A recent report from Citi Research’s Robert Sockin takes a trip across the global inflationary landscape and comes away with some key conclusions:

- Demand has played a larger role than supply in pressures on services prices.

- Inflation expectations remain remarkably well-anchored.

- Policymakers will likely give themselves a long runway to bring inflation back to target.

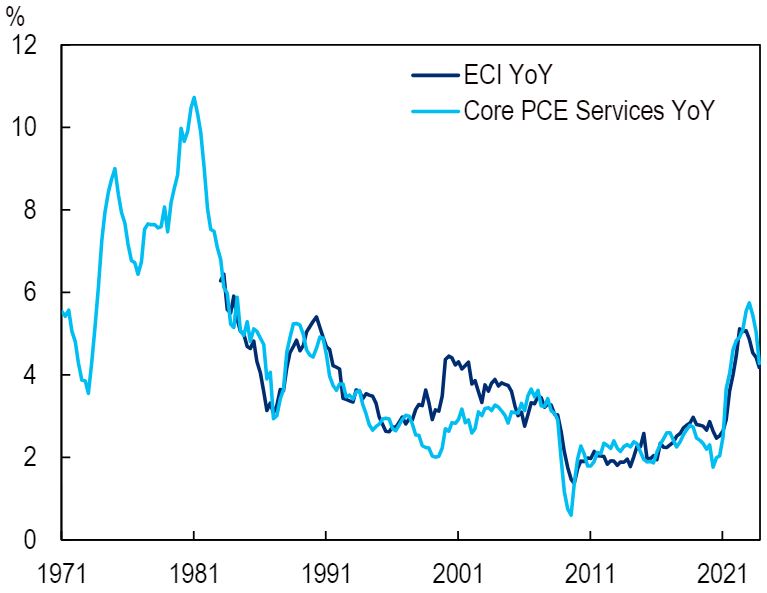

US Wages and Services Prices

© 2024 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, BLS, BEA, and Haver Analytics

The report looks at several key questions shaping the global inflation outlook and delves into inflation dynamics in the US, the euro area, and emerging markets economies. The team considers the following five questions:

- How is wage growth influencing broader inflation?

- What role have supply shocks played in driving inflation?

- Have inflation expectations been well-anchored in this cycle?

- Will central banks hit their inflation targets?

- Are any structural shifts at play that will shape inflation in the years ahead?

Exploring those questions yielded several key conclusions, explored in the report:

- Supply-side factors have been the primary driver of pressures on good prices. Goods supply chains were disrupted by strains from the pandemic and the war in Ukraine; goods inflation has cooled in lockstep with such stresses easing. Citi’s supply-chain pressure index has been remarkably stable in the past few months and remains near pre-pandemic levels despite geopolitical stresses that have raised shipping costs. That said, the Citi Research team notes that inflation risks remain due to tensions in the Middle East, and Chinese overcapacity has driven exported disinflationary forces for the rest of the world.

- Services inflation looks more demand-driven, as pressures have stayed elevated despite supply-side improvements. The authors note that wages are putting upward pressure on services prices, with the degree varying across economies. In the US, wages and services inflation look tightly tied together, but wages have been more of a lagging indicator in the euro area due to the prominence of collective bargaining. High wage growth has also been an important driver of inflation in many emerging markets.

- Inflation expectations have been remarkably well-anchored, with the authors seeing little evidence that the pass-through from actual inflation to those expectations has changed meaningfully compared with the pre-pandemic years. In the authors’ view, this development, seen across a wide range of countries, speaks to the credibility of monetary policy and central banks’ commitment to bring inflation back to target. For now, the team writes, there’s reason to believe long-term inflation expectations won’t rise to levels Fed officials would see as “unanchored”.

- The report’s base case is that inflation will gradually converge back into the vicinity of central banks’ targets, but it also notes that the speed of inflation’s fall will vary by economy. They also continue to see two-sided risks, and cannot rule out scenarios in which the global economy returns to the pre-pandemic configuration in which many economies struggled with too little inflation rather than too much of it. A related question is how policymakers would respond to inflation remaining above target. The authors note that a shift in inflation targets—such as the Fed moving to a 3% target—seem unlikely for now. Instead, they see many central bankers operating with more flexibility than they have in the past, giving themselves a longer runway to get inflation back to target in coming years.

- The report examines inflation’s trajectory, and which factors pose longer-term upside and downside risks to the global inflation picture. Such factors include aging demographics, technological improvements, and the shifting contours of globalization. Demographics is a particularly interesting factor to consider, the Citi Research report says, as there’s a debate about whether population aging puts upward or downward pressure on prices.

For more information on this subject, and if you are a Citi Velocity subscriber, please see the original report, dated 12 April 2024, here: Global Economics - Where is Inflation Heading? A Tour Around the World

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.