Citi’s Global Theme Machine: What’s New for 2023?

Citi Research’s Global Theme Machine is now in its second decade. This year’s annual rebalance introduces eight new themes. The Theme Machine has morphed over the past decade to take account of emerging innovations and changes in society, as well as geopolitical and economic challenges.

With an enriched set of data, the Theme Machine can further our understanding of the relative appeal of thematic investing, how this investment style has evolved over time, and how it compares to more traditional investment approaches. For 2023, the Theme Machine maps almost 6,000 stocks to 93 themes. That is more than 32,000 mappings in total.

For a full write-up on how the Theme Machine works and how it can help, see the full report. But here’s just a little more on the eight new themes that have been added this year.

What’s New?

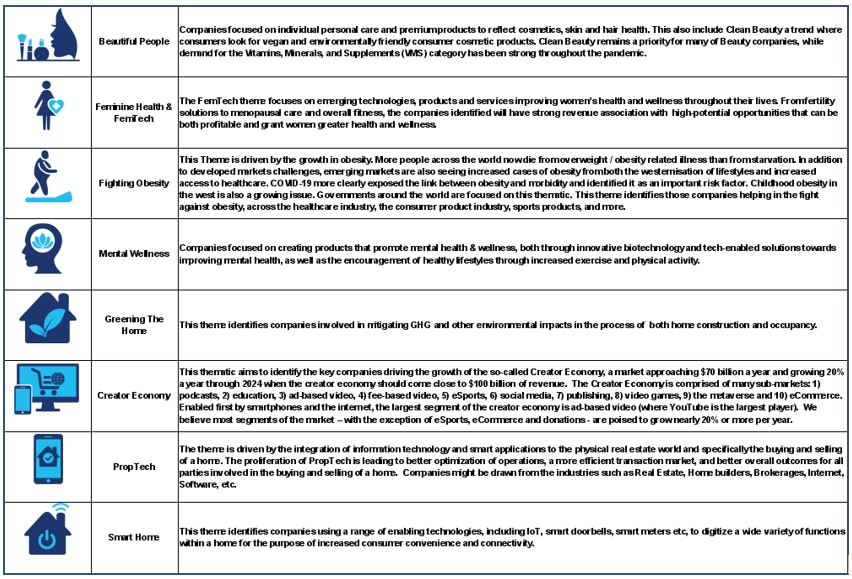

The 2023 rebalance of the Global Theme Machine includes eight new themes to the full suite of, now, 93 themes. These include Beautiful People (a Consumption theme), PropTech (a Financial theme), Feminine Health & FemTech, Fighting Obesity, and Mental Wellness, which all relate to Health Care. Then there is one new Industrial/Environment Trends theme – Greening The Home. And lastly come two IT-focused themes: Smart Home and Creator Economy. These are laid out in a bit more detail in the following figure:

New Themes for 2023 and Definitions

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

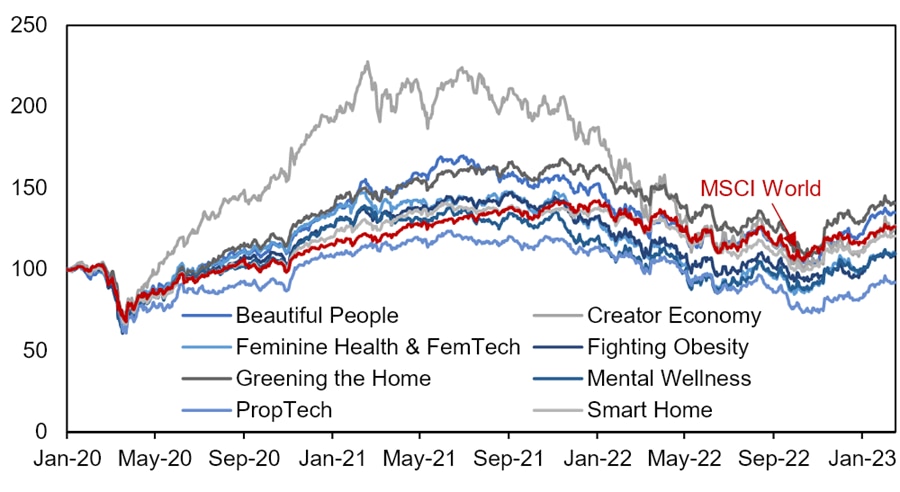

The mappings are new for this year, but the cumulative performance of these stocks aggregated at the exposure level over the past three years are shown in the next figure:

Past 3-year Cumulative Returns for New Themes for 2023

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, MSCI

From a performance perspective, the theme Creator Economy generated impressive returns following the drop in the market in February 2020; this is probably in part a consequence of changes related to working from home and greater dependence on digital products and services during lockdowns. It is also a consequence of growth-type sectors -- a style which outperformed during the first year of the pandemic.

Three of the new themes have delivered decent returns on an absolute basis and in excess of a global market index since January 2020. Greening The Home, for example, outperformed the MSCI World Index by 3.7% with slightly lower volatility. The new Health Care-related themes have not fared quite as well.

Greening The Home, PropTech, and Smart Home all have notably lower price/book ratios.

From an EPS growth perspective – which analysts have noted in the past is a typical driver of theme performance in the future – several of the themes are an improvement versus MSCI World: Beautiful People, Creator Economy, Feminine Health & FemTech, and Greening The Home stand out.

For a calculation of investment styles, performance analysis, return correlations, and more around the Global Theme Machine, please see the full report, first published on February 28, here: Global Theme Machine - Decoding Thematic Investing: Entering a New Decade of the Theme Machine

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.