China Economics: Out With the Old Three and In With the New Three

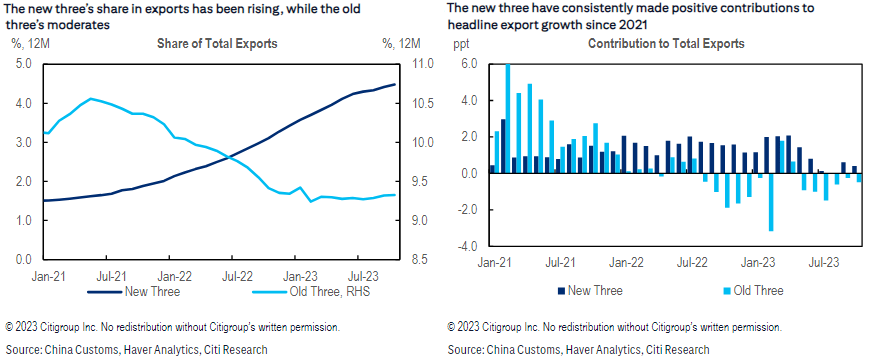

China’s exports have seen a marked shift, with the “Old Three” of household appliances, furniture, and clothing giving way to the high-tech “New Three” three of electric vehicles, lithium-ion batteries, and solar cells.

Thanks in part to the global green transformation, these New Three have made positive contributions to headline export growth in recent years, while the Old Three have proven to be a drag in recent months.

In the first 10 months of 2023, China’s exports declined 5.7% year over year amid global weakness for goods demand, while still outperforming peers in the APAC region. But the New Three surged 30% year over year to $128 billion during that period, contributing 1 percentage point to headline exports growth. The New Three’s share of total exports has risen to 4.5% year to date, a figure that is still small but up from 1.5% in 2020.

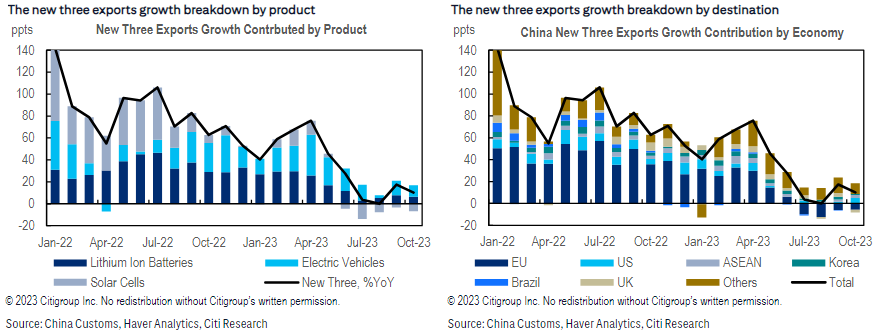

The authors note that China has established a relative comparative advantage in the New Three, and the European Union has become the largest market for these products. Exports of electric vehicles (EVs) grew 122.2% year over year in 2022 and maintained strong growth in 2023, up 92% year over year in the first 10 months. Currently, lithium batteries’ growth has slowed to 36.3% year over year from 79.1% in 2022. Solar cells’ slowdown is more obvious: a 3.0% year-over-year contraction so far in 2023, compared to 63% growth year over year in 2022. But that’s still higher than headline export growth.

By destination, the EU accounted for 44.4% of China’s New Three exports in 2022. Exports to the EU grew 17.2% year over year in the January–October period, contributing 25.4% of the New Three’s overall growth, although the authors note this growth has slowed since April.

The report then explores each of the New Three in detail.

Electric Vehicles

The authors note that China appears to enjoy a solid position in the EV industry. According to the China Passenger Car Association, China exported 1.1 million EV units in 2022, around one-third of its total auto exports; for the first 10 months of 2023, it exported 1.4 million units. According to the U.S. Energy Information Administration, China’s share of global EV exports reached 35% last year compared with just 4.2% in 2018. Chinese automaker BYD accounted for 18% of global EV sales in 2022, topping Tesla and VW.

The rise of EVs has propelled overall automotive exports; China is now the world’s largest exporter of cars, having surpassed Germany and outpacing Japan. By destination, the EU holds the majority share, accounting for 47% of China’s EV exports in value last year; exports to Asian countries such as Thailand, the Philippines, and India have also proved strong. By contrast, the authors note that exports of China-made EVs to the U.S. fell 32% year over year in January–October, hampered by high taxes and U.S. restrictions. China’s automakers pay a 27.5% import duty to send vehicles to the U.S. compared with just 10% on cars sent to the EU.

China is increasingly integrated into global EV supply chains, with collaboration among global players and local startups gaining traction—witness VW’s recent acquisition of a 4.99% stake in Chinese EV startup Xpeng or Stellantis’s investment in China’s Leapmotor to form an international joint venture. At the same time, Chinese automakers are seeking manufacturing outside the country to better access new markets. By producing locally, Chinese automakers can benefit from government incentives, avoid tariffs and high transportation costs, and mitigate political headwinds. Most of these new investments are planned in Eastern Europe, ASEAN, and South America.

Lithium-Ion Batteries

China has emerged as a major player in the manufacturing of lithium-ion batteries, which are primarily used in EVs. According to China’s Ministry of Industry and Information Technology, China’s shipment volume of these batteries reached 660.8 gigawatt hours in 2022, up 97.7% year over year, while its share in the global shipment volume reached 69.0%. The authors note that since batteries account for as much as 60% of a typical EV’s sticker price, China’s competitive advantage in lithium-ion battery cell production also gives its automakers an edge in terms of EV production costs. By destination, the EU is again the largest market for this New Three component, accounting for 38.4% of China’s total lithium-ion battery exports in 2022.

The authors note that trade policies abroad are the major uncertainty for lithium-ion batteries, with the U.S. Inflation Reduction Act leaving vehicles made with Chinese battery components ineligible for tax credits after 2024. The EU, meanwhile, has adopted new regulations on batteries sold in Europe.

Solar Cells

China is now the world’s largest producer and exporter of solar cells. According to the China Photovoltaic Industry Association, China’s solar-cell production capacity reached ~505.5 gigawatts in 2022, accounting for 86.7% of the global total. In value terms, China was responsible for 66.6% of global exports of solar cells in 2022.

This New Three component is poised to benefit from long-term policy headwinds. The EU’s Net-Zero Industry Act aims to more than double domestic demand for solar, wind, batteries, and other net zero technologies by 2030. But the U.S. has banned imports of goods made in Xinjiang, a major origin point for solar cell materials. As a result, China’s solar cell exports to the U.S. have fallen to 0.23% of the total in January-October 2023, down from 2.2% in 2020.

Looking Ahead

In considering this shift from the Old Three to the New Three, the Citi Research report says China has clearly risen up the value chain and remains competitive amid a reconfiguration of the global supply chain. The shifting export drivers demonstrate progress in China’s industrial upgrading, although China remains a key manufacturing base for the Old Three as well as consumer electronics and machinery. This ability to manufacture a range of products from low-value consumer goods to high-tech innovative products provides resilience for China’s exports, and continuing upgrades to manufacturing capabilities, R&D investment, and emphasis on cost controls should help sustain its competitiveness in trade.

What lies ahead for the New Three? The Citi Research report says global demand will continue to shift toward sustainable solutions, and China should maintain its advantage in the New Three. But the global adoption curves for EVs and net-zero technologies could flatten; solar cells appear to have already seen their export momentum peak. The authors pencil in growth of New Three exports of ~15% year over year in 2024 compared with ~28% in 2023.

The report says China needs to manage external trade policy risks carefully, especially with the EU—the rise of the New Three brings risks of increased protectionism in destination markets. Since the EU is the largest market for the New Three, managing relations with it will be critical. The report notes that extensive trade between the euro area and China means there should be plenty of room for negotiation, and takes recent efforts to stabilize U.S.–China relations as a signal of China’s renewed pragmatism. But given limited ability to control such risks, China’s efforts to diversify its trade networks by reaching out to other countries are also important.

For more information on this subject, please see the full report, first published on 22 November 2023, here: China Economics: Shifting Export Drivers: From “Old Three” to “New Three”

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.

Related Stories

Citi Institute Future of Finance Forum 2025

The Citi Institute Future of Finance Forum brings together leading voices across finance, policy, and technology to explore how innovation is reshaping the financial system. With a focus on frontier technologies such as AI, blockchain, and quantum computing, the Forum connects industry experts, regulators, and thought leaders driving the next wave of transformation.

This year’s event featured guest speakers including Hon. Caroline Pham, Acting Chairman of the U.S. Commodity Futures Trading Commission, and offered forward-looking perspectives on the future of digital assets, financial infrastructure, and global innovation. Watch the highlights video above.

Watch the replays here