KEY TAKEAWAYS

- 2024 was another very strong year for crypto, whose total market cap grew ~94% by late December.

- A sharp crypto rally began after Trump’s White House win amid hopes for a more friendly regulatory landscape.

- We explore key themes that we think could shape crypto in 2025.

In a recent Citi Research report, a team led by decentralized-finance strategist Alex Saunders explores crypto’s 2025 prospects, examining key themes and offering views on a variety of metrics and market drivers, including the macro backdrop, portfolio allocation and what may lie ahead for regulation.

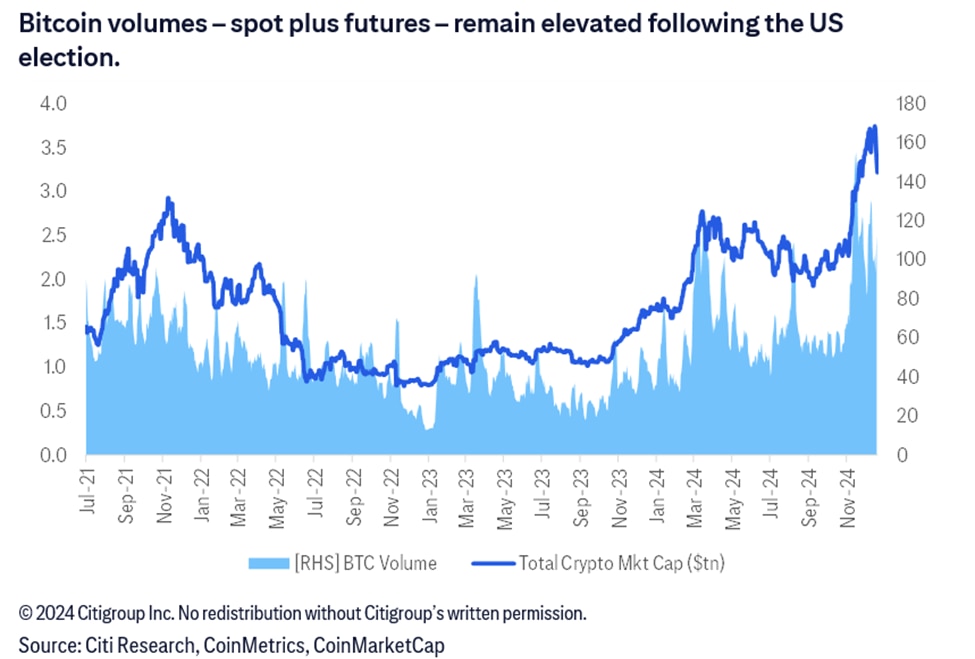

We begin by looking back, noting that 2024 was another strong year for crypto, whose total market cap grew from $1.65 trillion to $3.21 trillion in late December, a gain of ~94%. January saw launches for several spot exchange-traded funds (ETFs) for Bitcoin (BTC); July brought ETF launches for Ethereum (ETH). Inflows into these funds (mainly the Bitcoin offerings) proved quite strong, driving a gradual rise in Bitcoin dominance. The second and third quarters brought a crypto lull during which the asset class underperformed equities, but a sharp rally began after Trump won the presidential election, with markets clearly optimistic that the regulatory landscape would prove more favorable under his administration. November and December were a see-saw: Altcoins drove a new leg of the crypto rally and wiped out much of 2024’s increase in BTC dominance, but this was followed by a broad crypto selloff into year’s end that boosted BTC once again.

From macro matters to decrypting portfolio allocation

In previewing 2025, we cover multiple themes.

The first is macro matters. From a macroeconomic perspective, 2024 was defined by U.S. economic exceptionalism, with the U.S. enjoying something of a Goldilocks year: resilient growth, falling inflation, and a labor market holding up despite signs of softening. This created a favorable environment for risky assets, and crypto certainly benefited. We expect more of the same in the first quarter of 2025, but after that things are less clear.

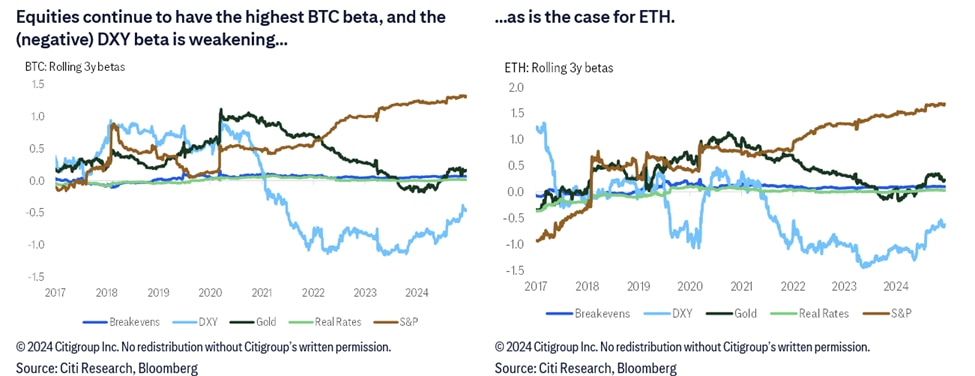

Equities remain the largest macro driver of crypto, with the impact of the U.S. dollar fading. A look at three-year macro betas for BTC and ETH shows the long-term equity beta has been consistently growing for both currencies over the past few years, but the typically inversely correlated USD beta — represented in the charts below by DXY, the dollar index — has been weakening (i.e., becoming less negative) and the gold beta has turned positive after a brief stint in negative territory.

While our equity strategists are calling for elevated S&P 500 volatility in 2025, we expect crypto volatility over the longer term (i.e., a year or more) to resume its downtrend. Crypto markets remain highly speculative, meaning they’re prone to sharper moves in both directions. But this still-nascent asset class will continue to mature, especially if we see a more transparent U.S. regulatory framework. The scale at which BTC is being incorporated into investment portfolios should also put downward pressure on volatility, as rebalancing helps offset both price strength and weakness.

Contagion risks from crypto for the broader financial (namely equity) markets should remain relatively limited, as the early-stage and tech-centric nature of crypto and blockchain technology likely means investors will view crypto as something of a tech subsector. But we note that contagion risks from sharp crypto drawdowns have risen with the growing involvement of more traditional financial investors who are also some of the largest participants in the global equity space.

Spot ETFs are a notable theme as we approach their second year of trading. Spot Bitcoin ETFs began trading in the U.S. on January 11, 2024; their Ethereum counterparts began trading on July 23, 2024. Through December 19, BTC funds had seen ~$36.4 billion of net inflows; overall net inflows for ETH ETF funds had totaled $2.4 billion for the same period.

We think flows will remain the most significant driver of BTC returns. Flows have explained ~46% of the variance in BTC price action, with the beta showing that $1 billion of inflows has led to ~4.7% returns. Since January, equities have now explained 15% of price volatility, with BTC’s beta sitting between 1.4 and 1.5. For ETH, the flow-return relationship has mainly been driven by a couple of outliers; ETH has been much more correlated with the S&P 500 since its ETFs started trading in July. Overall, we continue to expect fund flows to be BTC returns’ strongest driver in the near term, but don’t expect this to be true for ETH unless fund flows pick up dramatically.

We update the performance and revisit the assumptions of our previous work on crypto and asset allocation and update our Black–Litterman-style analysis of adding Bitcoin to a multi-asset portfolio. One consequence to consider when mulling potential regulatory changes is that crypto may bring more tokens into the mainstream. So far, Bitcoin has been relatively unconstrained from a U.S. regulatory perspective: It’s been defined as a commodity, whereas the Securities and Exchange Commission has taken the view that other tokens may be securities. A multitude of crypto tokens beyond BTC and ETH are actively traded, making up about one-third of total market cap.

An index is a traditional way of accessing broad investment markets, but we don’t think building a broad index for crypto makes sense yet. We looked at that question using CoinMetrics data on all supported coins; our broad takeaway is that indexing hasn’t added value of late. This is likely because of Bitcoin’s dominance and the fact that technological advancement has a winner-take-all flavor due to large network effects. From the data, it seems the best approach is to either be very narrow (Bitcoin or the three largest tokens) or very broad (the top 10 or top 30 tokens).

From stablecoins to the regulatory picture

We see stablecoins — cryptocurrencies that seek to maintain a more stable value by being pegged to another financial instrument — as the on-ramp to decentralized finance, with Tether (USDT) and USD Coin (USDC) the two largest. Interaction with smart contracts is typically done via crypto tokens; given crypto’s inherent volatility, there’s a need for coins that don’t fluctuate as much and can act as a store of value. In addition, stablecoins are used as a medium of exchange and longer-term we see potential for stablecoin innovations disrupting cross-border trade.

Crypto’s post-election run of enthusiasm has been accompanied by large issuance of stablecoins. Much of the issuance has occurred in USDe, launched earlier this year by Ethena Labs and now the third-largest stablecoin. We’d classify USDe as a reserve-backed stablecoin, though it has some algorithmic tendencies. Ethena has also launched a reserve-backed stablecoin called USDtb, seen as a reserve asset for USDe. In other news, USDC’s Circle and centralized exchange Binance have entered a strategic partnership, with Binance adopting USDC as a vital reserve-backed stablecoin for its own corporate treasury. Both these developments pose a risk to Tether’s dominance as other stablecoins become more widely adopted and new innovations are launched. We largely see stablecoin market diversification as a positive, as it should lessen the potential for systemic risks from a specific issuer.

Activity and adoption are critical concepts to track: Any network’s utility is a function of how useful it is, and that utility is enhanced by having more activity and more users. We see trading/flows (including stablecoins), on-chain metrics and total value in decentralized finance as crucial factors to monitor.

We note crypto has seen the most strength this year during U.S. trading hours, though this trend has reversed in recent weeks. BTC volumes rose after the U.S. elections and remain elevated; average BTC volumes in 2024 are ~85% higher than those of 2023, and we expect these averages to continue trending higher in 2025.

The second adoption metrics we look at are on-chain, and there have been healthy increases since the election. Stablecoin market caps have risen significantly, with a particularly sharp increase since Trump’s victory.

Another note of interest is that high-inflation countries are adopters of stablecoins and crypto. Nearly half of the countries with the largest crypto ownership are in emerging markets; of them, several have underlying economic/financial issues such as high inflation. From this perspective, there’s strong empirical support for crypto’s use case as a store of value. It makes sense that individuals concerned about inflation or confiscation of personal assets might search for alternatives.

Finally, we consider regulation. President-elect Trump has changed his views of crypto, becoming an apparent proponent of crypto-friendly policies and making reference to proposals such as a strategic bitcoin reserve. We see this as less a de-regulation story than one about removing headwinds. The U.S. has at least begun to move away from regulation by enforcement, toward a broader framework. But progress remains slow; outside of the U.S., the EU has signed the Markets in Crypto Assets regulation into law, which outlines reserve requirements for stablecoin issuers. In considering the lag between legislation in the U.S. and in other major jurisdictions, we note that attitudes may change in the U.S. if crypto companies are attracted to regions that offer more regulatory clarity.

Our new report, Digital Asset Take: 2025 Outlook — A New Hope, explores these and other themes in greater detail and offers links to prior notes of relevance. The report is available in full to existing Citi Research clients here.