An analysis of capex projections for Citi-covered U.S. companies in 2022 shows that spending plans have increased since late last year. But indications are that 2023 will be far less robust.

2022 capex strength — Current capex plans (excluding Financials and REITs) for U.S. companies covered by Citi research analysts translate to near 23% growth in 2022 vs last year. However, the top 20 projected spenders account for 47.4% of the total $776B projected. Thus, concentration is a factor.

Early look at 2023 — Capex growth expectations for 2023 are for a much smaller 2.7% increase. Tech and related (via Consumer Discretionary and Communication Services) continue to be the most important contributors to capex intentions.

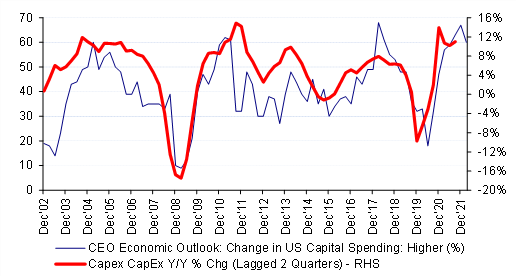

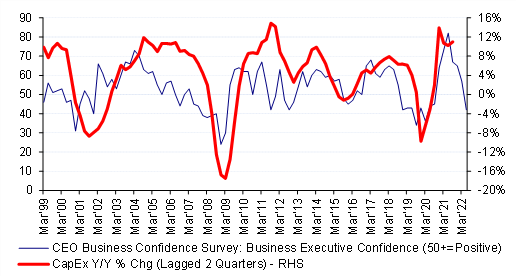

Expect some risk to budgets — C-suite business confidence typically leads capex by two quarters. Most recently, survey data shows a sharp falloff in confidence. In turn, this would normally presage some unwinding of capex plans.

CEO Economic Outlook: Change in US Capital Spending: Higher (%) vs Capex Y/Y % Change (lagged two quarters) |

CEO Business Confidence Survey: Business Confidence vs Capex Y/Y % Change (lagged two quarters) |

|

|

|

|

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

© 2022 Citigroup Inc. No redistribution without Citigroup’s written permission. |

|

Source: Citi Research, Haver Analytics |

Source: Citi Research, Haver Analytics |

Are capex plans about to peak?

In a November 2021 note covering the same ground, capex of $729.7B was projected for 2022, following an estimated $636.6B in 2021 (US Equity Strategy - Capex Connections). 2022 capex is now projected notably higher, with expected growth closer to 23%. While there will be some differences attributable to Citi coverage and analyst changes, the ‘net net’ is that capex plans have remained fairly robust. Not so for 2023 capex plans – growth is projected at a modest 2.7%.

Concerns regarding the impact of Fed rate hikes on demand, and growing recession fears raise questions about capex expectations from here. Historically, C-suite spending plans and business confidence provide important insights.

For more information on this subject, please see US Equity Strategy: Update on Capex Intentions

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.