Five Tectonic Shifts for German Industrials and Autos

A new Super-Sector Analysis by a team led by Martin Wilkie, Co-Head of Industrial Tech & Mobility at Citi Research, explores five tectonic shifts that are transforming industry norms in Germany, and looks at the strategies companies are turning to by way of a response.

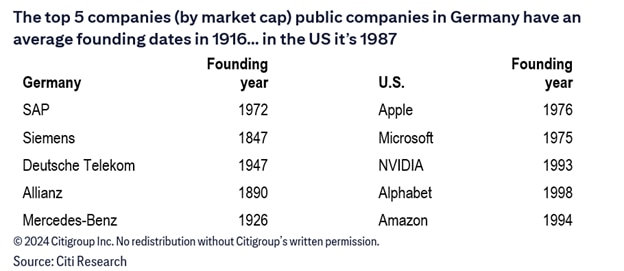

For openers, we note striking differences between the U.S. and German stock markets. NVIDIA’s market cap, at ~$2.9 trillion, is higher than the entirety of the German stock market at ~$2.6 trillion. The five largest U.S. companies by market cap are, on average, less than 40 years old; in Germany the average age of the top five is more than a century. This speaks volumes, both about the durability of Germany’s industrial champions but also about the lack of new corporate goliaths.

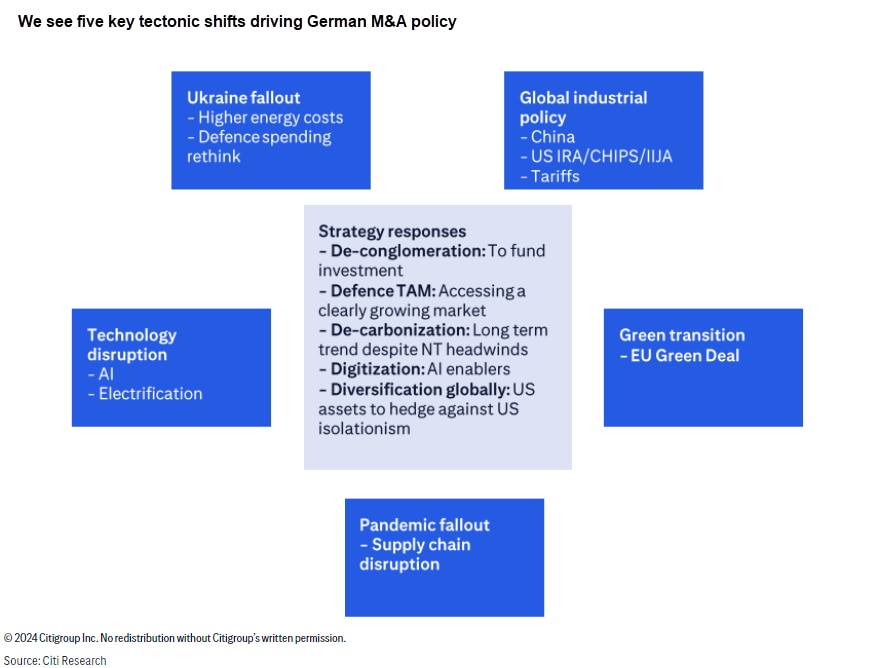

How Germany’s industrial champions respond to major shifts could have major effects on investment allocations and M&A. The five trends we see as increasingly disruptive forces for Germany’s industrial and auto sectors are:

- Rising national protectionism in other regions, especially China and increasingly the U.S.;

- the long-term impact of the Russia–Ukraine war, especially on energy and defense markets;

- the fallout from the pandemic on business models, notably supply chains;

- technology disruption, most recently from AI;

- and Europe’s Green Deal.

And the strategic responses we expect can be summarized as digitization; decarbonization; defense, diversification globally; and deconglomeration.

Digitization: Germany’s “Industry 4.0” strategy is aimed at driving digital manufacturing and consolidating Germany’s leading position in many manufacturing and engineering markets. We see the sudden surge in AI investment as adding new urgency to this push; our view is that vertical industry expertise and the installed base of industrial edge devices that control and gather information should form an AI “moat” for most industrial companies, with a further push into software to protect this moat. An aspect we see as worth watching is the digitalization of the car, with sharp development of cars’ electronic architecture, computing power and software to drive functionality. Historically, none of these domains has been a strength of the auto industry, leading to significant competitive disadvantages and long delays in new-model launches. This has led Volkswagen, for one, to invest in firms in China and the U.S.; we expect many more such tech-driven investments.

Decarbonization: We see two major industrial drivers of this trend for investment. The first is support for Germany’s energy-intense industries, which are currently at a structural global disadvantage due to high relative energy costs. Such cost disadvantages look set to persist, but in order to prevent an industry exit, Germany’s government is providing subsidies to these industries in return for reducing emissions during production. The second driver is the need for the German auto industry to future-proof itself against the rise of China battery electric vehicles (BEVs). Elements of this strategy include a need to make huge investments in manufacturing, government policies aimed at speeding consumer adoption of BEVs, and potential EU tariffs on China BEV imports.

Defense: Increased U.S. isolationism and potential policy changes under a Trump presidency have increased expectations for German defense spending and detoxified an end market that some industrial companies had spurned. An increasing number of German businesses have lifted self-imposed bans on supplying the defense industry; meanwhile, Germany now aims to spend 2% of its GDP on defense later this decade, an unprecedented policy change following three decades of underspending.

Diversification globally: U.S. domestic content credits and/or high import tariffs could incentivize local U.S. production to serve the U.S. market. This would mean U.S. domestic assets could be needed to serve U.S. demand, with such assets becoming more appealing as a hedge against isolationism. We also think past dependence on China for growth and earnings will be reappraised. That would mean a balancing act for the auto market, as China has been the key growth driver for the industry for more than 20 years and generates nearly 30% of global auto demand, making this important market hard to give up. As part of the China reappraisal, we expect other markets (such as India) to become targets for growth.

Deconglomeration: This trend isn’t new, as industrial conglomerates arguably had their global heyday in the 1980s and 1990s; General Electric was the world’s most valuable company in August 2000. Since then, dismantling conglomerates has been the trend, with sector companies simplifying and decentralizing at an increased pace over the last decade. In autos, descending valuations have often meant group valuations substantially below their sum-of-the-parts value. This has driven some management teams to either spin off some group companies or create IPOs for them.

Our new report, Industrial Technology & Mobility: How disruptive forces are driving the M&A landscape in Industrials; Focus on Germany, also includes stock conclusions and a discussion of how Germany might respond to changes in EU industrial and competition policies. It’s available in full to existing Citi Research clients here.