 2.4% this year, down only modestly from 2.7% in 2023. In a sign of economic activity’s continuing resilience, our forecast has risen by more than half a percentage point since January.

Of late, however, downside risks have intensified, with data for several major economies falling short of expectations. For the U.S., recent weeks’ data have been the softest relative to expectations in roughly two years; for the euro area and China, the shortfall is the largest since mid-2023. An additional challenge has come from an uptick in geopolitical tensions; while energy markets seem to consider it unlikely that a conflict will limit physical oil supplies, we note that such an outcome would act as a supply shock for the global economy, lowering growth and boosting inflation.

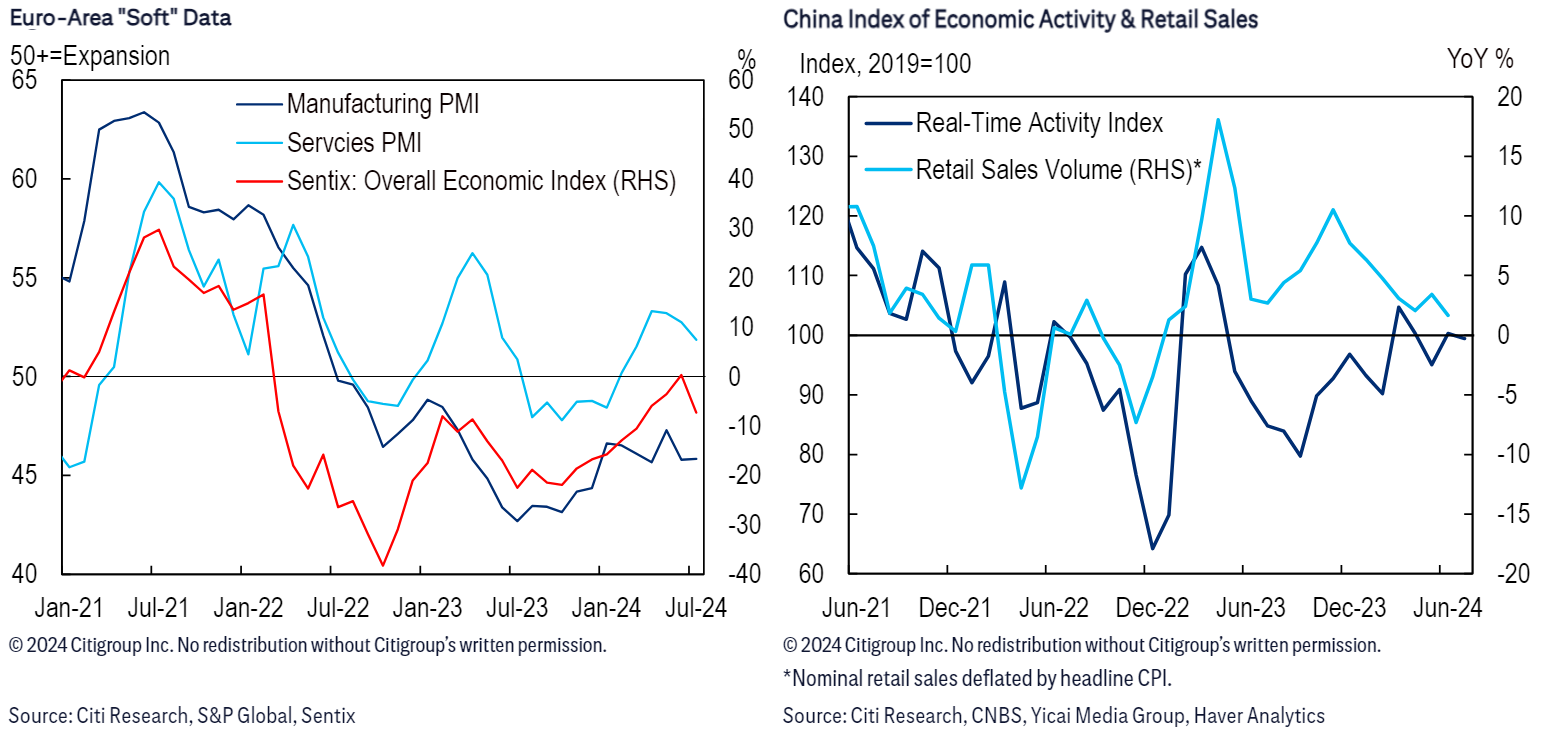

Despite downside risks and headwinds, global PMIs have held up well through July, with few if any signs of a sharp slowdown. At the same time, global inflation has continued to ease. Global headline inflation is now below 2.5%, though services inflation remains high. But we think services inflation will keep grinding lower as growth moderates and labor markets loosen further. While the “last mile” in the inflation battle may still pose challenges, we think the upside risks to global inflation look less pronounced than they have for the last few years.

Economic developments

The U.S. remains central to the global outlook. Recession fears hit fever pitch earlier this month, but such worries have moderated of late with additional readings painting a more resilient economic picture. The arguments for a recession are historical: Past episodes of high inflation and wage growth alongside tight labor markets have typically led to periods of negative economic growth and rising unemployment. But there are also strong arguments in favor of a soft landing. Our bottom line is that recent market gyrations reflect heightened uncertainties about whether or not a recession is brewing. A recession is our base case, but data in upcoming weeks will be critical in assessing the U.S. economy’s underlying strength.

For the euro area, second-quarter GDP growth came in better than expected, but higher-frequency data may be signaling a loss of momentum. While data still point to modest growth this year, we see risks as increasingly tilted to the downside. In China, many indicators continue to highlight cyclical softness, but we expect to see additional fiscal stimulus and further monetary easing in the year’s second half, and think growth just below China’s official 5% target is still achievable. And while the global manufacturing recovery still looks lackluster, indicators for several emerging-markets Asian economies have shown strength.

What’s ahead for central banks?

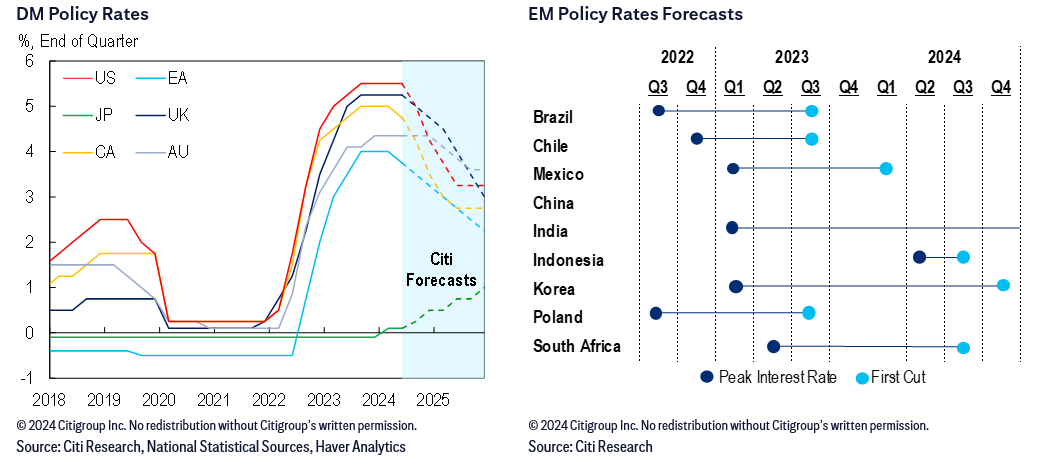

A combination of more favorable inflation dynamics and worries about downside risks to activity has opened the door for central banks to engage in a full-blown global easing cycle, which we expect to gain steam in the months ahead.

Central banks are seeing more scope to reduce the restrictiveness of their policies. In recent weeks, the UK, Canada and New Zealand have all cut rates; all told, the cutting cycle over the last few months is the largest seen over the last 20 years aside from global recessions. It’s our view that central banks are just getting started: We expect the Fed to deliver a first rate cut in September, with the European Central Bank resuming easing as well. Central banks for many major developed markets are then likely to ease in lockstep through the rest of 2024 and much of 2025.

Australia and Japan remain outliers. We expect Australia to remain on hold this year and deliver its first cut in February, though risks remain tilted toward a later start date. Japan recently raised rates, and we expect further hikes in this cycle.

Many emerging markets began easing relatively early, but their easing cycles have been gradual, with less scope for cuts than anticipated in some cases. As developed-markets rate cuts gain momentum, emerging markets may be able to begin a new phase of cutting cycles. Moreover, we note a growing debate over whether the Fed should start its cutting cycle with cuts of 50 basis points or more; such a jumbo move could open the flood gates for faster cutting cycles elsewhere.

Even so, central banks have fought hard to wrestle inflation to within a stone’s throw of their targets. Unless there’s a further slowdown, we think they may be hesitant to ease policy rapidly and so run the risk of jeopardizing their hard-won gains.

Our new report, Global Economic Outlook & Strategy: Global Resilience — The Plot Thickens, also includes views of equity strategy and other assets. It’s available in full to existing Citi Research clients here.