Citi LIBOR Transition Update

Outstanding US Law-Governed Citi-Issued USD LIBOR CMS Instruments Planned to be Calculated Pursuant to Fallback Provisions after June 30, 2023

New York – On November 14, 2022, ICE Benchmark Administration (“IBA”), the publisher of the USD LIBOR ICE Swap Rate, announced that it intends to cease publication of all ICE Swap Rate settings based on USD LIBOR after June 30, 2023 (the "Cessation Date"). This announcement follows the announcement by the UK Financial Conduct Authority on March 5, 2021, that all USD LIBOR settings will either cease or no longer be representative after the Cessation Date. The USD LIBOR ICE Swap Rate is also referred to as a constant maturity swap (or “CMS”) rate, and in this press release is referred to as the “USD LIBOR CMS Rate”.

Citigroup Inc. and certain of its consolidated subsidiaries have issued debt securities, certificates of deposit, preferred stock, asset-backed securities and trust preferred securities that:

- use the USD LIBOR CMS Rate as a benchmark (i.e., as a reference for calculating or determining one or more valuations, payments or other measurements),

- will not mature before the Cessation Date and

- are governed by U.S. law or the law of a U.S. state (“Legacy CMS Instruments”).

Citi is issuing this press release to provide notice that, after the Cessation Date, it expects that calculations referencing the USD LIBOR CMS Rate in the Legacy CMS Instruments will no longer be calculated by reference to the USD LIBOR CMS Rate, but instead will be calculated pursuant to the applicable fallback provisions described below.

Legacy CMS Instruments

Each Legacy CMS Instrument in scope of this press release falls into one of the following categories. Please refer to the corresponding annex for a list of the Legacy CMS Instruments covered by this press release.

1. Initial fallback to dealer quotations

Annex 1 lists Legacy CMS Instruments containing fallback provisions that provide that, if the relevant USD LIBOR CMS Rate is not published on any day on which the rate is required, the calculation agent will determine the rate on the basis of quotations provided to the calculation agent by leading swap dealers in the New York City interbank market for the fixed leg of a fixed-for-floating USD interest rate swap transaction, where the floating leg is based on USD LIBOR (as set forth in more detail in the terms of these Legacy CMS Instruments). Under the terms of these Legacy CMS Instruments, if the calculation agent is unable to obtain a sufficient number of such quotations, then the relevant USD LIBOR CMS Rate will be determined by the calculation agent in good faith and using its reasonable judgment.

As it is expected that the USD LIBOR CMS Rate will not be published following the Cessation Date, the calculation agent intends following the Cessation Date to request quotations for USD interest rate swap transactions referencing USD LIBOR, as described above. If the calculation agent is able to obtain a sufficient number of such quotations (as set forth in the terms of these Legacy CMS Instruments), then calculations based on the USD LIBOR CMS Rate in these Legacy CMS Instruments will be calculated instead by reference to such quotations.

In light of the fact that USD LIBOR is expected to cease or no longer be representative after the Cessation Date, it is currently uncertain whether it will be possible to obtain quotations for USD interest rate swap transactions referencing USD LIBOR (as set forth in more detail in the terms of these Legacy CMS Instruments) after the Cessation Date. In the event that the calculation agent is unable to obtain a sufficient number of such quotations after the Cessation Date, the calculation agent may decide not to request quotations indefinitely, as to do so would serve no purpose. If a sufficient number of quotations are not available on any date of determination for any Legacy CMS Instrument or if the calculation agent has determined prior to such date of determination that it is futile to continue requesting such quotations, the calculation agent intends to follow the approach adopted by the International Swaps and Derivatives Association ("ISDA") for the swaps market and determine the relevant USD LIBOR CMS Rate in accordance with the fallback provisions set forth in Annex 3. Broadly, these fallback provisions consist of using the USD SOFR ICE Swap Rate (“SOFR ISR”), adding the ISDA fallback spread adjustment and applying technical adjustments to account for differences in payment frequency and day count conventions between USD LIBOR swaps and SOFR swaps. IBA has announced that it intends to publish a rate calculated in this manner starting on July 3, 2023.

2. Initial fallback to calculation agent selection of alternative rate

Annex 2 lists Legacy CMS Instruments containing fallback provisions that provide that, if the calculation and publication of the relevant USD LIBOR CMS Rate is permanently canceled, then the calculation agent may replace that USD LIBOR CMS Rate with an alternative rate that it determines, in its sole discretion, represents the same or a substantially similar measure or benchmark as that USD LIBOR CMS Rate. For these Legacy CMS Instruments, the calculation agent intends, for all calculations made after the Cessation Date, to replace the relevant USD LIBOR CMS Rate with a fallback rate calculated in accordance with Annex 3.

This press release applies only to the Legacy CMS Instruments listed on one of the annexes 1 or 2.

The applicable issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for certain of the securities to which this communication relates. Before investing, any investor should read the prospectus in that registration statement and the other documents the issuer has filed with the SEC for more complete information about the issuer and such securities. Any investor may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any investor can request these documents from Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, telephone: (800) 831-9146 or email: prospectus@citi.com.

Annex 1

Legacy CMS Instruments with Initial Fallback to Dealer Quotations

Issuer: Citigroup Inc.

CUSIP

|

1730T0T58 |

17298CDA3 |

|

1730T02P3 |

1730T3AU7 |

|

1730T07K9 |

1730T3AV5 |

|

1730T0KZ1 |

1730T3AW3 |

|

1730T0HV4 |

17298C3F3 |

|

1730T0HN2 |

17298C3Y2 |

|

1730T0JN0 |

17298C6K9 |

|

1730T0E21 |

1730T0RN1 |

|

1730T0E96 |

1730T0SM2 |

|

1730T0G78 |

1730T0TK5 |

|

1730T0K32 |

1730T0TQ2 |

|

1730T0L31 |

1730T0TT6 |

|

1730T0L64 |

1730T0TZ2 |

|

1730T0N62 |

1730T0UB3 |

|

1730T0P86 |

1730T0UG2 |

|

1730T0R50 |

1730T0UK3 |

|

1730T0R76 |

1730T0VD8 |

|

1730T0U49 |

1730T0A58 |

|

1730T0W21 |

1730T0A82 |

|

1730T04K2 |

1730T0A90 |

|

1730T04Y2 |

1730T0C23 |

|

1730T05M7 |

1730T0C56 |

|

1730T06G9 |

1730T0LH0 |

|

1730T07D5 |

1730T0KV0 |

|

17298CAD0 |

17298CBZ0 |

|

17298CAF5 |

|

|

17298CAT5 |

|

|

17298CBB3 |

|

Issuer: Citigroup Global Markets Holdings Inc.

CUSIP

|

17324CGG5 |

|

17324CHL3 |

|

17324CHH2 |

|

17324CP34 |

|

17324CRG3 |

|

17324CSG2 |

|

17324CUT1 |

|

17324CVW3 |

|

17324CVT0 |

|

17324CXL5 |

|

17328YSU9 |

|

17329FJ62 |

|

17329FTP9 |

|

17326YKV7 |

|

17326YQT6 |

Issuer: Citibank, N.A. (CBNA)

CUSIP

|

172986HF1 |

172986HR5 |

|

172986HB0 |

172986HA2 |

|

172986GQ8 |

172986GV7 |

|

172986GY1 |

172986HV6 |

|

172986HT1 |

172986HZ7 |

|

172986CJ8 |

172986KD2 |

|

172986GW5 |

172986JB8 |

|

172986GH8 |

172986CK5 |

|

172986GZ8 |

172986JL6 |

|

172986HD6 |

|

|

172986HN4 |

|

|

172986HS3 |

|

|

172986HK0 |

|

Annex 2

Legacy CMS Instruments with Initial Fallback to Calculation Agent Selection of Alternative Rate

Issuer: Citigroup Inc.

CUSIP

|

17298CLW6 |

|

1730T0X46 |

|

1730T02D0 |

|

1730T02B4 |

|

1730T02V0 |

|

1730T03J6 |

|

1730T03W7 |

|

1730T04U0 |

|

17298CAR9 |

|

17298CCL0 |

|

1730T3AX1 |

|

1730T3AY9 |

|

1730T3AZ6 |

|

17298CFQ6 |

|

17298CFV5 |

|

17298CG36 |

|

17298CG69 |

|

17298CG77 |

|

17298CGD4 |

|

17298CGE2 |

|

17298CGK8 |

|

17298CGL6 |

|

17298CGS1 |

|

17298CGZ5 |

|

5C00639Q1 |

Issuer: Citigroup Global Markets Holdings Inc.

CUSIP

|

17329FUH5 |

17327TY83 |

17328WEM6 |

17328YDR2 |

17328YXE9 |

|

17329UUK5 |

17327TX50 |

17328WBS6 |

17328YC44 |

17328YRF3 |

|

17329QW71 |

17327TR99 |

17328WLX4 |

17328YBD5 |

17329F6V1 |

|

17329QVX5 |

17327TC38 |

17328WLT3 |

17328YBK9 |

17329FC93 |

|

17329U4M0 |

17327TG34 |

17328W7C6 |

17328Y6U3 |

17329F2E3 |

|

17329UD40 |

17327TK54 |

17328WG77 |

17328YFV1 |

17329FC36 |

|

17329QPS3 |

17327TH90 |

17328WJZ2 |

17328YCS1 |

17329F6J8 |

|

17329UR86 |

17327T3U8 |

17328WJS8 |

17328YJW5 |

17329F5M2 |

|

17329QKY5 |

17328V2A7 |

17328WKS6 |

17328YF58 |

17329F7B4 |

|

17329QQS2 |

17328VDM9 |

17328WRC4 |

17328YGL2 |

17329F4X9 |

|

17329QXR6 |

17328V5F3 |

17328WT24 |

17328YHY3 |

17329FFX7 |

|

17329UGK1 |

17328VG53 |

17328WUU0 |

17328YNH3 |

17329F2X1 |

|

17329U4U2 |

17328VVN7 |

17328WXG8 |

17328YXT6 |

17329FFK5 |

|

17329FL93 |

17328VRF9 |

17328WTH1 |

17328YJT2 |

17329FKB9 |

|

17324CXG6 |

17328VMM9 |

17328WTN8 |

17328YPN8 |

17329FDA9 |

|

17324CYQ3 |

17328VJB7 |

17328WQ68 |

17328YK45 |

17329FE91 |

|

17324CZA7 |

17328VQ52 |

17328WVX3 |

17328YLG7 |

17329FRU0 |

|

17329FVK7 |

17328VNM8 |

17328WRM2 |

17328YY73 |

17329FPJ7 |

|

17329FEG5 |

17328VVD9 |

17328WNC8 |

17328YQV9 |

17329FDT8 |

|

17329FY81 |

17328W5M6 |

17328WXB9 |

17328YSW5 |

17329FDV3 |

|

17329FS96 |

17328W2U1 |

17328WXH6 |

17328YRR7 |

17329FL85 |

|

17326YND4 |

17328W4Y1 |

17328WZF8 |

17328YZV9 |

17329FMP6 |

|

17326YVA1 |

17328WAV0 |

17328Y3L6 |

17329FCB8 |

17329FDG6 |

|

17326YXP6 |

17328W5K0 |

17328Y3Q5 |

17328YYU2 |

17329FKT0 |

|

17326YCC8 |

17328W3Y2 |

17328Y2M5 |

17324CHQ2 |

17329FXP4 |

|

17326YP91 |

17328WAR9 |

17328Y2R4 |

17324CJ64 |

17329FXS8 |

|

17326YYA8 |

17328W7K8 |

17328YH72 |

17324CED4 |

17329FSB1 |

|

17326YVR4 |

17328WM96 |

17328YBM5 |

17328YU69 |

17329FWM2 |

|

17326YL95 |

17328WGN2 |

17328YT38 |

17328YU85 |

17329FUC6 |

|

17327TRA6 |

17328WJ82 |

17328YDL5 |

17328YY99 |

17329FXV1 |

|

17327TC95 |

17328WHK7 |

17326YH41 |

17328YS70 |

17329UCD1 |

|

17327TJ23 |

17328WJA7 |

17326YCA2 |

17328YRS5 |

17329FZ23 |

|

17329U2J9 |

17329UYM7 |

17329UXB2 |

17329QB74 |

17324CLR5 |

|

17329Q2F6 |

17329FYS7 |

17329QYS3 |

17329QH94 |

17324CLA2 |

|

17329FVW1 |

17329FUM4 |

17329U3P4 |

17329QGM6 |

17324CMJ2 |

|

17329QL24 |

17329FVE1 |

17329U2C4 |

17329QE30 |

17324CR65 |

|

17329QBM1 |

17329Q5C0 |

17329U3D1 |

17329QB41 |

17324CGJ9 |

|

17329QET3 |

17329UQ87 |

17329U4V0 |

17329QD98 |

17324CLU8 |

|

17329QG79 |

17329USZ5 |

17329UDP3 |

17329Q6P0 |

|

|

17329QAZ3 |

5C005H9W8 |

17329UHB0 |

17329QP95 |

|

|

17329UEA5 |

17329UR94 |

17329U6P1 |

17329QNX4 |

|

|

17329UHX2 |

17328WAF5 |

17329U6E6 |

17329QUK4 |

|

|

17329U3F6 |

17329QD49 |

17329U5E7 |

17329QSV3 |

|

|

17324CFE1 |

17329ULU3 |

17329U7K1 |

17329QXS4 |

|

|

17329QK90 |

17329UAG6 |

17329UFJ5 |

17329QUC2 |

|

|

17329Q6S4 |

17329UKZ3 |

17329ULR0 |

17329QSM3 |

|

|

17329QAG5 |

17329UD32 |

17324CKB1 |

17329QTS9 |

|

|

17329QHD5 |

17329UF30 |

17290JAA9 |

17329QPC8 |

|

Annex 3

Fallback Rate

Where this annex applies, the calculation agent will follow the approach adopted under ISDA's Supplement 88 and calculate the relevant rate as the “Published USD ISR Fallback Rate”, or alternatively the “Calculated USD ISR Fallback Rate”, each as described below.

Published USD ISR Fallback Rate

The “Published USD ISR Fallback Rate” will be calculated based on (i) the SOFR ISR for the relevant tenor of the USD LIBOR CMS Rate referenced in the applicable Legacy CMS Instrument (also referred to as the “Designated Maturity”), (ii) the fixed spread adjustment published by Bloomberg Index Services Limited in the applicable tenor and (iii) certain convexity adjustments to compensate for the varying payment frequencies between the fixed and floating legs of the USD LIBOR CMS Rate and the SOFR ISR.

On March 10, 2023, IBA announced that it intends to publish a USD SOFR Spread-Adjusted ICE Swap Rate® for use as a benchmark in financial contracts and financial instruments by licensees starting on July 3, 2023. If published, we expect that such rate will be the Published USD ISR Fallback Rate, and we expect that the Bloomberg ticker will be as indicated below for each Designated Maturity of the Published USD ISR Fallback Rate indicated below:

|

Designated Maturity |

Bloomberg Ticker1 |

|

1 year |

USISOA01 |

|

2 years |

USISOA02 |

|

3 years |

USISOA03 |

|

4 years |

USISOA04 |

|

5 years |

USISOA05 |

|

6 years |

USISOA06 |

|

7 years |

USISOA07 |

|

8 years |

USISOA08 |

|

9 years |

USISOA09 |

|

10 years |

USISOA10 |

|

15 years |

USISOA15 |

|

20 years |

USISOA20 |

|

30 years |

USISOA30 |

Note that a “Published USD ISR Fallback Rate” will only exist if an administrator publishes such a rate. If there is no “Published USD ISR Fallback Rate”, the “Calculated USD ISR Fallback Rate” will be applied instead. This requires the calculation agent to calculate the relevant rate in the same manner as the formula for the “Published USD ISR Fallback Rate” as described above.

Calculated USD ISR Fallback Rate

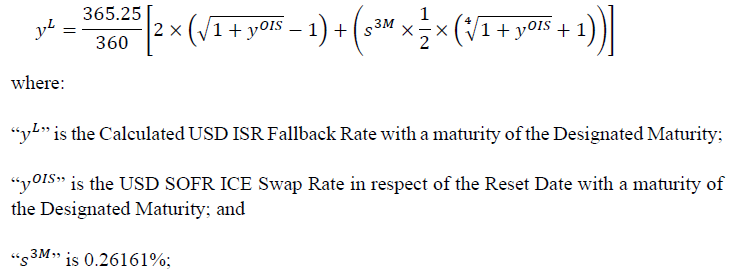

The “Calculated USD ISR Fallback Rate” is the rate calculated as follows, and the resulting percentage will be rounded to the nearest one hundred-thousandth of a percentage point:

“USD SOFR ICE Swap Rate” means the benchmark for the mid-price for the fixed leg of a fixed-for-floating U.S. Dollar swap transaction where the floating leg references the Secured Overnight Financing Rate ("SOFR") administered by the Federal Reserve Bank of New York (or any successor administrator) and both the fixed leg and floating leg are paid annually, as provided by IBA as the administrator of the benchmark (or a successor administrator); and

“Reset Date” means the date on which the Calculated USD ISR Fallback Rate is being determined under the terms of the applicable Legacy CMS Instrument.

About Citi

Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in its home market of the United States. Citi does business in nearly 160 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals with a broad range of financial products and services.

Additional information may be found at www.citigroup.com | Twitter: @Citi | LinkedIn: www.linkedin.com/company/citi | YouTube: www.youtube.com/citi | Facebook: www.facebook.com/citi

Media Contact

Danielle Romero Apsilos: (212) 816-2264, danielle.romeroapsilos@citi.com

Fixed Income Investor Contact

Peter Demoise: (212) 559-2718, peter.demoise@citi.com

Alternatively, please contact the Issuer at iborq@citi.com if you have any questions about anything contained in this press release.

1IBA has started to publish the indicative USD SOFR Spread-Adjusted ICE Swap Rate ‘Beta’ Settings for an initial period under the Bloomberg tickers indicated above. These settings are being provided solely for information and illustration purposes in order to enable recipients to evaluate the settings and provide feedback, and are not intended for, and IBA expressly prohibits their use for, any other purpose, including as a reference, index or benchmark in financial instruments, financial contracts, or investment funds.