2020 Annual Report

Citi's Value Proposition

A Mission of Enabling Growth and Progress

What You Can Expect From Us and What We Expect From Ourselves

Citi's mission is to serve as a trusted partner to our clients by responsibly providing financial services that enable growth and economic progress. Our core activities are safeguarding assets, lending money, making payments and accessing the capital markets on behalf of our clients. We have 200 years of experience helping our clients meet the world's toughest challenges and embrace its greatest opportunities. We are Citi, the global bank - an institution connecting millions of people across hundreds of countries and cities.

We protect people's savings and help them make the purchases - from everyday transactions to buying a home - that improve the quality of their lives. We advise people on how to invest for future needs, such as their children's education and their own retirement, and help them buy securities such as stocks and bonds.

We work with companies to optimize their daily operations, whether they need working capital, to make payroll or export their goods overseas. By lending to companies large and small, we help them grow, creating jobs and real economic value at home and in communities around the world. We provide financing and support to governments at all levels, so they can build sustainable infrastructure, such as housing, transportation, schools and other vital public works.

These capabilities create an obligation to act responsibly, do everything possible to create the best outcomes, and prudently manage risk. If we fall short, we will take decisive action and learn from our experience.

We strive to earn and maintain the public's trust by constantly adhering to the highest ethical standards. We ask our colleagues to ensure that their decisions pass three tests: they are in our clients' interests, create economic value, and are always systemically responsible. When we do these things well, we make a positive financial and social impact in the communities we serve and show what a global bank can do.

Financial Summary

In billions of dollars, except per-share amounts, ratios and direct staff

| 2020 | 2019 | 2018 | |

|---|---|---|---|

| Global Consumer Banking Net Revenues | $30.0 | $33.0 | $32.3 |

| Institutional Clients Group Net Revenues | 44.3 | 39.3 | 38.3 |

| Corporate/Other Net Revenues | 0.1 | 2.0 | 2.2 |

| Total Net Revenues | $74.3 | $74.3 | $72.9 |

| Net Income | $11.0 | $19.4 | $18.0 |

| Diluted EPS — Net Income | 4.72 | 8.04 | 6.68 |

| Diluted EPS — Income from Continuing Operations | 4.73 | 8.04 | 6.69 |

| Assets | $2,260 | $1,951 | $1,917 |

| Deposits | 1,281 | 1,071 | 1,013 |

| Citigroup Stockholders' Equity | 199 | 193 | 196 |

| Basel III Ratios — Full Implementation1 | |||

| Common Equity Tier 1 Capital | 11.7% | 11.8% | 11.9% |

| Tier 1 Capital | 13.3% | 13.3% | 13.4% |

| Total Capital | 15.6% | 15.9% | 16.1% |

| Supplementary Leverage | 7.0% | 6.2% | 6.4% |

| Return on Assets | 0.50% | 0.98% | 0.94% |

| Return on Common Equity | 5.7% | 10.3% | 9.4% |

| Return on Tangible Common Equity | 6.6% | 12.1% | 11.0% |

| Book Value per Share | $86.43 | $82.90 | $75.05 |

| Tangible Book Value per Share | 73.67 | 70.39 | 63.79 |

| Common Shares Outstanding (millions) | 2,082 | 2,114 | 2,368 |

| Total Payout Ratio | 73% | 122% | 109% |

| Market Capitalization | $128 | $169 | $123 |

| Direct Staff (thousands) | 210 | 200 | 204 |

Letter to Shareholders

- Michael L. CorbatChief Executive OfficerOctober 2012 - February 2021

Dear Shareholders:

Never could I have imagined that my final year as CEO of Citi would be consumed by a once-in-a-century health crisis that would upend the global economy and the lives of everyone on our planet. It was a year filled with immense pain and uncertainty but also courage and purpose - and we can take heart that even as it did its worst, the global pandemic has brought out the best in us.

2020 was a year that tested Citi like never before. From the beginning, I was determined to see that Citi not merely manage through but emerge stronger from the pandemic - and that, in addition to serving as a source of strength for our clients, we seize the opportunity to help lead the relief and recovery and remind the world of the invaluable role that Citi plays as a global bank.

I'm proud to say we have done that, by every measure. Entering the pandemic on a solid footing from a capital and liquidity perspective gave us the resources we needed to support our colleagues, customers, clients and communities during the sharpest economic downturn since the Great Depression. That financial stability enabled us to do many things to catalyze the recovery without jeopardizing our own safety and soundness.

From the onset of the pandemic, we acted swiftly. When shelter-at-home orders were issued last March by governments around the globe, we undertook a massive effort to keep our employees safe while serving our clients seamlessly. Within days, we had nearly 200,000 of our colleagues up and running at their kitchen tables and home offices. We offered childcare and in-home care options and enhanced health and education resources and provided special compensation to help ease the financial burden for 75,000 colleagues.

We were one of the first banks in the U.S. to announce consumer assistance programs for our credit card and mortgage customers. Though Citi historically has not been a large lender to small businesses, by year end we funded loans totaling $3.8 billion as part of the U.S. Small Business Administration’s Paycheck Protection Program and donated $50 million in proceeds from the program to support community economic recovery efforts.

For our globally minded clients who include multinational companies, emerging market leaders, governments, investors and ultra-high net worth households, we have been helping them contend with volatile markets, reconfigure supply chains, and access short- and long-term liquidity.

And because we take seriously our responsibility to the communities we serve, we have supported front-line health workers and deployed other resources to those who desperately need help. Combined with donations from Citi colleagues, contributions to pandemic-related causes from our company and the Citi Foundation topped $100 million in 2020.

Providing Strength in a Year of Upheaval

Despite the tumultuous impacts of the pandemic, we turned in solid financial results during 2020. In an operating environment more uncertain and challenging than any in recent memory, we kept revenues flat to the banner year of 2019. In 2020, we earned $11 billion of net income on revenues of $74 billion despite the roughly $10 billion increase we took in credit reserves as a result of the pandemic and the impact of current expected credit losses.

Even after meeting the capital and liquidity needs of our clients, we closed out the year exceptionally well-capitalized, with a Common Equity Tier 1 ratio of 11.7%, exceeding our 10% regulatory minimum. We also increased our Tangible Book Value per Share to $73.67, up 5% from 2019.

Our Institutional Clients Group performed well, delivering 13% revenue growth, positive operating leverage and 22% operating margin growth for the year. Our Treasury and Trade Solutions business, although negatively affected by lower rates, experienced strong client engagement and digital adoption, including a 9% year-over-year increase in users of our CitiDirect BE® banking platform.

Our global expertise means that we continue to be the first call for many of the most significant financial transactions and activities. In September, our team led the initial public offering for the enterprise software company Snowflake, which returned 100% to investors while creating a new $65 billion market cap company. In November, we were selected to serve as the financial advisor to the international public health organization Gavi in its effort to equitably distribute 2 billion vaccine doses for COVID-19 by the end of 2021.

Our Global Consumer Bank bore the impact of sharply decreased credit card spending, although we did see deposit growth in every region. In the U.S., our retail business benefited from exceptionally high mortgage refinancing as homeowners saw opportunities in this ultra-low-rate environment, and we experienced continued momentum in digital deposits. In Mexico, an ongoing slowdown in overall economic growth and industry volumes resulted in lower revenues. In Asia, card spending was down, but we saw strong performance in wealth management, with investment revenues at their highest level in a decade.

- Jane FraserChief Executive OfficerMarch 2021 -

"Citi is an incredible institution with a proud history and a bright future. I am excited to join with my colleagues in writing the next chapter."

We continued to combine our scale, digital capabilities and ecosystem to be where our customers need us to be. In the U.S., our largest consumer market, we expanded our lending partnership with American Airlines, announced private label and co-brand credit card agreements with two new partners, Meijer and Wayfair, and drove robust digital deposit sales. In Mexico, we worked with PepsiCo Alimentos Mexico and Amigo PAQ to enable mobile access to credit to more than 800,000 shopkeepers through our Citibanamex digital apps. And in Asia, we expanded our partnership with Grab to offer personal loans through the ride-hailing company's app.

Putting Citi on a Strong Footing

More than anything, 2020 demonstrated the value of our diversified and durable business model. But for Citi, the story of 2020 actually began many years earlier.

When I was appointed CEO in 2012, the firm was still in a tenuous position from the financial crisis several years before. At the time, I decided to accelerate a strategy that returned the firm back to basics. We streamlined our consumer business and embraced the shift to digital. We re-established Citi as a go-to bank for our institutional clients through our global network.

Working through our legacy assets, we optimized our capital base and reduced our net deferred tax assets by more than half, generating $7 billion of regulatory capital in the process. Our financial performance improved steadily as we became a simpler, smaller, safer and stronger institution. We transitioned from restructuring the firm to investing in it and significantly improved our returns.

Before the pandemic's impact on the economy and our businesses took hold, we had made tremendous progress in closing the gap with our peers. From 2012 to 2019:

- Citi's Net Income increased from $7.5 billion to $19.4 billion.

- Citi's Return on Assets increased from 39 bps to 98 bps.

- Citi's Efficiency Ratio improved from 72.0% to 56.5%.

- Citi's Return on Tangible Common Equity increased from 5.0% to 12.1%, closing the gap with our peers.

We dramatically increased the return of capital to common shareholders. From 2015 through 2019, we returned nearly $75 billion to our common shareholders while also reducing our share count by 30%.

Showing how far Citi has come since the financial crisis, in 2020 - the year of a pandemic - we had $3.5 billion more in Net Income, an 11 bps higher Return on Assets and 160 bps higher Return on Tangible Common Equity than we had in 2012. That's great progress but make no mistake: It was rooted in the hard work we put in during the years leading up to 2020. Prudent decisions we made in the wake of the last crisis have proved their full value in this one.

CITIGROUP — KEY CAPITAL METRICS

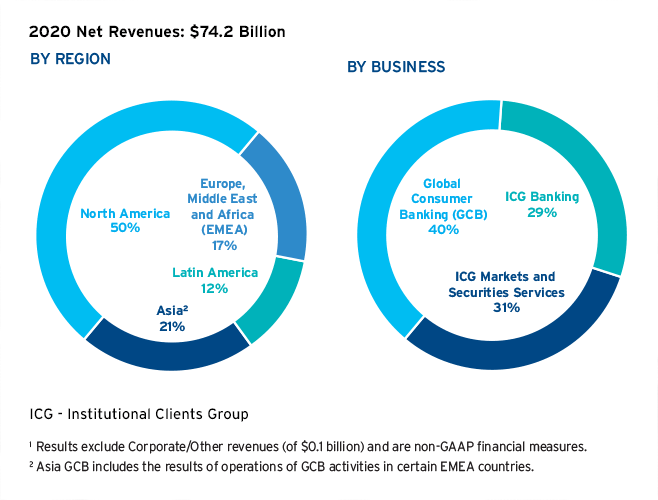

2020 NET REVENUES1

Leading with Purpose

Amid a global health crisis that has created so much economic and social upheaval, Citi's efforts to tackle long-standing societal challenges have become even more important.

We kicked off the year with the launch of the Citi Impact Fund in January. With $200 million to invest, it is the largest fund of its kind established by a bank with its own capital. In just its first year, the Citi Impact Fund has invested in 11 companies, the majority of which are founded by women, minorities - and in some cases both - that have the potential to make our cities and communities more equitable and sustainable.

The pandemic focused the spotlight on another intensifying global crisis - climate change. For more than two decades, Citi has led the industry's drive toward sustainability. In 2020, we announced a new five-year goal to finance and facilitate $250 billion in environmental projects and activities, following on the heels of completing $100 billion in environmental transactions four years faster than the goal we had set.

2020 also brought a long overdue reckoning with systemic inequity and social injustice. In the aftermath of the murder of George Floyd, we launched Action for Racial Equity, which encompasses $1 billion in strategic actions to help close the racial wealth gap and increase economic mobility in the U.S. The initiative underscores our determination to mobilize the full power of our business activities to attack the barriers that keep racially diverse communities from building wealth.

Each of these efforts helps advance our ambition to be a leader on a broad range of societal issues and challenges. In each case, these efforts enjoy the full support of our franchise because this is about more than just "doing good." It is a business imperative. By building a fairer, more inclusive and more sustainable economy, we all benefit - our company, our clients and customers, and the communities we serve.

Building on Our Success

Looking back at my time as CEO, I could not be more proud of what our firm has achieved. But I know there is always more to do. The pandemic will irrevocably change many things about banking, and we must embrace this opportunity to achieve a state of excellence in our risk and controls, our infrastructure and our ability to serve our clients.

Consent orders issued in October by the Federal Reserve Board and the Office of the Comptroller of the Currency have created additional urgency and a framework for the firm's transformation. Central to addressing regulators' concerns is improving Citi's risk and control environment, which will be essential to the new digital landscape.

Now, after 38 years at Citi, I leave this institution with Jane Fraser's hands at the helm, confident in the quality and comprehensiveness of the transformation she will be leading so Citi can continue its journey back to being the world's leading bank. I leave Citi perhaps proudest of the fact that it is again an indisputably strong and stable institution - and an institution our colleagues are proud of which to be a part. And I know that Jane will take our great firm to new heights while maximizing returns and delivering the full benefits of our franchise to all our stakeholders.

I will always be rooting for Citi.

Sincerely,

Michael L. Corbat

Chief Executive Officer, Citigroup Inc.

1 Tangible Book Value (TBV) is a non-GAAP financial measure. For the components of the TBV calculation, see "Capital Resources - Tangible Common Equity, Book Value per Share, Tangible Book Value per Share and Returns on Equity" in Citi's 2020 Annual Report on Form 10-K included with this letter.

2 Return on Tangible Common Equity (ROTCE) is a non-GAAP financial measure. For the components of the ROTCE calculations, see "Capital Resources - Tangible Common Equity, Book Value per Share, Tangible Book Value per Share and Returns on Equity" in Citi's 2020 Annual Report on Form 10-K included with this letter.

Global Consumer Banking

Citi's Global Consumer Bank (GCB) is a global leader in banking and wealth management, the world's largest credit card issuer and a partner of choice globally to the world's most iconic brands and digital leaders. The Global Consumer Bank serves more than 110 million clients in the U.S., Mexico and Asia, spanning 19 markets.

In 2020, the Global Consumer Bank continued to execute a digital-first, client-led growth strategy while pivoting swiftly to provide value, service and support to clients and communities impacted by the COVID-19 pandemic.

The GCB's model is distinct: digital-first capabilities complemented by a light physical footprint in leading urban markets. Our relationship banking model serves clients across the full spectrum of their needs as they borrow, pay, save, invest and protect and is supported by global assets and capabilities that are deployed locally. With a high-quality, highly digitally engaged customer base and one of the most dynamic partner ecosystems in the industry, the franchise is well positioned for where the world is headed.

Throughout the pandemic, Citibanamex colleagues continued to provide warm and professional service to clients in branches while following guidelines to ensure their well-being.

In a rapidly changing landscape, the GCB intensified its focus on three strategic priorities to position the franchise for long-term growth: winning in wealth management; leading in consumer payments and lending; and driving scale through digitization and partnerships. With digital at the core of our strategy, GCB delivered double-digit growth in deposits, enhanced value propositions and provided an array of digital capabilities, garnering industry accolades for client experience. Citi was named Best Digital Bank in Asia (Euromoney), Best Digital Bank in Mexico (Global Finance) and Bank with the Most Desirable Mobile Banking Digital Money Management Features in the U.S. (Insider Intelligence).

At the onset of the COVID-19 pandemic, Citi responded quickly, enabling thousands of colleagues to work from home in a matter of weeks, with requisite training, technology and onboarding, while retaining servicing for customers.

We launched assistance programs in markets worldwide, the first large bank to do so in the U.S., while also facilitating free cashing of U.S. government stimulus checks for non-customers. We continued to serve clients safely in branches, introducing new safety measures and cleaning protocols, as well as innovative ways to serve clients remotely, such as video banking in Asia and the U.S. As COVID-19 made mobile capabilities, high-touch digital services and the human touch critical, Citi introduced new and enhanced digital and mobile capabilities and evolved product benefits across our credit card portfolios to ensure value, utility and relevance to customers.

As of December 31, 2020, Citi had assisted more than 5 million customers and small businesses worldwide with a range of assistance measures, including fee waivers and deferral of credit card minimum payments. In the U.S., as part of the Small Business Administration's Paycheck Protection Program (PPP), Citi funded more than $3 billion to U.S. small businesses, many in the areas hardest hit by COVID-19. Net profit earned through participation in the PPP was donated to the Citi Foundation to support community economic recovery efforts.

The GCB operates approximately 2,300 branches and generated $1.1 billion in pretax earnings in 2020. At year end, the business had $345 billion in deposits, $282 billion in loans and $222 billion in assets under management.

Credit Cards

Citi is a global leader in payments, with 132 million accounts and $505 billion in annual purchase sales, and has unrivaled partnerships with premier brands across Citi Branded Cards and Citi Retail Services. At year-end 2020, card receivables were $153 billion.

Citi Branded Cards

Citi Branded Cards provides payment, credit and lending solutions to consumers and small businesses, with 54 million accounts globally. In 2020, Citi Branded Cards generated annual purchase sales of $427 billion and ended the year with a loan portfolio of $107 billion.

In 2020, we continued to evolve our value propositions, expand co-brand partnerships and provide new digital capabilities to make purchases faster, convenient and more rewarding.

In the U.S., as part of a more integrated, multi-product relationship model, we expanded our lending partnership with American Airlines, our partner of more than three decades, to include the Citi Miles AheadTM Savings Account, a new deposit product exclusively for American Airlines co-brand cardholders who reside within the U.S. but outside locations where Citi has a retail branch presence. The account provides the ability to earn more miles on everyday purchases, as well as relationship-based offers.

During an unprecedented year marked by the pandemic, we actively engaged with cardholders to ensure we met their evolving needs. In the U.S., for example, we introduced relevant points offers on the Citi Prestige® Card and expanded the $250 travel credit to include supermarket and restaurant purchases through 2021. Similarly, we introduced relevant accelerators to the Citi Premier Card, including increased rewards for supermarket and restaurant purchases, including takeout and curbside pickup. In addition, we introduced a temporary point-redemption option for U.S. cardholders by providing them with the choice to redeem cash rewards and ThankYou Points to pay the minimum due on their credit card.

We teamed up with World Central Kitchen, a nonprofit organization that uses the power of food to heal communities and strengthen economies in times of crisis and beyond, on a program to support hunger relief efforts during COVID-19 while further encouraging digital banking adoption among clients. In addition, we joined with Mastercard and a nonprofit organization called Start Small Think Big to help small businesses. As a long-time partner of Global Citizen, we supported its global broadcast and digital special, One World: Together at Home, in support of the World Health Organization and regional charities working to meet immediate COVID-19 needs locally.

With physical cards rapidly digitizing, we continued to expand digital lending capabilities and point-of-sale solutions to give customers ease, convenience and choice in payments.

In the U.S., we introduced our proprietary Citi Flex Pay capabilities to American Airlines co-brand cardholders and on Amazon. Citi Flex Pay enables customers to finance purchases by converting eligible purchases into a fixed payment plan. Citi Flex Loan, a digital lending solution introduced in 2019 that enables customers to convert a portion of their credit line into a fixed rate personal loan, continued to perform well, with the average balance more than doubling.

In Asia, more than 60% of personal loans were made digitally through its Citi Quick Cash, Citi PayLite and Citi Flexibill solutions. A seamless, self-service mobile application journey, coupled with data-enabled real-time triggers, helped meet customers' borrowing needs, with lending volumes in the mobile app up 67% despite a challenging environment. Innovation remains at the forefront of our business, with the recent expansion of our Grab partnership that allows customers to obtain personal loans on the Grab app via application programming interfaces (API).

In Mexico, Citibanamex is a leader in credit cards, with strong market share, compelling value propositions, including our reward programs (ThankYou® Rewards and Premia), and market-leading promotions such as Buen Fin, which included more than 40,000 exclusive agreements with retailers and businesses.

Retail Services

Citi Retail Services is one of North America's largest and most experienced retail credit solution providers of private label and co-brand credit cards for retailers. The business serves 78 million customer accounts for iconic brands, including Best Buy, Exxon, Mobil, L.L.Bean, Macy's, Sears, Shell, The Home Depot and Tractor Supply Company.

In 2020, Citi Retail Services announced private label and co-brand credit card agreements with two exciting new partners - Meijer and Wayfair. Meijer is a privately owned and familyoperated Midwestern retailer with more than 250 supercenters and grocery stores throughout the Midwest. Wayfair is one of the world's largest online destinations for the home, offering millions of items across home furnishings, décor, home improvement, housewares and more. Today, Citi is the consumer credit card provider to half of the top 10 U.S. ecommerce companies.

In 2020, Citi Retail Services generated purchase sales of $78 billion and ended the year with a loan portfolio of $46 billion.

A NEW WAY TO BANK NATIONWIDE ON GOOGLE PAY

Alongside the launch of the redesigned Google Pay in the U.S., then-Citi President and current CEO Jane Fraser shared a sneak preview of the Citi® Plex™ Account by Google Pay in 2021.

Today, customers want an integrated experience where their relationship with money operates at the same speed as the rest of their life. At Citi, we want to empower them with an account that provides smart - very smart - financial services built from the ground up with financial wellness and mobile functionality at its core.

The Citi Plex Account is a new digital checking and savings account built to make managing money simpler, smarter, safer and more rewarding, with financial wellness and mobile functionality at the core of the design. Consumers will open and manage these accounts through the Google Pay app on both Android and iOS.

"Just over a year ago, we set out on a journey with Google to create an experience that is 100% digital, and different, in banking," said Anand Selva, CEO of the U.S. Consumer Bank and incoming CEO of the Global Consumer Bank. "The Citi Plex Account is designed to give customers an always-on, friction-free, personalized experience at their fingertips."

The collaboration is the first of its kind in the U.S., bringing together Citi's banking know-how with Google's bestin-class user experience and technology to drive a stream of new services and capabilities. It aligns seamlessly with our U.S. Consumer Bank strategy, giving us a platform to drive significant scale in our Retail Bank by unlocking the power of our respective ecosystems to deepen our existing relationships and serve a larger and new generation of customers.

The Citi Plex Account is Citi's first-ever bundled checking and savings account solution. With extensive user experience and account management features powered by Google, the Citi Plex Account is designed to integrate seamlessly within Google Pay to deliver a richness of insights and capabilities to empower consumers with a simple, convenient and personal banking experience.

We are excited about the possibilities this collaboration creates for our clients and feel a tremendous sense of pride in helping to create a truly new and unique way to bank nationwide.

Retail Banking

With our high-tech, high-touch relationship model, Citibank serves as a trusted advisor to our retail, wealth management and small business clients at every stage of their financial journey.

Through Citi's Access Account, Basic Banking, Citi Priority, Citigold® and Citigold Private Client, we offer an array of products, services and digital capabilities to clients across the full spectrum of consumer banking needs worldwide.

In the U.S., Citi continued to digitize our retail bank model to drive national scale. Citi Accelerate Savings and Citi Elevate® Checking, digital high-yield savings and checking accounts for customers outside Citi's branch footprint, helped drive robust digital deposit sales, while Citi's Access Account, a checkless bank account with no or low monthly fees, no overdraft fees and access to Citi's digital, retail and ATM channels, continued to be one of our fastestgrowing products.

Citi also gave consumers a sneak preview of the Citi Plex Account by Google Pay, a new digital checking and savings account launching on Google Pay in 2021, and announced Mastercard as our network partner for the account (see the Google Plex section above for more information).

In the U.S., small business lending again exceeded $10 billion in addition to more than $3 billion administered through the Small Business Administration's Paycheck Protection Program, while in Mortgage, the low rate environment drove strong origination and refinancing activity. In the U.S., Citibank, N.A. originated $24 billion in new loans in 2020.(see the Citi Supports U.S. Small Business section below for more information)

ENABLING PROGRESS: CITI LAUNCHES CHOSEN NAME FEATURE ON BRANDED CREDIT CARDS

In October, Citi was proud to announce a new initiative offering transgender and non-binary people the ability to use their chosen name on eligible credit cards. The launch, in conjunction with Mastercard, provides eligible U.S. branded credit card customers with the option to use their self-identified chosen first name on credit cards.

With a recent survey by the National Center for Transgender Equality showing that one-third of transgender people reported suffering harassment or denial of service after showing ID with a name or gender marker that didn't match their appearance, the initiative is a step toward helping customers feel recognized, accepted and empowered to be their true selves.

Today, eligible existing credit cardmembers are able to request new credit cards that display their chosen name. Further, customers are able to be serviced by their chosen name when they call into customer service and also across online and mobile access points.

The response has been tremendous to date, with thousands of customers updating their cards with their chosen first name and feedback from customers such as the following: "I wish that there had been something like this when I began my transition. This will remove one of the many worries that we all have had when we were introducing our true selves to the world."

And this initiative really is an extension of the bank’s ongoing commitment to the LGBTQ+ community. Not only is Citi an active advocate for LGBTQ+ equality - most recently signing an amicus brief urging the Supreme Court to prohibit workplace discrimination on the basis of sexual orientation and gender identity in the U.S. and a letter to the Prime Minister advocating for trans equality in the U.K. - but we are committed to helping create an equitable and inclusive culture where we all recognize and respect how our identity affects our experiences. Also, for 16 consecutive years, Citi has received a perfect score on the Human Rights Campaign Foundation's Corporate Equality Index, a national survey that benchmarks corporate policies and practices for LGBTQ+ workplace equality.

Throughout the pandemic, Citi worked tirelessly to ensure that customers and small businesses felt confident that as an essential service, we were available to help them navigate this challenging time. To educate customers on the ease and convenience of digital banking, Citi introduced education campaigns, highlighting tools and capabilities available for customers to self-service as they complied with stay-at-home orders. By providing customers with quick links to set up online access, shortcuts to key digital tools and howto videos on key features, we issued a steady stream of communications reinforcing the quick, easy nature of digital banking. These communications were incredibly well received by our customers, and we saw significant digital adoption and engagement among clients. Since the onset of COVID-19, the percentage of Retail Bank accounts opened digitally has risen to nearly 60% globally as has the use of mobile check deposits in the U.S.

In December, Citi opened its largest global wealth hub in Singapore. Designed to enhance a visitor's connectivity to nature, the Citi Wealth Hub embodies biophilic design and is LEED certified.

In Wealth Management, we continued to enhance our capabilities and invest in our offerings and digital tools to meet a wider spectrum of customer needs.

In the U.S., we launched Citi Wealth Builder, an easy-to-use, low-cost digital investment platform targeted to Citi Priority (emerging affluent) and Citigold® (affluent) clients, and introduced Citigold Private Client, a value proposition for clients with a minimum of $1 million in assets under management. Together, Citigold and Citigold Private Client clients enjoy personalized wealth management services, including dedicated wealth teams, digital planning tools, fund access, and a range of exclusive privileges, preferred pricing and benefits to affluent clients around the globe.

In Asia, investment revenues were the highest in a decade, with record net new money driven by steadfast client engagement, remote advisory services and accelerated client adoption of digital platforms throughout the pandemic. We continued to enhance the client experience, opening our largest wealth hub globally in Singapore dedicated to Citigold and Citigold Private Client clients. With more than 30,000 square feet across four floors, the Citi Wealth Hub has over 30 client advisory rooms for clients to engage with Relationship Managers, access a team of specialists, and enjoy facilities for customized lifestyle events and investment seminars.

In Mexico, Citibanamex is one of the leading and historically significant financial institutions in the country, with top brand recognition, leading market share and an extensive retail branch network complemented by rapid digital and mobile user growth.

In 2020, in a first-of-its-kind partnership, Citibanamex teamed with PepsiCo Alimentos Mexico and Amigo PAQ to advance financial inclusion by enabling access to digital financial tools and lines of credit for shopkeepers to use the CoDi® electronic payment platform, offered by Banco de México, in the Transfer Citibanamex app. The partnership is poised to redefine the way in which collections and payments are made in Mexico for small and medium-sized companies, which represent about 50% of Mexico's gross domestic product.

CITI SUPPORTS U.S. SMALL BUSINESSES THROUGH THE PANDEMIC

Through our participation in the Small Business Administration's Paycheck Protection Program, one of the largest federal lending programs in history, we are proud to have served so many of our small business customers where and when they needed it most.

As a smaller lender to small businesses due to our light branch footprint, our service model has been built on individual relationships, pairing our clients with dedicated support from a tight-knit team of experts. Yet as the pandemic drove small businesses across the country to close their doors almost overnight, we wanted to do our part. That meant dramatically scaling up our capabilities to ensure we were ready to support a government-led response. The effort involved thousands of colleagues, from every area of the business, working around the clock to design, build, test, launch, scale and serve to help small businesses that were struggling to stay afloat. And as the data shows, we helped make a difference.

In 2020, Citi funded more than $3 billion in PPP loans to more than 30,000 businesses across the country that collectively employ more than 300,000 people. These loans, along with more than 4.5 million loans disbursed by thousands of our fellow lenders, have helped small businesses - the backbone of our economy - retain or rehire employees who may have lost their job in this crisis as economic activity slowed to contain the health crisis.

The makeup of Citi's PPP loan portfolio demonstrates the great need that our small business services customers had for this critical lifeline. Roughly 86% of Citi loans in this Small Business Administration program went to small businesses in the services sector, such as healthcare and professional services. With eight out of 10 U.S. jobs in services, the services sector is the lifeblood of the U.S. economy.

Services enable all economic sectors - from healthcare to manufacturing to agriculture - to be more productive, reach more consumers, and, ultimately, contribute to a better livelihood for Americans through job creation, higher wages and greater opportunities.

Similarly, Citi's PPP loans were concentrated in the markets where we have a branch footprint, including a high volume of loans in California, Florida, Illinois and New York, which were some of the states suffering most from the economic fallout. In fact, Citi's top sectors served - again based on total number of employees at the businesses that received loans - mirrored the hardest-hit sectors in the states where we funded the most loans. The correlation between where we made loans and the hardest-hit sectors occurred across each state where we had a significant number of PPP loans.

At its core, banking is about people and our dedication to enabling them to grow. Behind the numbers and statistics, there are stories - many of them moving - about the small business owners struggling to navigate a health and economic crisis unlike any we have seen before. To tell them, we created a video series with stories that span the country, found on the Citi Blog under "A Moving Year in Moving Pictures: A Small Business Video Series."

"When I reflect on the year," said David Chubak, Head of U.S. Retail Banking, "our all-out effort to support the Small Business Administration's PPP across the firm was one of the most meaningful highlights."

Institutional Clients Group

The Institutional Clients Group strives to be the best banking partner for our clients by offering a broad spectrum of wholesale banking products and services, driven by our unique global footprint. Working together, we provide innovative solutions to corporations, financial institutions, public sector entities, investment managers and ultra-high net worth clients.

Our network-driven strategy allows us to service those clients who value our unmatched country presence and who require a financial services partner that can help them grow in any country where they do business. This includes multinationals that are expanding globally, particularly in the emerging markets, and emerging markets companies that are growing beyond their home market or region.

With a physical presence in 96 countries, local trading desks in 77 markets and a custody network in 63 markets, we facilitate approximately $4 trillion in financial flows daily. We support 90% of Global Fortune 500 companies in their daily operations, helping them to hire, grow and succeed.

Citi’s Institutional Clients Group is uniquely positioned to take advantage of important, evolving global trends, including environmental, social and corporate governance (ESG), fintech, wellness and mobility. Our unmatched global footprint and innovative product set allow us to deliver responsible, objective advice and provide stellar execution to lead transformation for our clients.

Banking, Capital Markets and Advisory

Banking, Capital Markets and Advisory listens, collaborates and problem solves, working tirelessly on behalf of our corporate, financial institution, public sector and sponsor clients to deliver a range of strategic corporate finance and advisory solutions that meet their needs, no matter how complex.

Dedicating ourselves to these relationships and ensuring our client experience stands above all else, we leverage the breadth of our unmatched global network to provide debt capital raising, equity-related strategic financing, and merger and acquisition solutions, as well as issuer services. By serving these companies, we help them grow, creating jobs and economic value at home and in communities worldwide.

Following the market dislocation last spring, Citi was integral in reopening both the debt and equity markets, leading on several large transactions. In 2020, Citi led, as a bookrunning manager, over half of the record $1.7 trillion investment grade and $435 billion high-yield issuance volume. The issuance environment was very dynamic, with a rush to source liquidity during the first three months of the pandemic, turning to a more opportunistic and acquisition financing environment as the year progressed with markets steadily improving and ultimately rallying by year end. Citi was an early leader, providing significant balance sheet support for clients and guiding issuers that raised record amounts of liquidity from fixed income investors at the peak of the pandemic. As markets improved, Citi helped countless clients achieve record-low coupons. Citi served as a bookrunner on a number of landmark investment grade financings, including raising $25 billion in April for Boeing, $8.5 billion in March and $9.5 billion in April for ExxonMobil, $4.1 billion and €2.6 billion in September for Coca-Cola, and $8.9 billion secured financing in June for PG&E. Citi advised and executed on behalf of COVID-19-affected and opportunistic high-yield clients, including $8 billion in April for Ford, $4.7 billion in June for American Airlines, $2.0 billion in June for Occidental Petroleum and $2.8 billion in December for Community Health.

Citi acted as sole global coordinator and bookrunner on UEP Penonomé II's inaugural $262.7 million 144A/Reg S Green Notes offering in December, which refinanced initial construction financing for InterEnergy Group's 215-megawatt UEP Penonomé II wind project and its 40-megawatt Tecnisol solar project in Panama. The financing represents the first international green bond by a renewables portfolio under a project finance structure in Latin America, as well as the first private sector green bond in Central America and the Caribbean. The Notes' unique structure successfully monetized a five-year merchant tail post expiry of the power purchase agreements, thereby optimizing the projects' capital structure and operational flexibility, supported by their priority of dispatch as non-conventional renewables. Combined, UEP Penonomé II and Tecnisol are the largest non-conventional renewable energy producers in Panama and one of the largest diversified clean power companies in Central America.

In equity capital markets, historic volatility drove waves of equity issuance. Citi served as underwriter on a number of successful initial public offerings (IPO) in 2020, including Snowflake's $3.4 billion offering in September and Royalty Pharma's $2.2 billion IPO in June. We saw record issuance particularly in the special purpose acquisition company (SPAC) space, with nearly $100 billion issued in 2020. Most notably among 2020 SPACs was the $4.0 billion blank check company sponsored by Pershing Square Capital Management whereby Citi served as left lead on the transaction. In addition to being the largest SPAC raised globally, the transaction garnered significant praise for the use of minority broker-dealers as co-leads on the deal. Citi was left lead underwriter for both Dragoneer SPAC offerings for a combined total of $966 million and sole underwriter for the first ESG-linked SPAC in May. Citi was also selected as left lead for Shopify's two secondary equity offerings, including its $1.5 billion follow-on offering in May, representing the largest internet overnight follow-on to date.

Citi’s Global Mergers & Acquisitions Group advised on landmark transactions signed and negotiated during the peak of the COVID-19 crisis, demonstrating how our clients turn to us to provide trusted advice and to offer innovative strategic solutions. Citi advised Unilever on its transformational restructuring to create a simpler company with greater strategic flexibility and better positioning for future success. This transaction removes complexity and strengthens corporate governance by uniting its dual UK PLC and Dutch N.V. legal and listing structure resulting in a single parent company: Unilever PLC, which will have a market capitalization of approximately £110 billion. Citi was sole financial advisor to Telefóica on its joint venture with Liberty Global for its U.K. businesses (O2 and Virgin Media), valued at $38 billion. Citi served as a financial advisor to S&P Global on its announced merger with IHS Markit, an all-stock transaction implying an enterprise value for IHS Markit of $44 billion. This was one of the largest transactions of 2020, bringing together two world-class organizations with unique and highly complementary products and cuttingedge innovation and technology.

Citi Public Sector Group worked closely with governments and the public sector to find liquidity alternatives and advised on the issuance of social bonds to support countries in the emerging markets throughout the pandemic. In November, we announced our selection as financial advisor to Gavi, the Vaccine Alliance, for its COVAX Facility. In this capacity, a team consisting of more than two dozen senior bankers across multiple business units, spearheaded by the Public Sector Group, is providing Gavi with expert advice on structures to mitigate sovereign, credit and operational risk as the COVAX Facility seeks to facilitate pooled procurement and equitable distribution of safe and effective COVID-19 vaccines globally.

In addition, drawing on Citi's global reach with physical presence in nearly 100 countries and territories and the capability to serve nearly 60 additional countries, Citi's Corporate Bank served as a critical partner to large multinationals in COVID-19-affected industries throughout 2020, providing new lines of credit and shoring up balance sheets for many blue chip corporations. In 2020, Citi syndicated 500+ loans with volumes in excess of $895 billion.

Commercial Bank

Citi Commercial Bank puts 200 years of experience to work for midsized, globally oriented companies by delivering actionable insights and ideas, comprehensive banking solutions and a truly global network.

We provide high-quality financial advice, helping businesses prosper and grow in domestic markets, as well as internationally. Our distinctive approach puts the client at the center of everything we do. By understanding their industries and learning their business priorities, our Relationship Managers bring our clients insights designed to help them succeed. Whether providing capital to fund growth or refinancing debt, Citi Commercial Bank offers solutions that support the right capital structure to meet companies' short- and long-term financing needs. With the full spectrum of Citi's capabilities and access to our global network, we are able to deliver tailored solutions to meet our clients' unique goals and objectives.

In the past year, Citi Commercial Bank enhanced our core client and internal applications and significantly improved our processes, reducing client friction and digitizing more of the client experience. We continue our digital transformation with the redesign and expansion of CitiBusiness® Online features and a new Gateway portal in the U.S. for account onboarding, Know Your Customer and product setup activities and continued to build a world-class experience by facilitating a fully digital onboarding journey through Gateway and CitiDirect BE® Digital Onboarding.

Citi Commercial Bank worked together with the Global Consumer Bank in the U.S. to support clients adversely affected by the COVID-19 pandemic by providing loans and participating in the PPP programs administered by the U.S. government. We also participated in a number of other governmentsupported programs outside the U.S. and developed solutions to assist clients in need throughout the crisis.

Markets and Securities Services

Markets and Securities Services relies on global breadth and product depth to provide an enhanced client experience. Our sales and trading, distribution and research capabilities span a broad range of asset classes, providing customized solutions that support the diverse investment and transaction strategies of investors.

In 2020, Citi retained our ranking as the World's Largest Fixed Income Dealer for the fifth straight year, according to Greenwich Associates' Annual Benchmark Survey, which polled more than 3,500 fixed income investors around the world. Citi's leading market position is driven by our strength in both Rates and Emerging Markets, ranked #1, respectively, along with the top spot in Municipal Bonds. In addition to the distinction of being overall share leader, Citi ranked #1 in Overall Quality, Sales Quality, Trading Quality and e-Trading market penetration. Citi was also named Largest Affordable Housing Lender in the country for the 11th year in a row in Affordable Housing Finance magazine's annual survey of affordable housing lenders. Partnering with developers, nonprofits and local governments, Citi has helped create or preserve nearly 488,000 affordable housing units over the past decade. In 2020, Citi Community Capital, the bank unit through which Citi works to finance all types of affordable housing and community development projects, reported more than $7 billion of lending to finance affordable rental housing projects.

Citi closed a unique financing for 833 Bryant, a project designed to help confront the growing problem of homelessness. 833 Bryant Avenue will comprise 145 new permanent supportive affordable housing units in San Francisco to be built at a lower cost and on a faster delivery schedule than similar projects in the past. Citi played multiple roles in the effort: Low Income Housing Tax Credit investor; construction loan administrator; and Letter of Credit provider guaranteeing construction completion. In a departure from a typical 4% affordable housing project financing, we also structured and secured a rating for the tax-exempt private activity bonds that were publicly sold in the municipal bond market. The project is using modular construction, with units being built at Factory_OS in Vallejo, California, a new company in which Citi is an investor. Supportive services for the residents include intensive case management with ongoing, consistent tenant engagement that includes individualized health and wellness plans, eviction prevention, crisis intervention and on-site mental health services. (Photo credit: David Baker Architects)

Citi Velocity®, Citi's #1 ranked digital content platform for Institutional Clients, delivers electronic access to Citi's capital markets services across equities, futures, FX, emerging markets, rates, credit, commodities, securitized products, municipals, securities services and research spanning thousands of content creators and apps. Nearly 100,000 Institutional Clients spread over almost 150 countries use Citi Velocity on a regular basis across all asset classes. 2020 was the Citi Velocity platform's strongest year since its 2011 launch. In addition to pricing millions of derivative instruments and supporting half a billion data interactions, Citi Velocity made a big push into the audiovisual content and mobile space. We hosted 1,850 webcasts that were attended by more than 100,000 clients, an increase of 200% year-over-year. We produced over 3,100 videos and podcasts, 28% more than in prior years. The platform saw mobile growth soar 57%, while the number of unique client users grew 9%. While Citi Velocity was laser focused on being the best digital product for our clients, it was also used to offer clients and colleagues some respite from the year's events. Citi Velocity streamed two concert series in 2020, in partnership with the London Philharmonia, which became the most popular video content of the year.

In May 2020, Proxymity, a digital investor communications platform developed within Citi's Institutional Clients Group, was spun off into a standalone entity that raised $20.5 million in a strategic round of investment led by Citi Ventures, with participation from a global industry consortium. Proxymity's services include a digital, real-time and fully transparent proxy voting platform, providing post-meeting vote confirmation and giving investors up to nine additional days per meeting to research and vote. Proxymity also offers a shareholder disclosure platform that automates shareholder ID requests and eliminates the need for any manual handling. The idea for Proxymity was formulated in 2017 by two Markets and Securities Services colleagues as a way for issuers to better communicate with investors. As the idea for the platform evolved, D10X, an internal strategic growth model that enables employees to take new business ideas from concept to launch, helped Proxymity iterate and evaluate its vision to improve the proxy voting system. From there, the Citi Innovation Lab in Tel Aviv developed Proxymity into a market-ready offering in less than two years using a Lean team model and rapid, agile development. Citi is incredibly proud of what Proxymity has been able to achieve thus far and looks forward to continuing to support the platform as a member of the consortium.

In 2020, Citi entered into an alliance with BlackRock, through its Aladdin® business, to enhance the delivery of securities services to Citi's clients who use the Aladdin end-to-end investment management platform. Connecting to Aladdin Provider, Citi will provide outsourced middle-office services directly on a client's instance of Aladdin for seamless integration with the front office, from trade confirmation to post-settlement reconciliation. This agreement expands Citi's relationship with BlackRock, to whom we provide custody, accounting and/or fiduciary services for certain BlackRock funds domiciled in Hong Kong, Mexico and Colombia. In addition to funds managed by BlackRock, Citi provides custody services to many asset managers on the Aladdin platform. Joining the Aladdin Provider network will allow Citi to optimize our operating model to support not only BlackRock's asset management business but to provide an enhanced level of service to members of the broader Aladdin community.

Private Bank

The Private Bank is dedicated to helping the world's wealthiest individuals, families and law firms protect and responsibly grow their wealth.

From 50 locations worldwide, we serve more than 13,000 ultra-high net worth clients hailing from over 100 countries, including 25% of the world’s billionaires and more than 1,400 family offices. In 2020, total client business amounted to around $550 billion.

Our unique business model enables us to focus on fewer, larger and more sophisticated clients with an average net worth above $100 million. Clients enjoy a highly customized experience, with access to a comprehensive range of products and services spanning investments, banking, lending, custody, wealth planning, real estate, art, aircraft finance and lending, and more.

In everything we do, we emphasize personalized advice, competitive pricing and efficient execution. Citi Private Bank's close partnership with Citi's Institutional Clients Group means we can connect clients' businesses to banking, capital markets and advisory services, as well as to Citi's other institutional resources.

A growing number of our clients seek to align their investments with their personal values. Investing with Purpose is what we call our approach to sustainable and impactful investing. We help clients articulate their sustainability goals and objectives, provide them with comprehensive advice and offer in-house investment management that incorporates environmental, social and corporate governance principles. We also partner with third-party asset managers to deliver relevant themes and strategies.

In 2020, we transformed our flagship annual Family Office Leadership Program - often described by participants as "the Davos for family offices" - into a virtual summit. Sessions this year covered vital topics that include sustainable investing, advances in family healthcare practices, future of energy and the building of resilient families. Nearly 6,000 participants from 100+ countries took part in the program.

We also launched the Direct Private Investments business to identify opportunities for family offices and private investment company clients to actively invest in direct private deals.

Treasury and Trade Solutions

Treasury and Trade Solutions (TTS) provides integrated cash management, working capital and trade finance solutions to multinational corporations, financial institutions and public sector organizations around the globe. With the industry's most comprehensive suite of digitally enabled platforms, tools and analytics, TTS leads the way in delivering innovative and tailored solutions to clients. Based on the belief that client experience is the driver of sustainable differentiation, TTS has focused its efforts on transforming its business to deliver a seamless, end-toend client experience through digital capabilities, client advocacy, network management and service delivery across the entire organization.

Our digital transformation accelerated in 2020 with increased momentum in client engagement and digital adoption as evidenced by strong growth in CitiDirect BE® users, API volumes and digital account openings. Digital Onboarding is now live in 50 countries, and CitiDirect BE users were up 9% versus the prior year. Additionally, we delivered to the market 83 live APIs that collectively reached 1 billion API calls since inception.

Citi's digital channels remain pivotal in helping clients with operational resiliency while continuing to operate in remote or continuity-of-business modes. Digital Onboarding enabled clients around the world to set up accounts using eSignatures and overcome major obstacles due to the pandemic.

In 2020, as part of an effort to help to accelerate the global economic recovery, Citi joined CEMEX, Telefónica and 11 other companies and academic institutions to launch Restarting Together, a challenge that invited startups and small and medium-sized enterprises from across the world to find innovative projects to revamp our economies, enhance our cities and move society forward in response to the COVID-19 pandemic. The initiative was designed to contribute to a fast economic recovery and to create a more resilient society, as well as to reduce structural societal inequalities exacerbated by such crises.

More than 500 startups from 59 countries entered the challenge, and three winners were provided the opportunity to access mentoring and events, technology tools and acceleration services from the companies, including Citi, which supported the challenge. Restarting Together is an excellent representation of Citi's ongoing commitment to our mission of enabling growth and economic progress, as we seek to find new ways to solve problems.

With Instant Payments becoming a new norm, enabling our clients to disrupt their business model and shift toward a 24/7, always-on environment, we continue to invest in building a globally consistent Instant Payments proposition, having launched the capability in six additional markets in 2020, taking our global presence to 26 markets. Our global volumes have seen a growth of more than 70% year-over-year and are rapidly approaching the million daily transaction mark. With an ambitious road map to continue to expand our footprint and capabilities, we are very well positioned for another exciting and successful year in 2021.

In October 2020, in support of U.S.- based suppliers affected by COVID-19, we worked with the U.S. EXIM Bank to create facilities, including the guarantee of a $500 million facility by EXIM that allows Citi to finance accounts receivable from The Boeing Company to its U.S.-based suppliers. The agreement also includes the preliminary approval of a $327 million facility for the purchase of Boeing aircraft by Copa Airlines, exported from Renton, Washington.

Environmental, Social and Governance

Through our business, we address some of society's greatest challenges - an imperative stated in our mission and an idea that shapes our decisions every day. The need for action grew in urgency and scope in 2020 with the onset of the COVID-19 pandemic and a movement toward racial equity and systemic change in the U.S.

This section highlights our continued efforts as a bank, an employer and a philanthropist to address these societal issues and many others. Citi has the scale and capability to finance and support the institutions - governments, corporations, nonprofits and aid organizations - that can contribute to the future that we want and the future that our communities deserve.

In the midst of the global pandemic, we launched our new 2025 Sustainable Progress Strategy to address another global crisis: climate change. Our new strategy, which had been in the works well before COVID-19 began its catastrophic spread, is aimed at driving the transition to a sustainable, lowcarbon future in an environmentally responsible way that serves society's economic needs. COVID-19 became an accelerant for our work, illustrating the deep interconnections of systemic racism and societal, physical and environmental health.

Once a niche topic for investors, Environmental, Social and Governance (ESG) performance today is an essential part of our firm-wide strategy - deeply integrated into our business - and we continue to evolve our approach to managing ESG issues and opportunities.

Sustainable Growth and Climate Change

The climate crisis is one of the most critical challenges facing our global society and economy. The science is irrefutable, and the world's climate scientists agree that urgent action must be taken to address the current and potential impacts of climate change.

Since the onset of COVID-19, we have been continually reminded of the inextricable links between our health, economic success and the environment. Amid the pandemic, we launched our 2025 Sustainable Progress Strategy to accelerate our work in addressing the climate crisis, with the ambition to play a leading role in driving the transition to a low-carbon economy. As a global financial institution, we recognize the opportunity and obligation to drive capital to where it can have the most positive impact.

The core of our new five-year strategy consists of a commitment to finance and facilitate $250 billion in environmental projects and activities. This is an ambitious target that represents a commitment two-and-ahalf times larger than our prior goal, and which we aim to achieve in half the time. To support our $250 billion goal, we are financing activities in renewable energy, clean technology, water quality and conservation, sustainable transportation, green buildings and energy efficiency and have added circular economy and sustainable agriculture and land use as two additional areas under this goal.

Citi continues to be a leader in project finance, financing a number of infrastructure and renewable energy transactions. Citi acted as a mandated lead arranger for a $704 million financing package to develop the Highlander Solar Facility* in Spotsylvania County, Virginia. The Highlander Solar Facility was developed by sPower, which merged with AES’ clean energy business in early 2021. When completed, it will be the largest solar project in the eastern U.S., totaling 485 megawatts of power with alternating current of renewable power. Highlander Solar is strategically located approximately 50 miles from northern Virginia's Data Center Alley in the Dulles Technology Corridor, home to the world's largest concentration of data centers. Renewable energy generated by the facility will help blue chip technology companies, including Microsoft and Apple, with the significant electric load requirements of their data centers while advancing their corporate sustainability and climate change goals.

*The Highlander Solar Facility is also known as Spotsylvania Solar Energy Center.

We will continue to focus on helping our clients across all sectors in their transition, no matter where they are in their sustainability journey, to shift to more sustainable business models and practices that will advance our progress toward a low-carbon economy.

Another key aspect of enabling this transition is measuring, managing and reducing the climate risk and impact of our client portfolio, which is a key pillar of our 2025 Sustainable Progress Strategy. Citi has been a leader in climate assessment and disclosure in alignment with the Task Force on Climate-related Financial Disclosures recommendations and released our second comprehensive report in December 2020 detailing our progress. In addition to embedding this work across Citi, we're continuing to focus on industry collaboration to adopt new methodologies and analyze the climate risk associated with our client portfolio, such as the Paris Agreement Capital Transition Assessment and the Partnership for Carbon Accounting Financials.

Our new strategy also builds on our 20 years of experience measuring and reducing the environmental footprint of our own facilities and operations. As of the end of 2020, we achieved our goal of sourcing 100% renewable electricity to power our facilities globally, along with our third set of operational footprint goals. Looking ahead, we've launched our next set of goals focused on greenhouse gas emissions, energy, water and waste reduction targets and sustainable building solutions.

For more information on our sustainability efforts, please visit citi.com/citi/sustainability.

Financial Inclusion and Access to Capital

The past year has brought to the forefront the long-standing social, economic and racial inequities that have faced our communities. As a financial institution with a long history of commitments to support resilient and inclusive communities, we challenged ourselves to look at how we can do things differently.

Since the onset of COVID-19, we have been adjusting our approach to meet the immediate needs and challenges posed by the health crisis while staying focused on our longer-term strategic initiatives of increasing affordable housing, boosting minorityand women-owned businesses, and expanding financial inclusion globally.

By the end of 2020, Citi and Citi Foundation had committed more than $100 million in support of COVID-19-related community relief and economic recovery efforts globally. Funding was provided to support our most affected communities around the world, from food donations and housing stability loans to personal protective equipment and COVID-19 screening efforts. Our efforts were complemented by more than $2 million in contributions from our colleagues, which was matched by Citi for an additional $2 million through an employee donation program. Recognizing the disproportionate impact that COVID-19 has had on low-income communities and communities of color, Citi announced it would donate net profits from our participation in the U.S. Small Business Administration's Paycheck Protection Program to the Citi Foundation. The Foundation deployed $25 million of these proceeds to Community Development Financial Institutions across the U.S. to support small businesses and economically vulnerable households impacted by the pandemic. In 2021, the Foundation announced an additional $25 million investment to support small businesses owned by people of color.

As calls for racial justice intensified across the U.S., Citi launched Action for Racial Equity - a firm-wide commitment that includes more than $1 billion in strategic initiatives to help close the racial wealth gap and increase economic mobility. This initiative was launched in tandem with the release of a new Citi Global Perspectives & Solutions report, which showed that if the U.S. had closed critical racial gaps for Black Americans in wages, housing, education and investment 20 years ago, $16 trillion could have been added to the U.S. economy. To help close these gaps, we are focusing on providing greater access to banking and credit in communities of color, increasing investment in Black-owned businesses, expanding homeownership among Black Americans and advancing anti-racist practices in the financial services industry. Action for Racial Equity represents an unprecedented effort to leverage Citi's core business capabilities and the Citi Foundation's philanthropic efforts to change the way we operate and drive systemic change.

As part of our racial equity efforts, we allocated an additional $50 million to the Citi Impact Fund to exclusively support Black entrepreneurs. Since launching in early 2020, the Impact Fund has made investments in 11 companies - the majority of which were founded by women and/or people of color - that are addressing some of society’s biggest challenges.

Since 2007, Citi provided more than $1 billion in financial inclusion lending and supported nearly 4 million unbanked and underbanked small businesses in emerging markets, 3.5 million of which are owned by female entrepreneurs. Last year, we completed two transactions under Scaling Enterprise, a partnership launched with the U.S. International Development Finance Corporation and the Ford Foundation in 2019, through which we provide early-stage financing to companies that expand access to products and services for low-income individuals in emerging markets. For example, Citi disbursed a working capital facility to support Gradian Health Systems, a medical technology company that provides critical equipment to underserved hospitals and clinics across Africa.

Furthering the Citi Foundation's commitment to address youth unemployment, a persistent global issue exacerbated by the economic impacts of COVID-19, the Foundation expanded its Pathways to Progress job skills-building initiative in 2020.

Pathways to Progress aims to equip young people, particularly those from underserved communities, with the skills and resources they need to succeed in a rapidly changing economy. In addition, the expanded initiative includes a companywide commitment to provide 10,000 young adults with the opportunity to gain work experience at Citi and engage 10,000 Citi colleagues to volunteer their time and talent to serve as mentors, coaches and role models.

We have made it a priority to foster a culture of inclusion where the best people want to work, where people are promoted on their merits, where we value and demand respect for others, and where opportunities to develop are widely available to all.

Talent and Diversity

Four years ago, Citi was the first bank to disclose our adjusted pay results, and the following year we became one of the first companies to disclose our unadjusted or "raw" pay gap for both women and U.S. minorities. Our commitment to that transparency continues today.

These disclosures hold us accountable for the progress we want to make in being a diverse and inclusive company. They also send an important signal to our colleagues, clients and partners about how we are continuously working to get this right. We looked at both numbers again this year and found that, on an adjusted basis, women globally are paid on average more than 99% of what men are paid at Citi and that there is no statistically significant difference in adjusted compensation for U.S. minorities and non-minorities. Following our review, we made appropriate pay adjustments as part of this year's compensation cycle.

This year's raw gap analysis showed that the median pay for women globally is better than 74% of the median for men, up from 73% last year and 71% in 2018 and that the median pay for U.S. minorities is just under 94% of the median for non-minorities, which is similar to last year and up from 93% in 2018. Continuing to reduce our raw pay gap requires that we make progress on our representation goals - to increase representation at the Assistant Vice President (AVP) through Managing Director levels to at least 40% for women globally and 8% for Black employees in the U.S. by the end of 2021 - which we are committed to doing.

For our part, we're continuing to innovate how we recruit and develop talent and use data more effectively to help us increase diversity at more senior levels at Citi. We recently launched a firm-wide exercise where our 200+ leaders with representation goals on their scorecards are using data to understand where they have representation gaps in their hiring, promotions and retention. Diverse slates have been a critical component of our work. In 2021, we expanded our slate practice from at least one to at least two women or minorities in our interviews for U.S. hires and at least two women in our interviews for global hires.

We are expanding our group coaching program, Owning My Success, for top and emerging Black talent this year, extending the program from three to six months and offering it to all levels, including the Officer and AVP levels for the first time. In the first two years of the program, 150 Black colleagues have been a part of the program, participating in coaching and discussion on topics such as developing one's personal brand, networking and taking career risks. As part of the program, participants' managers engage in group coaching to help them support their Black direct reports and better understand their experiences.

Our philosophy is that every member of Citi's team is responsible for this progress in making Citi an even more inclusive and equitable workplace.

OUR ACTIONS SPEAK LOUDER THAN THESE WORDS.

Citi has a long-standing commitment to closing the racial wealth gap, and now with Action for Racial Equity, we have launched more than $1 billion in strategic initiatives to accelerate those efforts across our lines of business. These efforts will provide greater access to banking and credit in communities of color, increase investment in Black-owned businesses, expand homeownership among Black Americans and advance anti-racist practices in the financial services industry. That way communities of color can build a stronger economic presence and progress toward a future that we can all believe in.

Learn more about Citi's Action for Racial Equity at Citi.com/racialequity

© 2020 Citigroup Inc. All rights reserved. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

Stockholder Information

Citigroup common stock is listed on the NYSE under the ticker symbol "C." Citigroup preferred stock Series J and K are also listed on the NYSE.

Because Citigroup's common stock is listed on the NYSE, the Chief Executive Officer is required to make an annual certification to the NYSE stating that he was not aware of any violation by Citigroup of the corporate governance listing standards of the NYSE. The annual certification to that effect was made to the NYSE on May 14, 2020.

As of January 31, 2021, Citigroup had approximately 63,632 common stockholders of record. This figure does not represent the actual number of beneficial owners of common stock because shares are frequently held in "street name" by securities dealers and others for the benefit of individual owners who may vote the shares.

Transfer Agent

Stockholder address changes and inquiries regarding stock transfers, dividend replacement, 1099-DIV reporting and lost securities for common and preferred stock should be directed to:

Computershare

P.O. Box 505004

Louisville, KY 40233-5004

Telephone No. 781 575 4555

Toll-free No. 888 250 3985

E-mail address: shareholder@computershare.com

Web address: www.computershare.com/investor

Exchange Agent

Holders of Golden State Bancorp, Associates First Capital Corporation or Citicorp common stock should arrange to exchange their certificates by contacting:

Computershare

P.O. Box 505004

Louisville, KY 40233-5004

Telephone No. 781 575 4555

Toll-free No. 888 250 3985

E-mail address: shareholder@computershare.com

Web address: www.computershare.com/investor

On May 9, 2011, Citi effected a 1-for-10 reverse stock split. All Citi common stock certificates issued prior to that date must be exchanged for new certificates by contacting Computershare at the address noted above.

Citi's 2020 Form 10-K filed with the SEC, as well as other annual and quarterly reports, are available from Citi Document Services toll free at 877 936 2737 (outside the United States at 716 730 8055), by e-mailing a request to docserve@citi.com or by writing to:

Citi Document Services

540 Crosspoint Parkway

Getzville, NY 14068

Stockholder Inquiries

Information about Citi, including quarterly earnings releases and filings with the U.S. Securities and Exchange Commission, can be accessed via Citi's website at www.citigroup.com. Stockholder inquiries can also be directed by e-mail to shareholderrelations@citi.com

The cover and editorial section of this annual report are printed on McCoy, manufactured by Sappi North America with 10% recycled content and FSC®

Chain of Custody Certified. 100% of the electricity used to manufacture McCoy is Green-e® certified renewable energy.

The financial section of this annual report is printed on FSC® certified Accent Opaque from International Paper.

Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world

All advertising featured in this report ran in the U.S.

The cover and editorial section of this annual report are printed on McCoy, manufactured by Sappi North America with 10% recycled content and FSC®

Chain of Custody Certified. 100% of the electricity used to manufacture McCoy is Green-e® certified renewable energy.

The financial section of this annual report is printed on FSC® certified Accent Opaque from International Paper.

Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

Inside cover photo: Courtesy SOM © Magda Biernat Photography.