Growth in the United States is holding up well despite some signs of slowing. The euro-area economy seems to be bouncing back from the stagnation posted through the past two quarters. Recent data for China were softer than expected, they say, but the Chinese consumer’s post-COVID recovery continues.

Global Growth Forecasts

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research

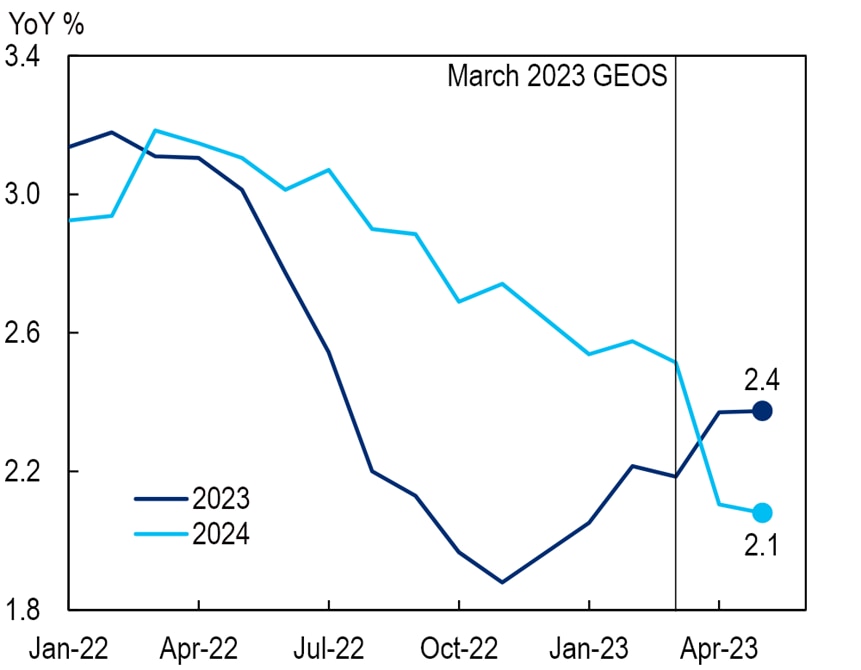

Citi Research expects global growth in aggregate to run at 2.4% this year and 2.1% next year. With trend growth currently near 3%, neither year is likely to see gangbusters performance relative to any absolute standard. But the more important point, the analysts say, is that in the face of headwinds — including the continued effects of the Russia-Ukraine war, high inflation, surging central bank policy rates, and more recent banking sector stresses — the global economy continues to advance.

High inflation also persists. Global inflation this year is likely to run at 5.6% and to moderate to 4.2% next year, well above central bank targets, they say.

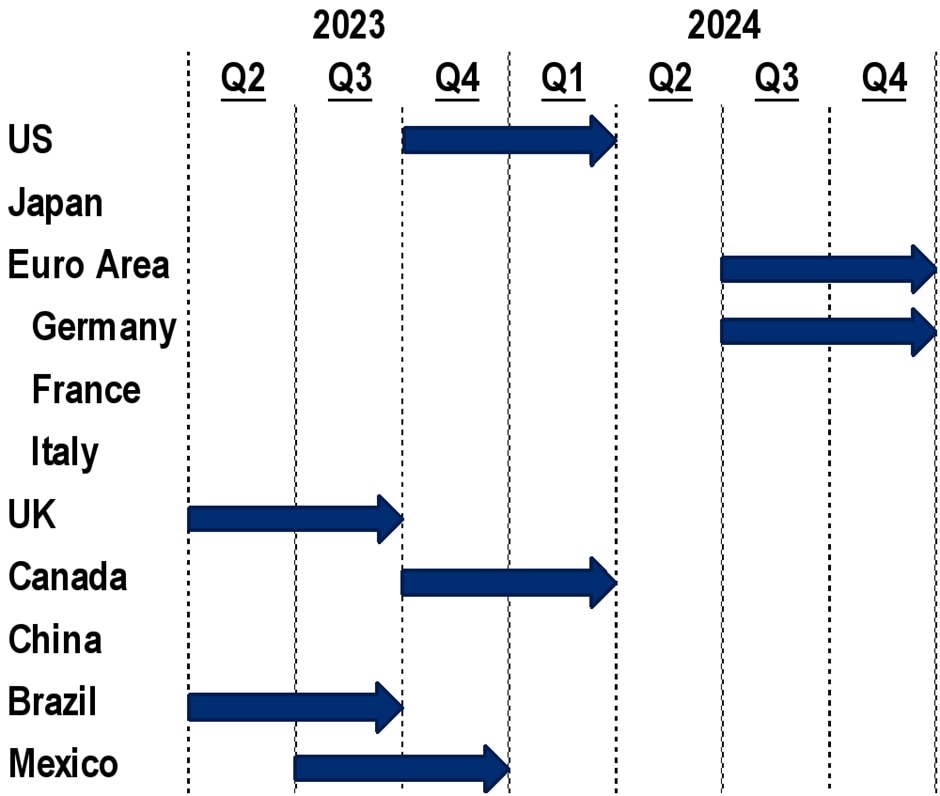

The drivers of inflation are different now. Now it’s not broken supply chains and surging goods spending but more tight labour markets and strong services demand. Regardless of what is driving it, inflation is high. In response, central banks have maintained tight policies. In some cases, they are even tightening. As a result, the team sees episodic weakness in various countries through the end of next year as shown in the following chart.

Recession Outlook

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research. Note: Arrows indicate recessions.

In the U.S., the team says that a recession is likely the only way to cool the tight labor market and continued inflationary pressures. As a result, their forecast envisions a downturn taking hold before the end of this year. Similarly, they expect that the ECB’s tightening, designed to counter above-target inflation, will result in a recession in the euro area during the second half of next year. They also see recessions in the United Kingdom, Canada, Brazil, and Mexico. In aggregate, global growth is projected to slow gradually through the first quarter of next year, but to remain positive. The team says they are increasingly convinced that a full-blown global recession, in which many countries move down together, is not in the cards.

In the full report, Mr. Sheets and team examine some of the deeper factors that are shaping global performance. These include red-hot services demand, persistently rapid inflation, high and rising central bank policy rates, and continued pressures on the banking system.

The bottom line, they say, is they see a global economy that, notwithstanding an array of adverse shocks, continues to manifest solid growth. While this resilience is good news, the ongoing strength of activity has also fueled inflation pressures — prompting central bank hikes. They expect that the tight monetary policy that has resulted will be maintained until inflation reverses. Notably, however, this reversal is likely to require a slackening of labour market conditions and recession in some major economies.

Relative to this baseline, the recent banking sector stresses pose downside risks, including the possibility of still-tighter credit conditions, weaker growth, and longer or deeper recessions.

For more information on this subject, please see the full report, published on 24 May 2023, here: Global Economic Outlook & Strategy - The Storms Continue, But So Does Global Growth

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.