These high prices have damaged household and business confidence. They’ve also created headwinds for industrial production. Manufacturing uses nearly 30% of Germany’s gas, with industries most at risk of impact from rising prices including chemicals, paper, cement/ceramics, and basic metals. Given ongoing supply constraints, these industries would need to halve their usage of gas to ensure sufficient levels going forward. Citi Research economists estimate that cutting these industries’ output in half would contribute to a 1.5% fall in GDP. That raises the prospect that fiscal intervention will be needed. That assistance could come via targeted support for businesses through cheap, government-guaranteed loans to preserve liquidity, or furlough programs to prevent job cuts.

In the short term, the European Central Bank may well proceed with its rate hikes and perhaps accelerate their pace, the authors note. But when recession proper sets in and governments have to support the economy, coordination between monetary and fiscal policies may return. That means rates could peak by the end of the year.

A Forecast That Bucks the Consensus

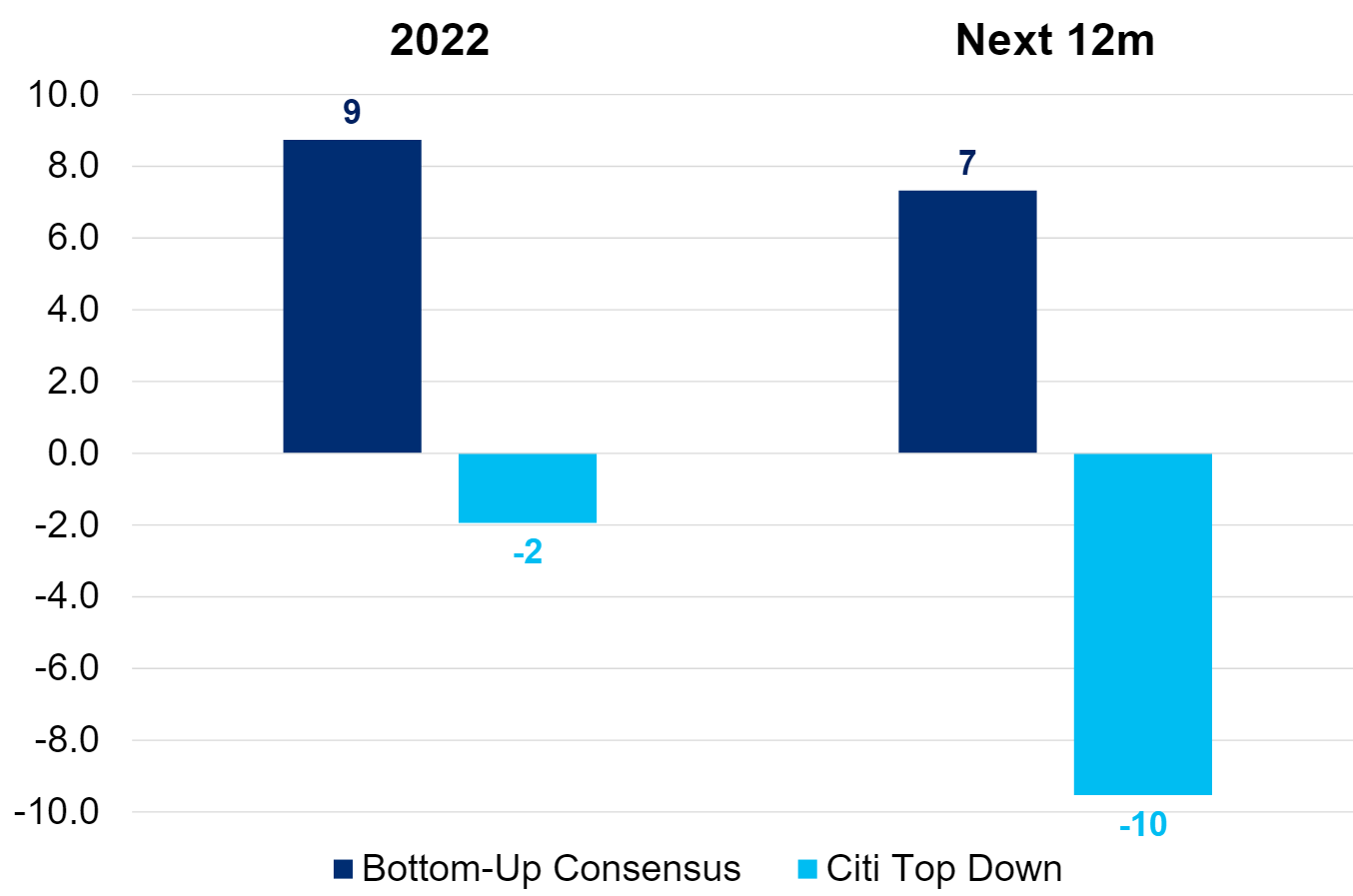

With a deeper euro-area recession now forecast, Citi Research’s European equity strategy team is updating its top-down earnings-per-share (EPS) forecasts for European equities excluding the United Kingdom. It now expects a 10% EPS contraction over the next year, in line with prior risk scenarios, with EPS contracting 2% this year as macro headwinds intensify in the second half.

Europe ex UK TOP-Down vs Bottom Up EPS Growth Forecasts

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Citi’s top-down forecasts are much more bearish than the current bottom-up consensus—collectively, analysts now expect 9% EPS growth this year and 6% growth in 2023. Excluding the commodities sectors—energy and materials—those EPS growth expectations look more reasonable at just 1% for 2022. But with Citi’s commodities strategists expecting meaningfully lower oil prices, energy-sector earnings could also be at risk.

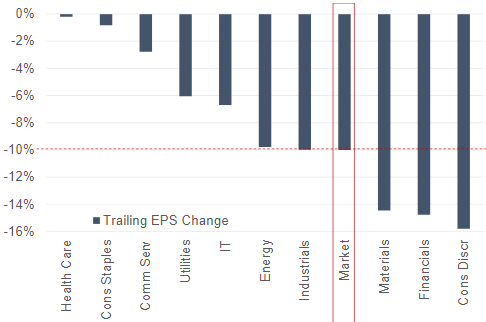

How would the 10% EPS contraction that Citi Research expects impact various European sectors? The strategists examined that question using a regression framework drawing on the last 13 years of historical data and concluded that materials, financials and consumer discretionary sectors might see earnings contractions of between 14 and 16%, with health care and consumer staples sectors likely holding up better.

10% EPS Contraction Potential Impact on Sector EPS

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

At the sub-sector level, the steepest EPS contractions would be felt by transportation (-32%) and autos (-58%). That’s according to Citi Research’s model, but the strategists note their worry that the impact on the materials sector might be greater than their model expects, given potential gas rationing’s effect on chemicals firms.

The authors emphasize that they can’t rule out more bearish scenarios – during the 2008-09 Great Financial Crisis, market EPS fell 51%. But they think— or perhaps, they admit, it’s better to say they hope—that this expected contraction won’t be that severe.

What Do Markets Expect?

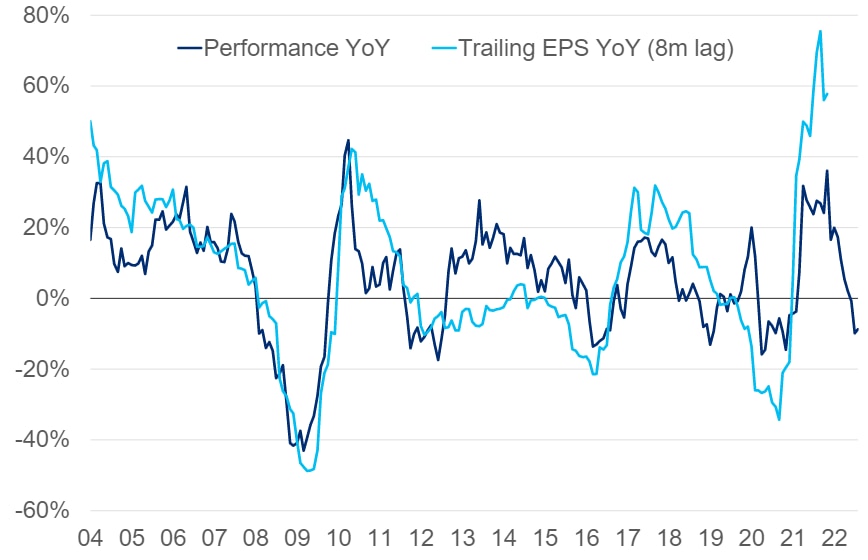

While analysts’ consensus expectation is for EPS expansion in 2022 and 2023, the European equity market seems to think otherwise. The market is now pricing in an EPS contraction of around 5%, though not an EPS recession.

Share Price (Loc) and Earnings per Share (led by 8 months)

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, DataStream

The authors note that they think the future direction of European equities will not just reflect the future direction of EPS revisions. The rerating reflects their hope for a recovery later in 2023, and the possibility that an imminent recession will constrain the ECB’s hawkishness and trigger a fiscal response that’s market-friendly—an important reminder, they note, that it’s not just bad news out there.

For the Citi Research report, please see European Equity Strategy - EPS Recession

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research. The comments expressed herein are summaries and/or views on selected thematic content from a Citi Research report. For the full CGI disclosure, click here.