China’s already strong influence on commodity markets is magnified by its role as a massive marginal consumer and, in some cases, marginal supplier of commodities. Currently global prices of energy are high but low for metals. The Citi report discusses recent fundamentals across energy, metals and agricultural markets in China and highlights five key Chinese policies worth paying attention to: petroleum product exports, crude oil imports, domestic coal production, property sector support, and zero-COVID policies.

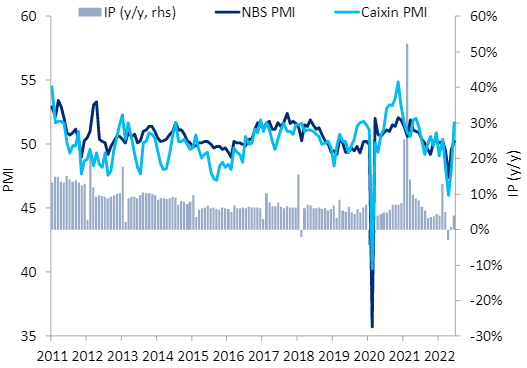

China monthly PMI and Industrial Production (LHS: NBS PMI, Caixin PMI; RHS: IP y/y change) |

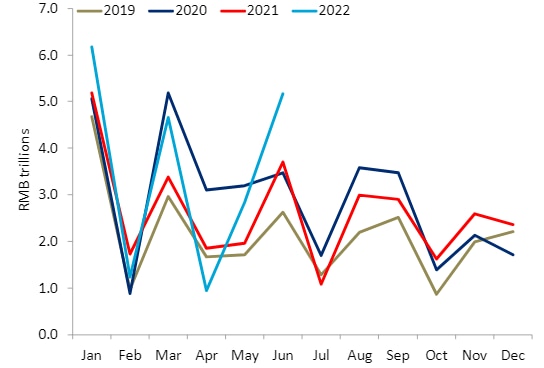

China Total Social Financing (CNY trillion), 2019-present |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, NBS, Wind |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. Source: Citi Research, NBS, Wind |

Here’s a little more on the five policies in focus.

- China could loosen up the global oil market and help ease inflation by exporting more petroleum products, particularly diesel. China exporting more diesel could kill three birds with one stone. Product exports fell to a 6-year low in June. But as the only major refining centre still with sizable spare capacity, if China were to export more diesel, then global diesel cracks should fall more. A looser diesel market could loosen the crude oil market, similar to how a tight diesel market in 2008 was a reason for high oil prices. As Russian natural gas supply cuts have tightened global natural gas markets further, potentially adding to more natural gas to diesel switching, having more diesel supply would help.

- If China decides instead to only stock up on more oil due to energy security concerns, as it plans to add more than 200-mbbl of crude oil storage capacity between 2021 and 2023, the oil market could stay tighter in the absence of higher petroleum product exports from China. As the world’s largest oil importer, the possibility of filling newly constructed storage capacity to tank-tops by mid-2023 could add 0.6 to 0.7-mb/d to China’s crude oil imports.

- It’s robust domestic coal production policy should help keep some coal prices low and could help keep LNG imports modest, leaving more for the rest of the world, when global markets for both thermal coal and LNG are tight. Lifting coal production by 300-mt this year looks very likely. While much of the coal produced looks to be of lower quality, which has not helped much to lower prices of high quality thermal coal, at least prices of lower quality coal have moderated. LNG imports could stay weak if facilities that could burn lower quality coal could displace natural gas demand elsewhere.

- Strong support for the property sector would give metals and bulks demand a major boost. The property sector has been a key growth engine for years, with many related upstream and downstream sectors, such as appliance sales. Limiting any contagion is key, as the current severe weaknesses in land purchases and new housing starts do not bode well for commodities demand and imports.

- Zero COVID policies are the most well-known and consequential. There are signs of further easing, which should help rebuild consumer confidence and improve business productivity. However, inconsistent policy signals and the likely hesitancy of local officials to relax stringent COVID-related controls remain a concern. Citi Research’s Economics team does not expect any major COVID-policy loosening until Mar’23.

The full report offers greater detail on the macro backdrop as well as analysis on implications for bulk commodities, natural gas and base metals, among others. Here’s it is. China Commodities - Five policies from the world’s largest commodity consumer and large producer could change 2022 commodity markets globally

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.