Real-Time Receivables: Why Instant Payments for Collections are the Next Big Thing

Instant payments have revolutionized payments in recent years. Today, over 90% of the world’s markets, as measured in GDP, are covered by instant payments schemes1. With key value add services emerging in more markets, innovative solutions that support instant collection are providing corporates with new opportunities to gain efficiency and provide a better customer experience.

Instant Payments are data-rich, available 24/7, and processed in real time, facilitating payment on-demand without cut-offs, as well as straight-through reconciliation. In short, they meet the needs of our round-the-clock online world, delivering value to consumers, corporates and financial institutions.

In a growing number of markets, instant payments are becoming an important collection method alongside other traditional consumer payment methods, such as cards. Brazil is a good example where instant payments have rapidly become the preferred method of payment for many consumers. In the fourth quarter of 2021, instant payment transactions by volume exceeded credit card transactions in Brazil and the trend has continued. Person-to-Business payments made up about a quarter of instant payments traffic in the market by early 20232 . Considering that instant payments were introduced in Brazil in the latter half of 2020, it is difficult to overstate the impact of their rapid adoption on the payments landscape of the country. Overlay services such as Proxy ID and QR code have been critical to propelling adoption through ease of use. India and various markets in Southeast Asia have seen similar experiences in terms of consumer adoption. In Europe and the US, while mass consumer adoption has not yet been realized, innovations through Open Banking and overlay services like Request to Pay are laying the groundwork for instant collections in these markets.

By overlaying instant payment rails with innovative solutions, instant payments can offer seamless, real-time, and often 24/7 consumer collections. Collections use cases for instant payments are now emerging in many markets around the world and adoption is on the rise – it’s time to explore how these solutions work and how they can bring significant value to corporates, consumers and society.

Instant Payments with QR Code

Instant Payments powered by QR codes

QR codes are now mainstream in many markets and adoption continues to grow. They make life more convenient by providing access to information – ranging from restaurant menus to appliance instruction booklets – at the touch of a button. In the same way, QR codes enable straightforward and convenient instant collections: a graphic link contains all the information necessary to make a payment instruction to the intended beneficiary.

There are two types of QR codes. Static QR codes contain fixed payment information while dynamic QR Codes vary for each transaction and can include a unique reference, making transactions easier to identify and enabling straight through reconciliation.

In markets where QR codes have been adopted for payments, consumers simply scan or upload payment QR codes into their banking application, which creates a payment instruction. All details are automatically entered, eliminating friction and typing errors. Once created and approved by the account owner, the transaction is processed as an instant payment. Using API messaging, the beneficiary can receive immediate notification that funds have been credited to their account, simplifying reconciliation.

Request to Pay

Request to Pay (Request for Payment in the US)

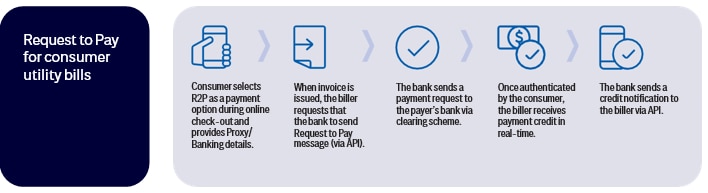

Request to Pay enables a payee to initiate a payment request, while the payer retains full control over the approval of the transaction. A messaging layer (supported by clearing systems) enables the exchange between payer and payee. In many countries, it is possible to send this request to a proxy ID (such as an email address or phone number). The payer usually receives the request digitally – as a pop-up notification on a consumer’s mobile for example, or as a request in a queue on a corporate’s electronic banking platform. Once the request is approved by the payer, it triggers an instant payment to the requestor.

In the case of online e-commerce transactions, this sequence can take just seconds. Typically, longer approval periods are allowed for less time- sensitive payments. Request to Pay offers a streamlined end-to-end collection process: the request, response and payment have the same unique reference number, enabling straight-through reconciliation (an especially valuable feature for invoice payments). Because these payments require the explicit approval of the payer, they are typically non-revocable, much like a cash payment.

Many markets, including the US, the UK, Europe, India, Thailand and Argentina have implemented, are piloting, or are in the process of rolling out these solutions to support corporate and invoice payments.

Instant Direct Debit and other solutions

Instant Direct Debit

Instant Direct Debit supports recurrent instant collections and enable digital mandate management. Requests for collection are instantly validated against the mandates, resulting in an instant collection and a completely digital streamlined experience. In some markets, this solution takes the form of a Recurrent Request to Pay. A request for payment is issued with a request for future authorization of a recurrent debit and once accepted by the payer, a mandate for a recurrent payment is created. Both payer and payee have control and access to key information.

These solutions are still at an early stage globally with only a handful of markets, notably Australia, India, and Hong Kong, having implemented them. However, given the rise of subscription services, this recurrent collection solution has tremendous potential.

Instant Payments with Real-time Notifications & Reconiliation through Virtual Accounts

In markets where the solutions outlined above have not yet been implemented by the clearing schemes, instant payments can be combined with bank reconciliation solutions such as a virtual account number ,or similar solution, and real-time credit notifications to enable instant collections. The payer places the provided virtual account number into the beneficiary account number field in the payment. The payee receives a credit notification API containing the virtual account number enabling them to instantly match the incoming payment to the appropriate open receivable. This solution increases the match rate for incoming credits, reduces manual reconciliation and enables the automated release of goods.

The Potential Benefits

Use Cases

How Instant Payments Can Add Real Value

POINT OF SALES AND E-COMMERCE CUSTOMER PAYMENTS

Instant Payments can enable merchants to reach consumers without cards and offer greater consumer choice in payment instrument in addition to cards and APMs such as online wallets. Merchants add either QR codes or Request to Pay to their existing collection options within the check-out experience. Corporates can also explore ways to incentivize adoption through discounts or promotions

DIGITIZATION OF CASH FLOWS

Instant payments can be used as a means for payment on delivery of goods – they provide a safe and secure collections method for logistics and delivery companies. For example, a logistics company that collects customs charges on delivery of goods can simply present a QR code for payment, immediately converting cash-based flows to a digital format.

BILL PAYMENTS

Both Request to Pay and QR Codes can be used to support corporate and consumer bill collections. Request to Pay offers a fully digital experience, where payers can choose to respond to requests for payments. For QR code, an invoice can be delivered electronically or via post, with a QR code included linked to the required payment details.

Citi's Value Proposition

At Citi, we are dedicated to developing best-in-class instant payments solutions.

Today, we have direct connections to over 35 instant payments systems, reaching over 65 countries globally.And we continue to invest in instant payments, supporting QR codes, Request to Pay, and Instant Direct Debits in a number of countries globally.These instant digital capabilities come in addition to our growing payment acceptance footprint for online card and wallet acquiring, now available in 20 countries, our Payer ID reconciliation solution available in 44 countries,and Direct Debit capabilities supported in 62 countries.

For More Information

If you would like more information on instant payments and how they may be able to support your collections, please contact your Citi representative.