Letter to Shareholders

Looking back at 2022, I don’t think any of us could have predicted the twists and turns the year would take. Lingering disruptions to supply chains, historic inflationary pressures, persistent lockdowns in China and the largest war on European soil since World War II combined to create a tumultuous environment for businesses and financial markets.

As a leading global bank with a more-than-210-year history, these dynamics are not unfamiliar to us. And as we showed throughout the pandemic, Citi is an important source of strength and stability during times of immense change and challenge. This is an opportunity and a responsibility we take very seriously.

So, for me, 2022 will be remembered most for two things:

The first is how we continued to support our clients. We helped them navigate macro and geopolitical dynamics. We advised them in their digital transformations and supported the shifts in their business models. We guided them in their transitions toward a clean-energy economy. When war broke out in Ukraine, we sprang to the aid of our employees and clients on the ground, and helped our multinational clients unwind their operations in Russia in response to Western sanctions aimed at the country.

The second is the important strides we are making to position Citi to win in the decade ahead. In March 2022, at our first Investor Day in several years, we set a vision and refreshed our strategy to change our business mix and simplify our operating model. We have absolute clarity on our future, and we are focused on accelerating growth, gaining share and increasing returns for shareholders over time.

By most measures, we ended the year in a stronger position than we started.

A foundation for the future

Our vision for Citi is to be the preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in our home market.

To that end, we have laid the foundation by focusing on five core interconnected businesses: Services, Markets, Banking, Global Wealth Management and U.S. Personal Banking. We intentionally designed our business mix to withstand different macroeconomic conditions, and we have seen that borne out over the past year. So whilst the environment has changed, our strategy has not, and we remain steadfast in executing and delivering for our shareholders.

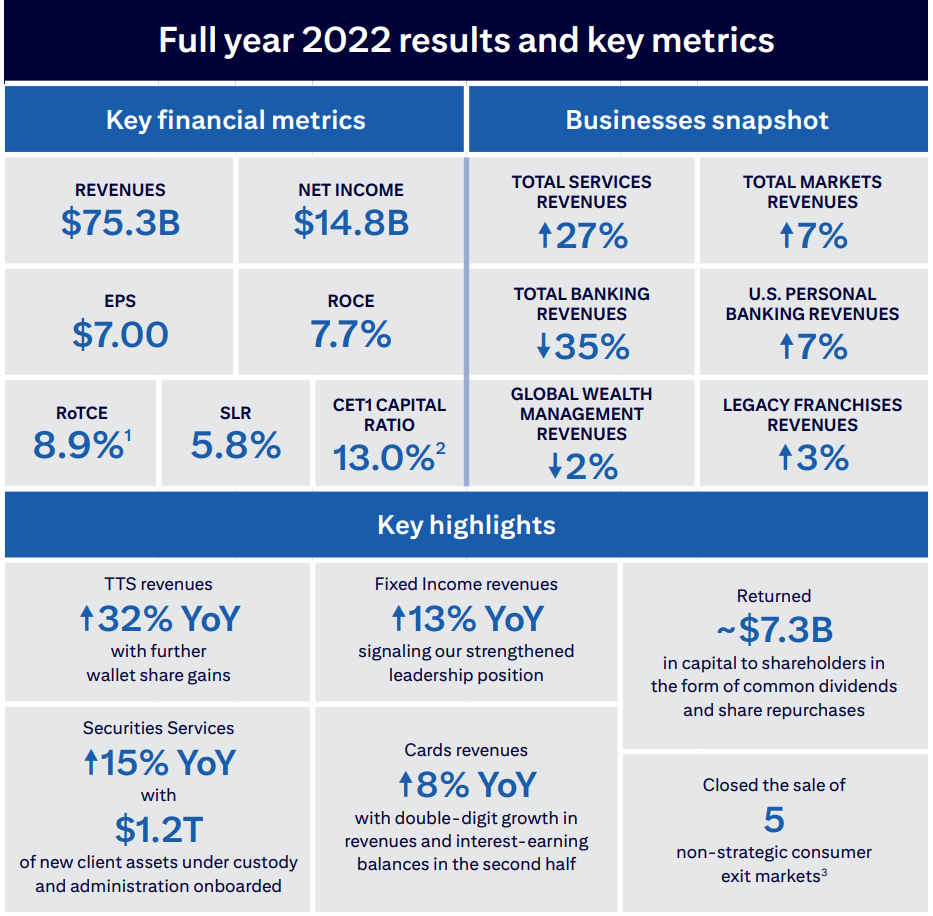

For the year, we delivered $14.8 billion in net income on revenues of $75.3 billion. Our Return on Tangible Common Equity (RoTCE1) was 8.9%, and we remain on track to achieve an RoTCE of 11–12% in the medium term.

We increased our Common Equity Tier 1 Capital ratio by nearly 80 basis points to 13%, which includes a buffer of 100 basis points above the regulatory requirement to help absorb the impact of various macro and other factors. Finally, our tangible book value per share1 increased to $81.65, and we returned more than $7 billion to our shareholders through common dividends and share repurchases.

We have absolute clarity on our future, and we are focused on accelerating growth, gaining share and increasing returns for shareholders over time.

How our core businesses fared

Our Services business had an exceptional year with revenues up 27% versus 2021. Treasury and Trade Solutions (TTS), the crown jewel of our global network, experienced a 32% increase in revenues as we continued to grow our wallet share with existing clients whilst also adding new client relationships. With the introduction of a seven-day sweeps service, the industry’s first 24/7 USD clearing capabilities and instant payments in 33 markets, we’re moving closer to an always-on, near real-time cash management solution for corporate clients. In Securities Services, we grew yearly revenues by 15% and onboarded $1.2 trillion in assets under custody and administration.

Our Markets business closed 2022 with revenues up 7% from 2021, ending the year with one of the best fourth quarters in recent memory. Our traders navigated the volatility quite well, with notable performance amongst corporate clients and strong gains in FX and rates. And together with our Corporate Bank, our Markets team continued to optimize its balance sheet.

Revenues in Banking fell 35% as we contended with a materially slower deal environment. But Banking remains a key part of our strategy, and we continued to play a leading role in the year’s notable transactions. This included acting as one of the lead advisors on Volkswagen’s €9.4 billion IPO of Porsche, the largest public listing of the year, and serving as financial advisor to Amgen on its proposed $27.8 billion acquisition of Horizon Therapeutics. We hired exceptional bankers in healthcare, clean energy and technology — all sectors critical to our growth — and welcomed new talent into our Commercial Bank as it has expanded into Canada, Germany and Switzerland.

In U.S. Personal Banking, revenues for the year rose 7% as we bolstered our leadership in payments and lending. Branded Cards grew revenues by 9%, whilst Retail Services revenues were up 7%. We launched new credit cards with ExxonMobil and AT&T and celebrated 35 years of our co-branded credit card partnership with American Airlines. Revenues in Retail Banking were roughly flat for the full year, but we continued to enhance our digital capabilities, growing digital users by 6% for the year. And as part of our efforts to break down barriers to banking, last year we became the first of the largest U.S. banks to completely eliminate overdraft fees and returned item fees for our customers.

We also made progress building out our Global Wealth Management business despite the economic headwinds that slowed activity amongst our Asia-based clients in particular and reduced overall revenues by 2%. Having unified our Wealth businesses under a single platform, we’ve been acquiring new clients and investing in hiring advisors to make sure we’re well-positioned for success as the markets recover. In addition, we forged ahead with our global expansion, opening Private Bank offices in Paris and Frankfurt, a new Wealth center in Hong Kong and a Citi Global Wealth at Work presence in Luxembourg.

Greater connectivity and focus

A centerpiece of our go-forward plan is increasing the linkages between our businesses so we can more easily engage clients in one part of our firm with products and services from another. By delivering the full power of Citi to clients, we can deepen existing relationships and win new mandates.

Our Markets and Banking businesses are now aligned more closely than ever, and, as a result, we are supporting our clients in a more integrated way. Our Wealth business is also benefiting from closer connections and received more than 60,000 referrals from the Retail Bank last year. In addition, we have established a new partnership agreement between Wealth and our Commercial Bank, where 90% of our clients are privately owned companies.

At the same time, we are making progress in simplifying our firm, making us easier to manage and allowing us to focus on the parts of our business where we know we can grow and improve our competitiveness.

We announced our intention to exit 14 consumer businesses in Asia, Europe, the Middle East and Mexico — businesses that do not have clear synergies with our global network. As a result of swift but disciplined execution, in 2022 we successfully closed the sale of our consumer businesses in Australia, Bahrain, Malaysia, the Philippines and Thailand. In March 2023, we closed the sale of our consumer businesses in India and Vietnam and are on track to close two additional markets by the end of the year. We also are progressing with the wind-down of our consumer business in Korea. In addition to exiting our consumer and local commercial banking businesses in Russia, we are actively ending nearly all institutional banking services in the country, and by the second quarter of 2023, our only operations will be those necessary to fulfill any legal and regulatory obligations. Apart from Russia, Citi will continue to serve our clients and invest in these markets through our institutional franchise and our Wealth business.

Citi’s Transformation

For our strategy to unlock the greatest possible value, we know we need to modernize our infrastructure so that we are scaled and agile and able to continue to deliver for our clients. The consent orders issued in 2020 by the Federal Reserve Board and Office of the Comptroller of the Currency underscored how we had underinvested not only in parts of our infrastructure but also in our risk and controls environment and our data governance.

Last year, we made progress in accelerating our work to address these gaps and simplify and modernize our operating model for the digital age. This work is so consequential in nature that we call it our “Transformation.” It remains my number one priority.

Whilst this is a multi-year journey, we are already seeing the fruits of our labors. We have dramatically streamlined our approval process for new products. And new stress testing capabilities enable us to make faster, better-informed risk decisions. This made a huge difference in how we have been able to minimize the impact of Russia’s invasion of Ukraine on all parts of our business.

Investments in our people and communities

Ensuring we have a culture characterized by excellence and accountability underpins the success of our Transformation and broader vision for the firm. Last year, we launched a program, Citi’s New Way, to help our colleagues adopt the everyday habits we need in order to operate with excellence. We have also hardwired accountability into our firm by strengthening our performance management process and implementing a greater emphasis on financial returns rather than on revenues.

The diversity of the nearly 240,000 people who work at Citi is a distinguishing aspect of our firm, as is the diversity of our Board, which is majority female. We remain committed to a workplace that mirrors the communities we serve. In 2022, we set new goals to increase the number of women and other underrepresented groups working at Citi. These new goals follow our success in exceeding the three-year goals we set in 2018 to increase the percentage of women in the firm globally and of Black talent in the U.S.

In another sign of our progress, last year we celebrated the promotion of one of the largest and most diverse Managing Director classes in recent years. Maintaining a workplace that is diverse, equitable and inclusive is not only true to our values but key to our competitiveness.

Our commitment to advancing diversity, equity and inclusion goes well beyond Citi’s walls as we continue to use our resources as a global bank to take on some of society’s toughest challenges. We expanded the Citi Impact Fund to $500 million in support of diverse founders who are driving both financial and social returns. And we delivered on our commitment to transparency and accountability by announcing the findings from an external review and audit of our $1 billion Action for Racial Equity initiative to help close the racial wealth gap.

We have also been a leader in reimagining the future of work. Drawing on lessons learned during the pandemic, we have institutionalized a hybrid work model for much of our firm. This approach provides the flexibility that our people want whilst also ensuring we benefit from the in-person collaboration, real-time coaching and apprenticeship that occurs only when we are physically together.

Everywhere you look around the firm, there is an undeniable sense of momentum. We have never been clearer about the bank we want to be, and we have made significant progress over the past year in bringing this vision to life. Through our relentless commitment to excellence, we are changing the trajectory of Citi to close the gap with our competitors and deliver a new era of success for all our stakeholders.

1 RoTCE and tangible book value per share are non-GAAP financial measures. For more information, see page 40 of Citi’s 2022 Form 10-K.

2 Citi’s binding CET1 Capital ratio was derived under the Basel III Standardized Approach as of December 31, 2022.

3 Closed the sale of India and Vietnam consumer businesses in March 2023.