The Generative AI Megatrend

Generative (Gen AI) is a branch of computer science that uses algorithms to allow supercomputers to create new content using previously created content. The content can be text, audio, video, images or code in response to short prompts.

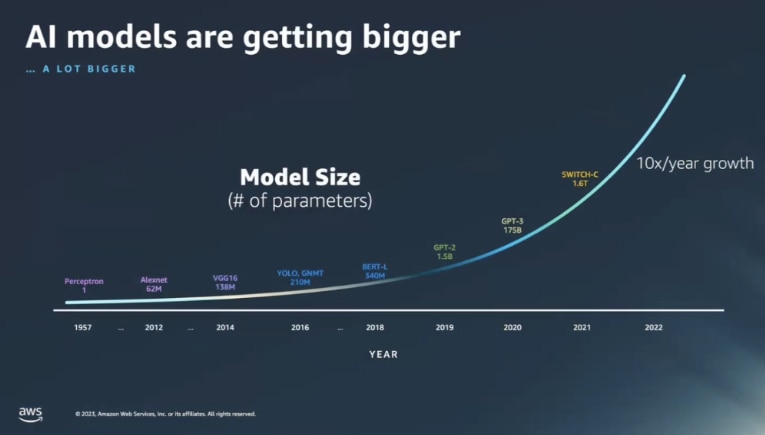

AI Models Are Getting Bigger and Driving New Use Cases

Sizing the AI opportunity is a no easy thing. Third parties and corporates estimate total AI TAM to be $350-$500B by 2026 and to grow at a 5-year CAGR of 30-50%. It is clear AI represents a promising trend for various software, hardware, and semiconductor companies. A KPMG survey of 225 U.S executives found:

65% believe generative AI will have a high or extremely high impact on their organization in the next 3-5 years.

60% say they are 1-2 years away from implementing their first generative AI solution.

Citi research analysts reckon that Gen AI more specifically is a trend that is bound to be widely adopted.

What does this mean for the networking market? Prior to the recent proliferation of AI applications, notably ChatGPT, networking power as a percentage of total data center cluster was around 5-10% (~2MW according to Microsoft Research). That has now drastically changed as models such as GPT-4 use parameters numbered in trillions.

400 & 800G Transition Megatrend

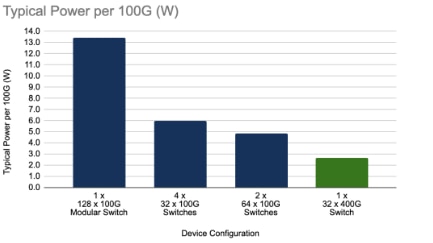

Citi analysts expect the migration to higher speed networking equipment to advance in the coming years to satisfy the requirements of high-bandwidth applications. As a result, they anticipate a broader adoption of 400G networking technology and building 800G volumes.

Example of 400G Device Power Use Relative to 100G Equivalents

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Arista Networks

An ever-increasing demand for high bandwidth applications, including streaming video, high performance compute (HPC), mobile 5G networks, and ChatGPT and other artificial intelligence (AI) and machine learning (ML) based applications, means demand for higher capacity network connectivity and faster data transfer.

Digital Transformation Megatrend

Digital Transformation is oft cited by CIOs as a top priority.

Broadly defined, digital transformation is the use of computer-based technologies to improve an organization's performance. The Covid-19 lockdown radically changed the mindset of many enterprises, as they were left scrambling to enable remote work and provide online service.

Post pandemic, while enterprises continue to prioritize these initiatives, macro dynamics have more recently contributed to a slowdown in the pace of these initiatives. Citi analysts anticipate spending in compute and storage infrastructure to be positively impacted from spending on digital transformation initiatives. This includes areas of edge computing, growth of unstructured data, hyperconverged infrastructure, and rise of consumption models.

What Is Edge Computing?

© 2023 Citigroup Inc. No redistribution without Citigroup’s written permission.

Source: Citi Research, Arista Networks

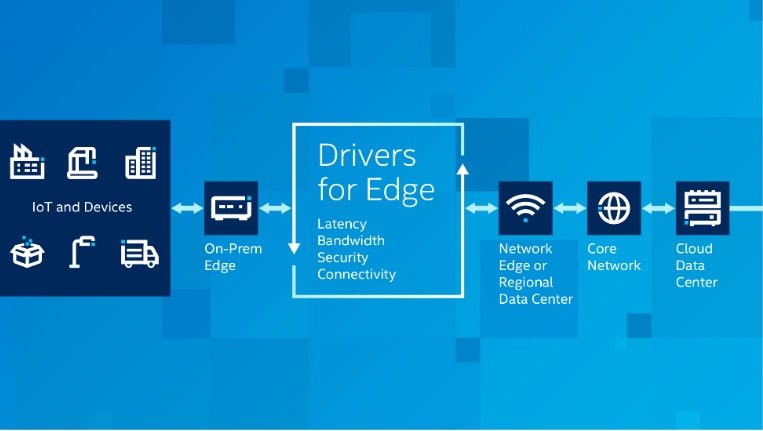

Over the past few years, CIOs have heavily invested in hybrid and multi-cloud-based infrastructure to better align IT spending with business priorities and empower developers with on-demand access to highly scalable infrastructure and advanced IT services. Progressive efforts are being spent on edge computing, as it is viewed as complementary to cloud computing. Edge computing is part of a distributed computing topology where information processing is located close to the edge – the physical location where things and people connect.

While cloud computing has been focused on modernizing, for a more agile and scalable back office, digital businesses require more agile and real-time front office or at the “edge,” where customers, employees, assets, and equipment interact with each other.

Factors driving the need to refresh and enhance edge infrastructure include:

1. The need for lower latency and more real-time data processing and analysis/insights to support and tackle increasingly performance-intensive workloads, which are AI and ML reliant, as well as a rapidly expanding set of applications to deliver new consumer services, everywhere.

2. Bandwidth requirements of sending data to and from the cloud center, and requirement for data to be processed locally even when the network is down.

3. Compliance reasons – whereby policies govern regional transfer of data to centralized data centers.

4. Security – protecting data from being hacked as it is transferred.

IDC estimates spending on Edge to double over the next 4 years to represent ~25% of total IT Hardware spending on data centers by 2026.

PCs Normalize

Meanwhile, a separate recent note from Citi Research’s Asiya Merchant says the PC market is normalizing following the pandemic boom, which saw revenues and units significantly expand in CY20/CY21, followed by double-digit declines in CY22 as excess inventory got digested.

The report also says the overall server market represents a US$120bln market. Processor and product refresh cycles are the primary growth drivers in this space.

Over the past 10 years, revenues in the server market have grown by ~8% CAGR while units have grown by 5% CAGR.

The overall storage market currently represents a ~$50-60bln market (including storage systems software). And also like servers, the storage market is highly cyclical and correlated to the broader spending trends in compute infrastructure.

By segment, the external enterprise storage market represents 22% of the storage hardware market and has grown at approx. 5% CAGR during 2017-2022, while internal server-based storage has grown slightly higher at 9%.

And last but not least. a recent note from Citi Research’s Andrew Gardiner expects the semiconductor market to broadly roughly double over the course of the current decade, from c$500bn today (below the pandemic peak) to around $1 trillion at the end of the decade. Such growth is significant, taking the industry to some very big round numbers, the note says, but represents “only” 9% growth from here until 2030.

Moore’s Law and the related shrinking of transistors and scaling of performance is a key driver for industry growth.

The semiconductor industry is increasingly using advanced material science and packaging techniques to drive improved performance, efficiency and transistor density beyond traditional shrink and scaling, in what has become known as “More than Moore.”

For more on that and the other two notes mentioned in this piece, if you are a Velocity subscriber, please see US Communications Equipment and Tech Hardware - Megatrends 2025; Generative AI, 400G & 800G Transition, & Digital Transformation , North America Hardware & Storage - PCs Poised For Recovery While Recovery in Storage & Compute Could Be Uneven and European Semiconductor Equipment and Semiconductors - “More than Moore” drives strong long-term growth . All three notes were first published on June 29th.

Citi Global Insights (CGI) is Citi’s premier non-independent thought leadership curation. It is not investment research; however, it may contain thematic content previously expressed in an Independent Research report. For the full CGI disclosure, click here.