By the Numbers: How Citi is Supporting Small Business Through the Paycheck Protection Program

With the second round of the Small Business Administration's Paycheck Protection Program funding underway, much of the discussion around the program has been about making sure the true small businesses secure access to the resources they need to survive.

Our goal is, and has always been, to help as many small business clients keep as many employees on payroll as possible. Despite the perception that larger businesses are benefiting from PPP more than smaller businesses, our data tells a different story.

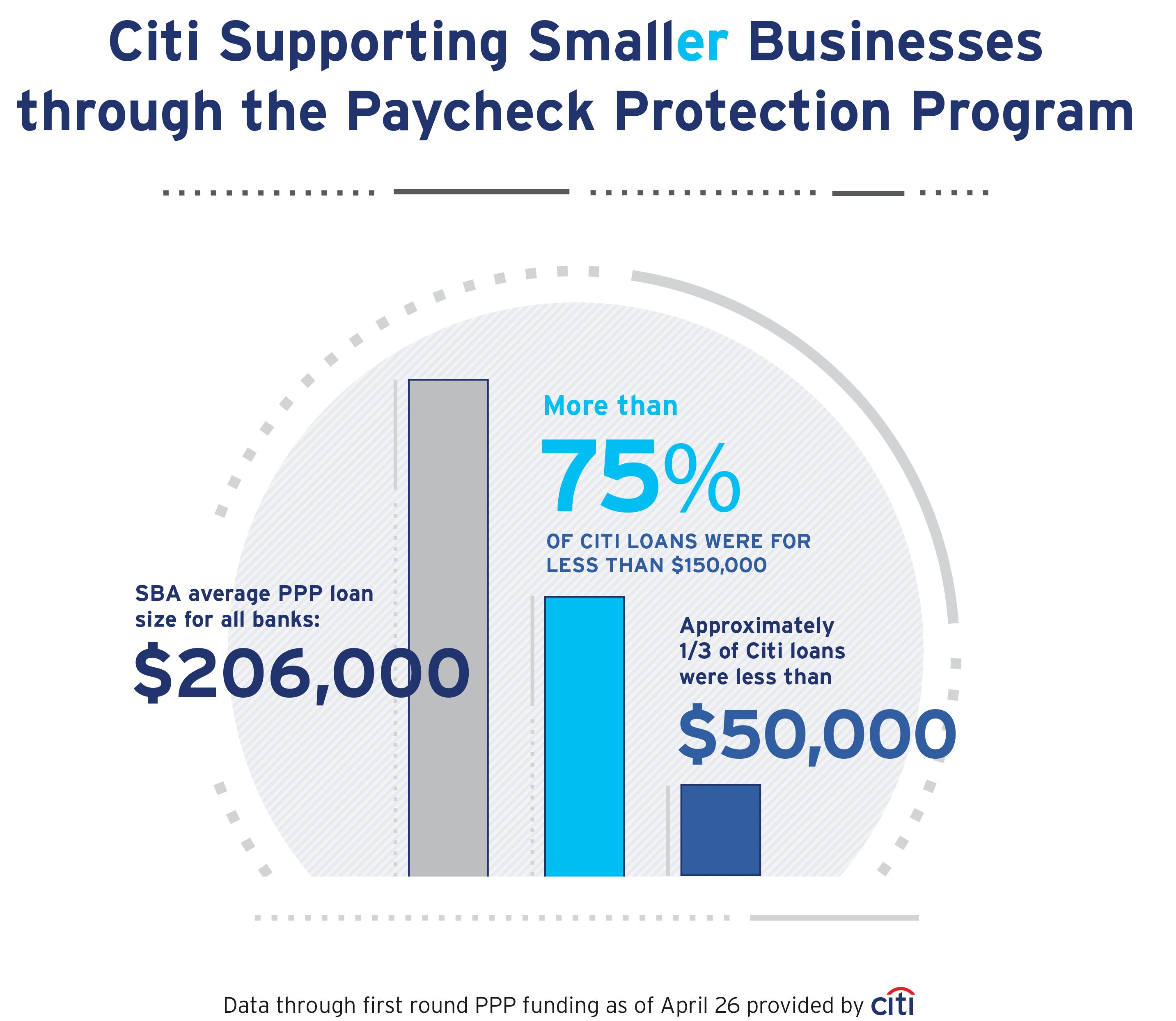

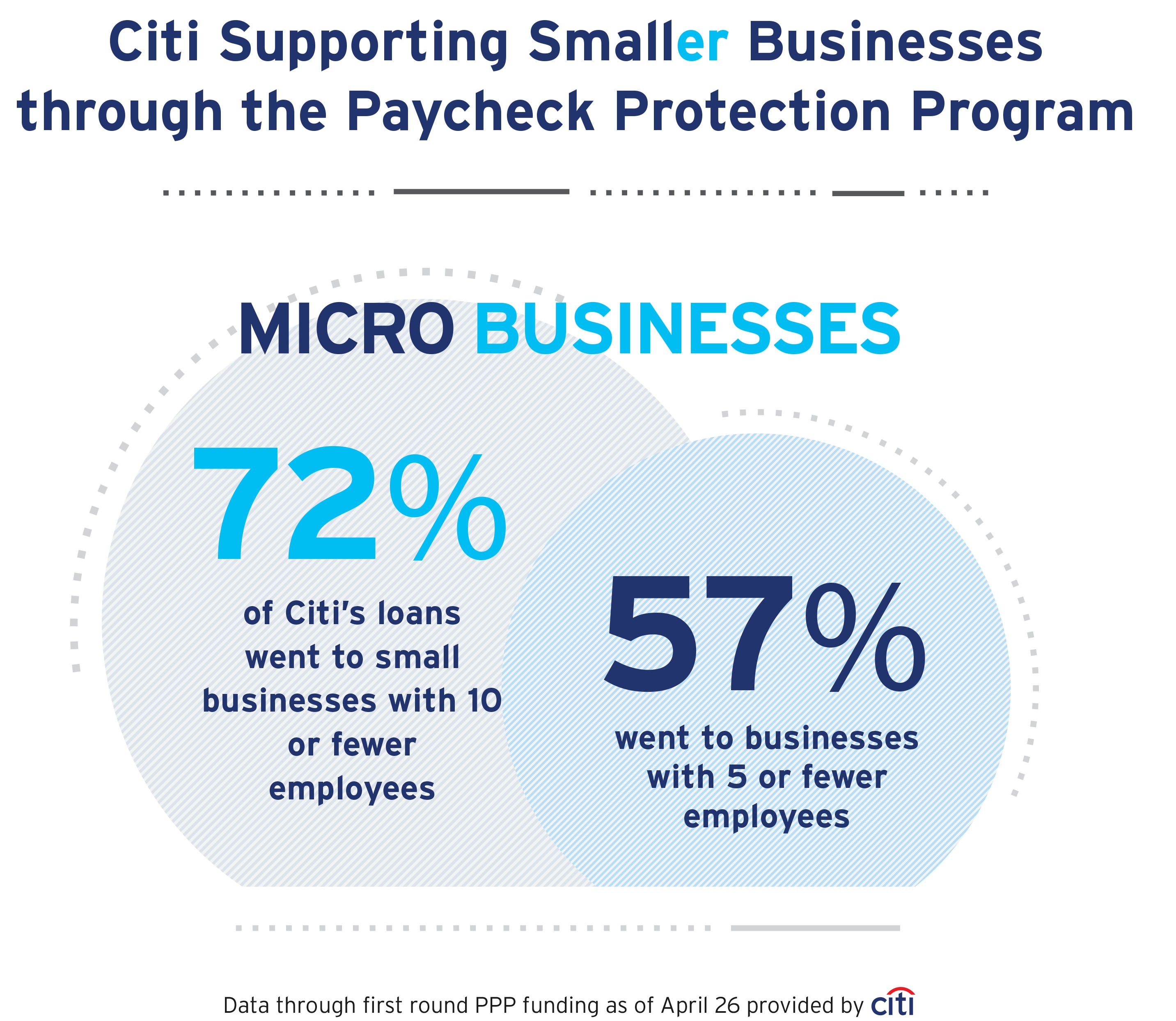

As you will see from the charts below, in the first round of our PPP lending, 72% of loans went to micro businesses, those with 10 or fewer employees while 57% -- more than half – went to businesses with five or fewer employees. By contrast, fewer than 5% of loans went to businesses with 100 or more employees. The average loan size was $175,000. The median loan size was $50,000.

Collectively, these small businesses employ more than 100,000 Americans, all equally deserving. The sectors served run the gamut from the restaurants, churches and nonprofits in your neighborhood to healthcare and construction companies, among others.

We are proud to serve every small business we can through PPP. These businesses are the lifeblood of our economy and we are all #inthistogether.