Women Entrepreneurs

Demonstrating and championing the economic case for gender equality in the global workplace has been a consistent feature of the Citi GPS series over many years. In this new report, we have turned our attention to advocating the business case for supporting women entrepreneurs to start and grow businesses. As the world seeks to build back from the pandemic, transition to a low carbon economy, and achieve the potential of the UN Sustainable Development Goals, we believe that building a gender-balanced playing field for entrepreneurs is critical. Supporting women entrepreneurs and women-led businesses is not just the right thing to do socially, it is one of the smartest things that governments, corporations, and the finance community could do economically.

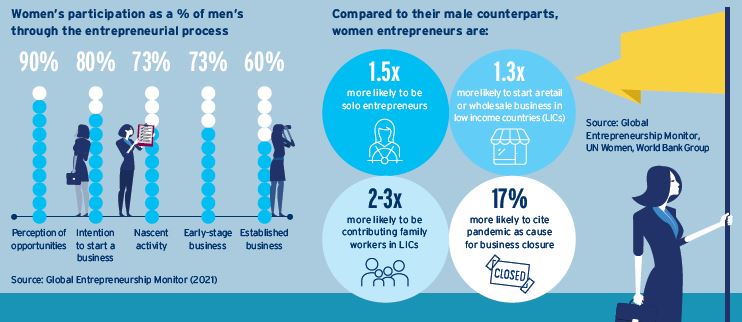

Today, women participate in entrepreneurship at 80% the rate of men, according to Global Entrepreneurship Monitor (GEM). This marks a significant improvement over the past 20 years: the equivalent report in 2001 found that women participated in entrepreneurship at roughly half the rate that men did across the countries included in that year’s data set. However, while the pick-up in the simple participation rate is welcome, it masks the fact that women still face many more challenges than men in starting and growing a business. Moreover, much of the growth in participation has been in developing economies where women often start businesses with minimal capital as solo-entrepreneurs in part because they find it even harder to access suitable employment in the formal economy. The International Labour Organization (ILO) estimates that, in 2021, women’s participation in employment was 63% that of men, meaningfully lower than the participation rate as entrepreneurs.

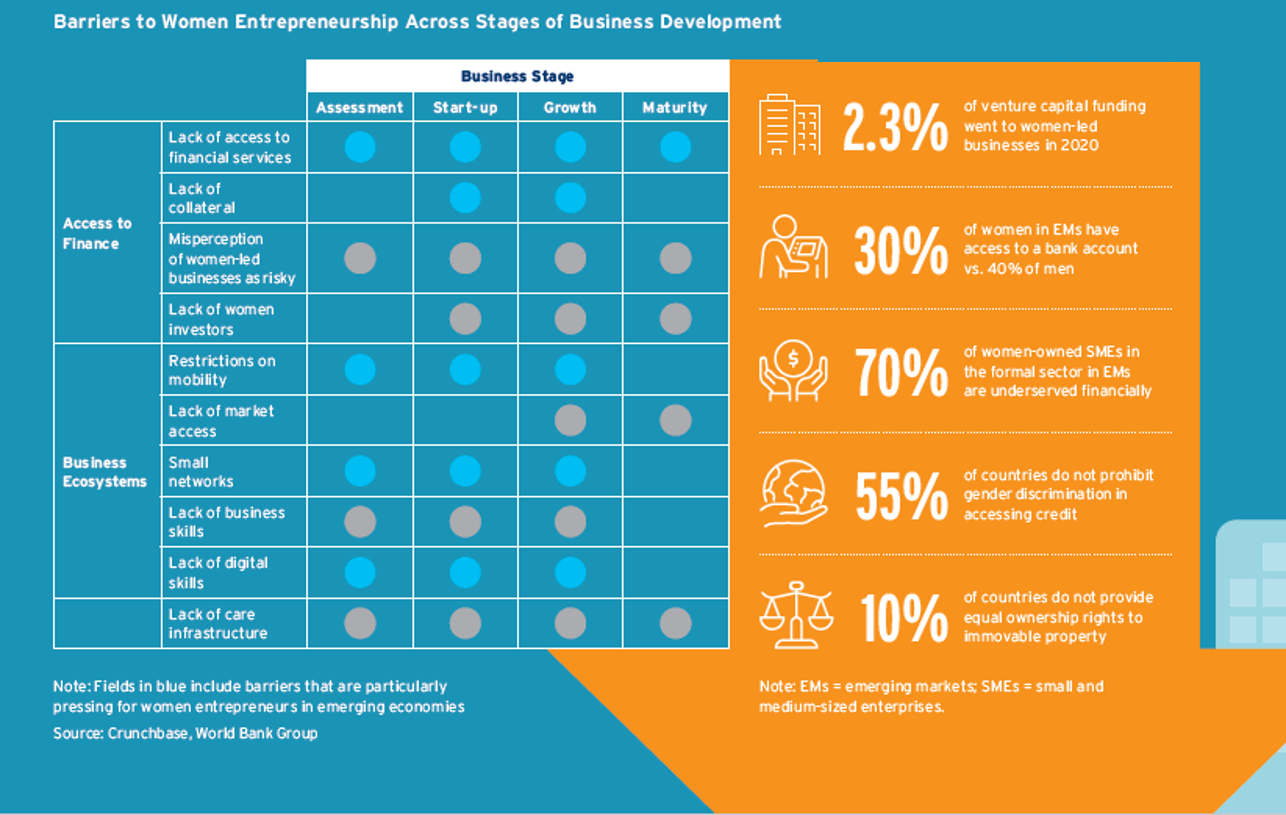

There is sadly no shortage of worrying statistics to demonstrate the barriers that many female entrepreneurs face. Lack of access to finance is one of the greatest challenges that women entrepreneurs face around the world. The barrier is perhaps best documented at the venture capital stage: global venture capital funding that went to women-led businesses reached 2.8% of all VC funding in 2019 and fell to 2.3% in 2020.[1] On other statistics, women-owned micro, small, and medium-sized enterprises (MSMEs) make up 23% of the total number of enterprises but account for 32% of the total MSME finance gap.

While critical in itself, access to finance is only part of the story, and simply improving access to finance is no guarantee that the entrepreneurial gender gap will close. Women’s entrepreneurial capacity is also materially under-leveraged. The ILO, for example, estimates that 50% of women’s entrepreneurial potential is underused, compared with just 22% of men’s.[2] And, according to the World Bank, 104 out of 190 countries still have legal barriers to women's entrepreneurship. Women entrepreneurs face a series of other barriers in accessing the full business ecosystem. These barriers come with different considerations in different countries, especially in developing economies, but range across legal, cultural and practical limitations on women’s participation in commerce; the difficulty of accessing national and international markets; challenges in building personal networks, with links to mentors who can help navigate the business ecosystem; less access to education and training, especially in business and digital skills; and disproportionate caring and domestic responsibilities, especially among married women.

In aggregate, our analysis finds that closing the gender gap in business growth globally could add up to $2.3 trillion to GDP and up to 433 million jobs on a conservative estimate of the substitution effect in the labor market. In addition to simple gains in economic growth and output, women’s economic empowerment also drives much wider social and economic multiplier benefits across families and communities. Women-owned or led businesses generally employ more women employees, which can help drive a virtuous circle in further boosting women’s economic empowerment. In addition, women tend to invest more of their income than men in the health, education, and welfare of their families and communities.

Women entrepreneurs can also play a decisive role in achieving the UN Sustainable Development Goals more broadly. Empowering women entrepreneurs is itself an exercise in development as they will create jobs, generate income, build human capital, and drive growth while reducing inequalities leading to reductions in poverty and hunger, and improving health and wellbeing. In addition, women are also an underused source of knowledge, perspective, and innovation, and the businesses they create can provide innovative solutions to global challenges.

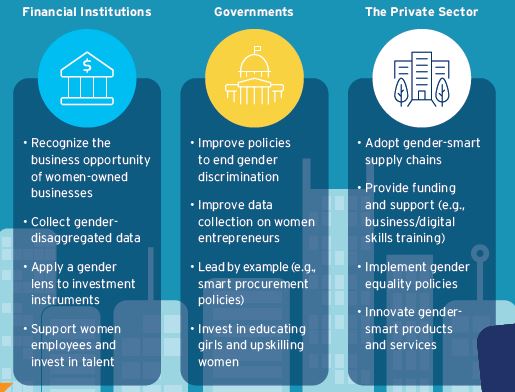

Having surveyed the global entrepreneurial landscape, we set out a series of recommendations for legislators and also for both public and private capital to help promote more gender-balanced outcomes. Financial institutions, including microfinance initiatives, banks, venture capital and private equity firms, and institutional investors, will be key to unlocking the opportunities around women entrepreneurs. We are here encouraged by two growing trends: the rapid transfer in wealth to women and the rise of environmental, social, and governance (ESG) and gender lens investing. We discuss these trends throughout this report.

Unlocking the potential of women’s entrepreneurship requires micro-level interventions alongside a dismantling of macro-level constraints. It also requires concerted actions across the law, public policy and the private sector. Only by partnerships can we put all our resources to productive use and achieve scalable and sustainable impact.

[1] Ashley Bittner and Brigette Lau, “Women-Led Start-Ups Received Just 2.3% of VC Funding in 2020,” Harvard Business Review, February 25, 2021.

[2] International Labour Organization, Women at Work Trends, March 8, 2016.

Authors: Ying Qin,Amy Thompson,Ronit Ghose, CFA,Ronak S Shah,

Gender Gaps in Entrepreneurship

Barriers to Women Entrepreneurship

What Opportunities Could Gender Parity Bring?

Key Actions to Unlock Potential