Artificial Intelligence (AI) will profoundly change the future of finance and money. And according to a new Citi GPS report, it could potentially drive global banking industry profits to $2 trillion by 2028, a 9% increase over the next five years.

Just as the steam engine powered the industrial revolution, and the internet ushered in the age of information, AI may commoditize human intelligence. Finance, a data rich industry with clients adopting AI at pace, will be at the forefront of change.

Long-established jobs have been eliminated in past periods of technological transformation, to be replaced by new ones. Many firms have vanished too. AI will repeat this cycle, possibly speeding it up.

For now, GenAI in finance is largely at a proof-of-concept stage. But we’re in a period of rapid and unprecedented transition. In this report, we discuss what use cases are likely in the next couple of years, and we gaze further ahead too, calling on insights from those at the sharp end of progress.

The tech adoption strategy of most incumbents involves adding it on top of existing products or using the new technology to boost productivity. Startups meanwhile are using new technology to disrupt and unbundle what incumbents do.

As AI-powered agents, bots and beyond, become prevalent, how will money and finance change? How will the underlying concepts and structures of finance be reshaped? In a bot-to-bot world, where machines transact with minimal human intervention, what will the world of money look like?

AI could drive productivity gains for banks by automating routine tasks, streamlining operations, and freeing up employees to focus on higher value activities.

Finance sector leaders are overwhelmingly optimistic about the profit impact of AI. Indeed 93% of respondents to a proprietary survey expect higher bank profits on the back of productivity gains. But caution will be needed around implementation timelines, talent costs, heightened competition, rising client expectations and the costs associated with greater AI generated activity.

A shift to a bot-powered world also raises questions around data security, regulation, compliance, ethics and competition. Since AI models are known to hallucinate and create information that does not exist, organizations run the risk of AI chatbots going fully autonomous and negatively affecting the business financially or its reputation.

AI-powered clients could increase price competition in the finance sector. The balance of power may shift.

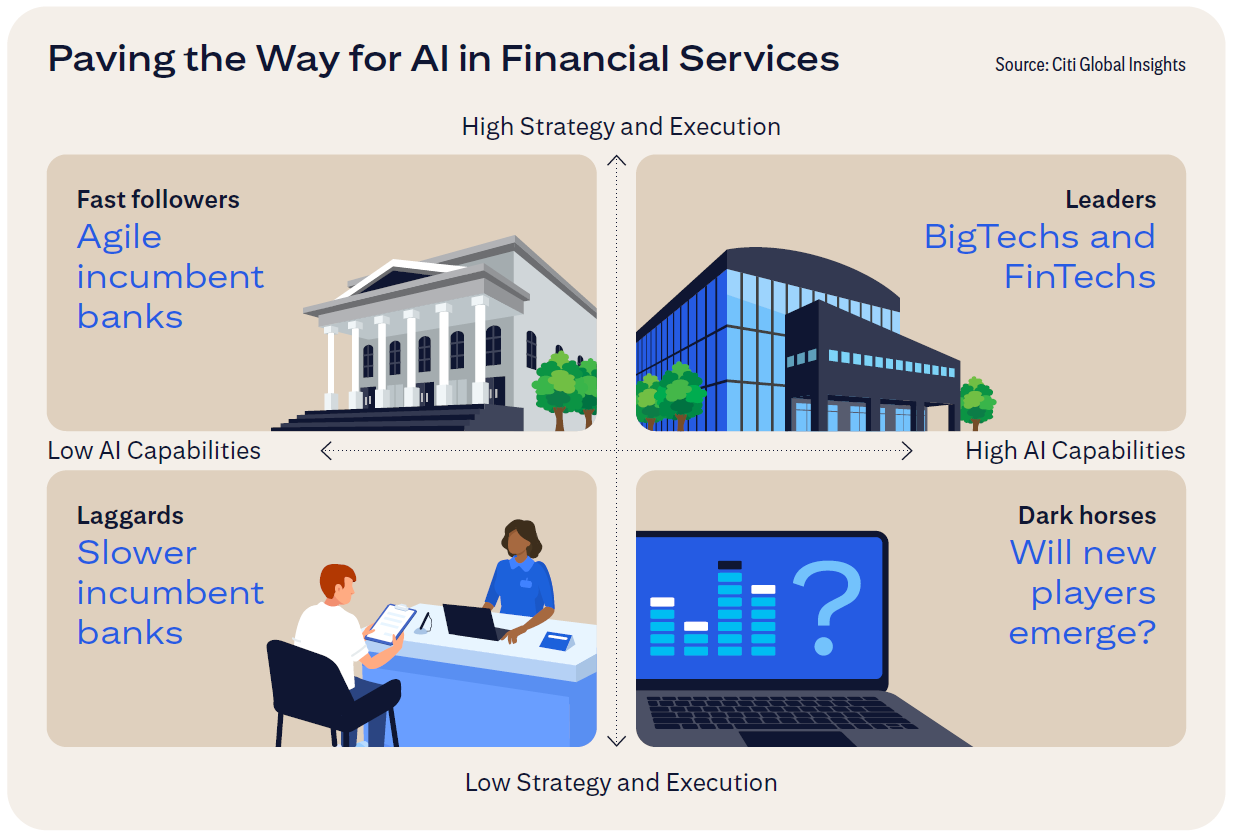

AI may be adopted faster by digitally native, cloud-based firms, such as FinTechs and BigTechs, with agile incumbent banks following fast. Many incumbents, weighed down by tech and culture debt, could lag in AI adoption, losing market share.

All technology goes through cycles: hype, disillusionment, then mass adoption. AI expectations have been high since mid-2023. As financial firms grapple with the transition, the gap between hype and mass production currently remains wide.

In the finance world, and beyond, most of us have already been wowed by AI’s potential to drive disruptive change. The question now is, how?