Metaverse and Money

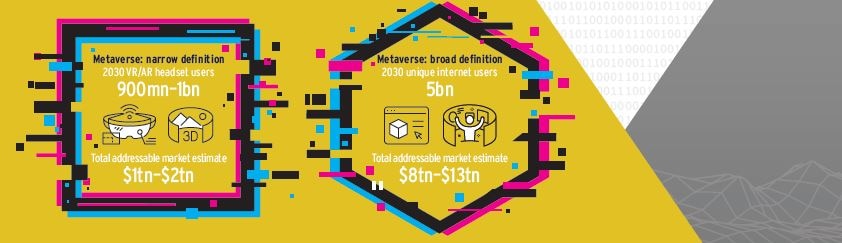

Today, the most popular way to experience the Metaverse is via a video game played on a virtual reality (VR) headset. But in the report that follows, we discuss the possibility that the Metaverse is moving towards becoming the next iteration of the internet, or Web3. This “Open Metaverse” would be community-owned, community-governed, and a freely interoperable version that ensures privacy by design.

Users should increasingly be able to access a host of use cases, including commerce, art, media, advertising, healthcare, and social collaboration. A device-agnostic Metaverse would be accessible via personal computers, game consoles, and smartphones, resulting in a large ecosystem. Using this broad definition, the total addressable market for the Metaverse could be between $8 trillion and $13 trillion by 2030, with total Metaverse users numbering around five billion.

But getting to that market level is going to require infrastructure investment. The content streaming environment of the Metaverse will likely require a computational efficiency improvement of over 1,000x today’s levels. Investment will be needed in areas such as compute, storage, network infrastructure, consumer hardware, and game development platforms.

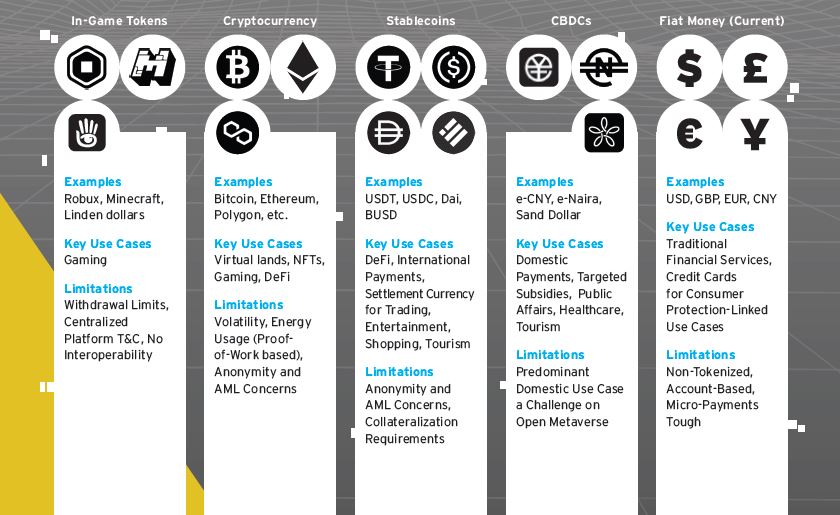

The definition of what counts as money in the Open Metaverse is also likely to be very different from what counts as money in the real world today. Interoperability and seamless exchange between underlying blockchain technology are critical to ensure a frictionless user experience. Different forms of cryptocurrency are expected to dominate, but given the multi-chain trend in the crypto ecosystem, cryptocurrency will likely coexist with fiat currencies, central bank digital currencies (CBDCs), and stablecoins.

Finally, if the Metaverse is indeed the new iteration of the internet, it will mostly likely attract greater scrutiny from global regulators, policymakers, and governments. Issues such as anti-money laundering rules for exchanges and wallets, the use of decentralized finance (DeFi), crypto assets, and property rights will all have to be addressed.

Authors: Ronit Ghose, CFA,Nisha Surendran,Sophia Bantanidis,Kaiwan Master,Ronak S Shah,Puneet Singhvi,

The Metaverse Is Potentially an $8 Trillion to $13 Trillion Opportunity

Metaverse Use Cases

Still Early: Metaverse Infrastructure Building

Money in the Metaverse