Fourth Quarter and Full Year 2021 Results and Key Metrics

HIGHLIGHTS

- Returned $11.8 Billion of Capital to Common Shareholders in 2021; Payout Ratio of 56%3

- Book Value per Share of $92.21

- Tangible Book Value per Share of $79.164

Read the full press release with tables and CEO commentary.

View the Financial Supplement (PDF)

View Financial Supplement (Excel)

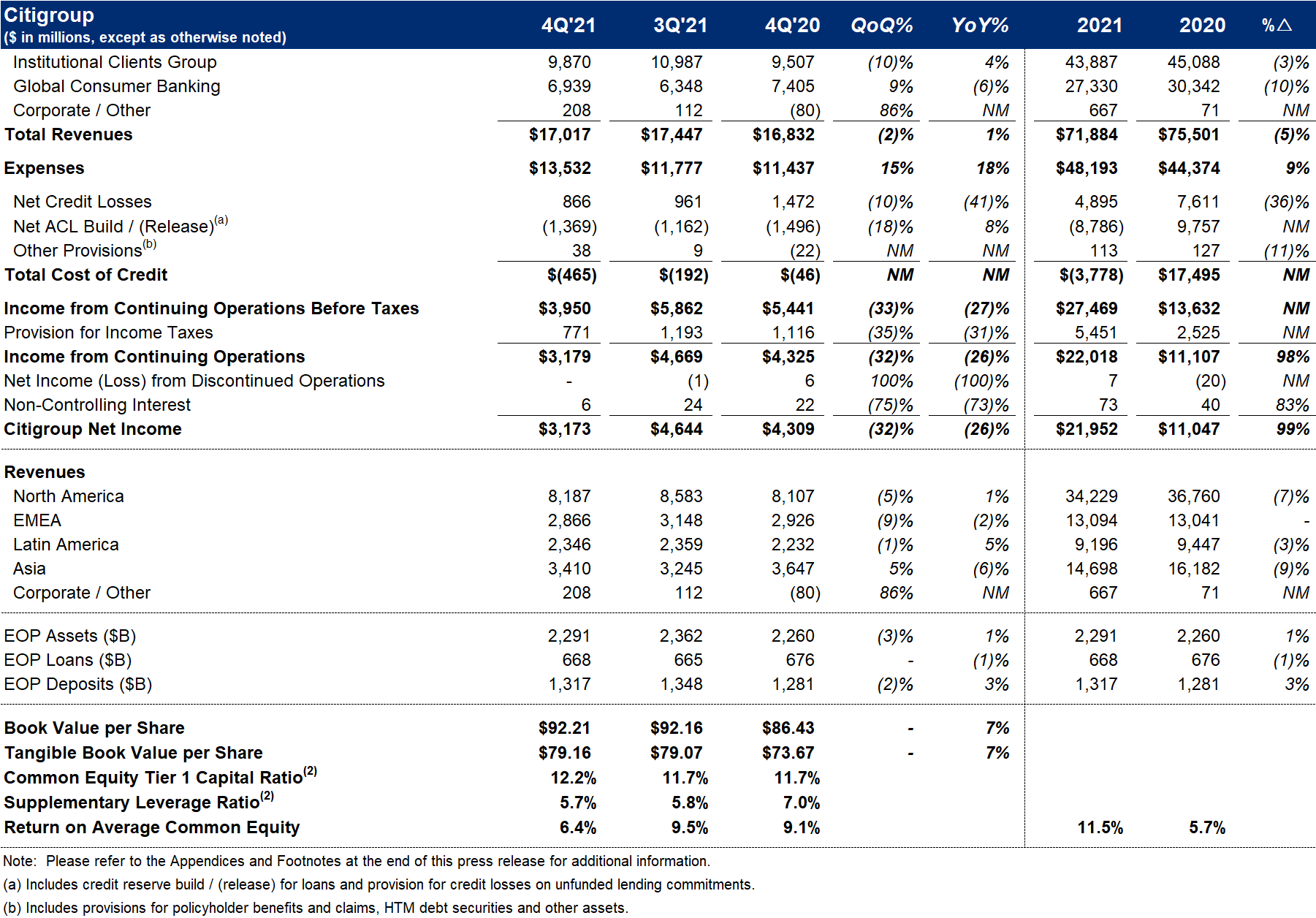

New York – Citigroup Inc. today reported net income for the fourth quarter 2021 of $3.2 billion, or $1.46 per diluted share, on revenues of $17.0 billion. This compared to net income of $4.3 billion, or $1.92 per diluted share, on revenues of $16.8 billion for the fourth quarter 2020.

Revenues increased 1% from the prior-year period, primarily driven by strong growth in Investment Banking in the Institutional Clients Group (ICG) and higher revenues in Corporate / Other, partially offset by lower revenues across regions in Global Consumer Banking (GCB).

Net income of $3.2 billion decreased 26% from the prior-year period, reflecting higher expenses, partially offset by higher revenues and lower cost of credit. Results for the quarter included a pre-tax impact of approximately $1.2 billion ($1.1 billion after taxes) related to the divestitures of Citi's consumer banking businesses in Asia5.

Earnings per share of $1.46 decreased 24% from the prior-year period. Excluding the impact of Asia divestitures, earnings per share of $1.99 increased 4%, primarily reflecting a 4% reduction in shares outstanding.

For the full year 2021, Citigroup reported net income of $22.0 billion on revenues of $71.9 billion, compared to net income of $11.0 billion on revenues of $75.5 billion for the full year 2020.

Jane Fraser, Citi CEO, said: "With the announcement of our intention to focus our franchise in Mexico on our Institutional and Private Bank franchises, we have made the final decision related to the refresh of our strategy as it pertains to markets we intend to exit. We continue to make steady progress on executing our strategy as demonstrated most recently by the signing of an agreement to sell four consumer businesses in Asia. We are also aligning our organization and reporting structure with our strategy, including the creation of the Personal Banking and Wealth Management and Legacy Franchises segments. This will make it easier for our investors to understand the performance of our core businesses and optimize the businesses we have chosen to exit.

"We had a decent end to 2021 driving net income for the year up to $22 billion in what was a far better credit environment than the previous year. Citi returned nearly $12 billion of capital to shareholders and Tangible Book Value increased 7% during the year. We continue to Transform our bank with a focus on simplification and building a culture of excellence. We have seen the resilience and importance of Citi as we have supported our clients through uncharted waters and we will continue to serve them with pride," Ms. Fraser concluded.

Percentage comparisons throughout this press release are calculated for the fourth quarter 2021 versus the fourth quarter 2020, unless otherwise specified.

Fourth Quarter Financial Results

Citigroup

Citigroup revenues of $17.0 billion in the fourth quarter 2021 increased 1%, reflecting strong growth in Investment Banking, the Private Bank and Securities Services in ICG and growth in Corporate / Other, partially offset by lower revenues across regions in GCB and in Fixed Income Markets in ICG.

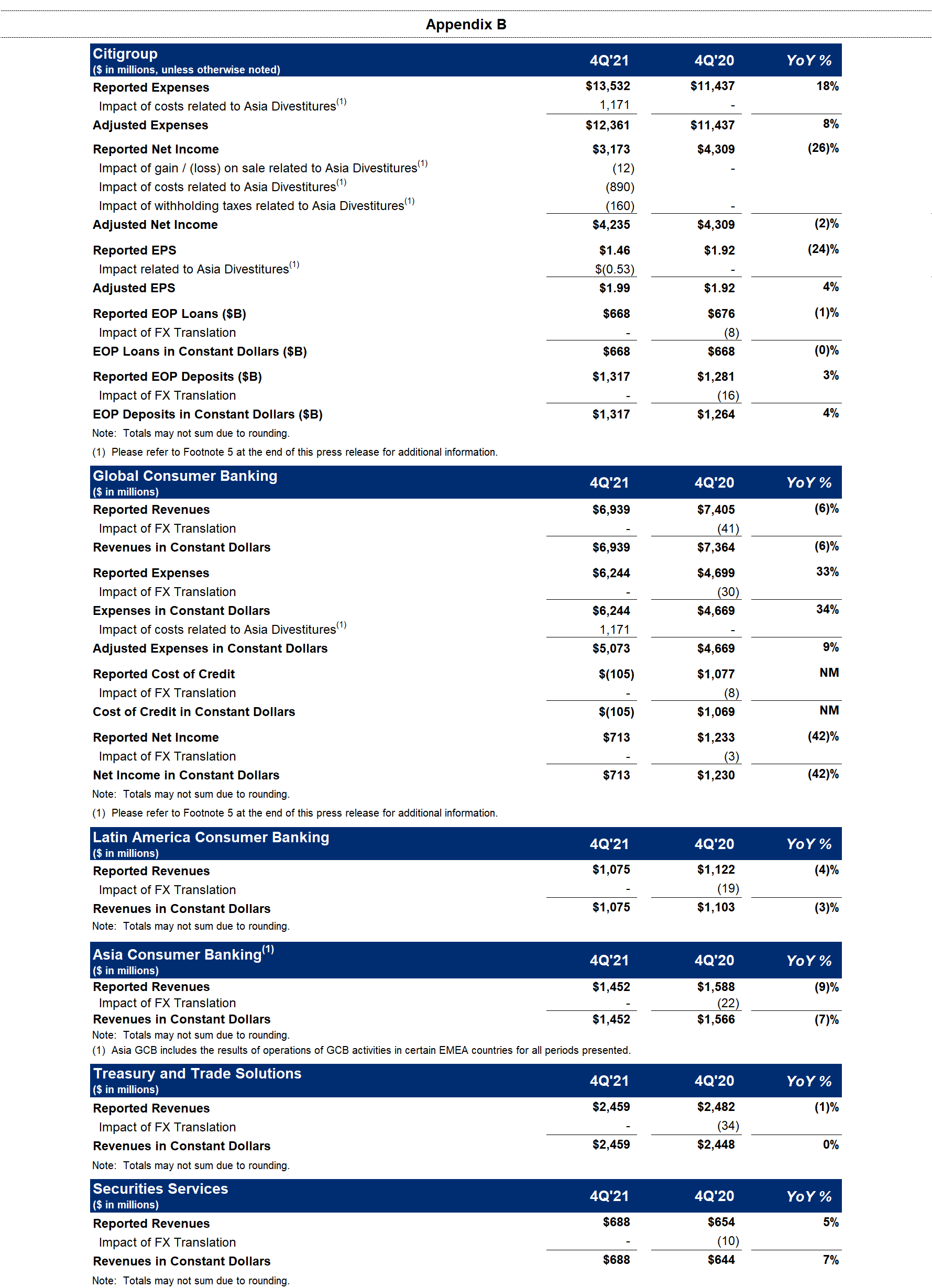

Citigroup operating expenses of $13.5 billion in the fourth quarter 2021 increased 18%. Excluding the impact of Asia divestitures, expenses increased 8%, driven by continued investments in Citi's transformation, business-led investments and revenue-related expenses, partially offset by efficiency savings.

Citigroup cost of credit of $(0.5) billion in the fourth quarter 2021 compared to $(46) million in the prior-year period, primarily reflecting an improvement in net credit losses.

Citigroup net income of $3.2 billion in the fourth quarter 2021 decreased 26% from the prior-year period, driven by the higher expenses, partially offset by the higher revenues and lower cost of credit. Citigroup's effective tax rate was 19.5% in the current quarter compared to 20.5% in the fourth quarter 2020.

Citigroup's allowance for credit losses on loans was $16.5 billion at quarter end, or 2.49% of total loans, compared to $25.0 billion, or 3.73% of total loans, at the end of the prior-year period. Total non-accrual assets decreased 40% from the prior-year period to $3.4 billion. Consumer non-accrual loans decreased 30% to $1.5 billion, while corporate non-accrual loans of $1.9 billion decreased 47% from the prior-year period.

Citigroup's end-of-period loans of $668 billion as of quarter end decreased 1% from the prior-year period on a reported basis. Excluding the impact of foreign exchange translation6, loans were largely unchanged, primarily reflecting loan growth in the ICG offset by the impact of Asia divestitures.

Citigroup's end-of-period deposits were $1.3 trillion as of quarter end, an increase of 3% on a reported basis and 4% in constant dollars, driven by a 6% increase in GCB and a 4% increase in ICG.

Citigroup's book value per share of $92.21 and tangible book value per share of $79.16 each increased 7%, largely driven by net income. At quarter end, Citigroup's CET1 Capital ratio was 12.2%, an increase from the prior quarter driven by actions to reduce risk-weighted assets (RWA) and a temporary pause in common share repurchases in preparation for the implementation of the Standardized Approach for Counterparty Credit Risk on January 1, 2022. Citigroup's SLR for the fourth quarter 2021 was 5.7%, a decrease from the prior quarter. During the quarter, Citigroup returned a total of $1.0 billion to common shareholders in the form of common share dividends.

Institutional Clients Group

ICG revenues of $9.9 billion increased 4%, primarily driven by higher revenues in Investment Banking, the Private Bank and Securities Services, partially offset by a decline in Fixed Income Markets.

Banking revenues of $5.8 billion increased 18% versus the prior year (including gain / (loss) on loan hedges)7. Treasury and Trade Solutions revenues of $2.5 billion declined 1% on a reported basis and were largely unchanged in constant dollars, driven by lower deposit spreads, offset by strong growth in non-interest revenues. Investment Banking revenues of $1.8 billion increased 43%, reflecting strong growth across products. Debt underwriting revenues increased 24% to $767 million, Equity underwriting revenues increased 16% to $507 million, and Advisory revenues increased significantly to $571 million. Private Bank revenues of $963 million increased 6% (excluding gain / (loss) on loan hedges), driven by higher fees and lending volumes, reflecting strong momentum with new client acquisitions, partially offset by lower deposit spreads. Corporate Lending revenues of $548 million decreased 6% (excluding gain / (loss) on loan hedges), reflecting lower volumes, partially offset by a lower cost of funds.

Markets and Securities Services revenues of $4.0 billion decreased 11%. Fixed Income Markets revenues of $2.5 billion decreased 20%, as solid growth in FX and commodities was more than offset by a decline in rates and spread products. Equity Markets revenues of $785 million decreased 3%, as continued growth in prime finance balances and structured activities was offset by a decline in cash. Securities Services revenues of $688 million increased 5% on a reported basis and 7% in constant dollars, driven by higher settlement volumes and higher assets under custody, partially offset by lower deposit spreads.

ICG operating expenses of $6.9 billion increased 10%, reflecting continued investments in Citi's transformation, business-led investments and revenue-related expenses, partially offset by efficiency savings.

ICG cost of credit included net credit losses of $81 million, compared to $210 million in the prior-year period, and a combined net ACL release and other provisions of $386 million compared to a release of $1.3 billion in the prior-year period. The net ACL release in the current quarter primarily reflected continued improvements in portfolio credit quality.

ICG net income of $2.5 billion decreased 22%, as the lower ACL releases and the higher expenses more than offset the higher revenues.

Global Consumer Banking

GCB revenues of $6.9 billion decreased 6% on a reported basis and in constant dollars, reflecting lower revenues across regions.

North America GCB revenues of $4.4 billion decreased 6%. Citi-Branded Cards revenues of $2.1 billion decreased 3%, primarily reflecting continued higher payment rates. Citi Retail Services revenues of $1.3 billion decreased 10%, reflecting lower average loans and higher partner payments. Retail Banking revenues of $1.0 billion decreased 6%, driven by lower deposit spreads and lower mortgage revenues.

Latin America GCB revenues of $1.1 billion decreased 4% on a reported basis and 3% in constant dollars, reflecting lower loan volumes in both retail banking and cards.

Asia GCB revenues of $1.5 billion decreased 9% on a reported basis and 7% in constant dollars, reflecting lower deposit spreads and higher payment rates.

GCB operating expenses of $6.2 billion increased 33% on a reported basis and 34% in constant dollars. On this basis and excluding the impact of Asia divestitures, expenses increased 9%, reflecting continued investments in Citi's transformation, as well as business-led investments, partially offset by efficiency savings.

GCB cost of credit of $(105) million compared to $1.1 billion in the prior-year period, driven by a combined net ACL release and other provisions of $910 million compared to $195 million in the prior-year period, related to improvements in the macroeconomic backdrop, as well as lower net credit losses.

GCB net income of $713 million decreased 42%, as the higher expenses and the lower revenues more than offset the lower cost of credit.

Corporate / Other

Corporate / Other revenues of $208 million increased significantly, driven by higher net revenue from the investment portfolio.

Corporate / Other expenses of $369 million decreased 21%, reflecting the wind-down of legacy assets.

Corporate / Other loss from continuing operations before taxes of $(106) million compared to a loss of $(507) million in the prior-year period, reflecting the higher revenues and the lower expenses.

Citigroup will host a conference call today at 11 a.m. (ET). A live webcast of the presentation, as well as financial results and presentation materials, will be available at https://www.citigroup.com/global/investors. Dial-in numbers for the conference call are as follows: (866) 516-9582 in the U.S. and Canada; (973) 409-9210 outside of the U.S. and Canada. The conference code for both numbers is 8287872.

Additional financial, statistical and business-related information, as well as business and segment trends, is included in a Quarterly Financial Data Supplement. Both this earnings release and Citigroup's Fourth Quarter 2021 Quarterly Financial Data Supplement are available on Citigroup's website at www.citigroup.com.

Citi

Citi, the leading global bank, has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions. Citi provides consumers, corporations, governments and institutions with a broad range of financial products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

Additional information may be found at www.citigroup.com | Twitter: @Citi | YouTube: www.youtube.com/citi | Blog: http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

Certain statements in this release are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations and are subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or occurrences. Actual results and capital and other financial condition may differ materially from those included in these statements due to a variety of factors. These factors include, among others, macroeconomic and other challenges and uncertainties related to the COVID-19 pandemic: such as the duration and severity of the impact on public health, including the duration and further spread of the coronavirus as well as any variants becoming more prevalent and impactful, impacts to the U.S. and global economies, financial markets and consumer and corporate customers and clients, including economic activity and employment, as well as the various actions taken in response by governments, central banks and others, including Citi; consummation of planned or intended business sales, exits or wind-downs, including within the expected timeframes and obtaining any required regulatory approvals and satisfaction of various other conditions and approvals, macroeconomic challenges and uncertainties and local banking conditions, the impact of closing adjustments and the incurrence of unexpected charges or expenses, the impact of accounting for currency translation adjustments related to the affected businesses and the realization of the expected impacts on capital; and the precautionary statements included in this release. These factors also consist of those contained in Citigroup's filings with the U.S. Securities and Exchange Commission (SEC), including without limitation the "Risk Factors" section of Citigroup's 2020 Form 10-K. Any forward-looking statements made by or on behalf of Citigroup speak only as to the date they are made, and Citi does not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statements were made.

Contacts:

Press: Danielle Romero-Apsilos (212) 816-2264

Investors: Jennifer Landis (212) 559-2718

Fixed Income Investors: Thomas Rogers (212) 559-5091

Click here for the complete press release and summary financial information.

1 Preliminary. Citigroup's return on average tangible common equity (RoTCE) is a non-GAAP financial measure. RoTCE represents annualized net income available to common shareholders as a percentage of average tangible common equity (TCE). For the components of the calculation, see Appendix A.

2 Ratios as of December 31, 2021 are preliminary. Commencing January 1, 2020, Citigroup's Common Equity Tier 1 (CET1) Capital ratio and Supplementary Leverage ratio (SLR) reflect certain deferrals based on the modified regulatory capital transition provision related to the Current Expected Credit Losses (CECL) standard. Excluding the deferrals based on the modified CECL transition provision, Citigroup's CET1 Capital ratio and SLR as of December 31, 2021 would be 12.0% and 5.6%, respectively, on a fully reflected basis. For additional information, please refer to the "Capital Resources" section of Citigroup's 2020 Form 10-K.

For the composition of Citigroup's CET1 Capital and ratio, see Appendix C. For the composition of Citigroup's SLR, see Appendix D.

3 Citigroup's payout ratio is the sum of common dividends and common share repurchases divided by net income available to common shareholders. For the components of the calculation, see Appendix A.

4 Citigroup's tangible book value per share is a non-GAAP financial measure. For a reconciliation of this measure to reported results, see Appendix E.

5 Reported expenses include the impact of costs related to the Korea voluntary early retirement program (VERP) of approximately $1.1 billion (approximately $0.8 billion after-tax) and contract modification costs related to the Asia divestitures of approximately $119 million (approximately $98 million after-tax). For additional information about the Korea VERP, see Citigroup's Current Report on Form 8-K filed with the SEC on October 25, 2021 and Citigroup's Current Report on Form 8-K/A filed with the SEC on November 8, 2021.

Reported net income includes an approximately $160 million accrual for withholding taxes related to certain Asia divestiture markets and a pre-tax true-up loss of approximately $14 million (approximately $12 million after tax) related to the sale of the Australia consumer business. For additional information about the Australia sale, see Citigroup's Current Report on Form 8-K filed with the SEC on August 9, 2021.

Results of operations excluding these Asia divestiture-related impacts are non-GAAP financial measures. For a reconciliation to reported results, see Appendix B.

6 Results of operations excluding the impact of foreign exchange translation (constant dollar basis) are non-GAAP financial measures. For a reconciliation of these measures to reported results, see Appendix B.

7 Credit derivatives are used to economically hedge a portion of the Private Bank and Corporate Loan portfolio that includes both accrual loans and loans at fair value. Gains / (losses) on loan hedges includes the mark-to-market on the credit derivatives and the mark-to-market on the loans in the portfolio that are at fair value. In the fourth quarter 2021, gains / (losses) on loan hedges included $21 million related to Corporate Lending and $0 related to the Private Bank, compared to $(298) million related to Corporate Lending and $(14) million related to the Private Bank in the prior-year period. The fixed premium costs of these hedges are netted against the Private Bank and Corporate Lending revenues to reflect the cost of credit protection. Citigroup's results of operations excluding the impact of gains / (losses) on loan hedges are non-GAAP financial measures.