Citi analysts conducted a wide-ranging analysis of the European power market based on the latest available information, including renewable capacity installed and electricity demand, finding that the road to electrification is anything but smooth.

The main conclusions they reached are as follows:

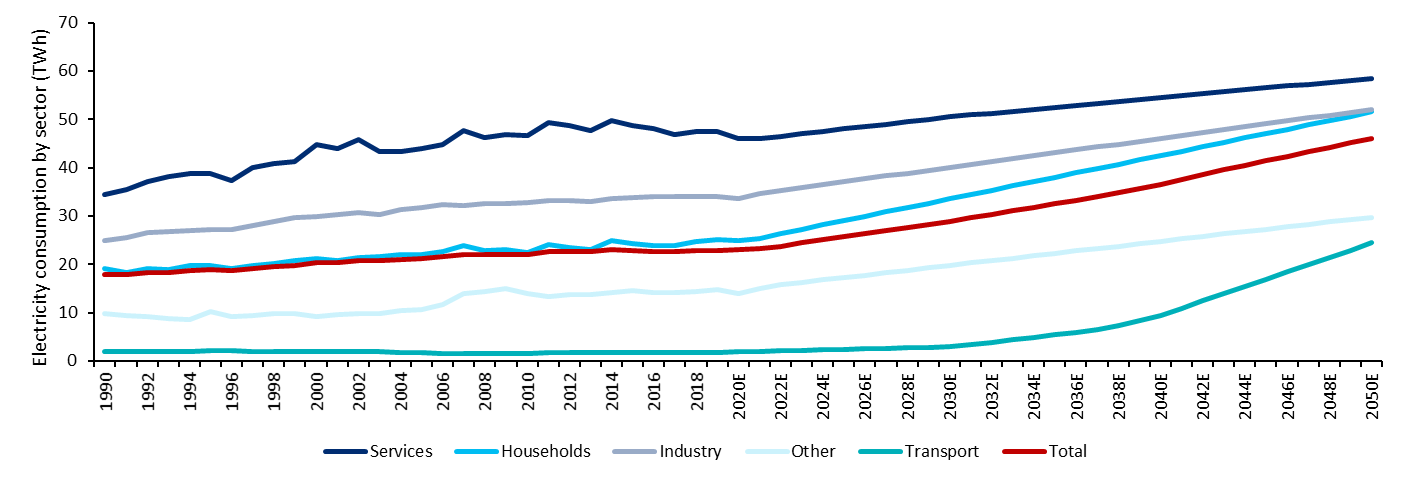

1) Contrary to general perception and expectations, European electricity demand remains low amid energy efficiency.

And Citi analysts don’t expect this to materially change over the next few years.

2020 saw a decrease in electricity demand across Europe of around 4.3% (2750 TWh) due to Covid-19 lockdowns. In 2021, analysts noted a strong rebound of around 3.2% in Europe (at 2840 TWh).

This is driven, they say, by a gradual restart of economies after the pandemic and economic normalization driven mainly by the Industry, Services and Transport sectors. At the same time, residential sector electricity demand has kept growing, driven by an increase in remote working.

For 2022, Citi analysts forecast electricity demand in Europe to grow by 1.7% YoY (reaching 2889 TWh) as European economies keep rebounding from the pandemic.

The drivers for electricity demand growth will be about two elements: mainly improving cost competitiveness of electricity and hydrogen.

Citi expects electricity cost competitiveness to improve largely on account of the EU electrification policy that is encouraging member states to shift the cost of decarbonisation.

Citi analysts say hydrogen will have an important role in decarbonizing economies. It can be produced from almost all energy resources, though today’s use of hydrogen in oil refining and chemical production is mostly covered by hydrogen from fossil fuels, with significant associated CO2 emissions. This is known as “grey hydrogen”. Meanwhile, ‘green’ hydrogen is created from energy derived from renewable sources. Consequently, their development should go hand-in-hand.

2) Electrification is a mirage

Very little progress has actually been made in electricity penetration over the past 30 years. The EU green deal is targeting to increase electrification from 22% in 2015 to 30% by 2030 and to 50% by 2050. Recent trends (partially affected by COVID) show some acceleration in what has otherwise been a disappointing trend (no increase in electrification over the past decade). In Citi’s view, the high relative cost of electricity has hindered the transition but policy makers will likely keep reducing the relative cost of electricity by modifying tax allocation by fuels, introducing carbon taxes on gas and so on. On Citi estimates, despite limited progress so far, electrification should accelerate, reaching 30% by 2030 (vs 23% in 2020).

Electrification trend across sectors |

|

|

|

Source: EUROSTAT and Citi Research Estimates |

3) Renewable capacity additions remain limited

Signs are mounting that Europe is struggling to translate its pledges and targets on decarbonization into reality. Following 30GW of renewable capacity additions in 2020, Citi expects 2021 to be only slightly better adding some 32 GW, a level almost 50% below the 60GW yearly capacity addition needed to reach EU 2030 targets.

An analysis of the data reveals that the overall stable outcome at the European level is supported by an acceleration of growth in certain countries (notably Netherlands, Poland, Belgium and Sweden) rather than a generalized growth in installation across Europe.

Supply chain disruptions and spikes in installations costs will, in Citi’s view, cap growth in 2022 and 2023.

In the meantime, the closures of thermal and nuclear assets are set to make the European demand supply-balances increasingly fragile.

The current power crunch (winter of 2021-2022) might recur and the lessons learned (impact on economy, shutdown of energy intense sectors, and bankruptcy of retailers) should encourage a rapid change in regulation.

Cumulative European capacity |

|

|

|

Source: EUROSTAT and Citi Research Estimates |

4) Europe is increasingly reliant on thermal generation. Despite poor demand, European markets are set to tighten largely reflecting the closure of nuclear and coal assets and slow growth of renewable energy. 2020 saw the closure of 35 GW of solids in the EU, mainly attributable to Germany (25.3 GW), Spain (3.7 GW) and Poland (1 GW closure). For 2021, Citi sees another 5 GW of closures followed by another 25 GW in 2022 as Germany, France and Poland keep closing coal plants together with the rest of the EU.

Oil represented only a small fraction of the total electricity capacity in EU at 19 GW in 2020 (1.8% of the total).

Gas should play an important role in this energy transition as it will represent a viable source to overcome any shortage due to a removal of solids and oil. In this regard, some countries will likely rely more heavily on it than others (such as Italy with 50 GW by 2030).

On 2 February, the European Commission adopted its sustainable finance taxonomy for electricity generation to include nuclear and gas under limited circumstances. Natural gas power plants would be deemed green if they produce emissions below 270g of CO2 equivalent per kilowatt hour (kWh) and receive a construction permit by 31 Dec 2030 and plan to switch to low-carbon gases by the end of 2035.

The full report goes on to present a country-by-country guide to the energy demand outlook across the EU. Read it here Western Europe Renewable Energy.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.