2019 Annual Report

Citi's Value Proposition

A Mission of Enabling Growth and Progress

What You Can Expect From Us & What We Expect From Ourselves

Citi's mission is to serve as a trusted partner to our clients by responsibly providing financial services that enable growth and economic progress. Our core activities are safeguarding assets, lending money, making payments and accessing the capital markets on behalf of our clients. We have 200 years of experience helping our clients meet the world's toughest challenges and embrace its greatest opportunities. We are Citi, the global bank — an institution connecting millions of people across hundreds of countries and cities.

We protect people's savings and help them make the purchases — from everyday transactions to buying a home — that improve the quality of their lives. We advise people on how to invest for future needs, such as their children's education and their own retirement, and help them buy securities such as stocks and bonds.

By lending to companies large and small, we help them grow, creating jobs and real economic value at home and in communities around the world. We provide financing and support to governments at all levels, so they can build sustainable infrastructure, such as housing, transportation, schools and other vital public works.

We work with companies to optimize their daily operations, whether they need working capital, to make payroll or export their goods overseas.

These capabilities create an obligation to act responsibly, do everything possible to create the best outcomes, and prudently manage risk. If we fall short, we will take decisive action and learn from our experience.

We strive to earn and maintain the public's trust by constantly adhering to the highest ethical standards. We ask our colleagues to ensure that their decisions pass three tests: they are in our clients' interests, create economic value, and are always systemically responsible. When we do these things well, we make a positive financial and social impact in the communities we serve and show what a global bank can do.

Financial Summary1

In billions of dollars, except per-share amounts, ratios and direct staff

| 2019 | 2018 | ||

|---|---|---|---|

| Global Consumer Banking Net Revenues | $33.0 | $32.3 | |

| Institutional Clients Group Net Revenues | 39.3 | 38.3 | |

| Corporate/Other Net Revenues | 2.0 | 2.2 | |

| Total Net Revenues | $74.3 | $72.9 | |

| Net Income | $19.4 | $18.0 | |

| Diluted EPS — Net Income | 8.04 | 6.68 | |

| Diluted EPS — Income from Continuing Operations | 8.04 | 6.69 | |

| Assets | $1,951 | $1,917 | |

| Deposits | 1,071 | 1,013 | |

| Citigroup Stockholders' Equity | 193 | 196 | |

| Basel III Ratios — Full Implementation1 | |||

| Common Equity Tier 1 Capital | 11.8% | 11.9% | |

| Tier 1 Capital | 13.4% | 13.5% | |

| Total Capital | 16.0% | 16.2% | |

| Supplementary Leverage | 6.2% | 6.4% | |

| Return on Assets | 0.98% | 0.94% | |

| Return on Common Equity | 10.3% | 9.4% | |

| Return on Tangible Common Equity | 12.1% | 11.0% | |

| Book Value per Share | $82.90 | $75.05 | |

| Tangible Book Value per Share | 70.39 | 63.79 | |

| Common Shares Outstanding (millions) | 2,114 | 2,369 | |

| Total Payout Ratio | 122% | 109 | |

| Market Capitalization | $169 | $123 | |

| Direct Staff (thousands) | 200 | 204 |

Letter to Shareholders

- Michael L. CorbatChief Executive Officer

Dear Fellow Shareholders:

In 2019, Citi delivered our most profitable year since 2006. The $19.4 billion we earned on $74.3 billion in revenues was $1.4 billion higher than in 2018. Our earnings per share of $8.04 were up more than 20% compared with the year before. We drove 4% underlying revenue growth across our Consumer and Institutional franchises.1 We have grown loans and deposits for 16 consecutive quarters.

We continued to make progress toward the financial targets we have laid out. We are on a path to return approximately $62 billion of capital to our shareholders, exceeding our commitment. To date, we have returned approximately $53 billion, including a portion of the roughly $22 billion we gained regulatory approval to return over the 2019 Comprehensive Capital Analysis and Review cycle. Most importantly, we closed out 2019 on a high note, with a Return on Tangible Common Equity of 12.1%, just above our 12% target and 120 basis points higher than in 2018.2

These results reflect how well our model can perform, even in an uncertain environment. Coming out of a tough fourth quarter of 2018 for the markets and our industry, we entered 2019 amid widespread predictions of a global recession and potential turn of the business cycle. Against that backdrop, the growth we drove came - as we said it would - from working collaboratively and creatively with clients to manage and grow their businesses in an increasingly complex environment characterized by trade routes shifting and supply chains realigning. We again proved the value of our global client network and unmatched ability to connect people and businesses to opportunities worldwide.

The year concluded with several economic storm clouds lifting. The U.S. and China signed a Phase 1 trade deal, the new United States-Mexico-Canada Agreement was ratified and Brexit was at last confirmed. At Citi, we emerged in a strong competitive position in terms of capital, liquidity, technology and, importantly, talent. Changes to my management team include a new President of Citi and CEO of Global Consumer Banking, Jane Fraser; a new CEO of our Institutional Clients Group, Paco Ybarra; a new CFO, Mark Mason; and new heads of our three regions. Our positive position across all of those areas permitted us to realize the benefits of investments we have made over the past several years in high-growth, high-return areas across the franchise. We also continued to invest in our infrastructure and culture of compliance and controls, in light of the enduring need to be an indisputably strong and stable institution.

In our Global Consumer Bank, we sustained momentum by generating 4% annual underlying revenue growth with contributions from all three regions: the U.S., Mexico and Asia.3 Since establishing a client-centric structure in our largest Consumer market, the U.S., our strategy of unifying Branded Cards and Retail Banking has yielded a steady stream of compelling new products and value propositions, from digital lending to flexible payments. We are targeting a significant opportunity to redefine scale not according to the traditional metrics of assets and footprint but with digitally driven experiences.

The strong revenue growth we saw in Branded Cards and $6 billion in U.S. digital deposit sales - five times that of the previous year - are signs that our integrated client-centric strategy is working. Two-thirds of our digital deposit sales came from outside our physical footprint, and half came from our card customers with no prior retail banking relationship with us. We also expanded our relationship with American Airlines to offer a new savings account designed to deepen relationships from cards-only customers to multi-relationship clients. And we announced a partnership with Google to explore launching a new checking account on Google Play in 2020, aimed at expanding the reach and breadth of our customer base. In Asia, we entered into new credit card partnerships with digital leaders Grab, Lazada and Indian e-commerce juggernaut Paytm. In Mexico, we continued to leverage Citibanamex's extraordinary prestige and leading market position to deliver double-digit growth in earnings before taxes even in a muted market environment.

Our Institutional Clients Group turned in an equally strong performance, driving balanced 4% underlying revenue growth across our franchise that serves corporate (including 90% of Fortune 500 firms), investor and government clients and ultra high net worth households and individuals.4 International Financing Review summed up the source of our market and wallet share gains when it named Citi 2019 Bank of the Year: "Citi is a truly global - and unique - corporate bank that joins the developed and developing world." Those connections run deep between our banking teams and clients and across products, sectors, markets and regions.

Our industry-leading Treasury and Trade Solutions (TTS) business is the backbone of our institutional franchise because our global client network makes Citi the first call to manage cash, process payments and create solutions to supply chain challenges and provides opportunities for clients in multiple markets and currencies. TTS has established itself within our firm and industry as a pioneer in steering the shift from analog to digital platforms and processes. In partnership with fintech firms, including Feedzai, HighRadius and Cachematrix, TTS is actively exploring artificial intelligence, machine learning and blockchain applications to automate cash management, foreign exchange and fraud protection to consolidate its position as the premier global commerce banking platform.

Our Markets and Securities Services business continues its strong performance having topped the Greenwich Associates' Global Fixed Income Dealer rankings for the fourth consecutive year. Securities Services grew deposit balances versus the prior year through new mandates and organic growth from existing clients. Citi Private Bank retained the award for the Best Global Private Bank from the Financial Times for the second year, finishing 2019 with year-over-year growth across product areas.

To enhance how we serve midsized companies that value our global reach, we realigned our organizational structure to have Citi Commercial Bank report into the Institutional Clients Group globally. This new alignment leverages the full breadth of solutions provided by our client network and gives us new opportunities to continue to build and develop our top talent.

CITIGROUP — KEY CAPITAL METRICS

2019 NET REVENUES1

A year after we aligned our structure to create a holistic client coverage model in the form of the unified Banking, Capital Markets and Advisory (BCMA) team, our share rose year-over-year across mergers and acquisitions (M&A) and equity and debt capital markets. Our increased share shows how we can deliver a full suite of services to clients who rely on us to sustain steady transactional flow. BCMA fulfilled its mandate by executing on an even higher share of the year's significant deals. We were financial advisor to U.S. biotech firm Celgene on its $96.8 billion merger with Bristol-Myers Squibb, the largest-ever healthcare M&A deal. We were lead financial advisor to Raytheon on its all-stock merger with United Technologies' aerospace unit. We also were joint global coordinator and bookrunner on Alibaba Group's nearly $13 billion secondary listing in Hong Kong, the largest global follow-on deal in the sector and a sign of confidence in an important hub for Citi, the region and the world.

In 2019, the expectations of consumer and institutional clients continued to converge. Both groups want simple, seamless experiences that are not just best of bank but best in life, prompting us to allocate substantial resources and mindshare to exceeding our clients' evolving expectations of engaging with Citi on their channel of choice.

Our strategy to capture the abundant opportunities inherent in this trend is threefold. First, we partner with startups that value our model, global client base and brand to test and deploy new technologies at scale. Second, we invest in firms with demonstrable growth potential and ability to create solutions that deliver real benefits to our firm and clients. And third, we develop proprietary solutions through our internal D10X incubation program and network of Innovation Labs. Regardless of source, our intent is the same: tapping technology to eliminate client pain points and frustrations, streamline our processes, and deliver holistic, integrated products and services to customers and clients of all sizes and sectors more seamlessly and efficiently than peers. That strategy is showing results, and Citi's digital leadership has been recognized in each region. Citi was named Best Digital Bank in Asia by Euromoney, Best Digital Bank in Mexico by Global Finance and the firm with the Most Desirable Mobile Banking Features in the U.S. by Business Insider Intelligence.

In August, when the Business Roundtable - an organization of CEOs of major U.S. companies, of which I am a member - announced a revised statement of purpose and principles for responsible firms, I found the lively debate that ensued healthy and reassuring, but for us at Citi, the approach is not new. The statement said simply that companies should take the interests of all stakeholders - including shareholders, colleagues, clients, suppliers and communities - into account when making decisions. With every action we take, we strive to demonstrate the value we contribute and the values we uphold. Ultimately, taking stakeholder interests into account benefits our shareholders. We have been on this journey for some time and welcome the actions companies are taking to hold themselves accountable to higher environmental, social and governance standards.

We also see this as a positive development because these expectations arise from the higher levels of trust and credibility businesses have built, notably with their own people. Research reveals that a global majority do not trust the media or government to do the right thing for them or for society. Still, three out of four believe their own employer will. As colleagues and clients want to work for, and do business with, companies that affirmatively reflect their own priorities and principles, more firms intent on attracting and retaining top talent are rising to the challenge.

As for Citi's concrete commitments, our businesses seek out opportunities to address challenges that impact our clients and communities. Our government clients around the world urgently need infrastructure. The G20 has estimated that nearly $100 trillion is needed for global infrastructure spending by 2040, but there is a spending gap of $18 trillion. Citi's Public Finance team is playing its part by financing, among other critical projects, the two largest airport public-private partnerships in U.S. history. We also financed the construction of new subway systems in Panama and Peru, helping two fast-growing metropolises in dynamic emerging economies reduce traffic and carbon emissions.

In the communities we serve, one particular infrastructure gap is increasingly pressing: affordable housing. As urban populations soar and cities become less affordable for many, what has long been an acute shortage is becoming a crisis. In 2019, Citi ranked first among U.S. financiers of affordable housing for the 10th year in a row. We financed over $6 billion worth of affordable rental housing projects. In partnership with developers, nonprofits and governments, our Citi Community Capital team has helped to create or preserve nearly 500,000 affordable units over the past decade.

We have been on the front lines and in charge of leading our industry with our sustainability strategy since joining the United Nations Environment Programme Finance Initiative in 1997 and co-founding the Equator Principles in 2003. That is the first framework developed by responsible financial institutions to assess and manage the environmental and social risks associated with project finance. Flash forward to September 2019 and Climate Week in New York: Citi was the only U.S. bank to sign on to the United Nations' Principles for Responsible Banking, joining a coalition of 130 global financial firms that have agreed to align their business practices related to climate risks and opportunities with the UN's Sustainable Development Goals and the Paris Agreement.

In 2013, Citi achieved our first 10-year $50 billion Environmental Finance Goal three years early, and in 2019, we exceeded our second 10-year $100 billion Environmental Finance Goal four years ahead of schedule. In 2019, we were a founding signatory of the Poseidon Principles, a voluntary framework aimed at reducing the carbon emissions of maritime shipping. We are also on track to achieve our goal of sourcing 100% renewable electricity across our global operations in 2020.

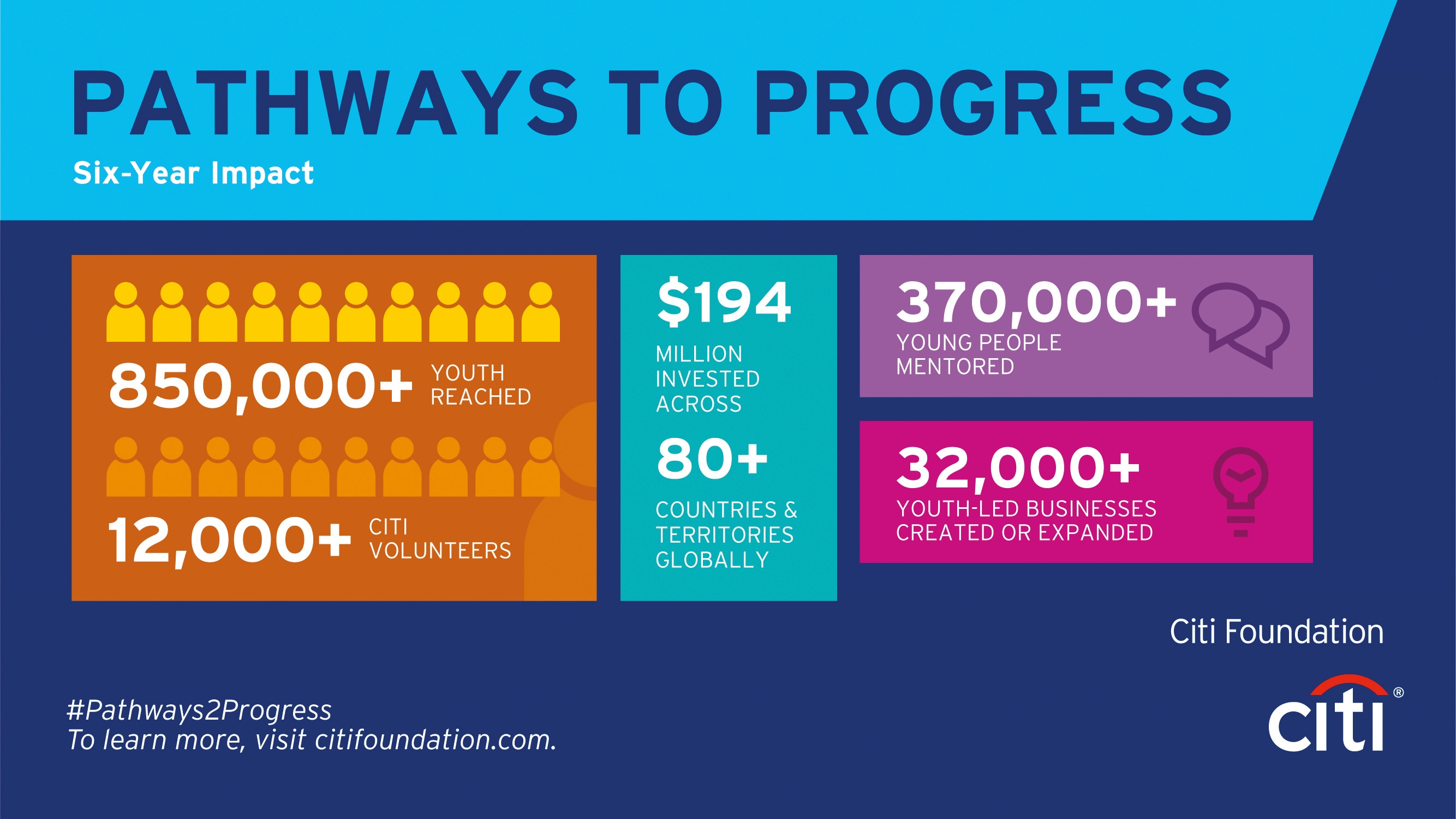

There are few areas where the gap between the scale of the need and of the progress to date is wider than in the field of inclusive finance. With the world's unbanked population estimated at 1.7 billion, our Inclusive Finance unit has worked with teams across our firm over the last decade to provide more than 3.3 million entrepreneurs, 3 million of them women, with access to capital and financial services in 34 countries in partnership with the U.S. International Development Finance Corporation, formerly OPIC. The Citibanamex Transfer account has attracted over 10 million customers, 80% formerly unbanked. The Citi Foundation's Pathways to Progress program, which started in 2014 in 10 cities and went global three years later, has helped prepare more than 850,000 youth for the jobs of today through paid internships, mentorship, workforce training and leadership development. We have invested over $194 million in this initiative to date and will soon be announcing its next stage.

The financial results we reported and the positive economic and social impact that we and our model have on our clients and communities have never been more closely connected. The Mission and Value Proposition at the front of this report describes not just what we do but how and why we do it. As we prepare to host our second Investor Day, in 2020, I have never felt better about our financial strength and competitive position, as measured by all the relevant metrics: revenues, returns, income and capital. I have also never felt better or more confident about who we are, what we stand for, and the lasting value of the many things we do for our clients, our communities, our shareholders, our people and all of our stakeholders worldwide. While there is no shortage of challenges ahead, I am confident in our ability to continue to rise and meet them.

Sincerely,

Michael L. Corbat

Chief Executive Officer, Citigroup Inc.

1 Excludes the impact of foreign exchange (FX) translation (constant dollars), as well as pretax gains on sale in 2018 of approximately $150 million on a Hilton portfolio sale in North America Global Consumer Banking (GCB) and approximately $250 million on an asset management business in Latin America GCB. For a reconciliation of revenues in constant dollars to reported results for Citi's consumer business (GCB) and institutional business (Institutional Clients Group), see Slide 31 of Citi's Fourth Quarter 2019 Earnings Review available on Citi's investor relations website. As used throughout, Citi's results of operations in constant dollars and excluding the gains on sale are non-GAAP financial measures.

2 Return on Tangible Common Equity (ROTCE) is a non-GAAP financial measure. ROTCE in 2018 excludes a one-time benefit of $94 million due to the finalization of the provisional component of the impact, based on Citi's analysis, as well as additional guidance received from the U.S. Treasury Department, related to the Tax Cuts and Jobs Act. For the components of the ROTCE calculation, see "Capital Resources—Tangible Common Equity, Book Value per Share, Tangible Book Value per Share and Returns on Equity" in Citi's 2019 Annual Report on Form 10-K included with this letter.

3 Excludes the impact of FX translation, as well as the gains on sale in North America GCB and Latin America GCB described in endnote 1. For a reconciliation of revenues in constant dollars to reported results, see the tables in "Global Consumer Banking—Latin America GCB" and "Global Consumer Banking—Asia GCB" in Citi's 2019 Annual Report on Form 10-K included with this letter.

4Excludes the impact of FX translation. For a reconciliation to reported results, see Slide 31 of Citi's Fourth Quarter 2019 Earnings Review available on Citi's investor relations website.

Global Consumer Banking

Citi's Global Consumer Bank (GCB), a global leader in banking, credit cards and wealth management, is a critical growth engine for Citi. With a strategic focus on the U.S., Mexico and Asia, the Global Consumer Bank serves more than 110 million clients in 19 markets.

In 2019, the Global Consumer Bank successfully executed its strategy to drive growth. It demonstrated the power and potential of its new, integrated client-centric operating model in the U.S., grew loans and deposits globally, introduced an array of industry-first digital capabilities and expanded its ecosystem of partners, one of the most powerful in the industry.

With the full power of the franchise together for the first time in GCB's largest market, U.S. Consumer Banking implemented a strategy to deepen relationships across Cards and Retail and provide seamless experiences to customers nationwide. Capitalizing on our distinct model, we launched an array of new products and digital capabilities, forged new and expanded partnerships, and introduced new value propositions to grow and retain multi-relationship clients.

Globally, we continued to introduce industry-leading digital capabilities, redesign the client experience, and embed our services in the most popular social and e-commerce platforms, enabling customers to bank anytime, anywhere, on their channel of choice. Clients and the industry took note. We generated double-digit growth in digital and mobile users globally, and client engagement and satisfaction meaningfully improved. Citi was recognized with a number of industry awards, including Best Digital Bank in Asia (Euromoney), Best Digital Bank in Mexico (Global Finance) and Most Desirable Mobile Banking Features in the U.S. (Business Insider Intelligence).

Importantly, Citi continued to execute strategic multi-year investments in key growth areas — U.S. Branded Cards, Mexico and Technology — to drive a superior experience for clients, enhance our infrastructure and controls, strengthen cybersecurity and deliver value for Citi shareholders.

GCB operates 2,348 branches and generated $7.4 billion in pre-tax earnings in 2019. At year-end 2019, the business had $291 billion in deposits, $300 billion in loans and $176 billion in assets under management.

The world's largest credit card issuer, Citi is a global leader in payments, with over 138 million accounts and $564 billion in annual purchase sales, and unrivaled partnerships with premier brands across Branded Cards and Retail Services. At year-end, card receivables were $175 billion.

Branded Cards

Branded Cards provides payment, credit and lending solutions to consumers and small businesses, with 55 million accounts globally. In 2019, Branded Cards generated annual purchase sales of $476 billion and ended the year with a loan portfolio of $122 billion.

Globally, we continued to strengthen our value propositions, expand co-brand partnerships, and provide new digital capabilities that make purchases faster, convenient and more rewarding.

In the U.S., we launched several new products to lay the foundation for a more integrated, multi-product relationship model. These included our new Rewards+SM card, a unique value proposition that provides cardmembers with the ability to earn more points on everyday purchases, as well as relationship-based offers that leverage our proprietary ThankYou® and Citi® Double Cash rewards products.

We expanded digital lending with two new solutions, Citi Flex Loan and Citi Flex Pay. Citi Flex Loan enables customers to convert a portion of their credit line into a fixed rate personal loan, while Citi Flex Pay enables customers to finance purchases by converting eligible purchases into a fixed payment plan. We continued to innovate and enhance our industry-leading ThankYou Rewards platform. We also enabled our real-time Pay with Points functionality.

To deepen relationships with existing cardmembers, we announced an expanded partnership with American Airlines. Our proprietary Citi Flex Pay capabilities will be available to our American Airlines co-brand cardholders, and our existing lending partnership will expand to include a deposit product, the Citi Miles AheadSM Savings Account, which will launch in 2020 to American Airlines co-brand cardholders who reside within the U.S. but outside locations in which Citi has a retail branch.

Internationally, we launched a suite of new products and digital capabilities. In Asia, we introduced co-brand and white label credit card partnerships with digital leaders, including Grab, Lazada and Paytm, with over 10 partnerships now live. We also launched an industry-first digital payment solution called Citi PayAll that enables cardmembers to settle big-ticket purchases in-app while earning rewards points. The feature launched in Hong Kong, Singapore, Thailand and the UAE. To date, nearly half of all credit card accounts and more than half of new loans in Asia are acquired digitally.

In Mexico, Citibanamex remains one of the leaders in the credit card segment, with strong market share, compelling reward programs, ThankYou® Rewards and Premia, as well as market-leading promotions, including more than 2,500 agreements with retailers and businesses.

Citi Entertainment®, the bank's award-winning global entertainment access program, and its live music platform, Citi Sound Vault, continued to provide cardmembers with exclusive access to extraordinary music experiences. In 2019, in partnership with Live Nation, Citi offered cardmembers access to more than 8,000 events with many of the world's biggest names in music.

Retail Services

Retail Services is one of North America's largest and most experienced retail credit solution providers of private label and co-brand credit cards for retailers. The business serves 83 million customer accounts for iconic brands, including Best Buy, L.L.Bean, Macy's, Exxon Mobil, Sears, Shell, Tractor Supply Company and The Home Depot.

In 2019, Retail Services continued to enhance value propositions, including partnering on new rewards benefits for Tractor Supply Personal Credit cardholders with a membership to the Neighbor's Club, the company's free loyalty program.

Retail Services generated purchase sales of $88 billion and ended the year with a loan portfolio of $53 billion.

Retail Banking

With a high-touch, segment-driven relationship model that serves clients across the full spectrum of consumer banking needs, Citibank serves as a trusted advisor to its retail, wealth management and small business clients at every stage of their financial journey.

Through Citibank, Citi Priority, Citigold and Citigold Private Client, we serve clients across the full spectrum of the wealth continuum so once they become a Citi customer, they can stay a Citi customer as their needs evolve.

In September, Citi CEO Michael Corbat officially marked the opening of Citi's new state-of-the-art operations site in Sioux Falls, extending a nearly four-decades-long commitment to South Dakota.

Mike was joined at the ribbon-cutting ceremony by South Dakota Lieutenant Governor Larry Rhoden; U.S. Senators John Thune and Mike Rounds; Sioux Falls Mayor Paul TenHaken; and U.S. Representative Dusty Johnson along with Citi colleagues, local business leaders and members of the community

At the event, Mike discussed the pride we feel in the role that Citi has played as a catalyst of growth in the city and shared how Citi's $72 million investment affirms our commitment to Sioux Falls and South Dakota.

Since 1981, when Citi opened a credit card operations center in Sioux Falls, the breadth of work has diversified, expanding to 22 business functions, including credit operations, technology, finance, treasury and transactions, and customer service.

The new building features open-concept working spaces to foster greater collaboration - a design Citi is using with its new buildings around the world. Additionally, the site has been certified with a LEED Gold designation from the U.S. Green Building Council, a testament to Citi's commitment to sustainability.

The modern four-story facility occupies 150,000 square feet on 19 acres in the southwest corridor of Sioux Falls. The new space features an abundance of natural light and panoramic views throughout the building, coupled with collaborative workspaces, new amenities and cutting-edge technology, making it a great place to come to work.

Citi has played an integral role in the Sioux Falls community, impacting a large number of nonprofit partners through Citi Foundation grants, investments, training, volunteerism and service.

Citi has a legacy of employee volunteerism and support for a number of nonprofit partners in Sioux Falls and South Dakota, including the Sioux Empire Housing Partnership, which helps families in South Dakota fulfill the dream of home ownership. As part of Citi's Pathways to Progress initiative, the Citi Foundation has invested in local organizations, expanding the skills of over 4,000 young people, and for more than a decade, Citi has partnered with the rural development organization Dakota Resources, which serves low-to-moderate income communities across the state.

In the U.S., Citi continued to evolve its retail bank model to drive national scale. In its six core strategic markets, Citi is a deposit leader, maintaining the highest average deposits per branch versus peers for the past six years. To deepen and acquire client relationships outside our branch footprint, we deployed a digitally led challenger strategy to drive incremental growth by leveraging the strength of our brand, the national scale and quality of our credit card franchise, and our leading wealth management capabilities.

New products were introduced for customers beyond our branch footprint, including Citi Accelerate Savings®, a digital high-yield savings account, and Citi ElevateSM Checking, a digital high-yield checking account. Digital deposit sales reached $6 billion in 2019, five times that of the prior year. To further drive national scale and embed our services on the platforms consumers use most, we announced our intent to explore providing checking accounts to consumers nationwide through Google Pay in 2020.

Across the U.S., Citi continued to advance financial inclusion and the economic strength and growth of communities. Citi's Access Account, a checkless bank account with no or low monthly fees, no overdraft fees, the ability to link to a savings account, and access to Citi's digital, retail and ATM channels, has been one of its fastest-growing products. Introduced in 2014, the account addresses the needs of a range of customers, particularly first-time and younger consumers, as well as often overlooked portions of the U.S. market, including low-income individuals, senior citizens and immigrants, by reducing the risks of overdrawn accounts and coinciding fees.

Through retail bank and small business credit card lending, as well as supply chain financing through its institutional bank, Citi invested more than $10.6 billion in small business lending in 2019, bringing its total for the decade to nearly $100 billion.

In Mortgage, having successfully transitioned direct servicing to Cenlar, Citi continued to intensify its focus on originations. Our mortgage business, which provides loans for home purchase and refinance transactions in the U.S., originated $16.9 billion in new loans in 2019.

Citi was proud to receive the #1 rating in customer satisfaction across the retail banking industry by the American Customer Satisfaction Index following being top rated among national banks in 2016 and 2017.

In Wealth Management, we continued to enhance our capabilities, investing in our offerings and digital tools to meet a wider spectrum of customer needs. Through Citi Priority, we serve the needs of emerging affluent clients. With Citigold and Citigold Private Client, we provide institutional-grade, personalized wealth management services, including dedicated wealth teams, digital planning tools, fund access, and a range of exclusive privileges, preferred pricing and benefits to affluent clients around the globe.

In 2019, Citibanamex showcased how an innovative financial inclusion effort is delivering on the firm's mission to enable growth and economic progress. In partnership with Banco de México, Mexican financial authorities and other banks, the innovative new electronic payments platform Cobro Digital, or CoDi, was launched.

CoDi will enable more than 5.5 million digital clients to transfer money and make payments of up to 8,000 pesos (US$400) per transaction with ease and at no cost using Quick Response(QR) codes.

At the announcement in Mexico City at its headquarters, the Palacio de los Condes de San Mateo de Valparaíso, Ernesto Torres Cantú, CEO of Citi Latin America, noted that "Citibanamex has consistently led and promoted the process of financial inclusion. More than 50% of the progress toward financial inclusion in this country in the past six years has been made through Citibanamex."

In a country where 80% of payments are made in cash and 40 million Mexican adults don't have a bank account, CoDi will change the way Mexicans transfer money and pay each other. Fundamentally, it aims to be a tool to help people improve their quality of life, leave cash behind and encourage financial inclusion.

CoDi is redefining the way charges and payments are made in Mexico - allowing monetary transactions to be more efficient and secure. The QR code, generated via Citibanamex Móvil and/or the Transfer app, can be read immediately, shared via text message or printed to facilitate payments for products or services. Users can perform these transactions directly from mobile phone to mobile phone. In addition, there will be lower commission costs, as well as a reduction in the use of cash.

The CoDi innovation has global consumer potential. The new platform is also simple and works with all smartphones, banks and telephone carriers.

The CoDi story goes beyond growth. It is a key example of how we are reinforcing our commitment to offer Mexico's best banking experience while driving financial inclusion and using new technologies to meet the expectations, needs and preferences of each of our clients.

In the U.S., we offered Citigold clients commission-free purchases on ETFs and enhanced digital planning capabilities with Citi® Wealth Advisor, a digital financial planning solution for creating custom financial plans focused on the needs and goals that matter most. For the third consecutive year, Citi was named the Best Bank for High Net Worth Families by Kiplinger.

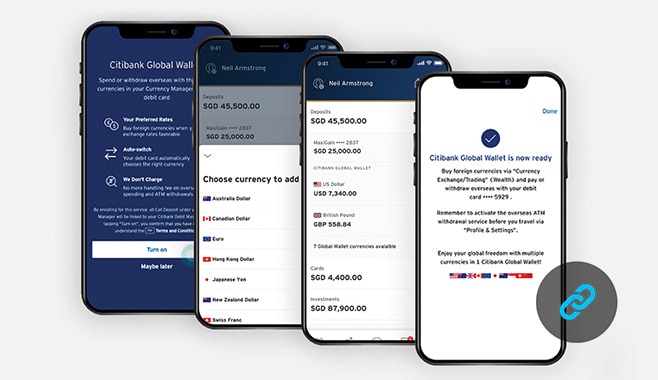

In Asia, we continued to enhance the client experience, unveiling a revitalized Citigold Private Client experience in China and launching Citibank Global Wallet in 13 markets, a market-first product that provides unrivaled convenience in foreign currency withdrawal and spending.

In Mexico, Citibanamex is one of the most well-regarded and historically significant financial institutions in the country, with top brand recognition, leading market share and an extensive retail branch network complemented by rapid digital and mobile user growth. In 2019, Citi continued to pace its strategic investments in technology, modernizing its branch and ATM network and digitizing its products and client base. Digital account opening was rolled out in branches across the country - a 12-minute experience from start to finish - while new, redesigned mobile app functionality is driving robust mobile user growth, up 50% for the year.

Institutional Clients Group

Citi's Institutional Clients Group (ICG) enables economic progress, growth and sustainability for our clients and for the world through our unparalleled global network.

The Institutional Clients Group includes five main business lines: Banking, Capital Markets and Advisory, Commercial Banking, Markets and Securities Services, Private Banking, and Treasury and Trade Solutions (TTS). Working together, we provide innovative solutions to meet the complex needs of corporations, financial institutions, public sector entities, investment managers and ultra high net worth clients.

With a physical presence in 98 countries, local trading desks in 77 markets and a custody network in 63 markets, we facilitate approximately $4 trillion in financial flows daily. We support 90% of Global Fortune 500 companies in their daily operations and help them to hire, grow and succeed.

Our network-driven strategy allows us to offer an integrated suite of wholesale banking products and services to clients who value our unmatched country presence and who require a financial services partner that can help them grow in any country where they do business. This includes multinationals that are expanding globally, particularly in the emerging markets, and emerging markets companies that are growing beyond their home market/region.

We are uniquely positioned to take advantage of important, evolving global trends, including mobility, fintech, wellness and sustainability; deliver responsible, objective advice; and provide stellar execution to lead transformation for our clients.

Banking, Capital Markets and Advisory

Banking, Capital Markets and Advisory listens, collaborates and problem solves, working tirelessly on behalf of our corporate, financial institution, public sector and sponsor clients to deliver a range of strategic corporate finance and advisory solutions that meet their needs, no matter how complex. Dedicating ourselves to these relationships and ensuring our client experience stands above all else, we leverage the breadth of our unmatched global network to provide debt capital raising, merger and acquisition (M&A), and equity-related strategic financing solutions, as well as issuer services. By serving these companies, we help them grow, creating jobs and economic value at home and in communities worldwide.

Citi executed several landmark underwriting and advisory transactions for clients in 2019. Citi acted as financial advisor and lead provider of committed financing to Occidental Petroleum Corporation on its acquisition of Anadarko Petroleum Corporation, a transaction valued at $57 billion that was the third largest energy acquisition globally and the largest in North America in the last 20 years. Its $21.8 billion bridge loan facility is the second largest in energy globally and the largest in North America. Citi served as Celgene Corporation's financial advisor on its announced merger with Bristol-Myers Squibb Company, creating a premier innovative biopharma company in the largest healthcare M&A transaction in history. Citi is serving as lead financial advisor to Raytheon on its all-stock merger with United Technologies' aerospace business. The transaction, which has a combined enterprise value greater than $155 billion, represents the largest aerospace and defense transaction in history. Citi is also serving as lead financial advisor to LVMH Moët Hennessy Louis Vuitton SE and is providing committed financing for its definitive agreement to acquire Tiffany & Co. in a $16.9 billion transaction, the largest luxury acquisition in history. This transaction is expected to close in mid-2020.

Citi was a joint global coordinator and joint bookrunner on Alibaba Group's $12.9 billion Hong Kong secondary listing, which was the largest global technology follow-on in history and the largest ever follow-on by a Chinese issuer. Citi acted as global coordinator, as well as sole financial advisor, debt structuring agent, hedging coordinator, documentation agent and facility agent on a €10.4 billion bridge facility package for CK Hutchison Group Telecom Holdings Limited (CKHGT) to support the creation of a new telecom holding company. Additionally, Citi acted as global coordinator and bookrunner on a €4.2 billion and £800 million bond offering for CKHGT. Citi also acted as global coordinator, bookrunner, mandated lead arranger and facility agent on the €4.2 billion dual-maturity term loan facilities and €360 million three-year revolving credit facility for CKHGT. Proceeds of the bond offering and term loan were used for repayment of the bridge facility.

Citi advised on a $20 billion three-part strategic liability management transaction for Petróleos Mexicanos (Pemex). Citi acted as a joint lead manager and joint bookrunner on a $7.5 billion offering of senior unsecured bonds to refinance short-term debt, joint dealer manager on Pemex's $7.2 billion dual Exchange Offers, and joint dealer manager on Pemex's $5 billion cash tender offer. Citi also structured a convertible equity portfolio financing solution for NextEra Energy Partners (NEP) and KKR to fund a renewables portfolio, a unique structure that met the strategic, corporate finance and return objectives of both clients. Under the agreement, KKR will acquire an equity interest in structured partnership with NEP that owns a geographically diverse portfolio of 10 utility-scale wind and solar projects across the United States, collectively consisting of approximately 1,192 megawatts.

Citi provided the $116 million affordable housing construction loan and $12.5 million permanent loan for the 14-story, 407-unit development serving people with disabilities and/or mental illness who have experienced homelessness, as well as families and veterans overcoming homelessness.

Markets and Securities Services

Markets and Securities Services relies on global breadth and product depth to provide an enhanced client experience. Our sales and trading, distribution and research capabilities span a broad range of asset classes, providing customized solutions that support the diverse investment and transaction strategies of investors and intermediaries worldwide.

We further streamlined our Markets operating model to drive better client service in 2019, combining FXLM and G10 Rates to create a single Rates and Currencies business line. As our clients continued to evolve and require a broad range of services, we also announced the formation of Equities and Securities Services, an integrated offering supporting the pre-trade, execution and post-trade requirements of our clients. This includes broad trading and execution capabilities for electronic and complex structured products, financing and hedging solutions, and clearing, custody and funds services.

Our digital channel, Citi VelocitySM, gives unprecedented access to capital markets intelligence and execution. More than 87,000 client users in 160 countries count on our #1 ranked platform to help them navigate markets and make trading decisions. Through our web, mobile and trading applications, clients can find proprietary data and analytics, Citi research and market commentary, access to fast, seamless and stable execution for foreign exchange (FX) and rates trades, and a suite of sophisticated post-trade analysis tools. Citi Velocity's API Marketplace gives clients unparalleled access to Citi's extensive proprietary data and content library.

Last year, we continued our support of the communities in which we live and work. Our annual e for Education campaign raised $8.15 million in 2019 to benefit education-focused nonprofits. Since its inception in 2013, the global philanthropic initiative has raised more than $37 million to help tackle childhood illiteracy and improve access to quality education. Throughout the nine-week campaign, our Foreign Exchange business donated $1 for every $1 million traded on its electronic platforms, including Citi Velocity, Citi's flagship trading platform for institutional clients, and CitiFX Pulse for corporate and custody clients. This year, Citi has expanded the campaign to include a broader range of electronically traded products, including local market bonds and futures and cash equities.

We retained our ranking as the world's largest fixed income dealer, according to Greenwich Associates' annual benchmark study, which marks the fourth year running that Citi has secured the top spot. We ranked #1 in sales quality and trading quality, as well as #1 in e-trading.

Citi Private Bank

The Private Bank is dedicated to helping the world's wealthiest individuals, families and law firms protect and responsibly grow their wealth. Our unique business model enables us to focus on fewer, larger and more sophisticated clients who have an average net worth above $100 million. Clients enjoy a highly customized experience, with access to a comprehensive range of products and services spanning investments, banking, lending, custody, wealth planning, real estate, art, aircraft finance and lending, and more.

In everything we do, we emphasize personalized advice, competitive pricing and efficient execution. As part of ICG, the Private Bank is able to connect clients' businesses to banking, capital markets and advisory services, as well as to Citi's other institutional resources.

Because our clients are increasingly global in their presence and in their financial needs, our unrivaled Global Client Service enables them to have dedicated local bankers in as many regions of the world as they require. They are, therefore, able to enjoy seamless, cross-border service from a worldwide team working together as one.

A growing number of our clients seek to align their investments with their personal values. Investing with Purpose is our philosophy and methodology for sustainable and impactful investing. We help clients articulate their Investing with Purpose goals and objectives, provide them with comprehensive advice and offer in-house investment management that incorporates environmental, social and governance principals, as well as partner with asset managers to deliver relevant themes and strategies.

Our offering is continuously evolving in order to address and anticipate our clients' changing needs. Included among our latest evolutions is the Private Capital Group, serving 1,400 family-owned businesses, family offices and private capital firms in 75 countries. We have extensive experience with the challenges that families and their Family Office executives regularly face, and we address their needs by combining the personalized service of a private bank with sophisticated cross-border strategies that are typically reserved for major institutions.

We are committed to helping our clients preserve their wealth for themselves, for their families and for future generations. As well as working with their other advisors to create appropriate structures and strategies, we help prepare their heirs for future responsibilities as wealth owners and leaders of the family business.

Treasury and Trade Solutions

Treasury and Trade Solutions provides integrated cash management, working capital and trade finance solutions to multinational corporations, financial institutions and public sector organizations around the globe. With the industry's most comprehensive suite of digitally enabled platforms, tools and analytics, TTS leads the way in delivering innovative and tailored solutions to its clients. Specific offerings include payments and receivables, liquidity management and investment services, commercial card programs, and trade services and trade finance. Based on the belief that client experience is the driver of sustainable differentiation, TTS has focused its efforts on transforming its business to deliver a seamless, end-to-end client experience through the development of its capabilities, client advocacy, network management and service delivery across the entire organization.

TTS continues its pursuit of delivering the best possible experience to its clients, launching leading-edge solutions and leveraging co-creation sessions held in the Innovation Labs, which in 2019 celebrated its 10th anniversary. The team's success is based on the foundation of the industry's largest proprietary network, with banking licenses in 98 countries and globally integrated technology platforms. In 2019, Euromoney magazine named TTS the World's Best Bank for Transaction Services in its annual Awards for Excellence.

TTS continues to transform itself to be the financial platform for global commerce. Digital technology is driving change across the industry, and Citi is adapting by migrating our capabilities to a digital platform. In 2019, digital onboarding went live in 25 countries - covering 58% of our global volumes. And we took our advisory dialogue with clients to new levels to help them accelerate their transformational journey to a new digital decade. Since the inception of digital onboarding, we have led over 3,000 advisory sessions with clients across our Digital Advisory, Treasury Diagnostics and Innovation Lab practices to help them grow, improve risk controls and enhance financial returns.

CitiConnect®, our API connectivity platform, reached a new milestone with more than 157 million API calls processed by clients in 2019, compared with 18 million in 2018, representing a growth rate of 750%. Core to our drive to digital is implementing a strategy where we combine our proprietary solutions and partner with fintech companies like HighRadius and Cachematrix, and key industry players like PayPal, making the services available on our industry-leading global network.

In 2019, we launched many innovative services for our clients, including Citi®'s Payment Outlier Detection in 90 countries, with advanced analytics, artificial intelligence and machine learning to help proactively identify outlier payments; and Cross-Currency Sweeps, a liquidity management solution that aggregates foreign currency balances into a currency and account of choice. We provided clients with an enhanced Supplier Finance offering, now with WorldLink® Payment Services, giving our clients access to the combined strength of two powerful platforms. We also introduced Citi® Global Collect, a collaboration between our TTS and Foreign Exchange businesses -a new cross-border platform to help clients manage collecting cross-border business-tobusiness payments by digitizing the transaction process and embedding FX capabilities.

ICG Recognition

- Citi retained its ranking as the world's largest fixed income dealer, according to Greenwich Associates' annual benchmark study, which marks the fourth year running that Citi has secured the top spot. Citi also ranked #1 in sales quality and trading quality, as well as #1 in e-trading, and was #1 overall in U.S. fixed income market share. CitiDirect BE® was ranked #1 by Greenwich Associates' digital banking benchmark study, claiming the top rank for the 13th consecutive year.

- In addition to being named International Financing Review's Bank of the Year, Citi was awarded the Best Global Bank for Governments and was named Global Equity Derivatives House, Global Emerging Markets Bond House and EMEA Bond House of the Year.

- Citi was awarded the Financial Times' The Banker and PWM Global Private Banking awards for Best Global Private Bank and Best Private Bank for Customer Service. Additionally, we won Best Global Private Bank for Global Families and Family Offices. The Private Bank was also named Best Private Bank for Net Worth of US$25 million or more by Global Finance.

- Global Finance named Citi Best Global Transaction Bank, Best Global Bank for Cash Management, Best Global Mobile Cash Management Solution and Best Online Cash Management in Asia. Additionally, Citi was named Best Bank for Cash Management and Liquidity Management in Latin America, as well as Best Bank for Payments and Collections in both Latin America and North America. Citi was also honored as Best Investment Bank for New Financial Technology Globally and in North America, as well as Best Private Bank in North America. Global Finance also bestowed several trade finance awards upon Citi, including Best Bank for Trade Finance in Frontier Markets and Best in North America and the United States.

- Citi earned top honors from Euromoney as the World's Best Bank for Corporates and Best Bank for Transaction Services Globally and in Asia. Euromoney also named Citi Central and Eastern Europe's Best Investment Bank.

- Celent awarded Citi its Model Bank of the Year award, reflecting our ongoing efforts to drive transformational innovation and digitization.

- Citi was named Derivatives Clearing Bank of the Year by GlobalCapital for the sixth straight year.

- Citi maintained top position as the largest affordable housing lender in the United States, according to Affordable Housing Finance magazine's annual survey of affordable housing lenders. This marked the 10th consecutive year that Citi has earned this distinction.

- Citi ranked #1 in Web Based Analytics and #3 Overall in the Institutional Investor inaugural Global Fixed Income Research Poll. In 2019, Citi was a leader in Institutional Investor's ranking of global equity firms coming in at second place, an increase of two spots from the previous year.

- Citi received a number of regional accolades, including Best Bank in Asia from CorporateTreasurer magazine, Best Bank for Emerging European, Middle Eastern and African Currencies from FX Week, and ABS Bank of the Year from GlobalCapital as part of its European Securitization Awards.

- Citi was named Most Innovative Investment Bank for Equity-Linked Products from The Banker.

Environmental, Social and Governance: Citi as a Corporate Citizen

Citi, as a global bank, employer and philanthropist, is focused on catalyzing sustainable growth through transparency, innovation and market-based solutions.

From climate change to social inequality to financial inclusion, there are numerous challenges facing society today. Citi is committed to contributing to solutions that address these issues. We collaborate both internally across our business units and externally with stakeholders to maximize our impact. We continue to learn from our experience and to bring diverse stakeholders to the table to help us understand what leadership looks like on these evolving issues.

Citi has the scale and capabilities to finance and support the institutions - governments, corporations, nonprofits and aid organizations - that can contribute to the future that we want and the future that our communities deserve.

This section of the report is not intended to be a comprehensive collection of our efforts but rather a sample of highlights to demonstrate how we deploy our products, people and financial resources to help build more inclusive, resilient and sustainable communities. Issues core to our environmental, social and governance efforts include:

Sustainable Growth and Climate Change

The impacts of climate change are becoming increasingly clear - not just the physical effects of a warming planet as it threatens communities and reshapes urban infrastructure but also the economic impacts as every sector examines its material risks and opportunities associated with these changes.

In 2015, as part of the launch of Citi's Sustainable Progress strategy, we made a bold, 10-year commitment, our $100 Billion Environmental Finance Goal, to help reduce the impacts of climate change through environmental finance activities around the world. In 2019, we exceeded our $100 billion goal, more than four years ahead of schedule, thanks to increasing focus on the need to solve the problem, growth in environmental finance activity in the global market, and the development of new and innovative financial products such as lending linked to key environmental, social and governance indicators. We have also achieved our environmental footprint goals and are on track to achieve our 100% renewable energy goal in 2020.

The $100 billion target we have just completed was only one step in a long journey - a marker on a path rather than an end goal. We have made significant commitments in support of a sustainable, low-carbon economy and are on the record for our strong support of the Paris Agreement. We have also been recognized as a leader in climate risk assessment and disclosure and were the first major U.S. bank to publish a Task Force on Climate-related Financial Disclosures report in 2018.

The science is clear: climate change is a monumental challenge, and we need to move toward a low-carbon global economy. While scaling financial flows to low-carbon solutions is a critical aspect of the transition, we also need a more holistic approach that supports the transition of existing carbon-intensive sectors. In addition to helping clients realize the opportunities inherent in transitioning to a low-carbon economy, we are conducting sophisticated analyses of the risks associated with our own and our clients' exposure to a variety of transition scenarios. We are also assessing our exposure to climate hazards to inform business continuity and resilience planning.

As we look ahead toward our new Sustainable Progress 2025 strategy, we look forward to continuing to collaborate with our clients on climate finance opportunities, as well as to better understand the challenges that need to be addressed by Citi, and the financial sector overall, in order to drive positive change.

For more information on our sustainability efforts, please visit citi.com/citi/sustainability.

Financial Capability and Access to Capital

Citi is committed to developing financial solutions that are safe, transparent and accessible - ones that provide real economic value, including for those whose financial needs are currently unmet. This year, Citi is on track to reach a major milestone - $1 billion in lending toward financial inclusion across the globe. We seek out innovative partnerships with financial institutions, telecommunications and fintech providers, government agencies, consumer goods companies and others that have close relationships with the unbanked and the underserved segments of society. Our partners are trusted leaders in their sectors who understand the needs of their local markets.

$100 Billion Environmental Finance Goal: Financial Highlights, 2014–2019

One example of these efforts is Scaling Enterprise, a $100 million loan guarantee facility launched by Citi, the U.S. International Development Finance Corporation (DFC) (formerly OPIC) and the Ford Foundation in 2019. Through this facility, we are able to provide earlier-stage financing in local currency to companies that expand access to products and services for low-income communities in emerging markets. Loans and working capital in local currency and at affordable rates can enable innovative social impact companies to achieve scale, greater efficiencies and lower costs. Scaling Enterprise will facilitate vital growth financing to companies that are expanding access to finance, agriculture, energy, affordable housing, water and sanitation to low-income households in emerging markets. In the first two transactions under Scaling Enterprise, the partners have committed $5 million in financing to InI Farms to help smallholder banana and pomegranate farmers in India access export markets and increase incomes by up to 20%, as well as $5 million in financing to d.light to expand access to off-grid solar energy in Kenya.

Citi has also partnered with the U.S. International Development Finance Corporation to expand microfinance loans to women in emerging markets around the world. In 2019, we committed to work with the DFC, the U.S. Agency for International Development and private sector partners to mobilize an additional $500 million for women in Latin America. In Tunisia, we recently announced the launch of a $10 million loan guarantee facility, which will provide growth financing to more than 17,000 microentrepreneurs, approximately 65% of them women. And in Jordan, Citi provided $5 million to Microfund for Women, which will now be able to give loans to an additional 10,000 underserved Jordanian women.

We recently launched a $150 million Citi Impact Fund to invest our own capital in U.S.-based companies that are applying innovative solutions to help address four societal challenges: workforce development; sustainability; financial capability; and physical and social infrastructure. We are also actively seeking opportunities to invest in businesses that are led or owned by women and minority entrepreneurs. This work complements our existing environmental, social and governance efforts and aims to highlight the ability to achieve financial returns while also making a positive societal impact.

The Future of Work

According to the U.S. Department of Labor, there are 7 million jobs at any one time that employers can't fill. Our Pathways to Progress initiative is designed to help close this jobskills mismatch by providing young people with the tools they need through training, work experience and entrepreneurial opportunities.

Since 2014, the Citi Foundation has invested more than $194 million to impact the lives of youth globally. This support has enabled community organizations and municipal leaders to connect more than 850,000 young people around the world to jobs, paid internships, mentorship, workforce training and leadership development. And these efforts have leveraged the time and talent of thousands of Citi employee volunteers.

We continue to believe that empowering young people, providing early work experience and financial knowledge, incubating an entrepreneurial mindset, and creating networks and access to role models are each integral to enabling youth to build a stronger future for themselves, their families and their communities. As we look ahead, we remain committed to tackling the youth unemployment challenge.

The Citi Foundation will reaffirm its philanthropic commitment, and we will complement these investments with youth-focused efforts happening across Citi, including programs that are helping us build a more diverse talent pipeline while also preparing the next generation for today's workforce.

"When we set our business priorities, we focus heavily on the balance of our business - the importance of not being overly reliant on any one product or geography and the benefits of that diversification to strong and consistent financial performance. We think about our people in much the same way. To be a healthy, high-performing organization, we need a well-balanced team that is representative of the places where we operate, in every part of the world. It's simply smart business."— Michael L. Corbat, CEO

Talent and Diversity

At Citi, we actively seek diverse perspectives at all levels of our organization because we know that it will improve performance and boost innovation. Over the last two years, we have elevated the conversation around race, gender and equal pay for equal work. Our increased transparency, which in turn breeds accountability and credibility, is a force for change both inside and outside our company. We've pushed ourselves beyond our comfort zone - not just to acknowledge the stark realities laid bare in the statistics around pay equity but also to recognize the social and cultural forces that produced them. We are being open about our data, what it means and what needs to be done to meet our goals.

In 2019, we made a decision to be transparent about a statistic that our CEO has described as "disappointing" and "ugly": our unadjusted or "raw" pay gap for women and U.S. minorities. The analysis showed that Citi's median pay for women globally was 71% of the median for men and that the median pay for U.S. minorities was 93% of the median for non-minorities. For our company, the data reaffirm the importance of goals we announced in 2018 to increase our representation of women and U.S. minorities in senior and higher paying roles at Citi. We know that is the only effective way for us to meaningfully reduce our raw pay gap over time. We also disclosed that on an adjusted basis, women globally are paid on average 99% of what men are paid at Citi. We also repeated the assessment for U.S. minorities and are pleased that after actions in 2018, there was no statistically significant difference between what U.S. minorities and non-minorities are paid at Citi. Following our review, we once again made appropriate pay adjustments as part of the 2019 compensation cycle. While we recognize that we have much more to do, we are proud of where we are headed.

We know that engagement with our people throughout their career paths at Citi, along with a commitment to being a company with values that they can be proud of, is essential to our success. We are innovating how we engage with, recruit and develop talent; we are using data more effectively to pinpoint our challenges and areas of opportunity for improvement; and we have increased accountability for our representation goals among people managers. In 2019, we built out our predictive analytics team to help us better understand how we attract, retain and promote top talent.

Citi is a proud partner of the International Paralympic Committee. For more information on the partnership visit citi.com/IPC.

© 2020 Citigroup Inc. All rights reserved. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

Stockholder Information

Citigroup common stock is listed on the NYSE under the ticker symbol "C." Citigroup preferred stock Series J, K and S are also listed on the NYSE.

Because Citigroup's common stock is listed on the NYSE, the Chief Executive Officer is required to make an annual certification to the NYSE stating that he was not aware of any violation by Citigroup of the corporate governance listing standards of the NYSE. The annual certification to that effect was made to the NYSE on May 13, 2019.

As of January 31, 2020, Citigroup had approximately 66,990 common stockholders of record. This figure does not represent the actual number of beneficial owners of common stock because shares are frequently held in "street name" by securities dealers and others for the benefit of individual owners who may vote the shares.

Transfer Agent

Stockholder address changes and inquiries regarding stock transfers, dividend replacement, 1099-DIV reporting and lost securities for common and preferred stock should be directed to:

Computershare

P.O. Box 505004

Louisville, KY 40233-5004

Telephone No. 781 575 4555

Toll-free No. 888 250 3985

E-mail address: shareholder@computershare.com

Web address: www.computershare.com/investor

Exchange Agent

Holders of Golden State Bancorp, Associates First Capital Corporation or Citicorp common stock should arrange to exchange their certificates by contacting:

Computershare

P.O. Box 505004

Louisville, KY 40233-5004

Telephone No. 781 575 4555

Toll-free No. 888 250 3985

E-mail address: shareholder@computershare.com

Web address: www.computershare.com/investor

On May 9, 2011, Citi effected a 1-for-10 reverse stock split. All Citi common stock certificates issued prior to that date must be exchanged for new certificates by contacting Computershare at the address noted above.

Citi's 2019 Form 10-K filed with the SEC, as well as other annual and quarterly reports, are available from Citi Document Services toll free at 877 936 2737 (outside the United States at 716 730 8055), by e-mailing a request to docserve@citi.com or by writing to:

Citi Document Services

540 Crosspoint Parkway

Getzville, NY 14068

Stockholder Inquiries

Information about Citi, including quarterly earnings releases and filings with the U.S. Securities and Exchange Commission, can be accessed via Citi's website at www.citigroup.com. Stockholder inquiries can also be directed by e-mail to shareholderrelations@citi.com

The cover and editorial section of this annual report are printed on McCoy, manufactured by Sappi North America with 10% recycled content and FSC®

Chain of Custody Certified. 100% of the electricity used to manufacture McCoy is Green-e® certified renewable energy.

The financial section of this annual report is printed on FSC® certified Accent Opaque from International Paper.

Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world

All advertising featured in this report ran in the U.S.

The cover and editorial section of this annual report are printed on McCoy, manufactured by Sappi North America with 10% recycled content and FSC®

Chain of Custody Certified. 100% of the electricity used to manufacture McCoy is Green-e® certified renewable energy.

The financial section of this annual report is printed on FSC® certified Accent Opaque from International Paper.

Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

Cover photo: U.S. wind and solar project owned by NextEra Energy Partners, LP and KKR. Financed by Citi.