Last year’s Citi Securities Services Evolution 2021 whitepaper saw global securities markets on the brink of transformation. This year, this transformation appears already underway, as witnessed by important settlement cycle reductions in major markets, plus a host of initiatives in related processes and technologies. However, there is also evidence that financial market infrastructures (FMIs) are developing and testing new technologies/processes in anticipation of change, rather than due to immediate demand.

All this effort and investment is being heavily influenced by the same three trends identified last year as being

transformational forces for change in the post-trade environment:

Settlement compression

Settlement compression has again been a high profile theme this year, with the US and its most closely-linked markets moving to T+1, plus the decision by India to embark upon the same journey. This has also been accompanied by a greater sense of purpose among FMIs, with several engaging in compression or digitalization projects for specific asset types, such as commercial paper or bonds. In addition, several traditional FMIs are working on pilots or proofs of concept in support of future compression, while several non-traditional FMIs are already capable of T+0 settlement.

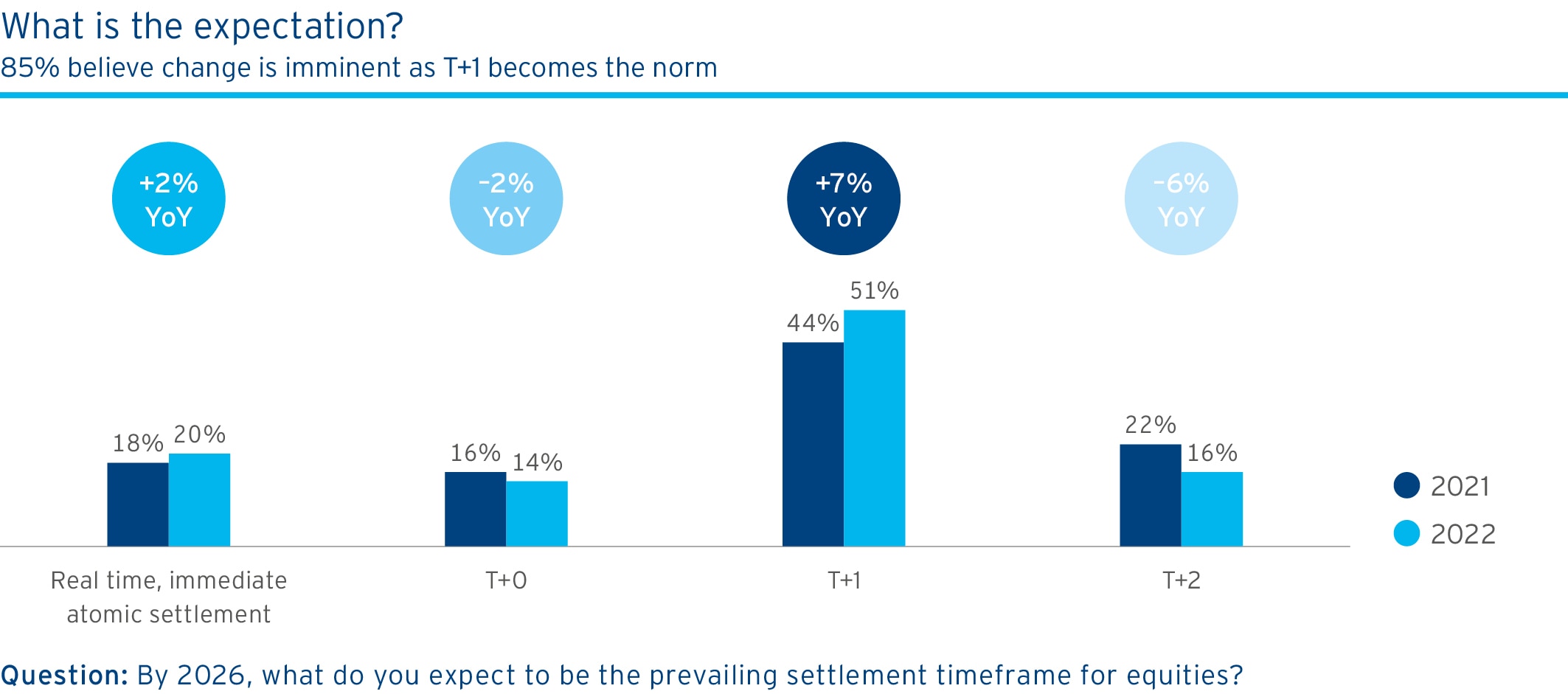

At the same time, market participants increasingly believe that shorter settlement cycles are the forthcoming reality, with 51% now thinking T+1 will be the prevailing equity settlement cycle by 2026. 85% also expect settlement to be at T+1, T+0 or atomic over the same timeframe, versus 78% last year.

Digitalization

Digital assets have continued to grow rapidly in importance since last year, as witnessed by a recent executive order1 to establish a national policy for them. Elsewhere, various polls 2,3,4 have underlined how seriously professional asset managers are now taking them as an asset class. This trend corresponds with the high levels of digital asset activity among market participants polled this year and the number of FMIs already live with (or working on) digital asset initiatives, tokenization and fractionalization.

On the matter of tokenization, both market participants and FMIs view it as likely to assist in adding market liquidity, though FMIs mostly see this relating mainly to illiquid asset classes, such as real estate. They were also somewhat skeptical about the value of digitizing existing assets, other than as an intermediate step towards native digital assets, in order to avoid having to run parallel systems and reconcile between them.

This was linked to FMIs’ concerns (also raised last year) that there needed to be robust regulation and legal infrastructure to support the evolution of native digital assets. Sentiment from the FMIs is that there is room for improvement, with most digital assets still being created by tokenizing existing physical assets. Additionally, FMIs also felt that greater international collaboration was therefore needed to support natively digital assets and also to reduce the risk of digital islands being created that would cause legal and standards inconsistency across jurisdictions.

Technology and digital transformation

The pace of technology development and adoption in support of the settlement process continues to accelerate. The past year has seen a slew of announcements, including the creation of a regulatory sandbox5 for distributed ledger technology (DLT)-based trading/settlement, several FMIs taking stakes in DLT fintechs and numerous DLT industry trials and pilots.

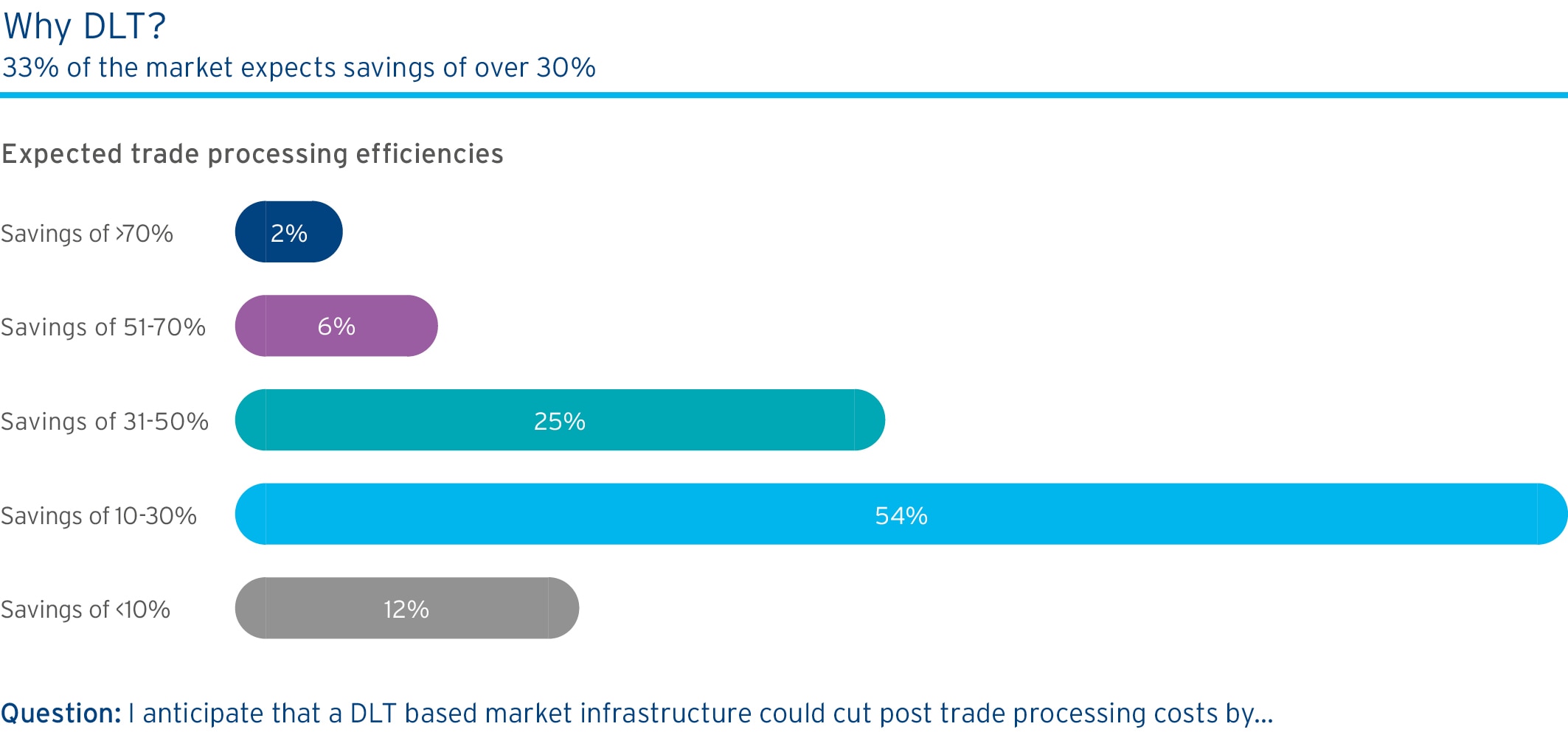

Nevertheless, there remains a dichotomy between market participants and FMIs on the subject of DLT. 21% of market participants see it as core to a successful transition to T+1/T+0 and 25% expect a DLT based market infrastructure to cut post-trade processing costs by 31-50% or more. By contrast, traditional FMIs are more cautious. Despite their high levels of DLT activity, most are still dubious about its suitability for mainstream securities settlement and none felt that cost savings were more than conjectural at this stage.

The overall picture revealed by FMIs and market participants is even more positive than last year. On several points — such as the use of DLT — there is closer accord between the two groups, but there is also an even greater sense of purpose and active preparation. Ultimately, the industry appears increasingly cohesive and prepared to invest the time and effort to further improve the settlement experience across a growing number of asset types.

1 https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/09/fact-sheet-president-biden-to-sign-executive-order-on-ensuringresponsible-innovation-in-digital-assets/

2 https://business-review.eu/news/more-than-a-third-of-traditional-hedge-funds-now-invest-in-digital-assets-nearly-double-a-year-ago-234454

3 https://www.etfexpress.com/2022/06/15/309998/institutional-investors-replace-retail-investors-major-holders-digital-assets

4 https://www.eurex.com/resource/blob/2872736/38c6dd474131994bfe2b45e7e76a0a45/data/20211208_crypto-survey-report.pdf

5 https://www.ashurst.com/en/news-and-insights/legal-updates/eu-adopts-dlt-pilot-regime/