Background

By 2030, up to $10Tn of institutional assets [1] could be “on-chain”, i.e., digitally represented on Distributed Ledger Technology (DLT) systems. As money and other assets become tokenized in the future, new technology solutions and processes will be required to trade and settle tokenized assets. For institutional-grade trading platforms looking to incorporate such new technologies, some of the key considerations include areas on capital efficiency, KYC/AML, information confidentiality and post-trade analytics.

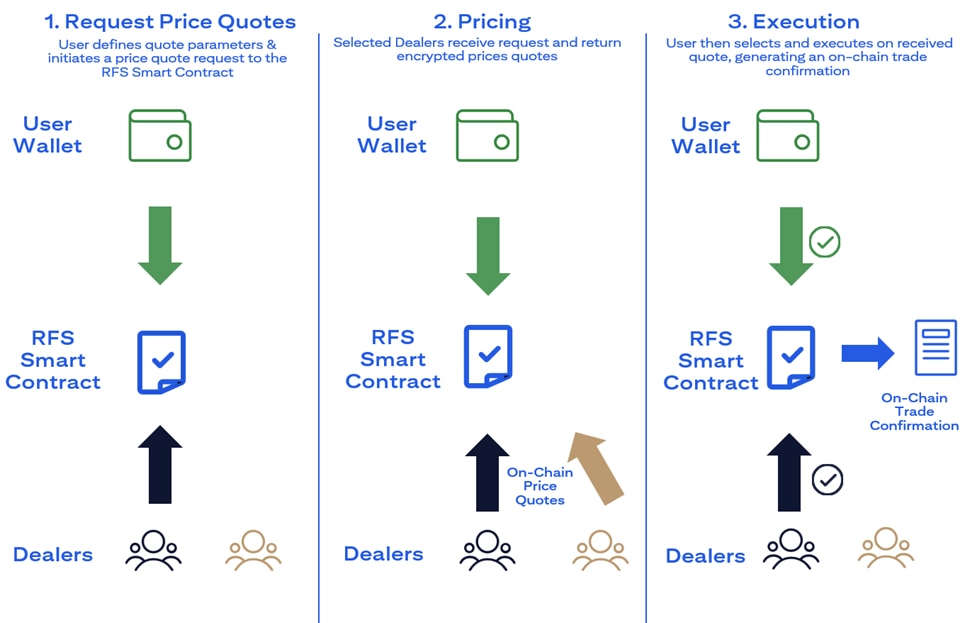

In collaboration with T. Rowe Price Associates, Inc. and Fidelity International, Citi has tested the use of blockchain infrastructure to price and execute simulated bilateral trades in an institutional compliant manner, via an On-Chain Request for Streaming (RFS) Application. The process is modelled after existing Request for Quotes (RFQ) processes which are widely used for bilateral trades in foreign exchange (FX), debt, and/or other institutional asset classes.

RFQ Process

In a typical RFQ process –

- Clients send RFQ to one or more dealers;

- Dealers respond to a client with a price quote; and

- Trade execution is confirmed once the client agrees to the price quote.

Generally, only counterparties should have visibility to their RFQ, price quotes and/or trade executions; dealers should not be able to view price quotes of other dealers; and dealers should only respond to RFQ from their onboarded customers.

Citi On-Chain Pricing Solution

In Citi’s On-Chain RFS Application, all price quotes and trade confirmations will be recorded on blockchain which provides immutable record-keeping and allows for best-execution and other post trade analysis within a single platform (which is presently not possible in existing systems). Clients would be able to use their wallets for identification, receive streaming prices, and confirm their trades “on-chain” in a cryptographically-secure manner. Data access and visibility would be designed to be consistent with existing institutional practices, such as only allowing counterparties of a quote and/or trade to access and view underlying data. As a result, subject to applicable laws and regulations, data privacy and confidentially would be preserved.

Citi’s On-Chain RFS Application explores the use of oracles for bilateral messaging and investigates factors that contribute to network latency. As trades are bilaterally confirmed, trading could also potentially leverage existing credit relationships without pre-funding, allowing for greater capital efficiency. While current scope is limited to simulated spot FX contracts for USD and SGD, the underlying solution could be adapted for any other asset class.

Greater Transparency

Based on Citi’s testing of the On-Chain RFS Application, all simulated quote and trade confirmations with timestamps are recorded on the blockchain, providing real-time status and transparency.

Increased Auditability and Security

Based on Citi’s testing of the On-Chain RFS Application, all simulated data is stored in a tamper-proof manner, and all simulated pricing and trading activities are initiated via blockchain-based wallets in a cryptographically-secured manner.

Potentially Enable New Use Cases

Citi’s On-Chain RFS Application could potentially be designed to be composable with other smart contracts to enable new use cases and asset classes.

Looking Ahead

Existing DLT initiatives have typically been focused on post-trade[2], with pre-trade pricing and trade execution occurring on separate legacy systems. By performing pre-trade and trade execution on the same ledger, Citi aims to build greater understanding in this space, potentially unlock new business use-cases and enable innovation for full “front-to-back” trading on blockchain infrastructure.

For more information on Citi’s On-Chain RFS Application, please contact digitalassets@citi.com

| |

“We are taking steps in building foundational capabilities to be able to offer liquidity, pricing and risk management to our global clients wherever they choose to trade – be in on traditional rails or on blockchain.“

Sam Hewson, Head of FX Sales, Citi | |

| “Developing user-friendly institutional grade execution is key to future scalability. This pilot is an important first step towards unlocking the value of a full end-to-end blockchain based trading lifecycle.”

Blue Macellari, Head of Digital Asset Strategy, T. Rowe Price Associates, Inc. |

| “Distributed ledger technology will revolutionize financial systems over time, and has the potential to democratize access to financial services and alternative investments. As a global asset manager, we are very keen to engage with partners like Citi to explore technological innovations like its Blockchain FX Solution, to understand the efficiencies it can bring to our processes and ultimately for the benefit of investors.”

Emma Pecenicic, Head of Digital Propositions and Partnerships, APACxJ Distribution, Fidelity International

|

[1] Citi’s Money, Tokens, and Games report, March 2023

[2] GFMA Impact of Distributed Ledger Technology in Global Capital Markets, May 2023